Summary

Executive Summary

We believe that in 2025 the European leveraged loan market will broaden its appeal to investors as a significant asset class to consider. While it has been well established in the US, it has grown significantly in recent years in Europe, with its market size currently close to that of the European high yield bond market. We expect this growth trend to continue, driven by robust demand from private equity firms, as they continue to view this type of credit as a flexible source of capital to support leveraged buyouts and M&A activity. We believe that European leveraged loans deserve to attract a higher degree of focus from institutional investors, given it is an asset class that stands out as an attractive source of returns and portfolio diversification.

In an uncertain environment characterised by elevated geopolitical risks, tariffs, large fiscal deficits and continued inflation uncertainty, we believe leveraged loans provide investors with an alternative source of diversification that has historically delivered stable performance across different phases of the cycle. Loans have historically shown less volatility compared to other fixed income assets, thanks to their low sensitivity to interest rates (given their floating rate structure) and a more stable investor base. Compared to high yield bonds, loans have a similar trading liquidity, but require a longer settlement period and have a slightly lower rating profile.

Looking ahead, we believe the outlook for leveraged loans remains supportive, and is backed by three main favourable factors. First, European leveraged loans offer relatively attractive yields in the fixed income space. Second, the default outlook for leveraged loans remains benign for 2025. Although economic growth is lacklustre and interest rates are relatively high, the default level has been dampened by interest rates starting to trend lower, and frequent refinancings taking place. Last, in a world of concerns about higher for longer rates, investor demand for floating rate leveraged loans is set to remain high.

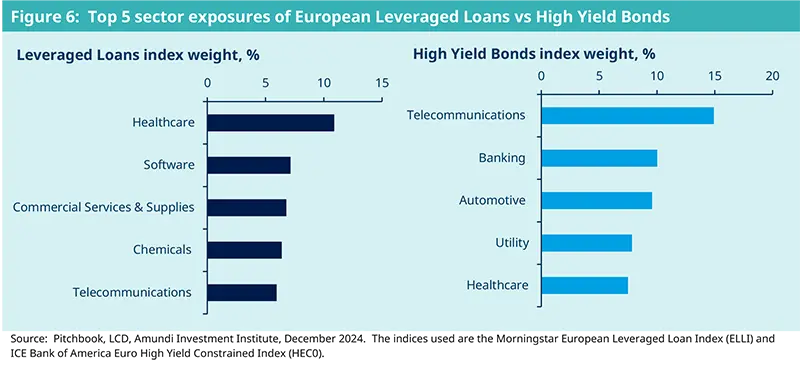

With regards to their role in portfolio construction, they are an interesting diversifier to consider, in our view. The exposure of the European leveraged loan asset class is mainly in defensive sectors, and thus it is complementary to that of the high yield bond market. Furthermore, they are among the few diversifiers which are resilient to higher inflation (floating rates), which contributes to a relatively low level of return volatility and weak correlation with other asset classes. Long-term historical analysis shows that an allocation to European leveraged loans would have helped to enhance the overall risk-adjusted returns of a European balanced portfolio. We believe that moving forward, there is room for an increasing role for leveraged loans in investors’ portfolios.

European leveraged loans offer attractive yields, low sensitivity to interest rates and weak correlation with the main asset classes, making them an appealing investment in an environment of high policy uncertainty

The increasing relevance of European leveraged loans for investors

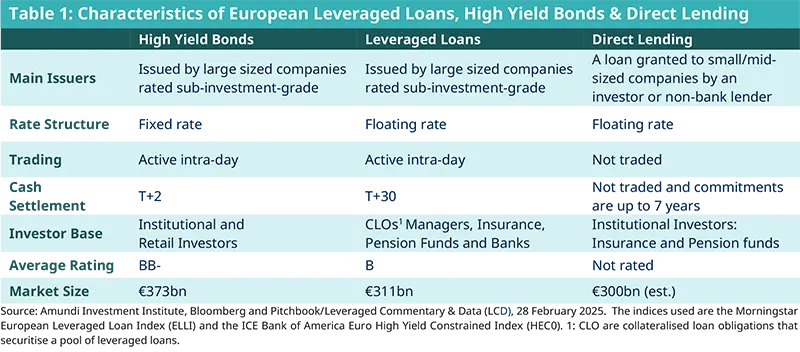

The European leveraged loan market (typically broadly syndicated bank loans structured as senior secured corporate debt) is a sub-investment grade asset class that sits between high yield bonds and direct lending markets in terms of its yield and liquidity profile.

