Summary

Key Takeaways

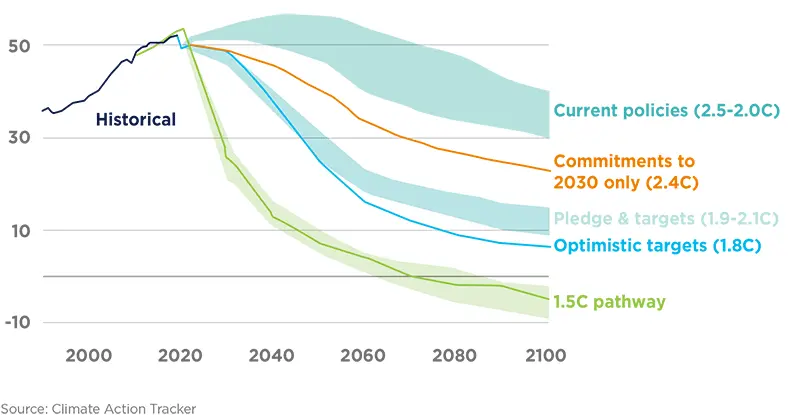

- Pledges by governments ahead and through the COP27 improved the announced stated scenarios from 1.8°C to 1.7°C (compared to 2.1°C ahead of COP26).

- G20 leaders agreed to pursue efforts to limit the global temperature increase to 1.5°C, and confirmed they stood by the most ambitious temperature goal of the 2015 Paris Agreement on climate change.

Introduction

Only 0.1°C, but a symbolic victory on compensation and momentum in financial system overhaul

On 6-20 November 2022, Heads of State, Ministers, and negotiators with representatives from business, civil society, mayors, and environmental organizations met in Sharm el-Sheikh in Egypt for the largest annual gathering on climate change. At the 27th Conference of the Parties1 (COP27) of the United Nations Framework Convention on Climate Change (UNFCCC), countries came together to take action towards achieving the world’s collective climate goals as agreed under the Paris Agreement.

This is the fifth time a COP is hosted in Africa, a continent responsible for only 3% of global emissions, yet disproportionately exposed to the negative impacts of climate change. In a pre-COP27 letter to parties and observers, the Egyptian COP27 President designate stressed the need “to restore the ‘grand bargain’ at the centre of the Paris Agreement and our collective multilateral climate process – whereby developing countries agreed to increase their efforts to tackle a crisis for which they are far less responsible, in return for appropriate financial support and other means of implementation.”

This letter came a few months after Barbados’ Prime Minister Mia Mottley launched the Bridgetown Initiative, a call to overhaul global financial system, with a focus on reforming the World Bank and the International Monetary Fund (IMF).

Following a year of increasing extreme weather events, broken temperature records, and a growing energy crisis worldwide, COP27 was meant to be both the COP of implementation, and the COP of emerging markets: held in Egypt, it offered a chance to bring in more typically marginalized viewpoints during discussions and to forge close ties of collaboration between developed and developing nations.

Nations were also required to show how they are putting their COP26 promises into practice, including urgently cutting greenhouse gas emissions, boosting resilience, preparing for unavoidable climate change impacts, and funding climate action in developing nations. Pledges by governments ahead and through the COP27 improved the announced stated scenarios from 1.8°C to 1.7°C (compared to 2.1°C ahead of COP26).

However, implementing the necessary measures remains the most daunting task in a challenging macroeconomic environment.

The key outcomes of COP27 in putting the world on a Paris-aligned trajectory and assisting developing nations in combating climate change are presented in the following sections. The loss and damage fund, as well as the momentum gathered by the Bridgetown Initiative appear already as the most significant results from this COP.

During the COP, G20 leaders agreed to pursue efforts to limit the global temperature increase to 1.5°C, and confirmed they stood by the most ambitious temperature goal of the 2015 Paris Agreement on climate change. Important announcements such as the Indonesian Just Energy Transition Partnerships (JETP= also emerged from the Bali Sumit. Taking stock of both the G20 and COP27 announcements, we are still a long way of placing the world on a well below 2°C trajectory. But the JETP focus on coal phase out represents hope as starting by seriously addressing the issue of 9,000 or more coal power plants is the most sensible thing to do.

Loss and damage : compensation and adaptation agenda

COP27 came to a historic conclusion with a decision to compensate «loss and damage» for vulnerable nations who have been severely affected by climate disasters. To help developing nations respond to loss and damage, governments decided to create new financial arrangements and set up a dedicated fund. Additionally, governments concurred to form a «transitional committee» to advise on how to operationalize the new financial arrangements and the fund at COP28 the following year. The transitional committee’s inaugural meeting should take place before the end of March 2023.

In the past year, many countries have seen unprecedented droughts, extreme flooding occurred in several parts of Asia (such as India and Pakistan), and record temperatures were witnessed over the globe, notably in the UK and Europe. Therefore, it does not come as a surprise that one of the first things on the agenda at this year’s COP was adjusting to the effects of climate change. Developing countries have long demanded that adaptation and mitigation be given the same weight in COP debates and the topic of compensation has emerged more than 30 years ago when small island states asked to countries that were responsible for climate change to pay for the consequences for rising sea levels.

