Summary

Introduction

The question of the green risk premium and ESG performance is on everyone’s lips. This question is related to several other issues that can be summarised as follows:

- What is the impact of climate investing on portfolios’ returns?

- Is there a bubble in the ESG investing market?

- Do investors face a crowding of green assets risk?

- Can we speak about an ESG risk premium?

- Is ESG a new risk factor?

Although all these topics are in fact interconnected, it is important to precisely identify the different notions, and avoid any confusion when speaking about the risk premium of ESG and green finance.

What is the difference between risk premium and historical performance when it comes to brown and green assets?

First, it is important to reiterate that the risk premium is the expected excess return earned by investors because they are exposed to a systematic risk. Therefore, we must differentiate between expected (or required) returns and historical (or realised) returns. From a theoretical point of view, there is a scientific consensus that the risk premium of brown assets1 is positive, implying that the risk premium of green assets is negative (Bolton and Kacperczyk, 2021; Pastor et al., 2021, Pedersen et al., 2021).

This is because there is a systematic market risk when investing in brown assets due to several factors, including carbon pricing, regulation, reputational, asset stranding and climate hedging risks. Moreover, it is obvious that high demand for green assets from ESG investors lowers their expected returns. However, we must be careful because the positive expected excess return of brown assets does not necessarily imply that the performance of green assets is lower than the performance of brown assets:

In equilibrium, green assets have low expected returns because investors enjoy holding them and because green assets hedge climate risk. Green assets nevertheless outperform when positive shocks hit the ESG factor, which captures shifts in customers’ tastes for green products and investors’ tastes for green holdings

The important word in this quote is equilibrium, meaning that green assets have low expected returns in the long run. In this case, investors will need to earn an additional return to compensate for the risk they take when investing in brown assets. In the short term however, when the market is not at equilibrium, green assets can outperform brown assets, in particular when we observe a supply/demand imbalance (Bennani et al., 2018, Drei et al., 2019). We have been in this situation in recent years, where green stocks have outperformed brown stocks on average between 2012 and 2016 (Roncalli et al., 2021). In the short term investment flows may have a substantial impact on asset pricing. For instance, van der Beck (2021) showed that “in the absence of flow-driven price pressure, the aggregate ESG industry would have strongly underperformed the market from 2016 to 2021”.

Therefore, there is no contradiction between a positive expected excess return of brown assets and the good performance of green assets over recent years. This illustrates the difference between risk premium and historical returns, i.e., the discrepancy between required returns and realised returns2.

What can we expect of brown asset performance in the context of the Net Zero shift?

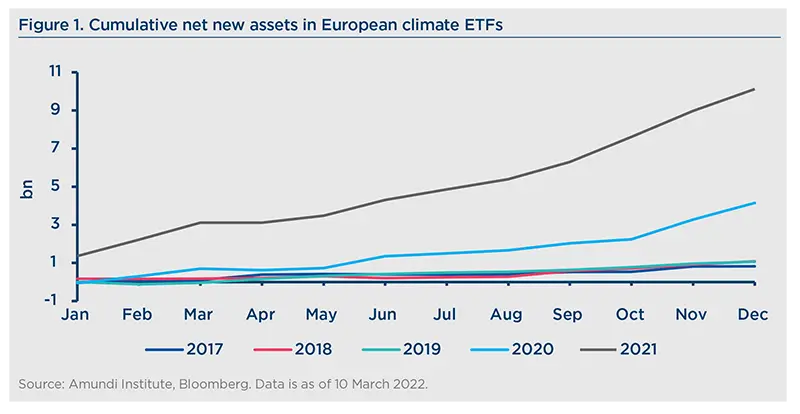

The previous remark suggests that the market is not yet at equilibrium. A natural question that arises from investors is then to evaluate how long it would take to reach equilibrium. In other words, investors would like to know when the market is likely to reward brown assets. The answer is not obvious since it depends on future flows from investors. Our conviction is that brown assets will continue to suffer because this is just the beginning of climate investing. Even though many institutional investors have moved in this direction, the paradigm shift is far from complete. First, it mainly concerns European institutional investors. Second, climate investing policies are continuously changing, especially to include the Net Zero objective.

Has the market fully priced the risk dimension of brown assets?

