Summary

Summary

The Conference of the Parties (COP)26 in Glasgow has been hailed as a turning point in the global fight regarding climate change amid a new US administration and a long and strenuous exit from the Covid-19 pandemic. Six years on from the Paris agreement, the objective is clear: limit the temperature rise to 1.5°C above preindustrial averages, which means reaching net zero carbon emissions by 2050, and cutting them by half this decade.

Currently we are not on the right track. In 2021, carbon emissions are set to rise at the secondfastest annual pace on record -- second only to the rebound after the Global Financial Crisis (GFC) in 2008. This runs counter to the growing narrative from policymakers and the private sector, who claim that climate change is the top priority on the global agenda. Indeed, we have seen climate change take centre stage in global macroeconomic and geopolitical dynamics, especially with regard to the USChina relationship. Although Covid-19 recovery packages provide a window of opportunity for ‘building back greener’, thus far, these plans fall short with regard to their climate ambitions.

The Covid-19 crisis has also put the spotlight on the social dimensions of the fight against global warming, calling for a ‘Just Transition’ to a lowcarbon economy. What do these dynamics mean for investors? What can they expect from the COP26 in Glasgow? In this paper, we provide a guide for investors on how to prepare for and understand the upcoming climate conference in Scotland.

What are the key implications for investors in the run-up to Glasgow?

Investors are increasingly making bold announcements in terms of reducing carbon footprints. This attitude is welcome. However, figuring out how to translate ambition into reality will be the challenge. On this front, it will be crucial for investors to assess their starting point, to define short-, medium- and long-term plans, and to design a plan that encompasses all facets of their business activity, from investment to reporting. New indicators – such as temperature scores – and new methodologies are becoming available. They have their respective merits and drawbacks but gaining early exposure to such innovations would enable investors to familiarise themselves with these new approaches.

1. The COP26: the coronation of climate policy

The upcoming COP26 in Glasgow will be a critical juncture. At a public policy level, it will mark the consecration of climate policy as one of the main drivers of macroeconomics and geopolitics for the 21st century. The United States has returned to the Paris agreement and President Biden made ambitious announcements at the recent Climate Ambition Summit he hosted in April: the US announced a target of a 50% reduction in greenhouse gas emissions by 2030 versus 55% for the EU. Several countries followed suit, notably Japan (46% reduction by 2030 from 26% previously) and Canada (40-45% reduction versus 30% previously).

This will put pressure on China and India. Beijing has already signalled its intent to become carbon neutral by 2060, although its Covid-19 recovery plan clearly falls short in the environmental sphere. The authors of a recent TransitionZero report argue that China must close almost 600 coal plants if it is to meet its pledges. Despite significant investments in wind, solar and even nuclear energy, China remains by far the largest polluter, as regional governors in China have been building new coal powered stations to fuel economic growth.

Another sign that climate policy is driving geopolitics related to recent announcements from John Kerry and Xie Zhenhua, the American and Chinese climate envoys, on cooperation between the two countries on climate change. It remains to be seen whether these words will be backed by concrete actions, but it is nevertheless a rare occurrence of positive language between the two largest polluters.

India has positioned itself as a key partner for the COP26. It has yet to announce a ‘net-zero’ plan, but will be under pressure to commit to certain climate goals. Since the beginning of climate negotiations, India has argued for ‘justice’ in terms of longterm contributors: developed countries have contributed more to the problem than developing countries over the long run, and it hardly seems fair that developing countries should sacrifice development to reduce carbon emissions -- with this even more the case as, on a per capita basis, India still pollutes far less than the EU or the US. Nevertheless, Indian policymakers have seemingly understood the strategic importance of renewable energy, with India and France notably founding the International Solar Alliance at the COP21 in Paris. India’s leaked draft National Electricity Policy for 2021 exemplifies these contradictions, with significant investments in renewable energy counterbalanced by an open door to new coal power plants. India’s positioning and commitments at the COP26 will be a critical ‘pass or fail’ factor.

The curtain is being drawn, making COP26 a ‘make it or break it’ moment six years after the Paris agreement. There has been no significant progress in terms of emissions reduction, apart from the small Covidrelated blip last year. If we are to reach net zero emissions by 2050, in line with a 1.5°C warming scenario, that should require cutting global emissions by half by 20301. Our collective and ambitious objectives need to be translated into concrete plans and actions now.