The term «mitigation» refers to actions taken to lessen or stop the emission of greenhouse gases. Making existing equipment more energy-efficient, employing new technologies and renewable energy sources, altering management procedures, and changing customer behavior are all examples of mitigation actions.

Adjustments to ecological, social, or economic systems in response to real or anticipated climatic stimuli and their effects or impacts are referred to as “adaptation”. In order to mitigate possible harm or take advantage of possible opportunities brought on by climate change, systems, methods, and structures must be changed.

Creation of a Loss and Damage Fund for vulnerable countries

At COP27, loss and damage was highlighted by developing countries as one of the main issues that needed to be addressed. Until now, loss and damage measures have not gathered consensus among key stakeholders. Loss and damage money is intended to cover the impacts of climate change that cannot be adapted to, nor mitigated, due to their devastating and disruptive nature, such as droughts that affect once-productive farms and rising sea levels that permanently flood island communities.

The compensation agenda has since its creation stumbled upon the opposition from ‘rich countries’ group, first against the concept of climate-related liabilities, then to narrow down the scope of countries eligible to compensation to the most vulnerable economies (and not to all emerging markets and developing economies), and include the participation from other large emitters.

In that respect, and bearing in mind the details of the fund, and committed amounts will need to be ironed out between now and the next COP, the creation of a Loss and Damage Fund for Vulnerable Countries, for the first time ever at a COP, can be seen as a major success.

Nevertheless, outstanding issues remain: first, the absence of consensus on what counts as loss and damage (such as the destruction of property, infrastructure, or natural ecosystems) and on how to connect specific natural disasters to the consequences of global warming.

Second, the specifics of how industrialized countries should make payments as well as which countries should be eligible to receive the funding have yet to be detailed. As many of the worst affected nations are experiencing financial issues, developing nations are requesting more public funding and grants rather than loans.

Last, according to a research by 55 vulnerable nations, the overall cost of climate-related losses over the past two decades was $525 billion, or 20% of their combined GDP (GDP). Additionally, these losses might total $580 billion annually by 2030. These sums are far less than the $1.3 trillion benchmark for loss and damage funding that was declared at COP26.

Adaptation Agenda

The COP27 Presidency presented its Adaptation Agenda, a program set to help populations adapt to the devastating impacts of climate change. The Sharm-el-Sheikh adaptation agenda is the first plan gathering state and non-state actors on adaptation issues. The agenda received support from the UNFCCC and more than 2000 organizations. The Sharm-el-Sheikh Adaptation Agenda lists 30 adaptation outcomes in order to improve resilience for 4 billion people who live in the harshest climatic conditions. Each category contains global suggestions that can be implemented locally to assist communities in preparing for the effects of climate change and directing their transition to climate resilient systems. For instance, mobilizing the $140 to $300 billion in public and private funding necessary for adaptation and resilience might encourage 2,000 of the biggest corporations in the world to incorporate physical climate risk and create workable adaptation strategies.

Snapshot of other Adaptation news

- Within the next five years, the totality of the world’s population should be protected by early warning systems. To this end, the UN Climate Early Warning Systems Proposal was announced earlier this year by UN Secretary-General António Guterres. The scheme, which is estimated to cost $ 3.1 billion by 2027, will focus on funding early warning systems in the most vulnerable nations. This plan was discussed more extensively at COP27, in light of the intensity and frequency of catastrophic weather occurrences. In this context, the United States have committed to doubling their financial contribution to the Adaptation Fund, bringing it to $ $100 million by FY 2022.

- The announcement at COP27 of the launch of the Global Shield Financing Facility was meant to go in that same direction. An initiative of the G7, this facility was introduced with the aim of raising money for nations experiencing climate calamities.

Moreover, Denmark, Finland, Germany, Ireland, Slovenia, Sweden, Switzerland, and the Walloon Region of Belgium announced a total of $ 105.6 million in new funding and emphasized the demand for even more support for the Global Environment Facility funds aimed at the immediate needs of low-lying and low-income states for climate adaptation.

- In addition, the European Bank for Reconstruction and Development launched its Climate Adaptation Action Plan (CAAP). This new strategy aims at integrating adaptation in the core activities of the bank, such as project and policy design, business development, funds allocation and partnerships.

The entire adaptation agenda is a reply to the Glasgow Climate Pact at COP26 to increase adaptation finance to developing countries.

IMPLICATIONS FOR INVESTORS

As reminded in the IPCC’s reports, climate adaptation is not only about the safety of populations but also about the resilience of companies operations and the security of their assets in face of climate-related events or more commonly called physical risks. Given the great initial support that the Sharm el-Sheikh Adaptation Agenda (called hereafter “The Agenda”) has received, we think it is insightful to analyse the implications for investors if the recommendations were to be implemented in governments’ policies.

The Agenda

- Focuses on five human and nature systems

- Considers seven physical risks identified as the most threatening

- Specifies 30 targets to achieve by 2030 or before.