The European leveraged loan asset class has experienced significant growth over the past decade, with its market size tripling since 2014. The market has reached €311bn, nearly the size of the European high yield market (€373bn). While this growth trend has been visible for a long time in the US, where the US leveraged loan market outsizes that of the US high yield market ($1.4 vs $1.3 trillion), it has been more recent in Europe, and we believe it is set to continue.

What are the leveraged loans?

Leveraged loans are senior secured corporate loans issued by well-established companies (average loan size in the Morningstar European Leverage Loan Index is c.€750m) to provide financing for acquisitions, leveraged buy-outs (LBOs) and/or general corporate purposes. They are typically structured, arranged and administered by investment banks and are syndicated to institutional investors (e.g. CLOs, credit funds and banks) through a primary issue market. These primary syndicated loans are usually held in medium- and long-term portfolios, and can be traded in an active secondary market. They are related to the high yield bonds and direct lending asset classes in that they all are used for general corporate, capital expenditure and acquisition financing requirements. Yet, they are underpinned by different investor bases and liquidity profiles (see Table 1).

Looking ahead, we believe the Leveraged Loan asset class will become increasingly relevant for investors, supported by its historic performance profile, attractive yields and relatively benign default dynamics, all of which contribute to a positive medium-term outlook.

Well-established market with stable performance across the cycle

European leveraged loans are an interesting diversifier and a source of income for long-term investors, with lower volatility and drawdown compared

to other fixed income markets.

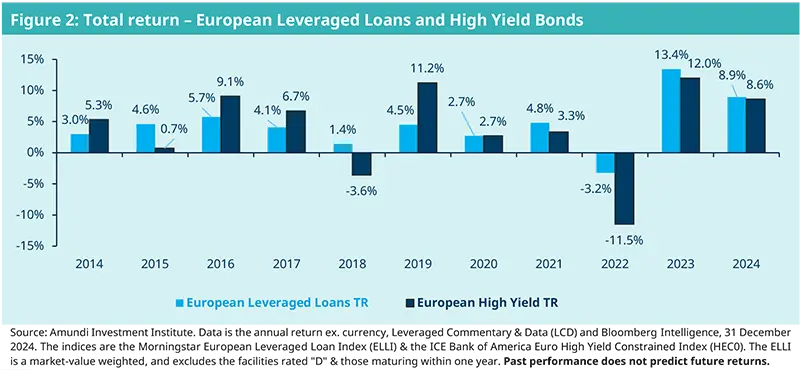

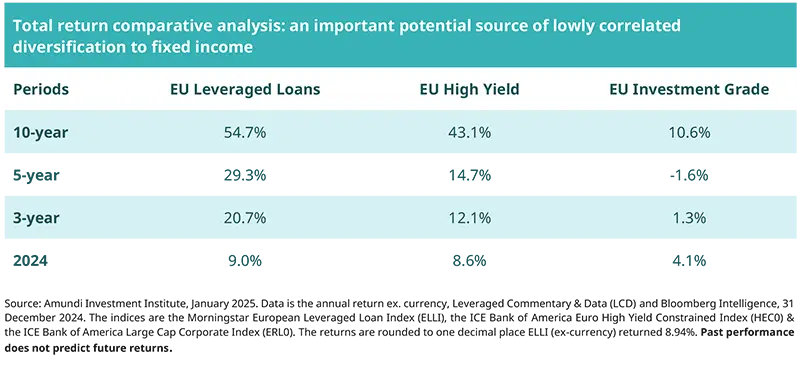

The European leveraged loans market is now well-established, offering investors a stable performance profile over the past decade in varying market conditions. On a total return basis, the asset class has outperformed other fixed income markets on a 10, 5 and 3-year basis and again in 2024 (see Appendix 1).

As part of the credit market, loans are sensitive to the economic growth outlook and risk sentiment. Yet, they show low sensitivity to interest rates due to their floating rate structure, a vital feature during 2022's rapid rate hikes. These caused notable losses in other bond markets while leveraged loans saw modest drawdowns. Equally, leveraged loans have achieved a stable performance profile in periods of negative and falling rates.

