Summary

Abstract

We analyze the portfolio choices of approximately 913,000 active participants in employee saving plans in France. Looking at the cross-section of equity exposure, we find that the inclusion of responsible equity options in the menu of available funds is associated with a 2.1% higher equity allocation by plan participants. Compared to an average equity asset allocation of 12.1%, it represents a material increase (17% in relative terms). Difference-in-differences analyses confirm that the introduction of a responsible equity option to a saving plan is followed by an increase of 7.2% in participants’ appetite for stocks, contrary to what happens with conventional equity funds. We discuss the role of personal values in explaining this phenomenon. Responsible investment products may reduce the gap preventing many retail investors from more actively participating in the stock market.

Conversation: CAN RESPONSIBLE INVESTING ENCOURAGE SAVERS TO INVEST IN EQUITIES?

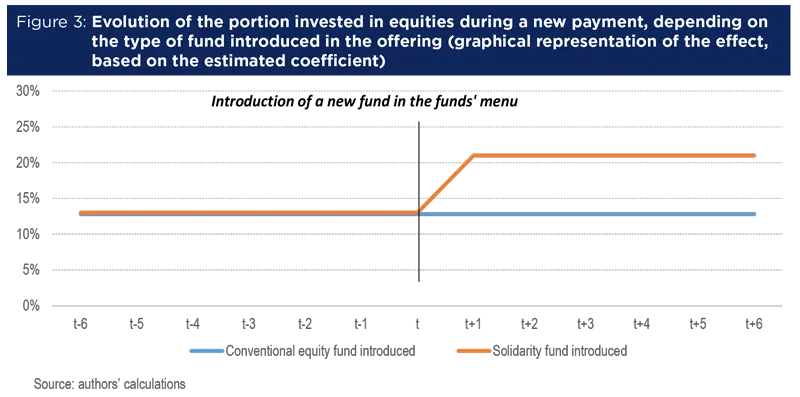

Recently, savers’ appetite for responsible investments has grown, but little is known about the consequences of this development on individual investment decisions. Employee savings plans constitute a unique laboratory for studying these choices. In a recent Amundi research article (Brière and Ramelli, 2021), we analysed the impact of introducing solidarity funds on the investment choices of more than 900,000 French employees. We show that the addition of a solidarity fund in the available funds offering led to a 7% increase in the equity allocation of new investments. Compared to an average equity allocation of around 13%, this increase is substantial and is a very encouraging result for French participation in the equity market.

Socially responsible investing (SRI) is booming. What is the appetite of savers for this type of investment?

Xavier Collot:

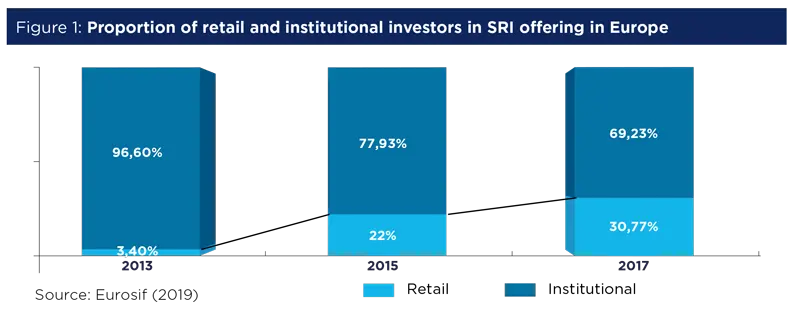

Responsible investing is increasingly popular among savers. For example, in a recent survey conducted by Vigeo Eiris for the Responsible Investment Forum more than 60% of French people say they place an important role for environmental and social impacts in their investment decisions. This figure is growing rapidly, since only 50% of French people were interested in it in 2013. Today, around 40% of retail investors are ready to ask their financial advisor for socially responsible investments. French people are particularly attentive to questions related to pollution, climate change, employment and human rights. This growing interest is reflected in a boom in the proportion of socially responsible financial products intended for individuals. Today, more than 30% of socially responsible assets managed in Europe (25% in the United States) are for individuals, compared to just 3% in 2013 (see Figure 1).1

At the same time, we observe that savers are very cautious about investing in the stock market. What is the situation in France, compared to other European countries?

Xavier Collot:

Indeed, the low participation of individual investors in the equity market is a concern for many countries. Low interest rates and longer life expectancies make it essential to invest part of a savings allocation in risky assets in order to achieve an adequate level of pension. Retail investment in equities is also a necessary condition for the development of capital markets in Europe, as stressed by the European Commission or ESMA.2 This participation is very low in most European countries. The proportion of household investment in listed equities (excluding pension and mutual funds) does not represent more than 6% in France and Germany, for example (see Figure 2). These figures are in line with the average for European countries. Participation is somewhat higher in Nordic countries (Finland, Sweden and Denmark). It is interesting to note, during the Covid-19 crisis, we saw a notable change in behaviour. In March 2020, at the peak of the crisis, individuals invested heavily in the equity market, as evidenced by AMF (2020), which reported more than 150,000 new investors in the French market since 2018. In the United States, major trading platforms3 saw the growth of new accounts rise by 170% during the first quarter of 2020. Young people seem to have participated significantly in this movement, seeing the fall in equity prices as an opportunity to invest. 4 That said, it is still too early to know whether this movement is linked to a desire to speculate in the short term in a few flagship stocks, particularly technology, or if it will generate a longer-term diversified investment in stocks.

Why do savers invest so little in equities?