To do so, we know since Copenhagen in particular that some challenges need to be addressed by policymakers directly. To encompass all of these, one could say that climate action is a massive and collective economic depreciation exercise of some activities (carbon intensive ones) and appreciation of others (carbon neutral ones). A toolbox of policies is available to governments to organise this depreciation/ appreciation exercise: carbon pricing, regulations banning activities, and tax incentives for carbon neutral activities2.

|

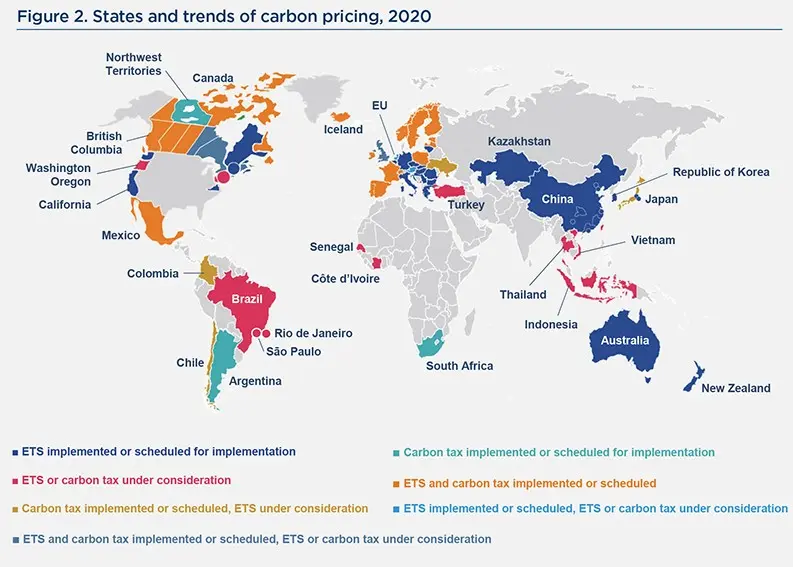

Carbon pricing: the ultimate solution? A growing number of economists are pushing the argument that carbon pricing is the most efficient tool that policymakers can use to shift businesses and economies to low-carbon models. Nobel Prize winning economist William Nordhaus has argued that “at a minimum, all countries should agree to penalise carbon and other GHG emissions by the agreed-upon minimum price”. Indeed, carbon prices shift the burn of adjustment from the highest emitters, but without resorting to complex and potentially highly distorting regulations. Polluters can either decide to invest in low-carbon technologies to reduce their carbon taxes or meet their capped emissions targets, depending on the system implemented. But they can also decide to maintain course and pay the fees. As such, carbon pricing is flexible -- and also a source of revenue for governments. Carbon pricing schemes currently cover approximately 20% of all carbon emissions versus 1% in 2000. This is a welcome improvement, but more needs to be done1. As of May 2020, there were 61 carbon pricing initiatives in place or scheduled for implementation, consisting of 31 ETSs and 30 carbon taxes2. What should be the optimal price of carbon? To reach the Paris agreement objective of keeping temperatures well below 2°C, the price of carbon should range between $50 and $100 per CO2 tonne by 20303. The EU carbon price has reached almost $50 while the Biden administration published an estimated cost of carbon of $52 and $62 in 2030, which compares with the $2-8 price range the Trump administration had given. ___________________ 1 IIF: GREEN WEEKLY INSIGHT The Social Cost of Carbon, 18 March 2021. |