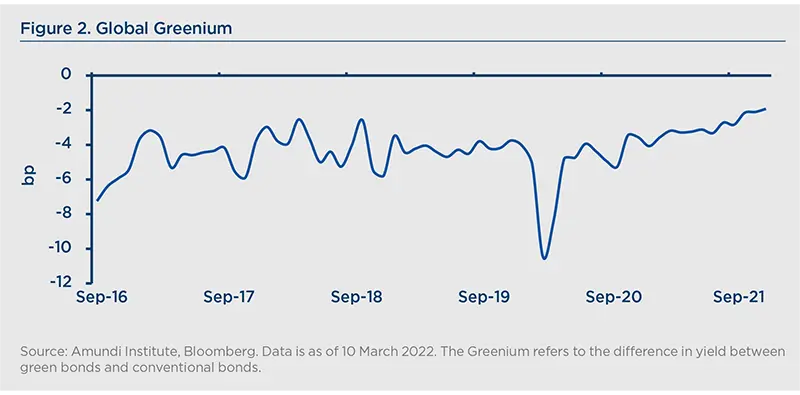

Another important question from investors is the magnitude of the risk premium. Let us consider for instance the Greenium, which is the yield difference between green bonds and conventional bonds (Ben Slimane et al., 2020). As expected, the current value of the Greenium is negative, but it is relatively low (perhaps too low) and close to -5 bp.

Of course, these figures do not reflect the green risk premium in the stock market. Nevertheless, it raises the question of its adequate value. In particular, investors may ask whether the expected excess return of brown assets really compensates for the additional risk of these assets. While there is an academic consensus about the existence of a positive risk premium for brown assets, they do not know if the risk will be rewarded at the right level. In other words, will brown assets offer at least the same Sharpe ratio as green assets? Proponents of the efficient market hypothesis will answer yes, because asset prices must reflect all information. The only way to obtain higher returns is to buy riskier assets, and the market has fully priced in the risk dimension.

Nevertheless, opponents of the efficient market hypothesis will answer that the market is often too optimistic, and has a lot of difficulty pricing in non-convex risks. This is really the issue because we do not speak about higher volatility here. Indeed, brown assets face a skewness risk. For instance, we know that the Sharpe ratio of low-volatility assets is higher than the Sharpe ratio of high-volatility assets (Frazzini and Pedersen, 2014). We also know that the skewness risk is underestimated by the market except in bad times (Roncalli, 2017). This explains the severity of financial crises, in particular the 2008 Global Financial Crisis.

Therefore, the debate about the adequate risk premium level of brown assets is still open.

Is there a bubble in the ESG investing market?

We cannot deny that the high demand for climate-friendly assets may induce a crowding risk. However, it would be false to assert that there is an ESG bubble. Before delving into these issues, we have to precisely define the terms ‘financial crowding’ and ‘bubble’, as there could be some misunderstanding around these concepts.

First, we need to distinguish between crowding of trades and portfolios, because crowding of trades is more problematic than that of positions. The former case is generally characterised by high pairwise cross-correlation and low liquidity, whereas we observe time-correlation in the latter. In both cases, we notice an overvaluation with respect to the fair price, but it is not systematic.

Second, a financial bubble is characterised by a sharp rise in the market price of some assets. This situation is followed by a crash because investors understand that there is an imbalance between the fundamental value and the market value of these assets. A financial bubble has its origins in the mimetic behaviour of investors who want to participate in the market momentum, even if it is not supported by fundamentals. A typical example is the dot-com financial bubble at the end of the 1990s. The motivation behind these investments is then to generate large financial gains. However, when many investors seek to cash in on their potential profits, the asset bubble bursts. As such, a financial bubble implies a buying pressure followed by a selling pressure, and these imbalances are both motivated by momentum behaviours.

The case of ESG investing is different. ESG investors invest in some assets for extra-financial motivations and not exclusively for financial ones. ESG investors do not buy ESG-friendly assets with the motivation to sell these assets in the future if they do not perform. This is why we cannot compare ESG investing to value investing, momentum investing or quality investing. These last three investment styles are driven by financial considerations. ESG investing is a very different investment style since it is also motivated by moral values, ethics or responsible duties.

Furthermore, it is not certain that ESG investing can be characterized as an investment style per se. For instance, we cannot apply the concept of style rotation to ESG investing and it is unlikely that ESG investors will revert to being business-as-usual investors in the future. For instance, we observe value-growth, value-quality or contrarian-momentum rotation, but we never speak about ESG vs. non-ESG rotation3. Therefore, it is true that there is an ESG trend, but the existence of an ESG bubble is very much overestimated. As such, it is unlikely that we will see ESG investors revert, because this is more of a structural change in the financial market or a paradigm shift in the investment framework than a short-term trend. This is why it may take considerable time and equilibrium is still far away.

Do investors face a crowding of green assets risk?

Nevertheless, we must recognise that there is a potential crowding risk on green assets, because the universe of green assets is relatively small. Even if it increases significantly, the demand for climate-friendly assets is huge. Moreover, we are observing a shift in investor preferences, as slowing climate change becomes a big concern for the financial community. For instance, the development of green sentiment can dramatically change the utility function of investors (Brière and Ramelli, 2021). In this context, the risk of crowding in climate investing is real, especially for some green thematic investments, and whether it happens will largely depend on supply dynamics.

