Summary

- Market reversal: Global stocks suffered big losses, with Japan’s Topix index racking up its largest one-day drop in more than three decades. European and US stocks also fell, while bond yields reversed the rise seen earlier this year. Disappointment over tech earnings, concerns about the US economy, and rising geopolitical risks contributed to the shift.

- Macroeconomic background: July labour market data point to a slowdown in the US economy. Combined with a more benign inflation picture in a restrictive rate environment, central banks will likely need to cut faster than they envisaged. Market volatility may affect the timing of cuts, but strong corporate and household balance sheets and proactive central bank actions should help ensure an orderly slowdown.

- Investment implications: A spike in volatility may warrant reducing risk exposure as a precaution, but the moves could create opportunities in developed markets, especially in equities. Government bonds appear less attractive after recent moves, while the outlook for corporate bonds is mixed, with investment grade credit preferred to the high-yield segment.

Global stocks fell sharply at the start of the week, with Japan’s benchmark Topix index on Aug. 5 suffering its biggest one-day drop in more than three decades. European shares and U.S. stock futures also declined. Meanwhile Emerging Markets stock indices, mostly in Asia (Taiwan and South Korea), fell into the red and currencies that had benefited from high carry trades funded by the yen, such as those in Latin America, lost ground.

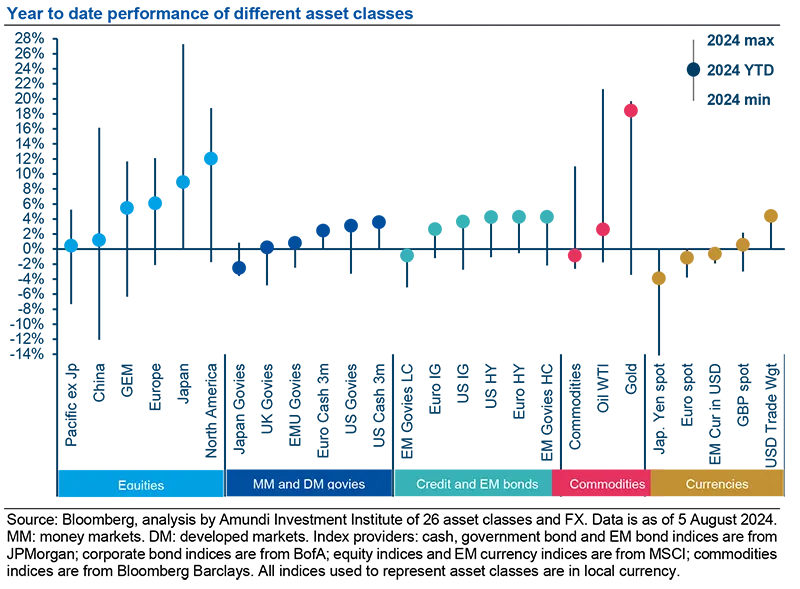

In the past month, Japanese stocks have dropped 23%, the EURO STOXX 50 and the Nasdaq have fallen 9%, US and German two-year government bond yields are 79 bps and 61 bps lower respectively and US high-yield spreads are 37 bps wider. The moves have erased the yearly gains in European stocks, cut the US stock gains to low single digits and pushed Asian and emerging market stock indices into the red, while bond yields have more than reversed the rise seen since middle of the year.

Why have markets reversed?

Three factors have contributed to the shift in sentiment over the past month. The first is disappointment over tech earnings and worries that artificial intelligence has been overhyped. Chip makers have been particularly hard hit, with the stock price of some of these companies down 15% or more due to weak earnings or delays to delivering their next generation of chips.

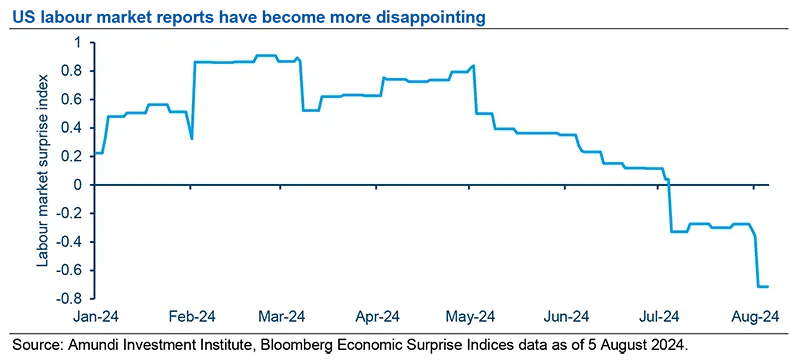

The second is broader concern that the US economy is slowing. Job creation has been a particular disappointment. The chart below shows Bloomberg’s economic surprise index on the labour market, and highlights how the positive surprises of the first and early second quarters have turned to disappointments.

The third is worries about geopolitical risk, particularly in the Middle East. After Israel killed a Hamas official in Iran and a Hezbollah official in Lebanon, there are fears that conflict in the region could escalate.

What is the macro economic background?