The structure of the investor base of the asset class contributes to its stability of performance. It is primarily an institutional market consisting of long-term investors (collateralised loan obligations (CLOs) 65%, long-term loan funds 25% and banks 10%). The stable ownership base of the asset class, combined with its floating rates, has resulted in a muted drawdown profile compared to other fixed income assets. This was visible in the asset class’ performance in 2015, 2018 and 2022, where loans showed greater resilience compared to high yield bonds. In 2015, high yield fell on concerns about Greek politics, the end of the Chinese growth story as well as the uncertain commodity cycle and energy sector outlooks. In 2018, a rise in risk-off sentiment due to macroeconomic and political worries (e.g. Italy’s budget dispute with the EU, Trump’s talk on tariffs) also dampened high yield bond performance. In 2022, following the Ukraine war and interest rate hikes, loans delivered a better drawdown profile than high yield bonds. However, partly as a consequence of more modest initial drawdowns, leveraged loans do not rally as strongly as high yield bonds in periods of favourable market sentiment. Leveraged loans’ lower volatility relative to other asset classes results from returns coming more from interest income, than capital gains, reinforcing the importance of loan selection when investing.

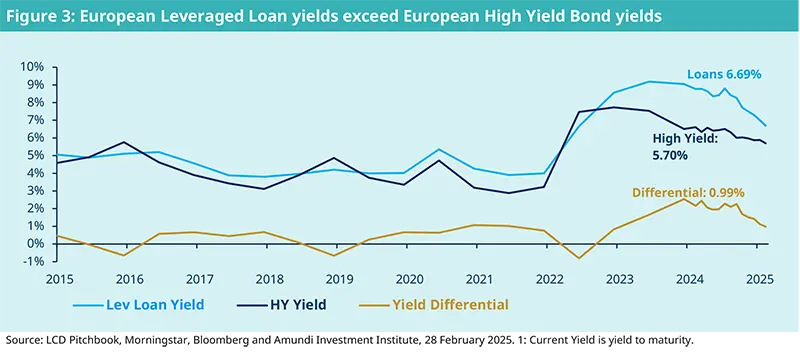

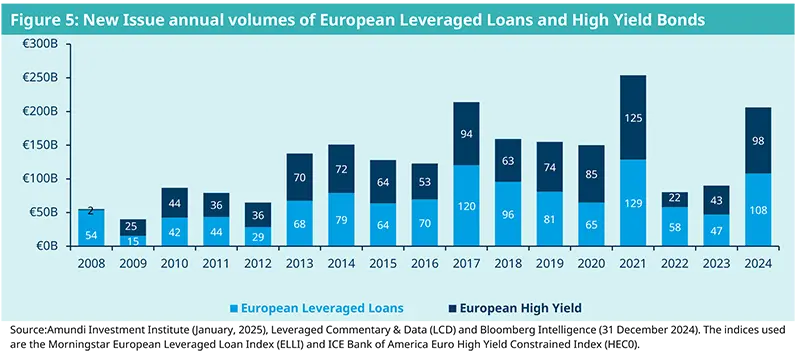

Attractive yield

While in the past European leveraged loan yields have been aligned to that of high yield bonds, in recent years the yield gap has widened in favour of leveraged loans. This has been due to the strong compression in high yield spreads driven by the undersupply of the European high yield market. Issuance in European high yield had declined from a 3-year average (full years 2019, 2020 and 2021) of €96bn down to an average of €54bn (full years 2022, 2023 and 2024) and the European High Yield Constrained Index (HEC0) size has fallen by nearly a fifth from €475bn in 2022 to €375bn in December 2024.[1] Meanwhile, loan spreads have remained aligned to their pre-Covid levels, although more recently they are showing signs of tightening. Another factor that has benefited loan yields has been the ECB’s interest rate hikes which began in 2022 to combat inflationary pressures. These and other technical factors have helped to push up leveraged loan yields to a significantly higher level than those of high yield bonds.

The usual loan yield pickup is visible when comparing European leveraged loans and high yield bonds markets at index level (see below). This also holds true when comparing on a like-for-like rating basis (i.e. single B leveraged loans versus single B high yield). Additional elements explaining this yield pickup are the delayed settlement cycle and the narrower but stable buying base. As a result, European leveraged loans display one of the most appealing net carries (adjusted for risk) across liquid credit segments.

Benign default outlook

At index level, 69% of issues are now bid above par. This combined with continued firm loan demand and a benign default cycle bodes well for the asset class in 2025.