Source: World Bank. ETS: emissions trading system. Data as of 10 May 2021

2. Covid-19: a window of opportunity to build back better

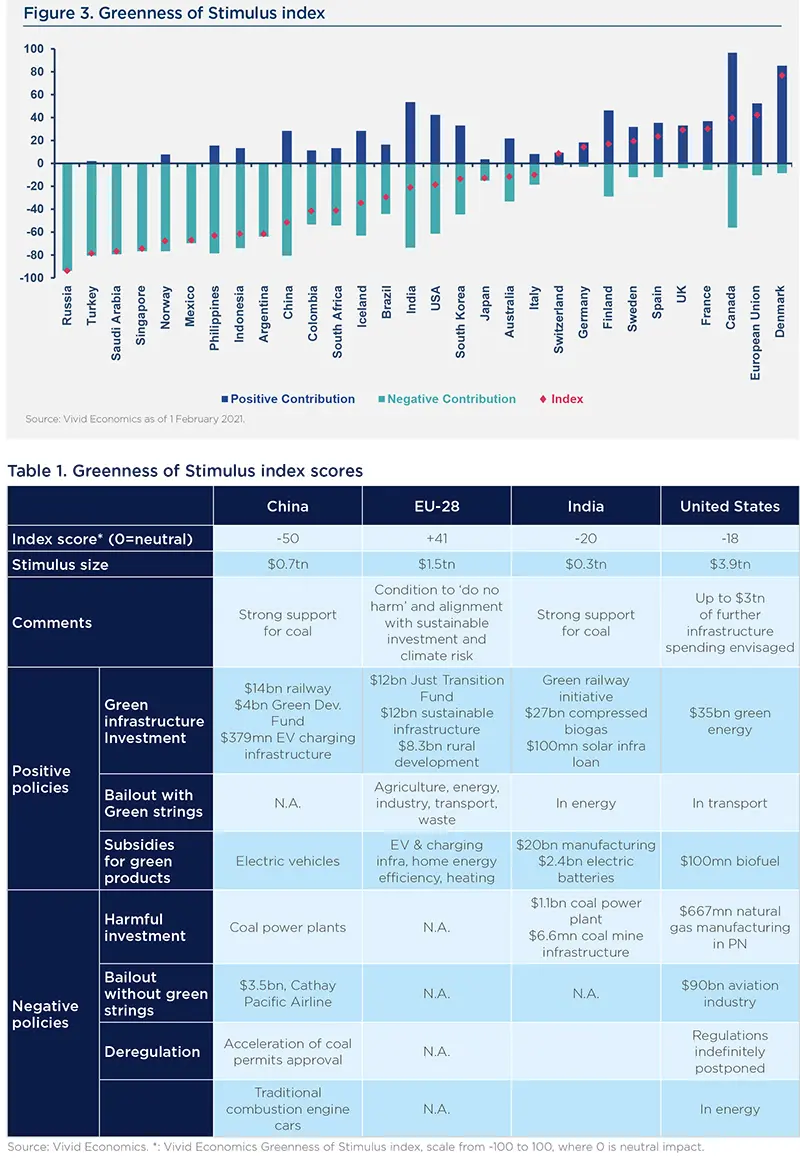

In a sense, the Covid-19 crisis should be considered as an opportunity. A majority of countries are now exploring (if they haven’t announced yet) recovery packages, with some featuring a green dimension. Indeed, the world’s leading economies have all announced stimulus packages ranging from billions to trillions of dollars, with inevitable impacts across sectors on carbon emissions and the environment. This begs the question: how green will those recovery plans be? The answer, so far, is a range. While much remains to be seen concerning the US, it is already clear that emerging economies have failed to step up, with China, India and Brazil notably sidestepping environmental issues, despite announcements on solar, wind, battery and forest investments. Unsurprisingly, the EU is leading the pack, with its Next Generation EU package. In the Union, all recovery loans and grants to member states will have an automatic ‘do no environmental harm’ clause.

To date, almost a third of stimulus announced across the globe will flow into environmentally intensive sectors that have negative impacts on climate change and/or biodiversity. The COP26 represents a key opportunity to change course and refashion these plans.

3. Going beyond climate change: incorporating the social dimension

There is more to the picture than simply climate change. One major factor is the social dimension of climate change: the social impacts that climate change has on societies around the world as well as those that result from the policies implemented to fight it.

The transition towards more sustainable models and consumption will be successful only if it is made socially acceptable. Recent events have demonstrated this over and over: from rejections of carbon tax increases in France to job losses in certain fossil fuel areas that are not directly compensated by ‘green’ jobs. The current Covid-19 crisis, which is still unfolding and regarding which socioeconomic ramifications remain to be fully seen and understood, will only compound this problem.

So, what is a ‘Just Transition’? In stylised terms, it is one in which the negative social impacts, such as job losses, are minimised while the positive social impacts are maximised. To be sure, the concept is not entirely new: its roots date back to the 1970s in the United States, when trade unions fought for workers whose livelihoods were threatened by new environmental regulations. Since then, it has taken different forms. In international climate negotiations, for instance, some states or regions have called for a ‘just’ contribution to fight climate change, meaning one that takes into account the fact that developed countries have overwhelmingly contributed to high levels of pollutions starting from the Industrial Revolution.

The 2015 Paris agreement notably called for actions that take into account “the imperatives of a just transition of the workforce and the creation of decent work and quality”. Finally, the Silesia declaration of 2018 called for special consideration regarding coal regions. Increasingly, the topic has spread from trade unions and international negotiations to day-to-day democratic life: in France, the government launched a Citizens Convention for Climate, inviting selected citizens from all walks of life to brainstorm on a new generation of climate policies.

If the concept has been around for half a century, why is this time different? For one, as mentioned above, the climate crisis has now been joined by a social crisis: poverty and inequality rates have risen, and may rise further as debt levels may constrain support for the poor and redistribution policies. Secondly, six years on from the Paris Agreement, it is clear that if we are to deliver on the ambitious climate promises made, words will need to be transformed into actions, potentially making their social impacts more salient than ever. This is even more the case as the longer we fail to act decisively, the more we face the risk of a brutal transition, an “Inevitable Policy Response”, as described by Vivid Economics and the Principles for Responsible Investment. Having said that, the Covid-19 crisis also presents a formidable opportunity to ‘build back better’, thereby including the social dimension in new sustainable policies.

