Summary

ESG and Sovereign Risk

What is Priced by the Bond Market and Credit Rating Agencies?

As recently as 10 years ago, ESG was considered a niche investment market reserved for the particularly conscientious investor. Fast-forwarding to today, ESG considerations have been placed firmly at the heart of the finance industry. Consumer awareness has risen with increasing attention paid not only to our individual carbon footprint, but also how it impacts upon society as a whole. Meanwhile international organisations have joined the call for legislation and in turn, policymakers and regulators have developed new rules. On the other side, asset managers, asset owners and investors have invested massively in ESG strategies.

One, oft ignored, aspect underpins this development; the emergence of extra-financial analysis. Whilst financial analysis relies on financial ratios, extra-financial analysis is dedicated to environmental, social and governance issues. This has meant that alternative data had to be developed to analyse issuers from a different angle. It is not uncommon to receive extra-financial ratings or information from ESG rating agencies that are completely at odds with the view provided by the credit rating agencies. The conflict between extra-financial and financial analysis or ESG and credit ratings remains complex:

Since we observe a feedback loop between extrafinancial risks and asset pricing, we may also wonder whether the term “extra” is relevant, because ultimately, we can anticipate that these risks may no longer be extra-financial, but simply financial*

Similarly, Ben Slimane et al. (2019) found a positive correlation between ESG and credit ratings. This is understandable since credit rating agencies might also incorporate extra-financial risks in their default risk models.

Rather than ESG analysis and credit analysis being opposing factors, we believe they are complementary. This is even truer in the case of sovereign risk and we imagine that the two approaches will converge in the near future. The reason for this is that the creditworthiness of a country is highly dependent on its economic growth, political environment, willingness to pay its debt, social stability, etc. and we can easily relate these factors to ESG metrics.

Key Findings

In this study carried out by Amundi Quantitative Research, the goal was to propose a new viewpoint on this relationship. This comprised of adding the most relevant ESG metrics to a more traditional approach, for example, where the bond yield spread of a country is explained by macro-economic variables such as economic growth or inflation and creditworthiness indicators such as the debt ratio or the probability of default measured by credit rating.

