Summary

Summary

As a large number of investors turn to green assets, this raises questions about investors’ impact on the economy, in particular through their influence on firms’ valuations and corporate behaviour. Understanding this effect is key for institutional investors, who not only care about the consequences of their investment but also struggle to understand how much of past performances have been driven by changing climate fundamentals and by changing environmental preferences of investors, i.e. “green sentiment”. Our recent Amundi Working Paper (Brière and Ramelli, WP N° 117, 2021) proposes a unique way to measure green sentiment and to quantify its effect. Over the period 2010-2020, changes in green sentiment anticipate a lasting stock out-performance by more environmentally responsible firms of approximately 50 basis points over six months (for a one-standard deviation higher green sentiment), as well as a 5% and 3% relative increase in firms’ capital investments and cash holdings.

Question 1

What is “green sentiment” and why is it important to understand its impact on stock prices and firm behaviour?

Jean-Jacques Barberis (JBB):

The past decade has seen significant changes in the way investors perceive environmental risks. There are several reasons for that. First, the information available on the costs of climate change has grown considerably, for example on major hurricanes (Katrina and Sandy, for example), or wildfires. In addition, various regulatory actions have emerged, especially in Europe (the European Commission action plan for sustainable finance, green taxonomy, European labels, etc.), to improve the transparency of available climate information and encourage investors to take environmental criteria into account in their portfolio construction (Barberis, Brière and Janin, 2020; Crehalet, 2021; Crehalet, Janin and Elbaz, 2021). Many initiatives have grown, bringing together bankers or investors (such as the Climate Finance Leadership Initiative, Climate Action 100+, Principles for Responsible Investment, Net Zero Asset Owner Alliance) for joint actions such as engagement or divestment campaigns. This led to a growing concern from all types of investors, both institutional and retail, and a growing appetite for responsible investments, as demonstrated by recent surveys and analyses of clients’ investment behaviour (Eurosif, 2020; Brière and Ramelli, WP n°104, 2021).

Marie Brière (MB):

In theory, this shift in investors’ appetite for green assets can have several consequences. On the one hand, it can modify investors’ appreciation of climate risks, e.g., the way in which they incorporate fundamental climate information into asset prices. On the other hand, it can also modify the preferences for different types of available assets, such as “green” and “brown”. This changing preference for green assets that are not related to fundamental information, is what we call “green sentiment”. Identifying these two components and their impact on prices is difficult because the two effects potentially have an impact on asset valuations. When we observe an increase in the price of green assets relative to conventional assets, such as the one observed over the past few years, we do not know whether this is related to the incorporation of fundamental information or to a change in investor preferences.

Question 2

Researchers in behavioural finance have shown that investors’ “sentiment” can impact stock prices. What about “green sentiment”, what is special about it?

JBB:

It is true that market or speculative “sentiment” (i.e. investors’ change in preferences that are not related to fundamental information) on asset returns and firms’ financing and investment decisions has been widely studied (see for example Baker and Wurgler, 2006). But despite the growing importance of green finance for both investors and policy makers, our understanding of the influence of environmental concerns on financial markets and corporate decisions remains limited. Several theoretical works indicate that investors’ environmental preferences can affect asset prices and, in turn, corporate behaviours (e.g. Pastor, Stambaugh, and Taylor, 2020). However, from an empirical perspective, identifying and studying the real impact of investors’ environmental preferences is challenging for at least two reasons. First, changes of such environmental preferences are not easily observable and measurable. Second, it is difficult to disentangle a change in environmental preferences from a change in expectations about firms’ fundamentals (cash flows and uncertainties), which are obviously also influenced by environment-related factors related, for instance, regulatory risks.

MB:

Our research (Brière and Ramelli, WP n° 117, 2021) proposes a unique way to estimate the changes in investors’ preferences for green assets that are not related to fundamental information, and to measure their impact on long-term equity returns. To do this, we evaluated arbitrage activity on the climate ETFs market i.e., the creation and redemption of shares in the ETF primary markets, which leads to observable flows in or out ETFs -- that recent work has shown to reflect nonfundamental information (Brown, Davies, and Ringgenberg, 2021; Davies, 2020).

The intuition is simple. ETFs and their underlying assets (individual stocks) have the same fundamental value, but ETFs are more prone to sentiment than underlying assets, due to their different ownership, significantly more tilted towards retail investors.1 Given these differences in ownership structure, non-fundamental demand shocks impact an ETF’s price differently from its underlying securities. When we observe violations of the law of one price between ETFs and the underlying assets (an ETF “premium”), this reveals non-fundamental demand shocks. These mispricings incentivise arbitrageurs, the Authorized Participants, to create or redeem ETF shares to correct the mispricing, creating observable ETF flows. By measuring the difference between these arbitrage flows on green and conventional ETFs, we can thus obtain an estimate of the non-fundamental demand for green assets.