Even if the practical implications to achieve such targets are still relatively vague, it is clear that some of these objectives require additional efforts from the food and financial sectors:

- In line with the Deforestation Pledge and global recommendations to stop agricultural expansion, deforestation needs to halt before 2025 and any conversion of non-agricultural land to agricultural land have to stop by 2030. Therefore, companies that are involved in the value chain of key commodities (e.g. beef, soy, palm oil, cocoa, coffee, wood, rubber) should develop appropriate oversight of their supply chain to ensure that their products or activities do not cause land conversion and deforestation. Engaging with such companies for more transparency, notably in the food sector, is therefore key to assess if the due diligence, chain of custody and certification processes they have implemented are sufficient to ensure zero deforestation in their value chain.

- The Agenda also makes several proposals to ensure food security. Innovative levers other than expansion need to be used to increase global production, drastically reduce food waste, and modify food consumption patterns toward more resource efficient and climate resilient products. Engaging companies in the food value chain to enhance transparency on the resource efficiency (notably energy and water efficiency as well as GHG intensity) of their food products and their exposure to physical risks is a lever of action for investors. Investors may push for ambitious reduction targets on food waste, as well as on the offering of alternatives to meat and seafood with high environmental footprint and negative impacts.

Rethinking International Financial Architecture and Mobilizing Finance

In a world awash with liquidity from various quantitative easing in developed countries, some observers have forgotten that finance remains a critical issue for climate adaptation and climate mitigation funding in most parts of the world, and this harsh reality has been exacerbated by the latest energy shocks and anti-inflation monetary measures that followed through.

Against this backdrop, Barbados’ Prime Minister Mia Mottley has built a global coalition to “overhaul the financial system”, with concrete propositions to reform the World Bank and the IMF as the world is still failing to provide developing countries with the funds they need to invest in resilience, address climate change and meet development goals.

The Bridgetown Initiative

The Bridgetown Initiative aims at transforming the financial system in order to help vulnerable countries access the funds they need to address climate hazards.

The Initiative’s ask can shift the focus at COP27 and is divided into three phases to mobilise and coordinate a new financial system that drives financial capital towards climate action and addressing the SDGs. The three phases are highlighted below:

- Provide Emergency Liquidity

- Expand Multilateral Lending to Governments by $1 trillion

- Activate Private Sector Savings for Climate Mitigation and Fund Reconstruction after a Climate Disaster through new Multilateral Mechanisms.

IMPLICATIONS FOR INVESTORS

How investors can support the development of the energy system of countries in frontier markets in a way that is both beneficial for their economic development and the global energy transition.

The Bridgetown initiative remains at this stage with no concrete support (nothing has been signed, no commitment has been taken) but the praise it has received at COP27 may lead to more concrete implementation of its proposals. The initiative aims to address critical questions to address critical questions of how to stimulate private climate-related investments in developing economies that:

- Have limited capacity to finance these investments

- Have limited access to financial markets due to their credit rating

- Need improvement of regulatory and policy frameworks

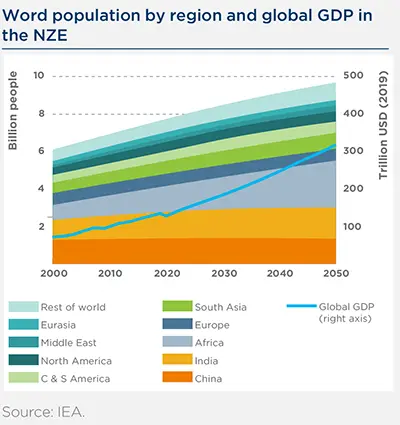

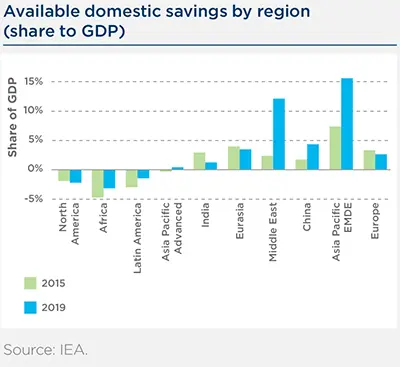

Developing countries are the key for success for the energy transition as the population of these regions are growing. “If energy transitions and clean energy investment do not quickly pick up speed in emerging and developing economies, the world will face a major fault line in efforts to address climate change and reach other sustainable development goals” according to the IEA.2

|

|

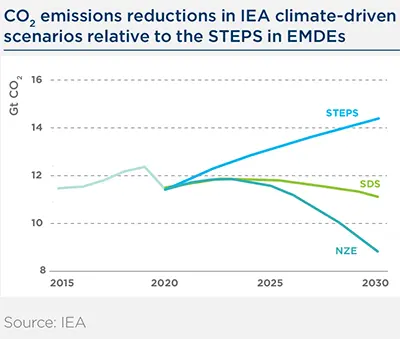

Due to the need of these countries to grow their economy, as well as their industrialization and urbanization rates, they will generate most of the growth in global emissions in the coming decades in the STEPS (Stated Policies Scenario) scenario3.