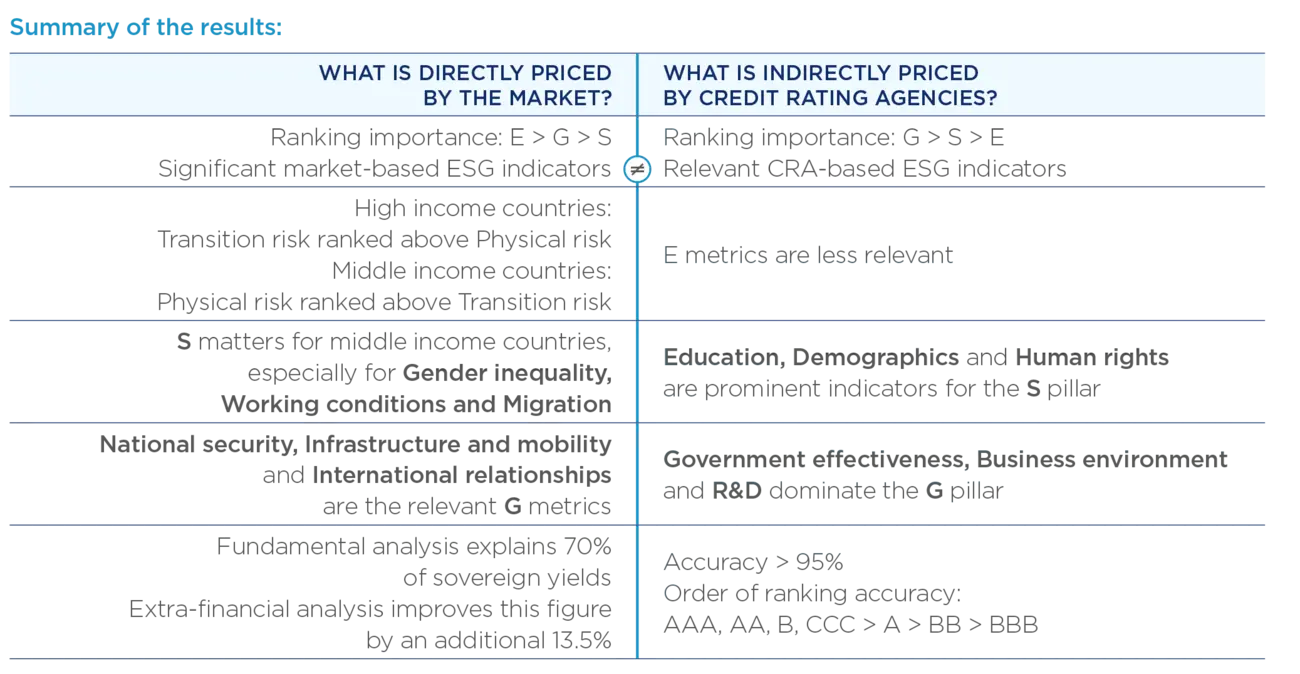

The aim is to identify these key ESG metrics and measure their marginal effects in order to determine which ESG themes are directly priced by the bond market. For instance, in the case of the environmental pillar, are transition or physical risks important drivers of the bond yield spread? We also investigate the ESG themes that are indirectly priced by the bond market through the credit rating. By considering both direct and indirect channels, we expect to identify the most relevant ESG indicators and themes for sovereign credit risk analysis.

As part of our analysis we grouped the data into 26 ESG themes broken down into 269 ESG variables. A single-factor analysis is performed on these variables to test their explanatory power on sovereign bond yields (after controlling for the effect of macroeconomic variables and the credit rating). We restrict our analysis to the 2015-2020 period in order to have a complete data set. Prior to 2010 in particular the data is not robust or relevant. Despite our aim to work on the largest possible sample of countries, the length and availability of some time series constrained our sample to 67 countries, which are nonetheless a fairly diverse mix of regions and levels of economic development.

Our analysis shows that all the 26 chosen ESG themes represent metrics that have an impact on determining a country’s creditworthiness, which corroborates investor’s integration of extra-financial criteria in bond pricing.