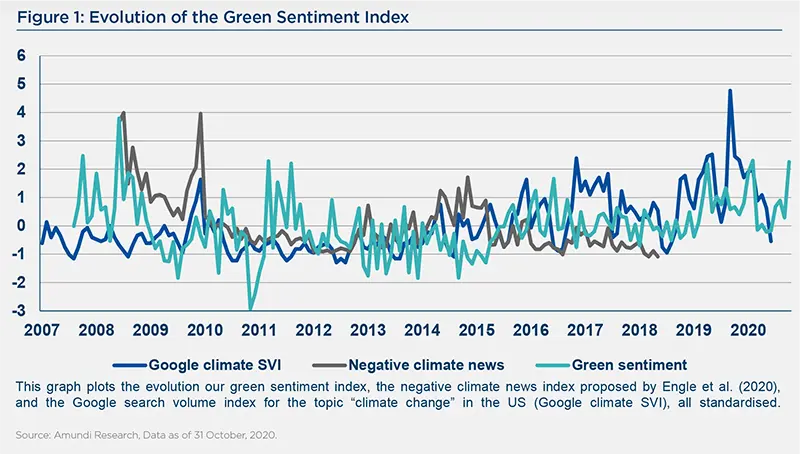

Using data on a comprehensive sample of US equity ETFs from January 2010 through June 2020, we estimated for each month the differential flows into green ETFs relative to flows into conventional ETFs, net of the effects of other fund characteristics. We use the estimated abnormal flows into green ETFs to build a Green Sentiment Index, measuring the changes in investor appetite for this theme, which are not yet incorporated in the value of the underlying securities that make up these ETFs. Our green sentiment index differs significantly from other proxies of attention to climate change, such as the Google search activity on “Climate change” or the news-based climate risk indexes adopted by Engle, Giglio, Kelly, Lee, and Stroebel, 2020 (see Figure 1). These measures are likely to reflect an undefined mix of both fundamental and non-fundamental information related to climate and environmental issues.

JBB:

A key result of this research is to estimate the stock price impact of green sentiment. A one-standard-deviation higher green sentiment is associated with an outperformance of the more environmentally responsible firm of approximately 30 basis points over a one-month horizon and 50 basis points over a six-month horizon, net of the effects of other firm characteristics. This impact on stock returns is large and significant, and it has the same order of magnitude than the impact of fundamental climate news, meaning that both climate risk information and changing green investors’ preferences have an impact on stock prices. Also, green sentiment has a long-lasting impact (over 6 months), with only a slight decay after that. It is particularly striking to see that this measure of sentiment derived from green ETFs flows has effects outside of the universe of stocks comprised in the ETFs baskets. There is a general appetite towards green stocks that goes beyond the particular sector of clean energy and is widely shared across markets.

Question 3

Is there also a “real” effect of green sentiment on firms’ behaviour?

MB:

Yes indeed, this is also something special about “green sentiment”. Our research shows that in quarters with higher green sentiment, environmentally responsible firms are able to profit from this new funding, by increasing their capital investment and their cash holdings.

We find that a one-standard-deviation higher green sentiment is associated with 0.21% higher capex and 0.27% higher cash holdings (representing a 5% and 3% relative increase) of the more environmentally responsible firms. The “real impact” of green sentiment is, however, heterogeneous across firms on the basis of their access to credit, as proxied by their credit rating. In particular, the influence of green sentiment on capex is focused on low (i.e. non-investment grade) and medium rated firms (“BBB”, “BBB+”, and “BBB-’’, based on the S&P scale).

JBB:

Many policy-makers and regulators worldwide expect the re-direction of capital market financing from “brown” to “green” activities to have a decisive impact in reducing carbon emissions (e.g., Lagarde, 2021). Changes in investor preferences for green assets have the power to shift investments from “brown” to “green” companies, which affects the cost of capital of green firms and, in turn, affects their capital investment decisions, in a potentially virtuous circle. The market for “green” assets is booming, and is arguably not in equilibrium. In a world where investor preferences are likely to remain heterogeneous, a key question is what new equilibrium is heading towards.

This research motivates the important role that investors (through their impact on capital markets) can have in greening our economy. This is key to Amundi’s current action and explains why we are deeply engaged in that direction (see our engagement for the Net zero Asset Management Initiative for ex).

___

1 In our sample, green ETFs have a median institutional ownership of approximately 24%, compared to roughly 42% for conventional ETFs and above 70% for individual stocks

References

- Baker, M. and Wurgler, J. (2006), “Investor Sentiment and the Cross-section of Stock Returns”, The Journal of Finance 61, p. 1645-1680.

- Barberis, J.J., Brière, M. and Janin, S. (2020), “Covid-19 Crisis and the ESG Transformation of the Asset Management Industry”, Amundi Day After N°3, November.

- Brière, M. and Ramelli, S. (2021), “Responsible Investing and Stock Allocation”, Amundi Working Paper n°104.

- Brière, M. and Ramelli, S. (2021), “Green Sentiment, Stock Returns and Corporate Behavior”, Amundi Working Paper, n°117.

- Brown, D.C., Davies, S. and Ringgenberg, M. (2021). “ETF arbitrage, non-fundamental demand, and return predictability.”, Review of Finance, 25(4), p. 937-972.

- Crehalet, E. (2021). “Introduction to Net Zero”, Amundi ESG Thema N°1, July.

- Crehalet, E., Janin, S. and Elbaz, J. (2021). “EU Fit for 55 package”, Amundi ESG Thema N°2, August.

- Davies, S. (2021). “Speculation sentiment”, Journal of Financial and Quantitative Analysis, forthcoming.

- Engle, R.F., Giglio, S., Kelly, B., Lee, H. and Ströbel, J. (2020), “Hedging climate change news.” The Review of Financial Studies 33.3, p. 1184-1216.

- Eurosif, 2020, Eurosif market study, Available at http://www.eurosif.org.

- Lagarde, C. (2021). “Towards a Green Capital Market in Europe”, Speech at the European Commission’s High Level Conference on the Proposal for a Corporate Sustainbility Reporting Directive, May 6, available at: https://www.ecb.europa.eu/press/key/date/2021/html/ecb.sp210506~4ec98730ee.en.html

- Pástor, L., Stambaugh, R.F. and Taylor, L.A. (2020), “Sustainable investing in equilibrium”, Journal of Financial Economics, forthcoming