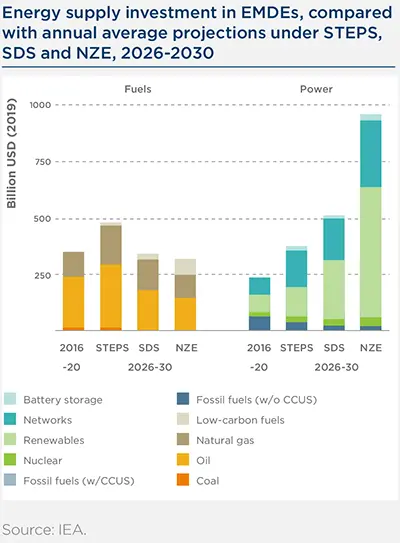

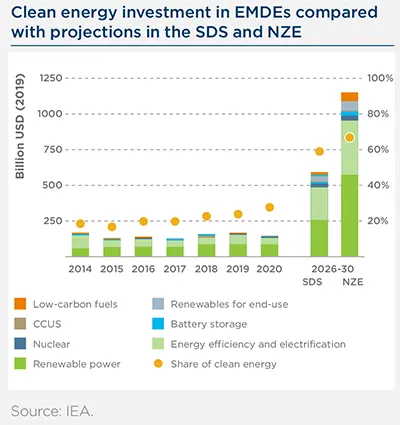

To reach a 1.5°C scenario, such as the one modelled by the IEA (NZE), investment in non-fossil energy supply may increase sharply in emerging and developing economies over the next decade. The amount of investment needed in the NZE is almost twice as high as in the well-below 2°C (SDS) scenario, and more than four times the level of the past years.

|

|

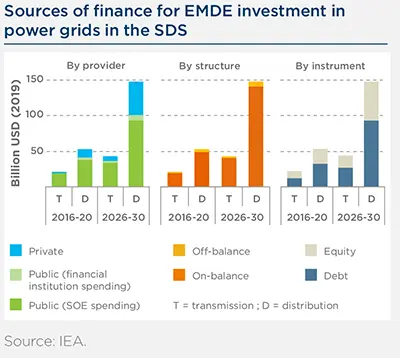

These investments could not be only financed by a switch from fossil fuel investments to green investments, as the decline of the former is limited under both a SDS or a NZE scenario. The need of net new investments is therefore high. If part of it might come from public spending, private capital is essential to reach the level needed. This capital is needed in the generation part but also in the distribution part to create the necessary networks. According to the IEA, in 2030, we should collectively spend around 9 dollars for each dollar spent in fossil fuel related CAPEX.

|

|

Just Energy Transition Partnerships

Among the initiatives to reshape the financial system inorder to give vulnerable countries the funds necessary to finance the climate transition, the Just Energy Transition Partnership (JETP) was launched as an initiative between emerging nations and developed countries to accompany them in their transition to a low carbon economy. Initiated during COP26 with South Africa, the goal of such partnership is to encourage countries to shift to more sustainable business models while guaranteeing that their economy will benefit from this transition, including with a solid investment plan and financing package.

South-Africa

Introduced at COP26, this partnership between South Africa, France, Germany, the UK, the US, and the European Union was designed to encourage and finance up to $8.5 billion the decarbonisation of the South African Economy. At COP27, South Africa’s President revealed the new Just Transition Energy Investment Plan. This announcement details the concrete application of the Just Energy Transition Partnership agreed in COP26. It focuses on:

- Allocating the funds received to develop the energy sector, electric vehicles and green

- Making the transition fair for the entire society and more specifically for those directly affected by the energy transition.

Indonesia

The Indonesia Just Energy Transition Partnership (JETP) was launched at the G20 Summit this year to accompany Indonesia in its energy transition from fossil fuels to clean energy. The plan sets ambitious emissions reduction targets that will be reached thanks to the substitution of fossil fuels with renewable energy. The transition plan also aims at building a transition that is fair to all and includes all economic sectors, affected directly or indirectly by the shift to a sustainable business model. The plan will mobilize $20 billion over the next three to five years to be invested in the transformation of the Indonesian economy.

The JETP has received great support among the nations of the G20, thus encouraging the future development of similar partnerships.

IMPLICATIONS FOR INVESTORS

How investors can support the transition of the carbon intensive energy mix of advanced emerging countries that are planning an orderly and just transition through the JETP mechanism.

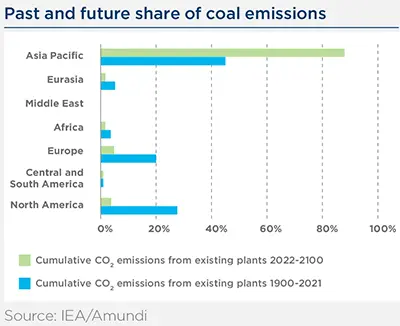

– JETP may become the major channel of public financing from developed to developing countries. It responds to the main criticisms that developed countries have made on the compensation agenda, as it now conditions funding to climate mitigation and adaptation efforts, and it excludes the polluting economies that now have the financial and technical capacities to operate their low carbon transition without assistance. JETP also supports coal phase-out acceleration and the development of low carbon solutions. Accelerating the energy transition of countries that are still highly relying on coal is key, as it is the most carbon-intensive fossil fuel. The Asia Pacific region represents the bulk of coal related future emissions with China representing 62% of future CO2 emissions from existing coal fired plant and India 13%, compared to 2% for Indonesia and 1% for South Africa.

