- The UK fiscal budget main political implications: The budget is designed to improve public finances, regain market trust, and help the Conservative government regain some ground ahead of the next election. However, ultimately, investor confidence in the UK has been shaken because of the volatile political environment that has persisted since the Brexit referendum and that has accelerated in recent months. That will be much more difficult to achieve for PM Sunak and his Chancellor, given the deep divisions that run through the Conservative party. Growing voter dissatisfaction and party infighting through 2023 is likely to lead to early elections, meaning political uncertainty will remain at the heart of investor concerns for some time.

- Main market implications: The budget offered no major surprises for markets participants. The scale of fiscal consolidation and most of the announced measures were in line with expectations and UK assets didn’t react in a disorderly manner. Restoring credibility was the government’s main goal and what was announced alleviates part of the risk premium attached to UK assets. Investors’ focus though may rapidly shift from UK fiscal responsibility to the UK growth and inflation mix, therefore suggesting it may be too early to start repositioning towards the country. Regarding rates expectations, the fiscal budget is not a game-changer and we continue to expect interest rates to peak around 4.5%. Concerning sterling, the correction may be over as the political premium dissipates, but we don’t yet see catalysts for an outperformance of the currency. In Equities, in local currency terms, the UK market has been one of the best performing equity markets this year to date. The UK market offers an interesting profile for large stocks, high dividend and a defensive sector profile that is interesting in times of stagflation.

What are the political and social implications of the UK budget?

This was as much a political budget as it was a budget to improve Britain’s public finances. The overall aim was to regain the trust of markets and to improve the chances of re-election for the Conservative party. Forcing voters to tighten the belt now, and hoping this will cause inflation, and interest rates, to fall could allow the Tories to claim credit for the improved economic environment and offer tax cuts ahead of the next election.

It was noteworthy that the Tories doubled down on supporting their key voter base, pensioners, by committing to raising pensions in line with inflation. Confirming more spending for ‘levelling up’ and increasing taxes on high income earners also highlights that the Conservatives are still targeting former Labour ‘red wall’ seats in left behind areas that switched to the Tories at the last election, but have since been increasingly disgruntled with the party.

By increasing spending for schools and the NHS, the Conservatives are trying to assuage their core middle-class voter base which is concerned with the deterioration of public services.

The social impact of the budget is less clear at this point. While tax increases will be felt across the board, the government has also announced various measures to support those hardest hit by the cost-of-living crisis. Overall, this budget has the potential to help the Conservative regain some ground ahead of the next election.

Will it improve the UK’s reputation with financial markets?

Yes, for now it should. The spending cuts and tax increases will help the government regain trust it lost over the recent ill-fated ‘mini-budget’ of PM Rishi Sunak’s predecessor, Liz Truss. Fiscal restraint and monetary policy aligning with fiscal policy will alleviate concerns over the direction of the UK’s finances and economic outlook.

However, ultimately, investor confidence in the UK has been shaken because of the volatile political environment which has persisted since the Brexit referendum and accelerated in recent months. Three Prime Ministers and four Chancellors in one year is not something that calms market anxiety. Therefore, at least as important as fiscal responsibility will be to restore trust in British politics. That will be much more difficult to achieve for Sunak and his Chancellor given the deep divisions that run through the Conservative party. Growing voter dissatisfaction and party infighting through 2023 is likely to lead to early elections, meaning political uncertainty will remain at the heart of investor concerns for some time.

This is both a political budget and a budget to improve public finances.

What about the UK’s ongoing commitment to Ukraine?

While supporting Ukraine militarily was of critical importance to former PMs Boris Johnson and Liz Truss, it is clear that Rishi Sunak does not share their level of enthusiasm for supporting Ukraine financially and militarily. Chancellor Hunt reversed former Chancellor Kwasi Kwarteng’s plan to increase defense spending to 3% of GDP, instead maintaining it at 2% of GDP. However, we still expect the UK’s appetite to support Ukraine militarily to remain high for now, as helping Ukraine fight Russia is a key concern for Conservative voters. Nevertheless, should the economic pain become increasingly difficult for UK voters, it is likely that the UK government will join other Western leaders in pressurising Ukraine to sit down for negotiations with Russia.

What will the implication for government debt and borrowing be?

Following the announcement of the new fiscal plan, the update in expected bond issuance volumes was the main focus on the radar screen of the gilt market. As expected, adjustments to the Debt Management Office’s financing remit point to lower volumes of planned issuance, as for the fiscal year 2022-23, planned gilt sales fell close to £170bn from the roughly £194bn announced in September. The reduction in funding needs by £24bn looks overall stronger than that expected by consensus based on recent surveys and regarding most projections, mostly in the area of a £10-15bn fall (on the back of £180-185bn in new expected issuance). The breakdown of adjustments by curve segment sees a higher relative cut in planned issuance with respect to September for short- and medium-term instruments than for long-term instruments, consistent with similar revisions in the opposite direction announced in September. Overall, under this regard, the announcement on next year’s borrowing confirms the commitment of the new government to regaining the trust of markets via more fiscal discipline. However, we expect that markets will keep monitoring medium-term borrowing perspectives in a weaker macroeconomic environment with risks on supply tilted to the upside and within a more restrictive monetary policy environment needed to fight inflationary pressures.

