Summary

Key Takeways

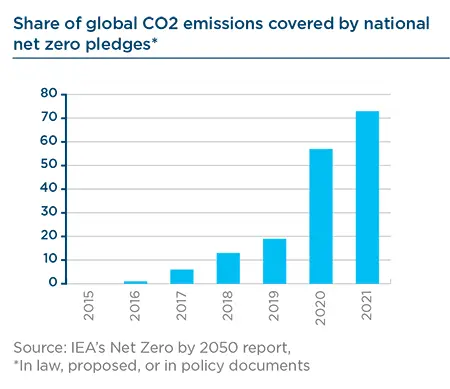

- Despite the Covid-19 crisis, we have witnessed a tremendous acceleration of net-zero commitments from a variety of public and private actors. However, this ambition is not yet followed by consistent actions to achieve this goal.

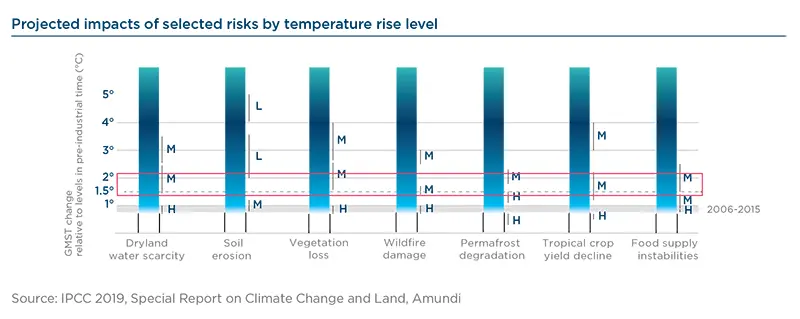

- The IPCC’s 2018 report highlighted the need to limit global temperature increase to 1.5°C: above this target, physical risks from climate change will have significant repercussions on our ecosystems. Reaching carbon neutrality by 2050 requires achieving net zero emissions: this is the anchor of the International Energy Agency’s (IEA) Net Zero Emissions Scenario (NZE).

- The world is not yet on the NZE track. To achieve this goal, the world needs collective mobilization: stronger international cooperation, commitments from the financial and industrial sectors, rapid technological innovation, and finally social acceptance.

- This scenario has important implications for Amundi’s engagement and investment activities. Indeed, this will imply new sector decarbonization pathways for key emitting sectors, different target levels for key decarbonization levers by sectors, and the development of different economic assumptions to avoid stranded assets and locking in future carbon emissions. At Amundi, we firmly believe that this process must be business- and geographic-specific.

Introduction: net zero is on everyone’s lips

Since last year, there has been a tremendous acceleration of net zero commitments, showing that despite the Covid crisis, the climate change mitigation goals set in the Paris Agreement remain firmly on the agenda.

The ambition is clear and comes from a variety of public and private actors:

– Governments representing c. 70% of global CO2 emissions.

– 110 energy-related corporates as of February 2021, and

– Financial institutions, sometimes through joint initiatives such as the Net Zero Banking Alliance, the Net Zero Asset Owner Alliance, or the Net Zero Asset Managers Initiative, of which Amundi will soon officially become a signatory.

But while the ambition is clear, the relevant individual actions required to collectively achieve this goal have yet to be fully identified. For instance, c. 40% of companies that have announced net zero pledges have yet to set out how they aim to achieve them.

In this context, we warmly welcome the release by the International Energy Agency last month of its new Net Zero Emissions (NZE) scenario: a detailed modelling of how the energy and industrial system should evolve to keep CO2 emissions within the remaining carbon budget before falling down to net zero by 2050.

In this paper, we discuss some key takeaways from the report and how this scenario informs our engagement and investment activities.

Why a new scenario? From Paris-aligned to net zero 2050

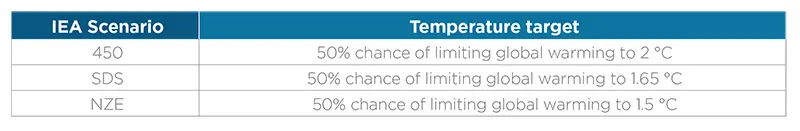

The IEA already had a number of Paris-aligned scenarios such as the Sustainable Development Scenario (SDS) or the Well-Below 2 Degrees scenario (WB2DS). These scenarios have been largely used as reference by investors, corporates, and initiatives such as the Science-Based target initiative (SBTi).

As a reminder, the objective of the Paris Agreement is not only to “keep global temperature increase ‘well below’ 2°C”, but also to “pursue efforts to limit it to 1.5°C”.

The release at end 2018 of a special report by the Intergovernmental Panel on Climate Change (IPCC) moved the cursor towards the 1.5°C target by showing the multiple risk mitigation benefits of this target. Above the 1.5°C, a number of climate change physical risks turn red (eg wildfire damage, food supply instabilities). Fluvial flooding risks for instance would be significantly heightened above the 1.5°C threshold.

|

The IPCC Special Report moved the cursor towards the 1.5°C net zero target “Limiting global warming to 1.5°C compared to 2°c is projected to lower the impacts on terrestrial, freshwater and coastal ecosystems and to retain more of their services to humans (high confidence).” IPCC 2018 |

In addition, this report made it clear that in order to have an even chance of limiting warming to 1.5°C, global CO2 emissions should reach carbon neutrality in about 30 years. In other terms, “net zero 2050”.

This “net zero 2050” is the anchor of the new IEA Net Zero Emissions (NZE).