– JETP investment plans require projects to comply with ESG reporting standards, which has become key and required for many investors. If these partnerships continue spreading to other developing countries, it could lay the foundations for increased national ESG disclosure standards in regions where climate finance is the most needed but insufficient today.

– National support with appropriate regulation remains key for investors.

- Backed by important national financing plans, JETP may represent investment opportunities in developing countries. National financing plans aim to finance low carbon solutions projects at lower interest rates. Under this condition, public investment would help to increase their attractiveness to private investors. However, it appears that the actual cost of the package granted to benefitting countries is not so low. For South Africa, only 4% of the $8.5 billion funding is in grants, most of the remaining being public loans. In the case of Indonesia, only half of the $20 billion financing pledge comes from public funding, and the remaining half from private investors.

- But investors also need national regulation to evolve in line with science-based targets. It is for instance difficult for an investor to engage a company to phase-out coal if the national law requires the company to keep its power plants operating. Joint engagement with the countries and their utilities companies are needed to accelerate the transition, in order to avoid, if possible, having to divest if the country is not is the right path. In parallel, investors might also contemplate increasing their investment in low-carbon solutions in those countries, as well as engaging corporates to increase their green CAPEX.

Debt for Nature swaps

Debt-for-Nature Swaps have gained popularity at COP27 as a means of achieving both debt relief and climate action. The instruments for frontier market countries have been supported by the IMF and other development organizations. In the upcoming four years, debt servicing obligations for fifty-eight of the developing nations that are most susceptible to climate change will total about $500 billion.

An example of this is Pakistan, which was forced to the verge this summer due to flooding that affected about a third of its area. The government obtained a $1 billion loan from the IMF to help it get by, but according to Bloomberg Economics, the flood damage is estimated to be worth $32 billion, and the country still has $3 billion in debt that needs to be repaid through June 2023.

Debt-for-nature exchanges have the potential to lower the debt loads of climate-vulnerable countries, releasing capital to enhance climate resilience. As they give developing nations, which are financially limited, the chance to make critically needed climate investments, climate or nature-related swaps may contribute to breaking that cycle. Using this method, nations such as Ecuador and Cape Verde hope to refinance $800 million and $200 million, respectively.

These tools are still not frequently utilized due to transaction costs, the requirement for monitoring, and a lack of well-defined conservation strategies.

The technologies are still not frequently utilized due to transaction costs, the requirement for monitoring, and a lack of well-defined conservation strategies.

Other financial mobilization initiatives

COP 27 launches initiatives to allow African countries to invest in building climate resilience.

The initiative “Reducing the Cost of Green and Sustainable Borrowing” in climate-vulnerable countries, launched by Egypt’s COP 27 Presidency and the United Nations Economic Commission for Africa, was designed to facilitate the access of developing countries to the funds they need in order to implement their post COVID-19 green recovery plan and tackle transition risks.

The initiative aims at reducing the cost of green borrowing for African countries, through Green and Social and Sustainability (GSS) Bonds. The cost reduction relies on five means:

- Reducing the borrowing cost by increasing sovereign bonds demand

- Introduction of standards in terms of ESG reporting

- Facilitate climate aligned sovereign debt emission through the creation of a Sustainability Sovereign Debt Hub

- Allowing developing countries to have access that is more regular to GSS Bonds market.

- Setting guarantees from Multilateral Development Banks

Launch of a catalytic initiative for Green Banks in Africa by the African Development Bank

On top of this, the African Development Bank Group has announced the launch of the African Green Bank Initiative, which will be backed up in 2023 by a $1.5 billion trust fund due to close in 2025 – the African Green Finance Facility (AG3F). Its aim is to structure and develop an ecosystem of local green finance mechanisms, in order to increase the mobilization of climate finance on the African continent. This initiative will provide a framework for the African Development Bank to provide financial institutions and governments with technical assistance grants, fundraising support and co-financing opportunities for green projects, by reducing the risks linked to in investing in sustainable projects

Breakthrough agenda

The growth of cooperation and collaboration will help the world adopt a more resilient, sustainable, and human-centered economic model, as well as the four goals of COP27. To connect our aspirations with the 1.5 degree pathway, this calls for a focus on technology and solutions that accomplish deep decarbonization.