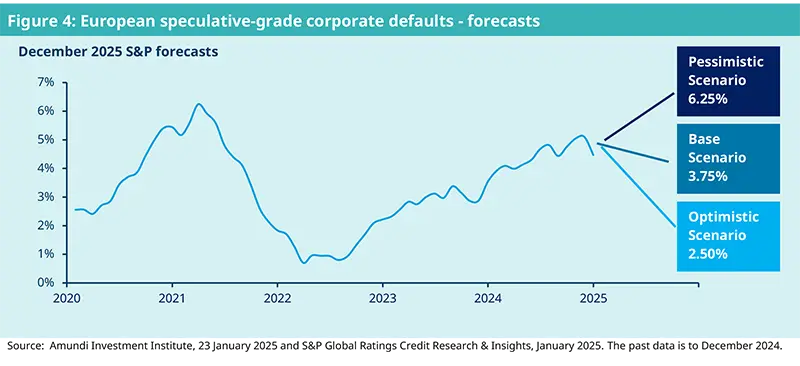

Turning to defaults, despite weak economic growth in Europe and the higher level of interest rates, they remained low in 2024 and below initial expectations (currently LTM default ratio is 0.30%). Defaults in leveraged loans and in broader credit markets have been low thanks to supportive global liquidity conditions, weaker but non-recessionary economic growth, declining private leverage and more rigorous banks and investors underwriting. Furthermore, the default environment has been helped by interest rates starting to trend lower and numerous refinancings throughout 2023 and 2024. During 2025, the S&P Global Ratings Research and Insights team expect the European 12-month speculative-grade corporate defaults to decrease to 4.25% (see Figure 4 below)3. However, leveraged loans constitute only part of this broad speculative grade asset class, and we foresee a tick-up of the leveraged loan default rate to be closer to 2%, with a typical average 60% recovery rate. Weaker creditor protection in documentation across sub-investment grade credit will see dispersion amongst recoveries in this 60% figure, ensuring that credit selection will be important alongside interest “carry” to deliver performance to investors. Only 1.6% of the European Leveraged Loan Index currently trades under an 80c price mark which is supportive of an overall benign default outlook for 2025 (see Figure 4 below).4

The overall backdrop supports a positive view for leveraged loans in 2025

The medium-term outlook for this asset class is on a firm footing. Loans are benefiting from a higher initial carry and low default rates. While expected ECB rate cuts may not enhance loan returns, EURIBOR rates are projected to remain above 2.0% over the medium to long term. This high initial carry may continue to favour leveraged loans over high yield bonds in the near future, a trend that has already been evident at the start of 2025. Also, at the beginning of this year, concerns about 'higher for longer' rates have impacted fixed income, while duration has not affected leveraged loans.

The technicals for the asset class are also supportive. We anticipate that demand will remain strong, driven by robust levels of CLO issuances and the likelihood that private equity firms will continue to view this type of credit as a flexible source of capital to support LBO and M&A activity. We discuss below our expectations for European leveraged loans total return performance for 2025. These expectations are estimates of future performance based on evidence obtained from past data. This data relates to the value of these investments and/or how current market conditions developed. Importantly, these estimates are not exact indicators. What investors will get will vary depending on how the market performs and how long they keep the investment. The investment may result in a financial loss. With the three-month Euribor expected to remain above 2% (currently at 2.5%)5, the tightening of weighted average margins to c.3.5% and the continuing of low default expectations, we believe this asset class could deliver a total return between 6% and 7% for 2025.

Five key characteristics of leveraged loans

1. A large and diverse opportunity set

As noted in the previous chapter, the European leveraged loan market has experienced robust growth over the last decade, with new loan issuances surpassing high yield bonds in eight of the last ten years. This established market provides a complementary source of diversification to the high yield bond market.

The European Leveraged Loan Index has over 400 issues, offering diversified exposure across countries and industries. It is primarily focusing on core countries (e.g., France, UK, Germany, Netherlands, and €-denominated US) and cash-generating businesses in defensive sectors. It has minimal exposure to the banks, oil, energy and gas sectors as well as low direct exposure to auto components (1.3%) and real estate management and development (1.6%).6

2. Floating rate structure

Leveraged loans feature floating short-term interest rates (Euribor) plus an additional spread (margin). Typically, they have a tenor of 5 to 7 years but can be repaid without penalty after 6 months, a flexibility that issuers and private equity sponsors highly value. In practice, loans often undergo refinancing within 3 to 4 years of issuance, usually through a sale of the business or other corporate events. In contrast, high yield bonds have a non-call period of two to three years, offering issuers the advantage of fixed pricing and visibility.