July US labour market data put the impending slowdown in the world’s biggest economy firmly on the market’s radar.

July US labour market data put the impending slowdown in the world’s biggest economy firmly on the market’s radar. All indicators – job growth, earnings, hours worked – point to a slower pace of income growth and this reinforces the last six months of weakening consumer confidence. Unemployment at 4.3% is now close to triggering rules of thumb that point to a more marked slowdown than a soft landing. Together with benign inflation data – the Personal Consumption Expenditures (PCE) price index is effectively now at the Fed’s 2% target – and the tightening in financial conditions triggered by the equity market correction, central banks will likely need to cut faster than they envisaged.

Monetary policymakers will need to assess the impact of economic indicators pointing to a medium-term slowdown and the extent to which the stock market declines tighten financial conditions. Beyond the drop in equities, index-linked fixed income markets also point to a persistent decline in decline in expected inflation: US TIPS prices indicate a 70bps decline in inflation expectations since April. Current policy interest rates have become even more restrictive, which explains why markets have moved to anticipate deeper rate cuts this year.

Extreme market volatility means market pricing of near-term rate cuts may oscillate. But underlying corporate and household balance sheets are sufficiently strong for the economic slowdown to be orderly. We therefore expect three 25 bps rate cuts this year in the US as a base case, and maintain our expectation of three more cuts by the European Central Bank (ECB) and the Bank of England (BoE) before the end of 2024.

Notwithstanding our recent concerns about excessive valuations in parts of the equity market, proactive moves by the major central banks should help stabilise markets in the near term. The corrections underway in parts of the tech sector will result in a more realistic assessment of the productivity potential of Artificial Intelligence (AI). Investment in AI-related equities and their valuations may now better reflect AI companies’ ability to monetise this technology in the near term. This also chimes with our view of the limits on how much AI-induced productivity increases can raise economic growth in the medium term.

Notwithstanding our recent concerns about excessive valuations in parts of the equity market, proactive moves by the major central banks should help stabilise markets in the near term.

What are the implications for investors?

The spike in market volatility may warrant reducing risk exposures for the time being as a precautionary measure.

However, in developed markets, we think the pull-back has created some good opportunities, particularly in equities. European broad stock indices have given up all the gains they had made since the start of 2024, even though earnings so far this year have generally met or surpassed expectations.

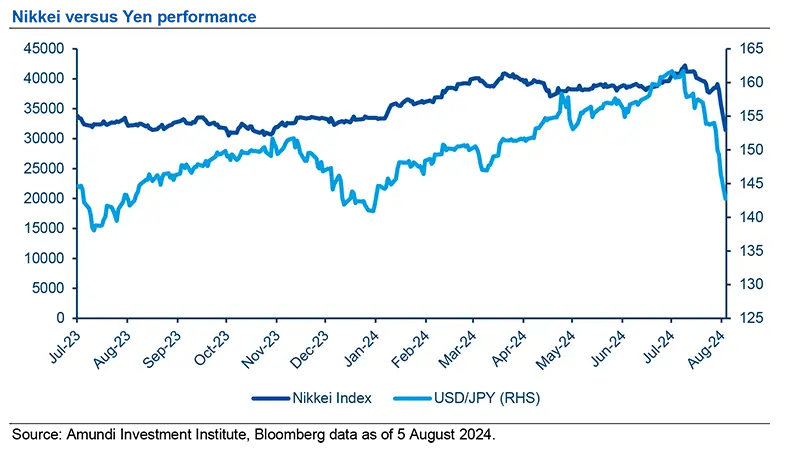

As a result, price/earnings (P/E) ratios based on earnings forecasts are back to levels not seen since the end of last year. Similarly, the Japanese market looks attractive after the recent fall. While Japanese equities have declined as the yen has strengthened, this may be an overreaction. The yen rally in the second half of 2022 - of a similar magnitude, albeit at a slower pace – had little effect on the Japanese stock market. We therefore believe Japanese equities could recover up to 10% of the lost ground by the end of the year.

Government bonds have gone from looking good value to looking slightly rich after the recent moves. Even if there is now more scope for the Fed to cut rates, as we argue above, yields are returning towards levels not seen since 2022, when the economic outlook was more gloomy than seems to be the case today. We think 10-year Treasury yields are likely to trade in a range between 3.40% and 4%, and the current 3.7% is in the middle of that range. Ten-year Bunds look slightly better value and could return to the late December 2023 lows under 2%, but in our view they are unlikely to fall much further than that.

The outlook for corporate bonds remains mixed. Investment grade bonds have benefitted from the drop in government yields and the widening in European investment grade (IG) spreads to 118 bp makes them look more attractive. US IG spreads are still tighter than Europe, at 105 bp, and correspondingly less appealing. High-yield spreads have widened sharply to almost 380 bp in Europe and 370 bp in the US, but that is still some 100 bp tighter than the mid-points seen in 2023, and we think the prices need to fall further before the asset class offers enough value.

In developed markets, we think the pull-back has created some good opportunities, particularly in equities.