Marie Brière:

Great question! This low participation of individual investors in the equity market is of concern to many public decision-makers and a puzzle for academics. Risk aversion seems at first glance to be the essential explanatory factor, followed by the lack of time and attention that individuals have to devote to their savings. It can be accentuated by low financial literacy (Van Rooij, Lusardi and Alessie, 2011). But researchers have shown that behavioural factors could also play a role, such as trust: investors’ trust in their environment (Guiso, Sapienza, and Zingales, 2008), but also trust in financial markets, which depends on past experienced performance (Malmendier and Nagel, 2011). Finally, it can also be influenced by non-financial factors, what economists call “social preferences”. These preferences are linked to the cultural environment and personal values of each individual. They play an essential role in consumption decisions (Vinson, Scott, and Lamont, 1977), political preferences and responsible investment choices. Hong and Kostovetsky (2012), for example, have shown the link between the political inclinations of American portfolio managers and their choice of securities, being more or less responsibility-orientated. Riedl and Smeets (2017) have shown the role of these preferences in the responsible investment decisions of individuals. These social preferences also have an impact on purely financial choices, and on the propensity to invest in equities in particular. 5

Can a responsible investing offering make a difference and encourage savers to invest in equities?

Marie Brière:

This is precisely the question we have tried to answer in our recent research (Brière and Ramelli, 2021). We analysed the impact of introducing solidarity funds to the funds’ menu offered in employee savings plans for nearly 900,000 employees in 6,500 companies.

Xavier Collot:

Solidarity funds offer a particularly interesting framework for analysis, because since a 2008 law was introduced in France,6 they are mandatory in the selection of funds offered by companies to their employees. They exist in several forms: equity, diversified or bond funds. These funds invest in companies of a social and solidarity nature (promoting access to housing, employment, care, education, the preservation of natural resources, etc.), which are given this label by an independent organisation, Finansol.

Marie Brière:

Our work shows that when solidarity equity funds are offered to savers, they invest more in equities than when this offering is not available (to the order of 2%, in absolute value, compared to an average allocation of around 12%, i.e. a relative increase of 17%). The addition of a solidarity fund in the funds’ menu is even associated with an absolute increase of almost 7% in the equity allocation of new investments made during the year, compared to the existing allocation. Conversely, we find that adding a conventional equity fund has no impact on the overall allocation of individuals. Young people were particularly sensitive to the introduction of solidarity funds in the offering. Our estimates show that a 30-year-old has invested an average of 3.2% more than a 50-year-old.

Two reasons can explain the difference in reaction to the inclusion of responsible versus conventional equity funds. The first possible explanation is that investors consider responsible funds will perform better than traditional funds, an unlikely assumption in the case of funds combining a dual objective, that is both financial and societal. The second possible explanation is that responsible investing makes equities more attractive to certain categories of investors who, for cultural or social reasons, would not have invested in equities. Thus, our results confirm that the decision to invest in equities is not only linked to financial factors, but that it can also be influenced by the supply of funds, especially responsible ones. In a context where the low participation of individuals in the equity market worries many countries, this result is potentially important and encouraging.

1. Eurosif et US SIF (2019) data.

2. Steven Maijoor: “Building the EU Capital Markets Union while Fostering Global Financial Markets“, ASIFMA Annual Conference in Tokyo, ESMA, October 2019.

3. Charles Schwab, TD Ameritrade, Etrade, see https://www.cnbc.com/2020/05/12/young-investors-pile-into-stocks-seeing-generational-buying-moment-instead-of-risk.html

4. Youth favourite trading app Robinhood registered 3 million new accounts in Q1 2020.

5. Kaustia and Torstila (2010) have shown that in Finland left-wing voters invest less in equities. These facts are not new. Shiller (1984) cites a 1954 survey of the attitude of New York Stock Exchange investors, seeking to understand the reasons for the low participation in the stock market. In addition to the lack of information available, another key factor cited was a "vague sense of prejudice against the stock market", with participation in the stock market not being consistent with the overall values of some of the respondents.

6. Loi de Modernisation de l'Economie, 2008-776, August 2008.

References

AMF, 2020, “ Retail investor behaviour during the COVID-19 crisis”, April

Brière, M., and S. Ramelli, 2021, “Responsible Investing and Stock Allocation”, Amundi Working Paper.

Guiso, L, P. Sapienza, and L. Zingales, 2008, “Trusting the stock market”, The Journal of Finance 63, 2557-2600.

Hong, H., and L. Kostovetsky, 2012, “Red and blue investing: Values and finance”, Journal of Financial Economics 103, 1-19.

Kaustia, M., A. Conlin, and N. Luotonen, 2019, “What drives the heterogeneity in portfolio choice? The role of institutional, traditional, and behavioral factors”, Working paper.

Malmendier, U., and S. Nagel, 2011, “Depression babies: Do macroeconomic experiences affect risk taking?”, The Quarterly Journal of Economics 126, 373-416.

Riedl, A., and P. Smeets, 2017, “Why do investors hold socially responsible mutual funds?”, The Journal of Finance 72, 2505-2550.

Shiller, R.J., 1984, “Stock prices and social dynamic”, Brookings Papers on Economic Activity 2, 457-498.

Van Rooij, M., A. Lusardi, and R. Alessie, 2011, “Financial literacy and stock market participation”, Journal of Financial Economics 101, 449-472.

Vinson, D.E., Scott, J.E., Lamont, L.M., 1977. “The role of personal values in marketing and consumer behavior”, Journal of Marketing 41, 44-50.