3. Actively traded but longer cash settlement time than high yield bonds

The leveraged loan cash settlement cycle is longer compared to high yield bonds (T+30 vs T+2), but a buyer has the benefit of accrued interest in this period and the seller is not exposed to market risk once the loan is sold. Despite this longer settlement liquidity, leveraged loans are actively traded over the counter and are priced intra-day, with multiple banks/trading desks as counterparties, allowing active management of these investments in a similar fashion to high yield bonds.

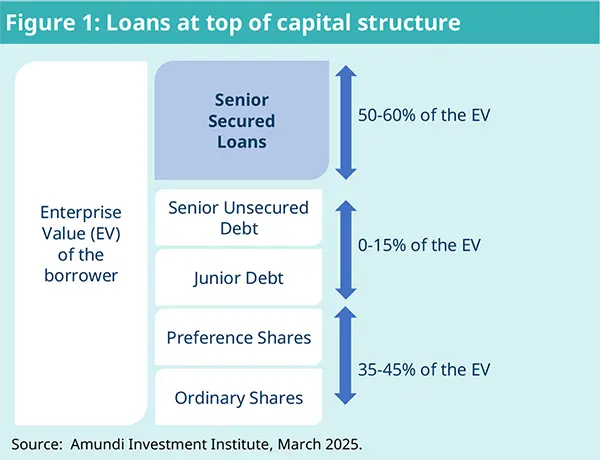

4. Investing at the top of the capital structure but with leverage

Leveraged loans are typically extended to sub-investment grade borrowers, posing a risk of non-repayment. However, this risk is mitigated by the loans being senior instruments secured by the borrower's assets. When issuers draw on revolving credit facilities beyond certain thresholds, typically they must meet quarterly tests, such as leverage ratios. In bankruptcy, senior secured lenders are prioritised for repayment.

Most issuers are owned by private equity sponsors who seek out stable businesses with strong operating cash flows to support the leverage. These private equity sponsors have significant 'dry powder' (uncalled capital) to support their companies should the need arise.

5. Good responsible investing data availability

In addition to the growing trend of ESG disclosure among companies in recent years, the European Corporate Sustainability Reporting Directive (CSRD) is intensifying the emphasis on companies' transition plans, and this is resulting in more ESG data being available to investors. The European leveraged loan market is also benefiting from this trend, offering sustainability-focused investors greater access to this asset class.

Given there is more limited opportunity for capital appreciation, credit selection is critical in maximising returns. The key will be to take index carry while avoiding pitfalls and the consequent price declines in individual holdings.

The appeal of European leveraged loans in asset allocation

A new world for diversification7

From an investor perspective, risk management challenges have radically changed from those of the last decade. Liquidity is not as abundant and rates are higher. The next phases of the economic cycle might remain atypical and short-lived – resulting in more volatile mainstream markets – with lingering tail risk from inflation in an era of high debt and rising fiscal deficits. Investors also face many more threats of a different nature, including: deglobalisation and geopolitical risks; greater fiscal and monetary policy influence; portfolio concentration; and higher trading instability. Finally, the natural protection that bonds provided in the past has faded: the equity/bond correlation hovers around zero and is both unstable and unreliable.

In a world of uncertainty and unstable equity/bond correlations, assets that deliver diversification will be in high demand, especially all-weather/low correlation assets.

Leveraged loans offer an appealing source of diversification to core asset classes in portfolio construction