Where do we go from here?

The debates around the ‘Just Transition’ testify to its complexity. Indeed, such a Transition has ramifications across all sectors, countries and social groups. One way to break this down is to look at it through four dimensions: workers, consumers, local communities and societies. Taking them in order, a Just Transition must ensure that workers in industries that are restructuring can find new employment in sustainable industries, and/or have adequate social safety nets. It is also one in which goods and services are aligned with the objectives of the Paris Agreement, and accessible to all. Local communities will be affected differently, and so sharing the benefits and costs equally will be crucial. The Just Transition must take care to ensure that every stakeholder plays their role in full through constructive dialogue to coordinated actions.

4. Implications for investors

What does this all mean for investors? It means they need clarity, they need a plan, and they need the right tools. Clarity first. Many themes will be thrown around at the COP26, from Net Zero to Just Transition to biodiversity. Understanding what each theme entails and what it means from an investment standpoint will be absolutely key.

Secondly, a plan. For each of these themes, investors will need to detail ambitious, credible, and transparent plans to reach their climate objectives. Responsible asset managers should work with their clients to accompany them on this journey, from the planning phase to the investments, all the way to reporting on progress made. Those plans need to incorporate four levers: investment processes, engagement policies, disclosures, and target setting. Corporates themselves are increasingly adopting decarbonisation plans, notably through the Science Based Target initiative (SBTi). The initiative evaluates emissions reduction targets of corporates against the sectoral objectives needed to reach netzero, working sector by sector. To date, there is a lot of progress to be made, as many corporates have yet to report (see figure 4).

Nevertheless, SBTi targets provide a useful and transparent indication of where corporates stand on their low-carbon transitions. For instance, in the power sector, being 1.5°C aligned means reaching zero carbon emissions by 2040.

Thirdly, the right tools. This must be understood broadly: in terms of investment products as well as extra-financial data. On products, it is important that asset managers start launching just transition solutions – for example, in the credit space, by rating companies on the basis of a just transition score. On this latter factor, there are exciting developments in the climate data space. For instance, some ESG data providers now compute temperature scores, a new metric that assesses a company’s trajectory to net zero. It is important that asset manager integrate this forward-looking metric into our investment processes.

So, what are the steps an investor can take leading up to the COP26?

- Set a short-, medium- and longterm strategy, with clear objectives in terms of reducing carbon emissions of portfolios, investing in green activities and technologies, and integrating specific themes (biodiversity, the social dimension of the transition), etc.

- Assess the starting point: what is the exposure to climate risks, both physical and transition? For example, development of a climate risk assessment tool could provide an overview of both climate risks and opportunities. Investors should consider integrating new climate data points as well that can give a different angle: for instance, newly developed temperature scores are more forward-looking than current carbon emission metrics and it is important to integrate these scores into portfolios.

- Based on the objectives set out above, activating levers to achieve these objectives could include the following:

- At the overall strategic asset allocation level, integrate environmental criteria, such as exposure to carbon, climate risks (physical and transition), investments in green technologies.

- Integrate carbon into investment strategies by decarbonising portfolios over time to meet Paris agreement objectives. In passive strategies, an obvious option is to consider Parisaligned or climate transition benchmarks. In active strategies, portfolios can set decarbonisation targets versus their benchmark of reference. Moreover, engagement should be a key lever to accompany corporates in developing and implementing robust environmental strategies. Active investors can also exploit the green premium by selecting not only companies that today are champions in the green transition but also companies that lag in terms of ESG rating today but that are putting in place a number of initiatives which will help them to be among the leaders of tomorrow.

- Invest in green activities, including carbon capture or reduction technologies – for instance, through green bonds or thematic strategies.

- Report clearly on objectives and progress made, and review regularly the objectives set out at the start.

|

Debunking carbon neutrality for corporates We need to reduce carbon emissions in order to limit the impacts of climate change. Globally, and as stated above, we need to reach net zero carbon emissions by 2050. For investors exposed to a diverse set of sectors and geographies, however, pushing for absolute carbon neutrality for all corporates may be misleading and perhaps even counterproductive for several reasons. An explanation is in order:

Investors and their responsible asset managers need to better understand what goes on behind ambitious ‘carbon neutral’ calls to make more educated and impactful investment decisions. |

DEFINITIONS

1 United Nations Environment Program – Emissions Gap Report 2019.

2 Climate Casino.