Summary

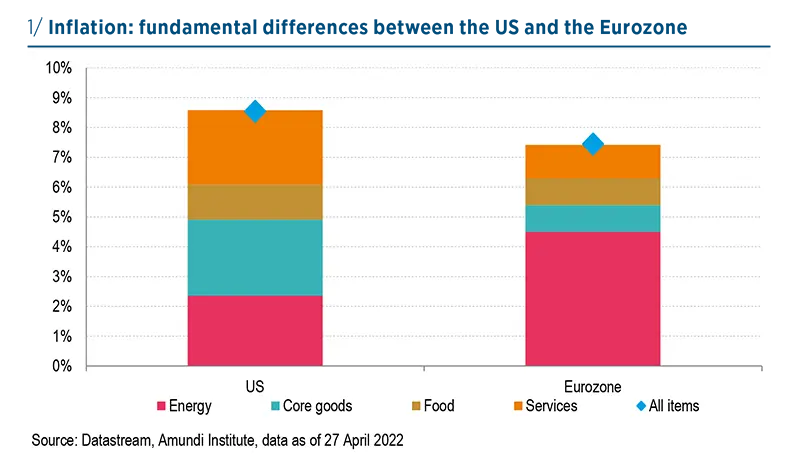

We expect central banks to remain on the hawkish side as long as inflation expectations remain on the upside, as central banks are afraid of losing their credibility. However, the Fed and the ECB are in different positions. The Fed wants to tighten financing conditions to slow demand, as the US economy is running hot. However, the ECB is stuck in an impossible situation: Eurozone inflation is primarily driven by higher energy costs, and a central bank has few “tools” to fight cost-driven inflation without hurting growth.

Core inflation could place pressure on central banks in the months to come

Inflation is skyrocketing. We expect that inflation is now close to peaking and will start to decline in the second half of the year, but core inflation could remain elevated and surprise on the upside. In March headline inflation reached 8.5% in the US and 7.4% in the Eurozone. Indeed, inflation first accelerated because of energy prices, commodity prices and supply bottlenecks. The war in Ukraine and ongoing lockdown measures in China have amplified these inflationary pressures. Supply bottlenecks are persisting much longer than expected. Henceforth, core inflation will be at the centre of attention. The risk is that inflation will be increasingly driven by second-round effects. On the one hand, more and more companies should continue to raise their prices to compensate for the jump in the cost of production. On the other hand, demand could be supported by a strong labour market (US) and targeted government support (Eurozone). “The longer inflation numbers are at the high level where they are, the more likely it is that wages negotiations, entry-level salaries, and renegotiations of existing agreements will actually take place.“ (Christine Lagarde)

The Fed wants to slow demand

We expect the Fed to remain firmly committed to fighting inflation. The Fed wants get to a neutral policy stance as rapidly as possible, in order to move to more restrictive levels if that is what is required to restore price stability. Chair Powell was clear on the Fed’s determination to do whatever it takes to bring inflation down when he said the FOMC would like to slow demand so that it is better aligned with supply, and that it is aiming for less accommodative financial conditions. The US economy is running hot:

- Inflation pressures remain high and continue to broaden. The pace of growth in core consumer prices slowed in March, but this was largely due to a steep drop in auto prices, and other prices continued to show increases.

- The US labour market is extremely tight and is pushing wages to grow at the fastest pace in decades. Demand for workers is “too hot -- you know, it is unsustainably hot.” (Powell).

We expect the Fed to hike rates at each meeting this year. Two to three 50bps rate hikes this year are on the table. Powell’s comments were on the hawkish side, endorsing the market’s pricing of a 50bp hike at the May, June and July meetings.

We expect central banks to remain on the hawkish side as long as inflation expectations remain on the upside

We do not believe in a recession soon in the US. We think the US economy is well positioned to absorb the next rate hikes:

- For the corporate sector: higher cash holdings, higher debt duration and lower effective cost of debt than before the Covid crisis.

- For households: healthy balance sheets, large stacks of accumulated savings, and a constructive wealth effect, as housing prices and shares rose sharply from pre-pandemic levels.