The announcement on next year’s borrowing confirms the commitment of the new government to regaining the trust of markets via more fiscal discipline.

What will it mean for rates and what do we expect from the BoE?

As widely expected, at its last meeting, the BoE joined the ECB and the Fed with a 75bp move. But despite the larger-than-previous hike, communications were overall dovish. Regarding the forward guidance, the BoE explicitly pushed back on market terminal rate expectations, acknowledging the need to tighten more, but less than implied by markets in the weeks before the meeting: the new set of macro forecasts published by the BoE is consistent with this message on the forward guidance. At the same time, the central bank made it clear that risks are still tilted to the upside, as the 2023 challenge for CBs will remain to maintain their credibility in fighting inflation. On the implied terminal rate, markets recently moved close to our expected level, pricing in most of the recent more dovish communications from the BoE and the recent announcements on the fiscal front. Following the last 75bp hike, we still expect to see a 50bp hike in December and our view is that UK interest rates will probably peak around 4.5%. In this respect, the most recent fiscal news flow does not appear to be a game-changer.

We continue to expect interest rates to peak around 4.5%.

What will it mean for sterling and UK assets?

Restoring credibility was the government’s main goal and what was announced alleviates part of the risk premium attached to UK assets. Investors’ focus though may rapidly shift from UK fiscal responsibility to the UK growth and inflation mix, therefore suggesting it may be too early to start repositioning towards the country. Inflation continued to surprise to the upside in October (thus weighing on real yields) while the UK economy looks set to enter a recession in 2023 (OBR projections suggest UK GDP will shrink by 1.4% in 2023), all elements leaving the GBP highly vulnerable to any negative surprise in the short term, in our view. The currency remains highly cyclical in nature and its real rates remains too low, given weak UK external positions. The pace of the correction may have peaked (as the political premium dissipates), but the currency may struggle to outperform in the absence of positive catalysts from abroad (the Fed plays a key role here).

The correction for sterling may be over, but we don’t yet see catalysts for an outperformance of the currency.

What are the implications for the UK equity market?

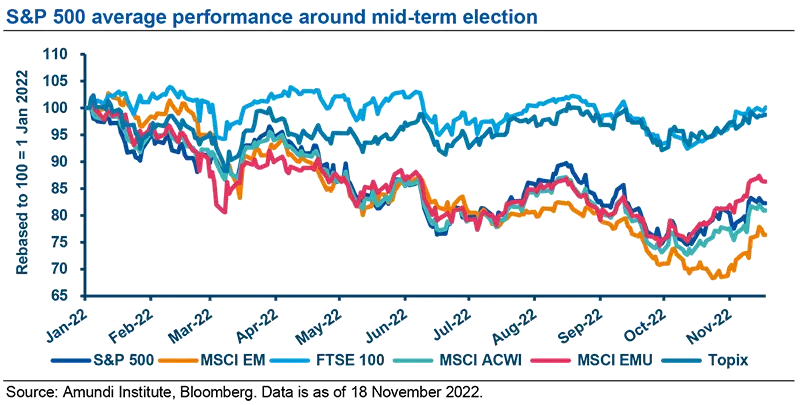

In local currency terms, the UK market has been one of the best performing equity markets this year to date, along with the Japanese market. As of 18 November, the FTSE100 was almost flat year-to-date, as was the Japanese Topix, compared to -14% for the MSCI EMU, -18% for the S&P500, -19% for the MSCI ACWI, and -24% for the MSCI Emerging Markets index.

Four key factors explain this strong performance:

- Currency weakness. The GBPUSD has fallen by 13% since the beginning of the year. The major British stocks are indeed very international. In comparison, the more domestic-oriented FTSE250 has fallen much more (-19%) than the FTSE100.

- One of the highest dividend yields in the world, at 4% compared to 3.4% for the MSCI EMU and 2.3% for the MSCI ACWI, which is clearly an advantage when expected returns are low.

- A fairly defensive profile due to its sector composition, which also serves to protect against big movements on the international markets. Defensive sectors (health, consumer staples, utilities, communication services) represent more than 40% of the MSCI UK’s market capitalisation compared to less than 30% for the MSCI EMU.

- A strong representation of oil and mining stocks in particular; they account for 23% of the MSCI UK, which is much more than the Eurozone market (12%), the US market (7%), or the Japanese market (5%). These stocks were the big winners in 2022, and have undeniable advantages for the longer term.

These different characteristics give the UK market an interesting profile for large stocks in times of stagflation, which is precisely the case not only for the UK economy, but for Europe as a whole – this year and next as we see it. With the FTSE100’s beta relative to the MSCI World fairly low (0.85), it is logical that the counter-trend rebound that has taken shape since mid-October has benefited it less, but as long as the underlying trend of a bear market in global equities is not definitively challenged, the UK market will retain its advantages in local currency terms relative to other equity markets.

The UK market offers an interesting profile for large stocks, high dividend and a defensive sector profile that is interesting in times of stagflation.