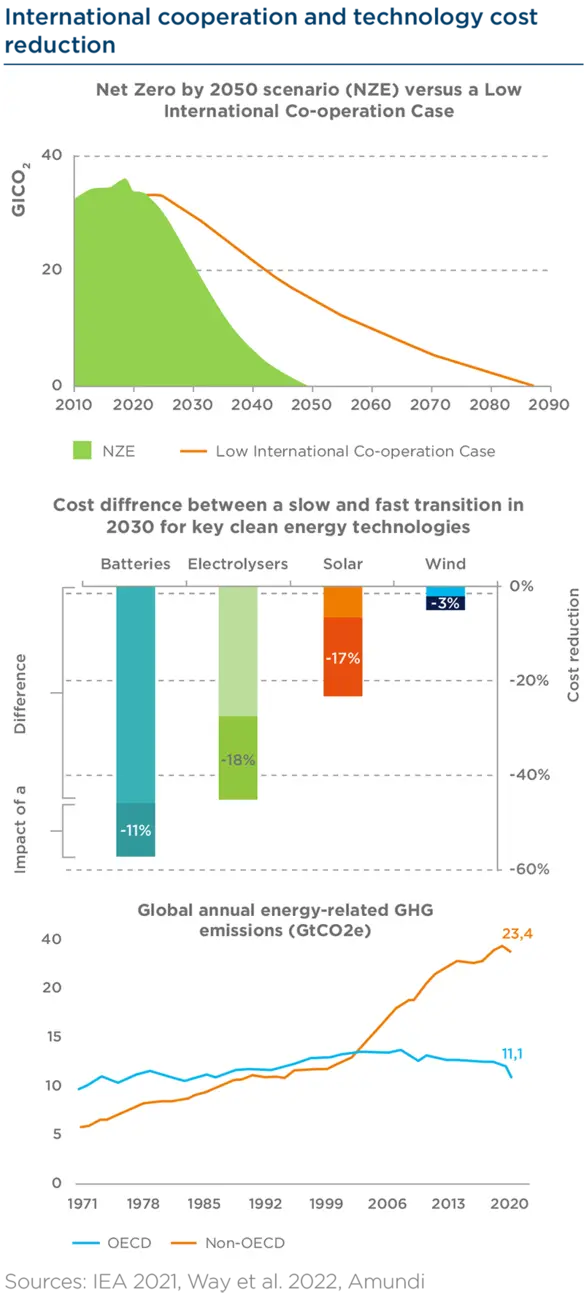

The development of several low carbon technologies within the next eight years is needed to achieve the Paris Agreement objectives. In particular, more private public cooperation is key to reduce the cost of critical technologies (e.g. electrolyzers, batteries, solar, power…) required in a 1.5°C trajectory. Global cooperation is even more needed as non-OECD countries, for which the top priority remains development, represent now more than two thirds of annual energy-related emissions.

The Breakthrough Agenda (hereafter called The Agenda), which now regroups countries representing over 70% of global GDP and more than 68% of global GHG emissions, including notably the EU, the US, Japan, China and India, is the most promising initiative to address this long lasting global issue.

The Agenda’s purpose is to develop sectoral initiatives - “The Breakthroughs” - that bring together governments and companies coordinated by international climate expert organizations (IEA, IRENA, ILO…) and initiatives (Energy Transition Council, Climate Investments Funds…). It currently covers five sectors (power, hydrogen, steel, road transport, and agriculture) representing more than 50% of global GHG emissions, with other highly emissive sectors like cement to be included next year. After the Agenda’s launch at COP26, the 28 Priority Actions laid out at COP27 are direct answers to the IEA’s recommendations for providing the global landscape necessary for the development of low carbon technologies at the levels targeted in the IEA Net Zero scenario.

IMPLICATIONS FOR INVESTORS

These priority actions provide visibility on the low carbon solutions that will be pushed as early as 2023 by this coalition via (but not only) financial support, shared technology learning, demand creation, and creation of commonly adopted low carbon standards. But the implementation of these priority actions into national or regional policies and public investment is not determined at this stage.

Investors may nevertheless expect further investment opportunities in the following technologies we have identified as benefiting from the strongest support from the 2023 priority actions:

- Energy storage, smart grids, as well as the extension and interconnection of power grids (e.g. interconnectors, connected microgrids) are identified as priority actions for the power sector in order to continue scaling up renewables by increasing the flexibility of power supply as well as the adaptability and resiliency of the grid. They should benefit from financial support on R&D efforts and boosted demand by future public policies.

- Hydrogen-related priority actions should drive a ramp up of clean hydrogen production and improve its competitiveness, notably through the announcement of public and private commitments on its large-scale use in enduse applications (aggregated commitments expected at COP28) in order to strengthen demand signals. If sufficiently strong, those signals would trigger an important multiplication of clean hydrogen production projects by limiting uncertainty on future hydrogen demand. In turn, this will also reduce the uncertainty related to the return of capital investments needed to build additional clean hydrogen production capacities. This is currently the major reason explaining the insufficient production capacities planned compared with what is expected in the IEA NZE scenario.

- Steel-related priority actions are expected to strengthen the demand for low-carbon steel, notably via announcements of public and private procurement and purchase agreement as well as by creating draft standards for low and near-zero emission steel. However, the actions taken to support projects on innovative low carbon steel technologies and to arrange trade conditions in order to improve their competitiveness are still vague at this stage.

The Alliance for Industry Decarbonization, which seeks to accelerate net zero goals and reduce industrial emissions, gathered at COP27 to lay out its implementation strategy. This group, which includes the International Renewable Energy Agency, will concentrate on six areas and enablers where to accelerate decarbonization. These include human capital, green hydrogen, heat process optimization, bioenergy with carbon capture, usage, and storage, and renewable energy.

Examples of a few initiatives launched to drive deep decarbonization efforts are mentioned below.