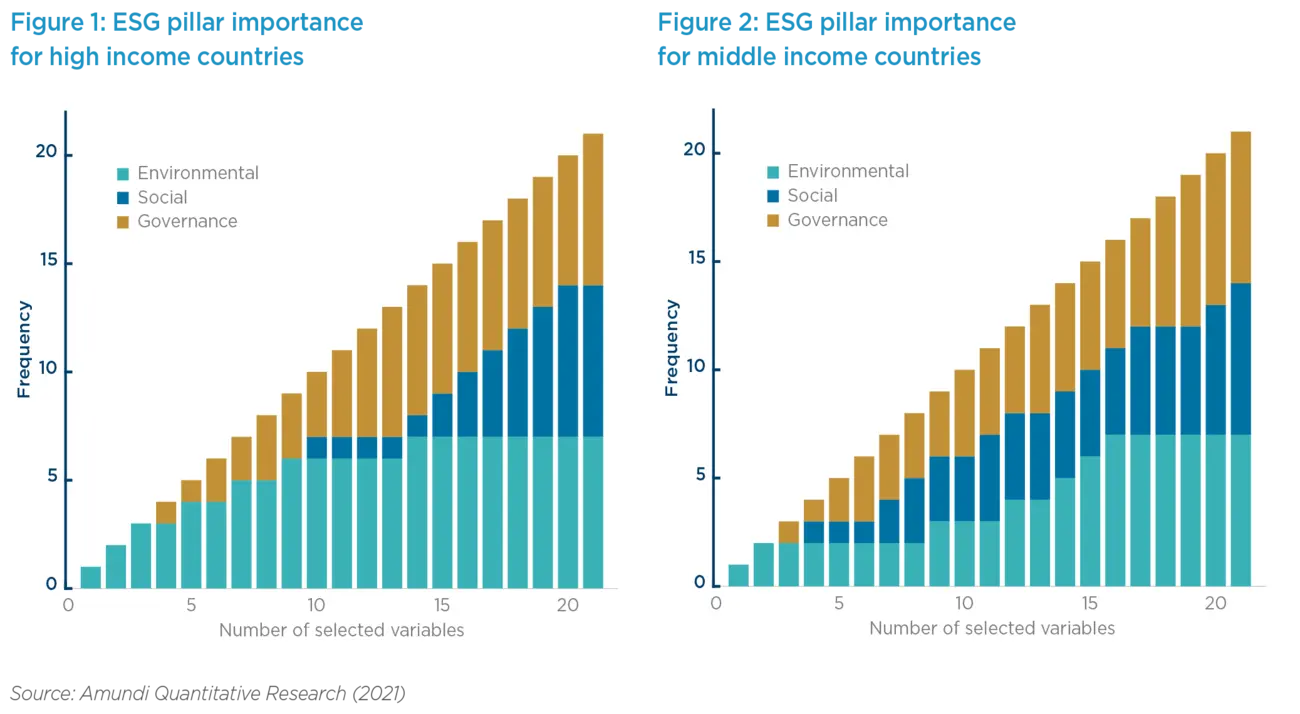

Dropping the analysis by individual E, S and G pillar, and combining the three different metrics together portrayed a different picture. The three pillars do not hold equal importance in sovereign bond pricing at a global level. Indeed, governance and environmental aspects dominate over social themes. Refining this analysis on separate samples of high-income vs. middle-income countries (Figures 1 and 2), we conclude that environmental issues are actually the primary concern for investors when assessing sovereign risk. Concerning the final multi-variate model, our estimation shows that fundamental analysis explains 70% of sovereign bond yields, whereas extra-financial analysis improves this figure by 13.5%. Combining financial and extra-financial analysis thus allows us to explain more than 80% of sovereign bond yields.

However, we observe a divergence between the two income groups in respect to the environmental dimension. While the sovereign yield of high-income countries is related to actions taken to address climate change, the sovereign yield of middle-income countries in contrast is sensitive to their resilience to natural hazards and their occurrence. These results reflect investor’s perception that transition risk primarily affects developed countries whereas emerging countries are more concerned by physical risk. Governance follows closely, independent of the level of development. The clear cut-off between high and middle-income countries also lies in the importance of the social pillar. For the highest income countries, it is ranked well after E and G metrics. For middle-income countries, it is nearly as important as governance. We believe this could be explained by the homogeneity among high-income countries on many social achievements. More leeway for improvement in middle-income countries means it is therefore open to increased scrutiny by investors.

|

All in all, improvements in the identified E, S and G metrics result in a lower borrowing cost for the sovereign issuer, but the importance of each distinct pillar is a function of the country’s level of development. |

| Figures 1 and 2 demonstrate the order of importance of each indicator in explaining the impact on yield in our ESG model. Each pillar is represented by a different colour. It can be noted that for high income countries the environmental pillar is the winning theme, whith the social pillar lagging with no social indicators being chosen amongst the first nine most important indicators. These results suggest that ESG bond pricing for high income countries is dominated by environmental and governance factors. For middle income countries, the results are more balanced with no pillar lagging the others. This means the ESG landscape is fully accounted for in sovereign bond issues from these countries. |

