Summary

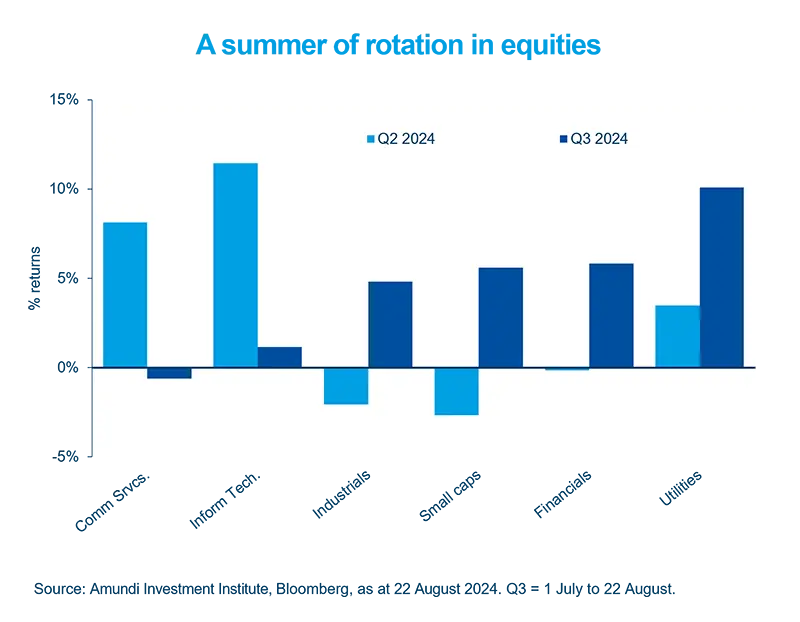

Market moves over the summer affirm our stance on rotation beyond large cap technology names towards areas that show a potential for strong earnings growth at reasonable valuations.

- The market rally seen this year is showing signs of broadening to other sectors.

- A continuation of this rotation depends on corporate earnings, economic growth and rate cuts by central banks.

- Investors should explore attractively priced businesses that show a potential for sustainable growth in earnings.

Global equities delivered strong performance this year on the back of resilient economic activity in the US and Europe. Some sectors such as technology outperformed the broader markets led by artificial intelligence-driven exuberance in the US. We are now witnessing signs of a broadening of this rally to other areas such as small caps, financials, that have lagged behind. Notably, August brought some market turbulence due to concerns around excessive optimism on artificial intelligence and disappointing US job market data. Markets have since recovered, but as we approach the final phase of the US elections, uncertainty may persist. Moving forward, market focus will remain on corporate earnings, monetary policy decisions, and economic growth, which could lead to further rotations.

Actionable ideas

- S&P 500 equal weighted

In order to explore rotation opportunities, investors may adopt an equal-weighted approach in US.

- Global and emerging market equities

The divergences in economic growth outlook globally calls for a global approach. This supports a case for exploring high quality businesses in Europe, UK and emerging markets.

This week at a glance

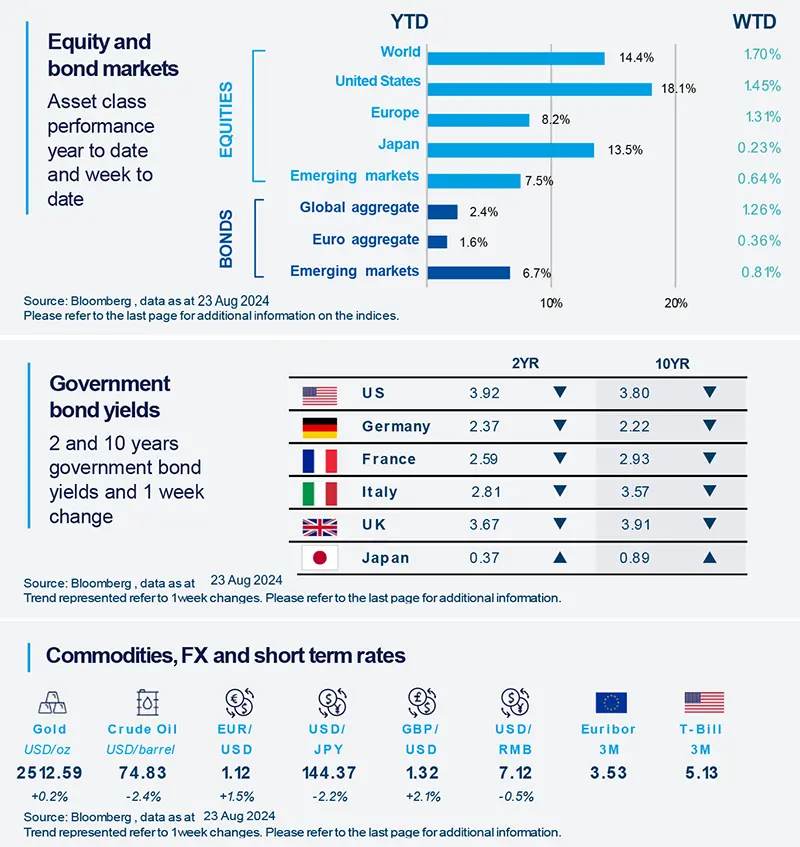

Equities looked past the summer volatility, and rose over the week amid expectations of interest rate cuts by the Fed. Bond yields declined. The dollar fell against most global currencies, and oil was also lower on concerns of slowing demand from large consumers such as China

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 23 August 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US jobless claims stabilise

The weekly initial jobless claims (people filing for claims for the first time) rose only modestly in the week ended August 17. Continuing jobless claims (those who are continuing to receive unemployment benefits) also edged higher but should level-off with a lag. We think this data is consistent with unemployment rate stabilizing for now and not deteriorating significantly in August.

Europe

Eurozone PMI got a boost from Olympics in France

After a July PMI (purchasing managers’ index) reading of 50.2 (below 50 level indicates contraction), the August PMI jumped to 51.2. This was driven by France and may be temporarily linked to the Olympics. However, there are downside risks coming from weak business confidence and worsening new orders, particularly on the manufacturing side. On the price front, there is positive news, with a further cooling of input cost pressures in the services sector.

Asia

Japan’s inflation is moderating

The national CPI inflation, excluding fresh foods and energy costs, dipped to below 2% in July, the first time since September 2022. But goods inflation strengthened sequentially, whereas services inflation remained subdued. Going forward, we think the CPI is likely to be in the range of 1.5%-2%, and wage growth is likely to improve.

Key Dates

|

26 Aug China medium term |

29 Aug US GDP, EZ consumer |

30 Aug GDP: France, Canada, India; |