Egypt launches various partnerships to develop its green energy offer

Egypt and Norway to Establish 100MW Green Hydrogen Plant on Red Sea, as Part of Agreements in COP27

Egypt and Norway launched the first phase to establish a major green hydrogen plant in Egypt’s Ain Sokhna on the Red Sea to produce 100MW. This plan will be coordinated by private and public actors and is part of Egypt’s ambition to become the cheapest producer of green hydrogen worldwide and contribute to 8% of the global hydrogen market.

The United States announced the launch of a new initiative to support Egypt in deploying 10GW of new wind and solar energy while decommissioning 5GW of inefficient natural gas generated plants.

A new project to assist Egypt in deploying 10 GW of new wind and solar energy while decommissioning five GW of inefficient natural gas power was also launched, according to the president of the United States of America.

Reaffirming the Net Zero Objective

Just as every COP, countries came together to take action towards achieving the world’s collective climate goals as agreed under the Paris Agreement. Achieving net zero by 2050 remains the core objective for public as well as private players.

The UN HLEG Report, a guardian of Net Zero

On the private front, the release of the first conclusions of the High Level Expert Group on the Net Zero Emissions Commitments of Non-State Entities, set by the United Nations, were noticed and commented. The group was launched at COP26, in order to assess the net zero pledges of non-State actors, including businesses, financial institutions, cities and regions. It published a report, that aims at guiding non-State actors in setting credible net zero targets, in order to avoid as much as possible greenwashing. The guidebook is organized around four main areas:

- Environmental integrity: ensure that objectives are aligned with the IPCC scenario of 1.5°C

- Credibility: set reachable targets and present decarbonization plans.

- Accountability: improve the Global Climate Action Portal, a tool registering pledges, transition plans and tracking annual reporting on implementation

- Role of governments: in achieving the 1.5°C target, governments have to lead by example and provide to non-states actors a favorable context for them to set Net Zero targets.

IMPLICATIONS FOR INVESTORS

As highlighted by the UN HLEG report which calls regulators to “develop regulation and standards in areas including net zero pledges, transition plans and disclosure” as well as by the recent disclosure standards established by the US Securities and Exchange Commission, financial institutions should anticipate a growing scrutiny on the integrity of climate plans that they disclose and of those disclosed by their investees. This implies potential reputational, regulatory and investment risks.

Through its research, engagement and voting activities, Amundi has developed a deep understanding of issues related to climate disclosure. In order to improve climate related disclosure and to prevent the previously mentioned risks, Amundi has decided to significantly ramp up its climate-related engagement activities (such as Net Zero, Just Transition, thermal coal phase out dedicated campaigns) and to strengthen its investment policies. Examples of the latter include new policy developments on lowering thresholds for thermal coal exclusions or on excluding companies whose activities are exposed to exploration and production of unconventional oil & gas extraction by over 30%.

While the application of the UN HLEG recommendations is unknown at this stage, investors may focus on the critical issues raised by the report, related to the assessment of and engagement with investee companies on their climate disclosure.

– Discrepancies on the perimeter, accuracy, and level of insurance of reported data:

Companies may report only on different activities, regions, scopes and type of greenhouse gases. Moreover, carbon accounting methodologies are not sufficiently standardized at the global level. In most cases, information disclosed and carbon accounting rules are contingent to national regulations, making direct comparisons less relevant. Moreover, it is difficult to attest that the reported reflect real emissions fairly generated by a company’s activities.

Engaging with corporates to report on all their activities, jurisdictions, scopes and type of greenhouse gases should remain a focus for investors willing to contribute to global net zero efforts. Corporates are also encouraged to use globally adopted standards, both on what indicators to disclose and how to compute them, as well as to make these figures certified by a third party.

– Reporting of biogenic emissions and removals:

Biogenic emissions: Discrepancies in emissions reporting mentioned before are particularly relevant for biogenic emissions such as the ones related to land use change (e.g deforestation,

destruction of peatlands and wetlands) and the combustion of biomass.

Given the growing use of bioenergy and that land use change alone is estimated to represent around 12,5% of global GHG emissions today, investors should encourage companies to report granular information on the biogenic emissions that occur across their value chain, to disclose lifecycle emissions factors and to make these figures certified by a third party.

Biogenic removals: Today, many companies directly assume that the net carbon intensity of bioenergy (i.e. emissions minus removals) is zero. Accounting the use of biomass as carbon

neutral relies on the assumption that the amount of carbon absorbed and stored during the life of biofeedstock (e.g. tree) is equivalent to the amount of carbon released when it is burnt. However, this assumption does not take into account the emissions related to possible land use change (e.g. conversion of forests into plantations) and the duration it takes feedstock to absorb carbon dioxide. More generally, the effective amount of carbon absorbed via biogenic removals are subject to high uncertainties notably because it depends on the carbon that would have been absorbed without the company’s activities, which can vary a lot from one estimate to another.

Therefore, encouraging companies to report separately on the biogenic emissions and biogenic removals generated along their value chain and make these figures certified by a third party would represent an engagement best practice.