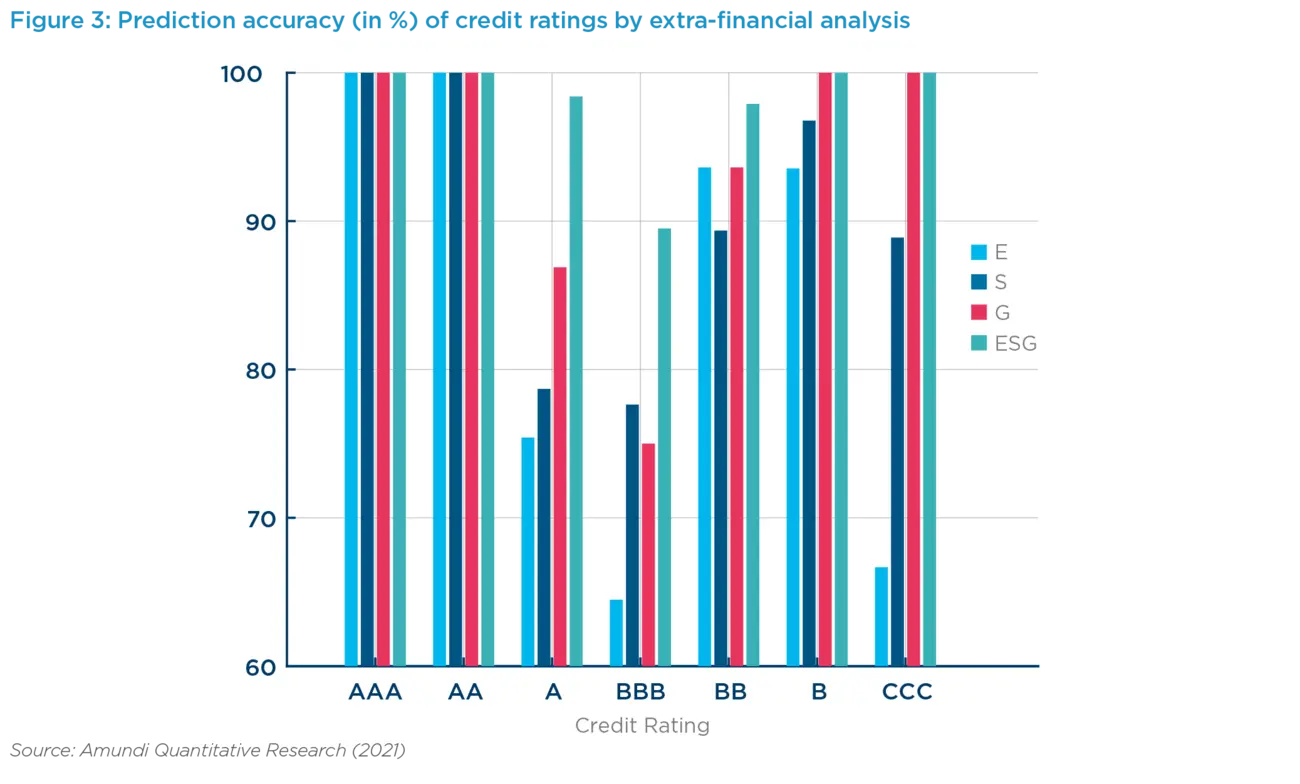

Finally, in attempting to predict credit ratings solely based on extra-financial criteria, our analysis demonstrates that governance and social pillars are actually the most critical factors. The E pillar lags behind the others, suggesting that credit rating agencies tend to underweight environmental issues. Combining all ESG indicators together, we demonstrate that for each rating segment (Figure 3), the set of selected indicators correctly predicts the rating in 95% of the cases on average. However, higher figures are obtained for high (AAA and AA) and low (B and CCC) rating segments with contrastingly lower accuracy figures for middle rating segments (A, BBB and BB). Interestingly enough, we remark that the selected set of metrics used to predict credit ratings differ substantially from those used to explain sovereign bond yields. It could be concluded that this is explained by a disparity between the ESG indicators employed by credit rating agencies compared to those scrutinized by investors to appraise the country risk. However, we could also argue that the market selects ESG metrics that are not already embedded in credit ratings in order to avoid double counting.

In conclusion, our analysis not only sheds light on the key ESG metrics and themes priced directly and indirectly by the bond market, but also allows us to rank the influence of the different E, S and G pillars depending on a country’s level of development, highlighting that all factors are not equal. This is beneficial since some of the identified ESG indicators could complement traditional credit risk analysis when deciding to hold a sovereign bond or evaluating country risk premium. In this context, conflicting extra-financial analysis and financial analysis does not appear reasonable. On the contrary, our results advocate for a greater integration between ESG analysis and credit analysis when assessing sovereign risk.

Summary of the results

Source: Amundi Quantitative Research (2021)

Working Paper - Abstract

In this paper, we examine the materiality of ESG on country creditworthiness from a credit risk analysis viewpoint. To address this, we consider a granular set of 269 indicators within the three ESG pillars to determine what the sovereign bond market is pricing in. From this set of ESG metrics covering the 2015-2020 period and 67 countries, we first determine the ESG indicators that are most relevant when it comes to explaining the sovereign bond yield, after controlling the effects of traditional variables such as economic strength and credit rating. We also emphasize the major themes that are directly useful for investors when assessing the country risk premium. At the global level, we notice that these themes mainly belong to the E and G pillars. Those results confirm that extra-financial criteria are integrated into bond pricing. However, we also identify a clear difference between high and middle-income countries. Indeed, whereas the S pillar is lagging for the highest income countries, it is nearly as important as the G pillar for the middle-income ones.

Second, we determine which ESG metrics are indirectly valuable for assessing a country’s solvency. More precisely, we attempt to infer credit rating solely from extra-financial criteria, that is the ESG indicators that are priced in by credit rating agencies. We find that there is no overlap between the set of indicators that predict credit ratings and those that directly explain sovereign bond yields. The results also highlight the importance of the G and S pillars when predicting credit ratings. The E pillar is lagging, suggesting that credit rating agencies are undermining the impact of climate change and environmental topics on country creditworthiness. This is consistent with the traditional view that social and governance issues are the main drivers of the sovereign risk, because they are more specific and less global than environmental issues. Finally, taking these different results together, this research shows that opposing extra-financial and fundamental analysis does not make a lot of sense. On the contrary, it advocates for greater integration of ESG analysis and credit analysis when assessing sovereign risk.

Working Paper - Published October 12, 2021

To find out more, download the full Working Paper

*Bennani et al., 2018