Summary

TLTRO repayments and redemptions will drive incoming ECB passive QT over the next few quarters. So far, banks have repaid a small amount of liquidity, while the ECB’s recent decision on remuneration of excess reserves has helped keep current excess liquidity abundant, aiming at a smooth transmission of its monetary policy.

The role of TLTRO for Eurozone excess liquidity and scheduled redemptions

TLTRO borrowing played an important role in lifting the ECB balance sheet following the outbreak of the pandemic crisis, accounting for roughly 40% of the overall increase since February 2020, with QE, mainly through PEPP, making up the rest. Consistent with these trends, Eurozone excess liquidity increased by €2.8tn, corresponding to roughly 70% of the overall balance sheet expansion.

Before the pandemic, TLTROs outstanding amounted to some €600bn, mainly related to funding needs. Out of the following €1.6tn increase, roughly 25-30% was probably due to increased funding needs linked to lending activity, purchases of government bonds, and replacement of existing unsecured borrowing with TLTRO liquidity, while the remaining part appeared to be related to opportunistic borrowing. In this respect, the very attractive conditions attached to the new operations have helped mitigate the cost of negative rates in an environment of rising excess reserves.

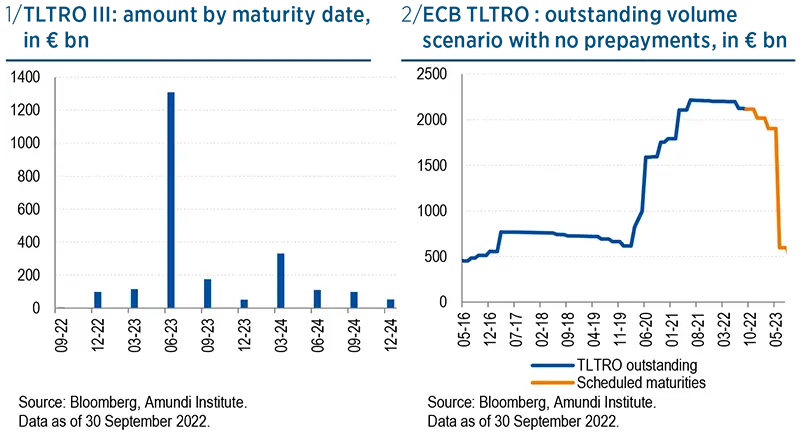

TLTRO repayments and redemptions will drive incoming ECB passive QT over the next few quarters. The maturity schedule shown in the chart below sees the largest volumes in June 2023. Before this, early TLTRO repayments will be a key driver of Eurozone excess liquidity. The right-hand chart below shows the resulting trend in the outstanding TLTRO amount without any meaningful prepayment compared to the scheduled timeline. The first date when banks decided whether to partly repay their liquidity was June 2022. After this date, the option for early repayment is on a quarterly basis. In June, banks repaid a very small amount of liquidity, around €75bn, as the rapid change in the ECB monetary policy stance and the ongoing rate normalisation increased the incentive to keep outstanding volumes stable. The trend in expected repayments changed significantly also in the ECB’s surveys of Eurozone banks. In this respect, rising uncertainty surrounding the economic outlook and the higher fragmentation risk led some financial intermediaries to refrain initially from early repayments and to postpone their payback. Then the July front-loaded ECB rate hike and the acceleration in the expected rate hiking cycle reduced even more the banks’ willingness to go through with early repayments.

Most TLTRO redemption volumes are concentrated in June 2023

Abundant excess liquidity in an environment of front-loaded rate hikes

Unlike previous hiking cycles, the current one not only appears aggressive in terms of front-loaded rate rises but is also taking place within a context of abundant liquidity surplus and a swift raise of rates into positive territory from a multi-year negative environment. As such, after having kept the deposit rate negative for eight years, the ECB finally brought it back to zero in July and then raised it into full positive territory by increasing policy rates by 75bp in September.

In terms of monetary policy implementation, the return of the deposit rate into positive territory has important potential implications on the transmission of monetary policy, depending on how the ECB will manage the remuneration of banks excess reserves first, and then of other deposits at the Eurosystem level, such as government deposits. Not only bank excess liquidity increased considerably through TLTRO, but also government deposits, which have more than doubled compared to pre-pandemic levels and were above €500bn recently. In the current context of collateral scarcity and huge excess liquidity being redeposited at the ECB, the reduction in reserve remuneration could have important implications on front-end bonds and repo rates. The demand for yield could indeed lead banks – and governments, as well – to invest at least part of their large amounts of extra cash in money-market instruments, fuelling richening pressures in a context of policy rate normalisation, likely impacting short-term asset swap spreads (ASW) that had already moved higher in previous months.

The recent ECB decision on remuneration of excess liquidity likely aims at reducing risks to monetary policy transmission in the front-end

Latest ECB decision on remuneration of excess reserves addressing current

At its September meeting – at which it at last raised its deposit rate broadly into positive territory at 75bp – the ECB decided to suspend its two-tier system remuneration system by reducing the multiplier to zero but did not change the remuneration of excess banking reserves. This is important in light of the guidance on future hikes to be expected over the next few meetings and implies that the entire amount of the excess reserves held both at the ECB deposit facility and in CB current accounts will be remunerated at the deposit rate. The statement was as follows:

“Following the raising of the deposit facility rate to above zero, the two-tier system for the remuneration of excess reserves is no longer necessary. The Governing Council therefore decided today to suspend the twotier system by setting the multiplier to zero.”

At the same meeting, the ECB reiterated previous messages on refinancing operations, namely that: “The Governing Council will continue to monitor bank funding conditions and ensure that the maturing of operations under the third series of targeted longerterm refinancing operations (TLTRO III) does not hamper the smooth transmission of its monetary policy.” Following these statements, and as hinted to at President’s Lagarde press conference, a review is likely to be conducted soon, including on TLTRO terms and conditions. The decision to suspend tiering appears to reduce the probability of some form of reverse-tiering to lower the remuneration of excess reserves at this stage. Removing some of the uncertainty on the short-term horizon, this decision helped limit the repayment of TLTRO borrowing at end-September, ultimately supporting the current liquidity environment. In our view, this decision may aim at reducing risks to monetary policy transmission in the frontend segment, providing some relief to the repo market, which had richened with a sharp widening of short-term ASWs. As such, the ECB’s latest decision looks consistent with the upcoming Q4 seasonality for liquidity in the current context of collateral scarcity.