Can we speak about an ESG risk premium?

The preceding paragraphs mainly concern green assets. What about ESG investing, and how is it different from climate investing? In many academic studies there is no difference between ESG and climate investing. Therefore, the theoretical models used for studying green and brown assets from a climate investing standpoint, are generally transposed to best-in-class and worst-in-class assets from the ESG investing viewpoint. Academics then conclude that worst-in-class assets exhibit a positive risk premium (Pedersen et al., 2021).

However, there are some differences between climate and ESG investing, and we argue that the adaptation is not straightforward. First, the traditional approach of analysing a security is outdated. Today fundamental analysis and extra-financial analysis go hand in hand. This is particularly true when it comes to credit and ESG analysis (Semet et al., 2021), but also equity and ESG analysis (Drei et al., 2019). Therefore the concept of fair or fundamental price must incorporate an extra-financial dimension. The business-as-usual approach considers that the fundamental asset price is independent from ESG risks. Whereas there is a paradigm shift in terms of investment framework, there is also a paradigm shift in terms of valuation. Today, ESG analysis produces information that helps to determine the fair price of securities, and an equity analyst or a credit analyst cannot ignore this information. It is therefore difficult to separate and measure the impact of ESG investing because ESG analysis is part of the ‘new normal’ of how the market functions.

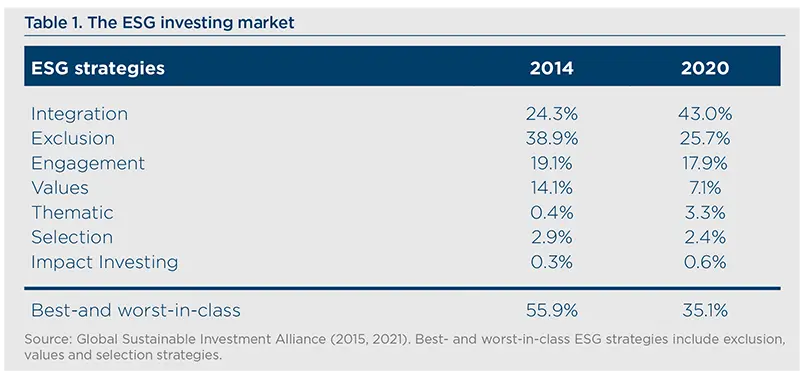

The second difference is that ESG investing cannot be reduced to overweighting best-in-class assets and underweighting worst-in-class assets. For a long time exclusion, values and selection strategies dominated the market of ESG investing. According to GSIA (2015, 2021), these strategies represented about 56% in 2014, but now account for just 35%. Moreover, if we focus on the last two years, we notice that annual growth is positive for thematic, integration and engagement strategies and negative for selection, exclusion impact investing and values.

Therefore, theoretical academic models that only consider best-in-class selection and worst-in-class exclusion are not representative of the comprehensive ESG investing market. For instance, ESG momentum or impact investing strategies cannot be put into those categories. It is better to speak about performances of ESG investing, and not the performance of ESG investing as if there is only one common strategy. This is why we observe more variation of asset holdings within ESG portfolios than with value or quality portfolios. These figures also confirm that fundamental and ESG analysis are converging since 43% of the ESG investing market corresponds to a full integration approach. Finally, unlike climate risk which is well-defined, the concept of ESG risk is more blurred since it mixes three dimensions: environmental risk, social risk and governance risk. As a result, there are many ways to consider whether or not an asset is ESG-friendly (Berg et al., 2019). For all these reasons the concept of ESG risk premium does not really make sense, because measuring performance is highly dependent on implementation and the investor’s ESG approach.

Is ESG a new risk factor?

Finally, the question of ESG as a risk factor is a little bit different from the question of the ESG risk premium. Indeed, best- & worst-in-class strategies are sufficiently implemented by asset owners and managers that an ESG risk factor helps to explain the cross-section of stock returns in some regions (Roncalli, 2020). There may be a paradox, because the alpha of the ESG risk factor is close to zero when we consider a multi-factor model based on size, value, low-volatility, momentum and quality. Nevertheless, there is confusion between the concept of common risk factor and the concept of alpha, which is another term used to speak about the risk premium. Moreover, most of the time, alpha is calculated as a relative past performance and does not correspond to an excess expected return. In fact, an ESG factor helps to diversify a factor investing portfolio, and has its place alongside quality and momentum for instance.