- Increased borrowing costs could weaken demand for homes, but with the inventory of homes for sale at a record lows, it could take time before that shift affects home prices.

The US economy is running hot

ECB to stick to rates normalisation despite the downside risk to growth

After the hawkish surprises of previous meetings, in April the ECB refrained from announcing a further acceleration of stimulus withdrawal, fully confirming both its previous guidance on QE, which is set to end in Q3, and the policy sequence, with interest rates to rise possibly, but not necessarily, after QE ends. At the same time, flexibility has been emphasised as a valuable means to preserve the transmission of monetary policy and avoid fragmentation, but mostly to be used in case of need and not in a proactive way. In June – when the new set of macroeconomic projections will be available – the ECB is likely to announce the exact month when QE will end. Under this respect, the latest statements delivered after the meeting from some ECB members, like Vice-President De Guindos, hinted at July as a possible timing to end QE.

The ECB remained much more focused on the risk of inflation expectations’ becoming unanchored than on downside risks’ weighing on growth

Although we perceived a more cautious stance at its last meeting, we keep our view that the Governing Council still seems more sensitive to the risk of record inflation than to a growth slowdown. Inflation is the ECB’s top priority, and the central bank will carefully monitor any possible signs of de-anchoring of inflation expectations. According to our current baseline scenario, we expect rate normalisation to lift rates out of negative territory over the next few months, with two hikes before yearend, followed by another in Q1 2023. Then we expect the ECB to pause, given a combination of growth slowdown and inflation likely to turn lower from peaks. When compared to market expectations’ currently implying five full hikes of 25bps over the next 12 months, we stay in the cautious camp, as our macroeconomic projections attach a higher probability to a technical recession, at least in countries such as Germany and Italy, which are more dependent on energy supply and prices.

The ECB has few “tools” to fight cost-driven inflation without hurting growth

Conclusions for fixed income markets

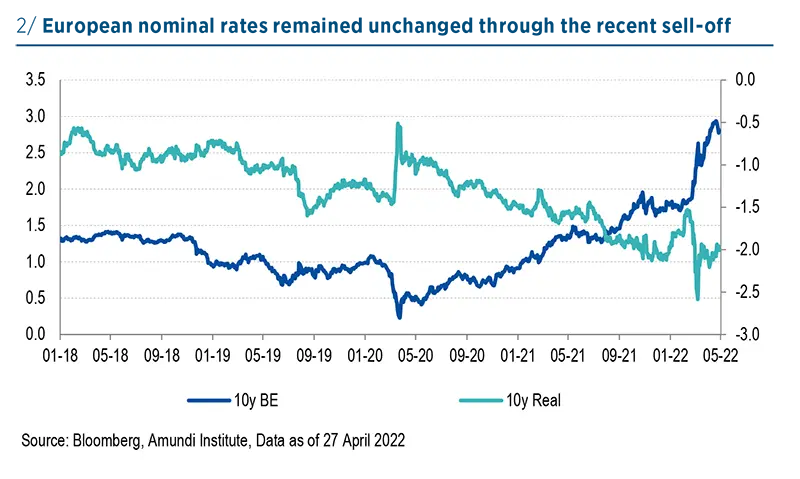

The short end of the US curve has intensively repriced over the last months. The US market is pricing more than 50bps for May and June and a mid-2023 peak in the OIS forward curve around 3.2%. Despite significant hike pricing and higher real yields, traded inflation has continued to drift higher across the forward curve. The 10-year break-even point exceeded 3% for the first time since the introduction of TIPS. In this context, we expect the Fed to remain on the hawkish side and we continue to see a compelling case for real yield shorts. In the Eurozone, we think that too much is priced in the short end of the curve but we do not expect a shift in the ECB communication soon. We remain cautious on peripheral debt as high inflation limits the ECB’s room to act and risks to growth are on the downside. Financing conditions will remain on the ECB’s radar screen, not only in terms of spreads but also in terms of overall bond yields. Finally, a cautious stance remains on credit markets, where US corporates look more resilient in terms of macro perspectives and technicals.

We’re still in a situation where we’re supportive in terms of monetary policy. Real rates are today very, very negative. So the beginning of the normalisation process should be relatively independent of the real economy