– Use of carbon credits from voluntary markets:

Carbon offsets should not prevent companies to reduce their emissions. Therefore, carbon credits must not be used in the achievement of interim targets. They need to be limited to residual not-abatable emissions for net zero targets. Additionally, the majority of carbon credits traded on the voluntary markets are derived from initiatives like reforestation that seek to produce biogenic removals, which, as previously mentioned, are fraught with considerable uncertainty regarding the actual amount of carbon absorbed.

Therefore, investors should advocate for companies to 1) use carbon credits only for not-abatable emissions and 2) display strong transparency about the certification schemes and due diligence processes they implement in order to ensure that the carbon credits they buy on voluntary markets faithfully reflect the expected amount of carbon dioxide permanently removed thanks to the underlying projects.

– Discrepancies on the perimeter and readiness of targets:

Like historical data, emissions reduction targets disclosed by companies may not cover all their activities, regions, scopes, or type of greenhouse gases. Moreover, unlike Nationally Determined Contributions (NDCs) that need to include targets at specific dates (2025, 2030, …) and to be updated every five years, there is no such mandatory rules for companies’ reduction targets. It lowers the readiness and comparability of pathways set by companies. Another difference is that for NDCs, emissions reduction targets need to be absolute in order to forecast the evolution of the carbon budget, while the choice of setting absolute or intensity-based targets is given to the company. It prevents to forecast a carbon budget and gives room for misleading signals, especially if the intensity denominator chosen is price-based. However, intensity pathways are particularly useful when comparing companies together, and with climate mitigation scenarios on a given activity like power generation.

Therefore, encouraging all companies to set 1) short term, mid-term, and long-term absolute emissions reduction targets that cover all their activities, regions, and scopes and 2) similar intensity-based pathways where relevant, especially for high emitting activities (e.g. power generation, oil and gas operations, transportation, steel, cement…) should remain a focus for investors.

– The necessity of a detailed action plan:

A credible climate action plan is expected to disclose the following elements:

- Quantified targets on the main mitigation levers (e.g. increase the low carbon share of electricity consumption, share of electric vehicles in global vehicle unit sales) and an estimate of their expected contribution to the targeted reduction, notably the contribution of carbon offsets.

- Breakdowns of annual and planned capital expenditures, highlighting the respective amounts and percentage of total CAPEX dedicated to low carbon and carbon intensive assets (Green vs. Brown CAPEX), with details about the projects included in the green and brown envelopes, as well as the classification methodology used.

- The percentage of total remuneration linked to the achievement of the climate strategy.

A positive signal from the G20

The seventieth meeting of the G20, that took place in Bali on November 15th and 16th. During this meeting, the G20 has reaffirmed pledges to limit global warming to 1.5 C, sending a positive signal to the COP 27 negotiators.

What about emissions peaking?

See UNFCCC report on Nationally Determined Contribution to learn more

The Paris Agreement objective of limiting global warming to well below 2°C, preferably to 1.5 C (i.e. Net Zero) implies to reduce the growth rate of greenhouse gas emissions and thus reach a peak of emissions as soon as possible, followed by a continuous decrease of emissions in order to reach a climate neutral world 2050.

According to the latest predictions, taking into account countries’ commitments, this peak should happen around 2025. In order to reach the peak of emissions as soon as possible – or rather, to start the decrease as soon as possible –, the phase out of coal phase needs to be accelerated. In its latest report “Coal in Net Zero Transitions”, the International Energy Agency highlighted that emissions related to coal could prevent us from achieving Net Zero by 2050.

Projected trends in emissions and warming

Global greenhouse gas emissions in gigatonnes of carbon dioxide equivalent

Learn more about countries’ Nationally Determined Contributions (NDC)

Learn more about the United Nations’ 2022 NDC Synthesis Report

Conclusion

While COP 27 was the occasions for new individual commitment from countries to achieve the 1.5°C warming objective by 2050, no new agreement was concluded between countries at COP27 about greenhouse gas emissions reduction.

The current path to decarbonization is not sufficient to meet the Paris Agreement goal to limit global warming to well below 2°C and preferably 1.5°C by 2050. Far from it, as it appears that this path could lead the world to a dramatic 2.8°C warming – which still marks a decrease from the 2015 global warming trajectory of 3.5°C above pre-industrial averages. If previous pledges were to be implemented, a report by the IEA shows that global warming could be limited to 1.7°C by 2100, which represents a drop of 0.4°C compared to pre-COP26 announced policies scenarios.

Still, the 1.5°C target remains a key weapon in the fight against climate change and need more than ever to remain our global shared priority. Decreasing our ambition would already admit losing the battle, whereas what we need now is more commitments, more actions and more alignment between parties.

Another regret of this COP is that the objective of phasing down coal has been maintained, despite numerous voices calling for its phase out. A one-word difference that could well be the game-changing element in reaching – or not, Net Zero.

Sources:

1. “Parties” referring to the 197 nations that agreed to the United Nations Framework Convention on Climate Change (UNFCCC) in 1992.

2. Financing clean energy transitions in emerging and developing economies – Analysis - IEA

3. According to IEA “STEPS explores where the energy system might go without a major additional steer from policy makers”.

A special thank you to Tristan Chaillou, Basundhara Dutta and Apolline Day for their contribution.