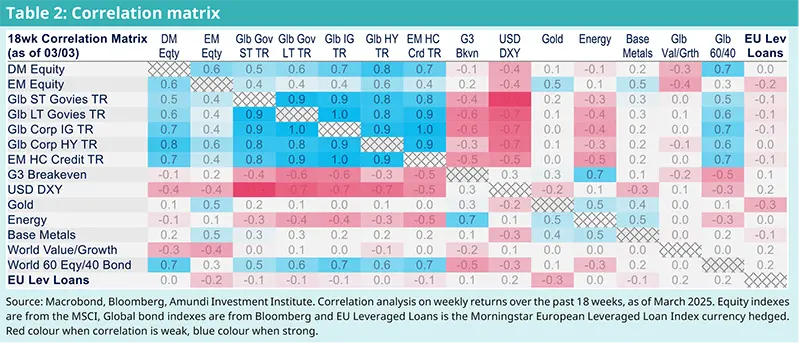

Leveraged loans provide some of these diversification benefits: floating rates provide a natural hedge against inflation; the focus on stable businesses and high debt seniority provides a defensive bias; and their stable ownership/holding base relative to other credit segments results in lower volatility. In the correlation matrix below, European leveraged loans display negative or no correlation with mainstream assets. These statistics, which encompass the multiple market rotations that have unfolded since November 2024, emphasise the diversification benefit from European leveraged loans.

Leveraged loans may help optimise allocation’ risk/reward

European leveraged loans’ historical risk/reward ratios have proved appealing compared to the majority of markets, and we expect this to continue in a world where many risky assets, such as equities and high yield credit, trade at historically high valuation levels.

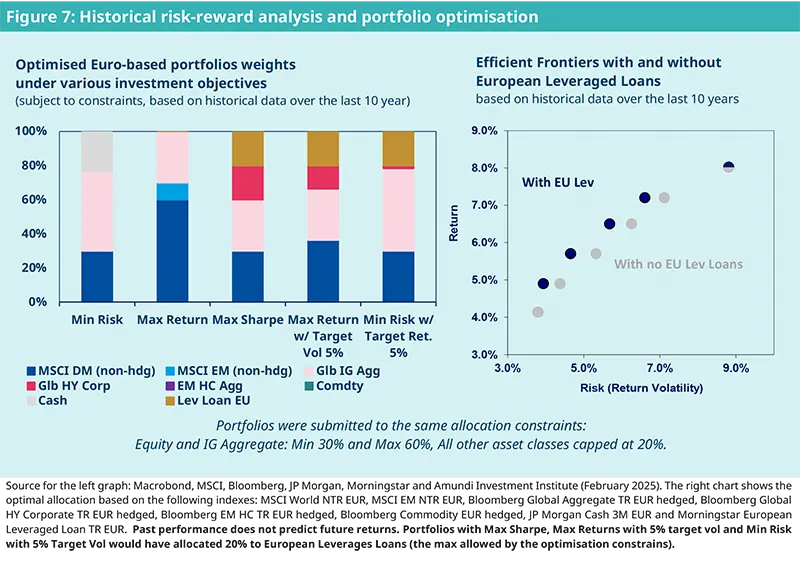

Based on data over the last 10 years, we simulated allocations that optimised the risk/reward for diversified Euro-based portfolios. Our optimisation shows that portfolios targeting a return volatility between 3% and 9% would have benefited the most from including European leveraged loans. In other words, without leveraged loans, investors would have had to accept lower returns, or higher volatility.

Designed to be similar to 40/60 or 60/40 portfolios, these portfolios were submitted to the following constraints: a minimum and maximum equity and government bond weights of 30% and 60%, respectively, and a maximum 20% weight for all other asset classes (Figure 7). The left chart reveals that portfolios seeking to maximise the Sharpe ratio, or to maximise performance with a 5% volatility objective, or to minimise volatility with a 5% performance objective, would have all allocated to European Leveraged Loans.

The optimisation results are synthetised on the right chart with the so-called “efficient frontier” (which determines, for a given level of risk, the allocation mix that delivers the highest possible return). This efficient frontier is always above that of portfolios having no allocation to European Leveraged Loans, submitted to the same constraints. These analyses emphasise that European Leveraged loans provide both a source of returns and diversification for a large spectrum of investors’ risk profiles.

Appendix 1: Leveraged loans have a good performance track record

Sources

1. Source: Amundi Investment Institute (January, 2025), Leveraged Commentary & Data (LCD) and Bloomberg Intelligence (31 December 2024). The indices used are the Morningstar European Leveraged Loan Index (ELLI) and ICE Bank of America Euro High Yield Constrained Index (HEC0). The high yield market size data was sourced from Bloomberg Intelligence.

2. Morningstar European Leveraged Loans Index, 28/02/25.

3. S&Ps speculative grade default rate include high yield bonds, leveraged loans and distressed exchanges.

4. Date 28/2/25.

5. 12/03/25.

6. Source: Pitchbook/LDC, January 2025.

7. Diversification does not guarantee a profit or protect against a loss.