Indeed, we face a ‘chicken and egg’ problem here. There are periods when we can explain the ESG risk factor using the momentum risk factor, and there are other periods when we can explain the ESG risk factor using the quality risk factor, but the reverse is also true. For instance, do momentum flows explain a part of ESG flows, or do ESG flows explain a part of momentum flows? The academic debate remains open. From an investment perspective, it is better to adopt a mixed framework than a black and white approach. Indeed, the time-varying relationships between ESG and the other risk factors, and its additional explanatory power, are sufficient to consider ESG as a new risk factor.

______________

1 In this paper, we distinguish climate and ESG investing. Therefore, green and brown assets refer to climate-friendly and climate–unfriendly assets, whereas ESG best-in-class and worst-in-class are used to name ESG-friendly and ESG–unfriendly investments.

2 Investment flows are not the only explanation of the good performance of green stocks over some periods. Indeed, some green assets are linked to other factors such as quality, implying that green assets may outperform brown assets when the quality factor posts positive returns. Moreover, the performance of brown assets is also related to commodity prices, such as oil.

3 It does not exclude a possible rotation within ESG themes depending on the economic environment. For instance, we observe a social preference during the Covid-19 lockdowns (Sekine and Lepetit, 2021). We also observe that the wining pillar (E, S and G) changes over time and depends on the region (Drei et al., 2019, Lepetit et al., 2021). Nevertheless, this is not a strict rotation, for instance selling the E pillar and buying the G pillar. In fact, it mainly concerns new investment flows driven by investors’ preferences in terms of ESG themes.

Bibliography

- Ben Slimane, M., Da Fonseca, D., and Mahtani, V. (2020), Facts and Fantasies about the Green Bond Premium, Amundi Working Paper 102.

- Ben Slimane, M., Dumas, J-M., and Sekine, T. (2021), Factor Investing and ESG in the Corporate Bond Market Before and During the COVID-19 Crisis, Bankers, Markets & Investors, 165, pp. 13-22.

- Berg, F. Koelbel, J.F., and Rigobon, R. (2019), Aggregate Confusion: The Divergence of ESG Ratings, MIT Working Paper.

- Bennani, L., Le Guenedal, T., Lepetit, F., Ly, L., Mortier, V., Roncalli, T. and Sekine, T. (2018), How ESG Investing Has Impacted the Asset Pricing in the Equity Market, Amundi Discussion Paper 36.

- Brière, M., and Ramelli, S. (2021), Green Sentiment, Stock Returns, and Corporate Behavior, Amundi Working Paper, 117

- Bolton, P., and Kacperczyk, M. (2021), Do Investors Care about Carbon Risk?, Journal of Financial Economics, 142(2), pp. 517-549.

- Drei, A., Le Guenedal, T., Lepetit, F., Mortier, V., Roncalli, T. and Sekine, T. (2019), ESG Investing in Recent Years: New Insights from Old Challenges, Amundi Discussion Paper 42.

- Frazzini, A., and Pedersen, L.H. (2014), Betting Against Beta, Journal of Financial Economics, 111(1), pp. 1-25.

- Lepetit, F., Le Guenedal, T., Ben Slimane, M., Cherief, A., Mortier, V., Sekine, T., and Stagnol, L. (2021), The Recent Performance of ESG Investing, the Covid-19 Catalyst and the Biden Effect, Amundi Working Paper 116.

- Pedersen, L.H., Fitzgibbons, S., and Pomorski, L. (2021), Responsible Investing: The ESG Efficient Frontier, Journal of Financial Economics, 142(2), pp. 572-597.

- Pastor, L., Stambaugh, R.F., and Taylor, L.A. (2021), Sustainable Investing in Equilibrium, Journal of Financial Economics, 142(2), pp. 550-571.

- Roncalli, T. (2017), Alternative Risk Premia: What Do We Know?, in Jurczenko, E. (Ed.), Factor Investing: From Traditional to Alternative Risk Premia, Elsevier.

- Roncalli, T. (2020), ESG & Factor Investing: A New Stage Has Been Reached, Amundi Viewpoint.

- Roncalli, T., Le Guenedal, T, Lepetit, F., Roncalli, T. and Sekine, T. (2021), The Market Measure of Carbon Risk and its Impact on the Minimum Variance Portfolio, Journal of Portfolio Management, 47(9), pp. 54-68.

- Semet, R., Roncalli, T., and Stagnol, L. (2021), ESG and Sovereign Risk: What is Priced in by the Bond Market and Credit Rating Agencies?, Amundi Working Paper 115.

- Sekine, T., and Lepetit, F. (2021), The Coronavirus and ESG Investing: The Emergence of the Social Pillar, Amundi Expert Talk.

- Van der Beck, P. (2021), Flow-driven ESG returns, Swiss Finance Institute Research Paper Series, 21-71