Whereas, the IEA Sustainable Development Scenario (SDS) is modelled with the constraint to hold the temperature rise to below 1.65 °C with a 50% probability and is targeting net zero by 2070, the NZE scenario is consistent with limiting the rise to 1.5°C and is targeting net zero as soon as 2050.

All net zero scenarios are not created equal. How does the IEA NZE compare with other 1.5°C scenarios?

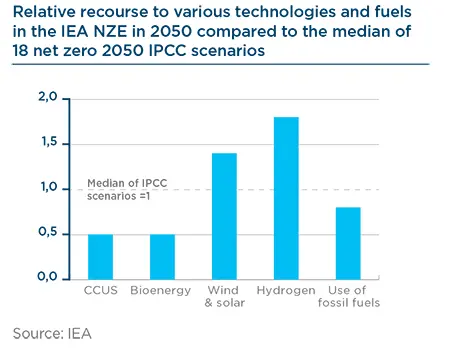

IEA NZE indicates only one of potentially many paths to net zero.

The 2018 IPCC report includes 90 different 1.5°C-aligned scenarios. The common constraint is the remaining carbon budget, estimated at 580GtCO2 for a 50% chance of achieving the target. Modelling can then differ based on a range of key assumptions such as the burden sharing between fossil fueland agriculture & forestry-related emissions, preferences for certain mitigation measures over others (eg, recourse to carbon capture and storage options), or potential leeway for overshooting the 1.5°C target between now and 2100.

A strong bias of the IEA NZE for instance is the decision not to have recourse to naturebased carbon sinks such as afforestation to net the remaining fossil-fuel related emissions in 2050, referring to uncertainties over the permanency, additionnality and verification of these offsetting mechanisms.

We will welcome of course other views than the one of the IEA on credible net zero 2050 paths to inform our understanding of the consensus over concrete actions needed to curb energy-related emissions, and also to complete the picture for the implications for the food value chains as the agricultural sector is not covered by the IEA NZE.

As we support an orderly and fair transition, we want to set a number of principles though. We expect scenarios to be based on conservative assumptions in recognition of the technological uncertainties, environmental and social impact trade-offs, and positive feedback loops accelerating temperature rise. We would not retain scenarios allowing temperature overshoot for instance as they tend to delay action and place the burden on next generations and/or yet-to-be-proven technologies.

The IEA NZE clearly relies on technologies which have yet to be deployed at scale to demonstrate their effectiveness, such as carbon capture & storage, clean hydrogen or solid-state batteries. There is a particularly strong recourse to hydrogen which seems to find its roots in the current general enthusiasm around the molecule but assumptions appear well balanced overall compared to other IPCC scenarios.

A positive point in particular is that the modelling takes into account risks of tradeoffs with other SDGs.

– For instance, in consideration of the food vs fuel negative trade off, the modelling ensures that the modelled growth in bioenergy supply does not require an overall increase in cropland used for bioenergy.

– Another positive for us is that the IEA NZE is framed to deliver other societal benefits (SDGs) on air pollution and universal energy access for instance.

We have no doubt that this scenario will become a key reference for many stakeholders and encourage corporates that would want to design their own global net zero 2050 scenario to inform their strategy, to position it against the key assumptions and outcomes of the IEA NZE.

What are the key features of this IEA Net Zero scenario? Faster and stronger

Those already familiar with the IEA Sustainable Development Scenario will not be surprised by the recipe. The ingredients are by and large the same. But while the difference in temperature target looks small (-0.15°C), the pace and the magnitude of the shift of the deployment of decarbonisation solutions both on the supply side and demand side levels are even more staggering in the NZE.

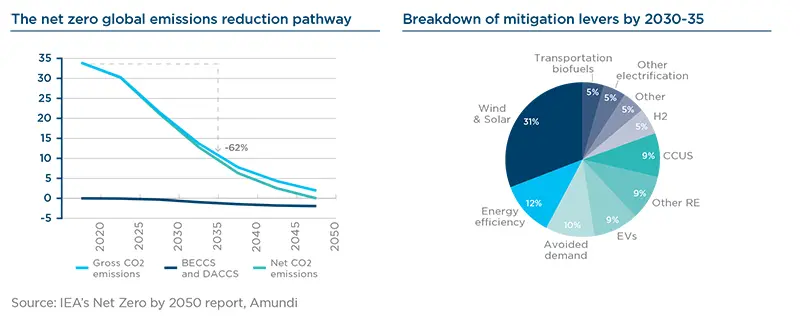

For global net CO2 emissions to be cut by 41% by 2030 (vs 2019) and 100% by 2050, the IEA NZE counts on:

– A faster electrification of the industry, buildings and transport sectors (eg faster ramp-up of electric cars) coupled with a faster decarbonisation of the power generation mix (wind & solar).

– Much faster energy-efficiency gains: eg up to 11x faster in the aluminium industry, while energy consumption of new buildings has to be 50% lower as early as 2030.

– The deployment of hydrogen, alternative fuels, and CCUS deployment in ‘hard-toabate’ sectors where electrification is not possible.

Negative emissions technologies (biomass-fired power generation coupled with CCS, and direct air capture) are needed beyond 2030 to offset 1.7Gt of unabated residual CO2 emissions in 2050. The IEA NZE does not count only on technologies though. ‘Behavioral changes’ levers such as car sharing, speed limitations, limitation of air travel for tourism and business, are also needed to contain demand growth in hard to abate sectors (eg, airlines, cement): these measures deliver c. 1/3 of additional CO2 cuts beyond the SDS by 2030.

While we plan to publish subsequent notes focusing on the specific roadmaps for key sectors, we already want to shed light on a few implications for supply sectors.

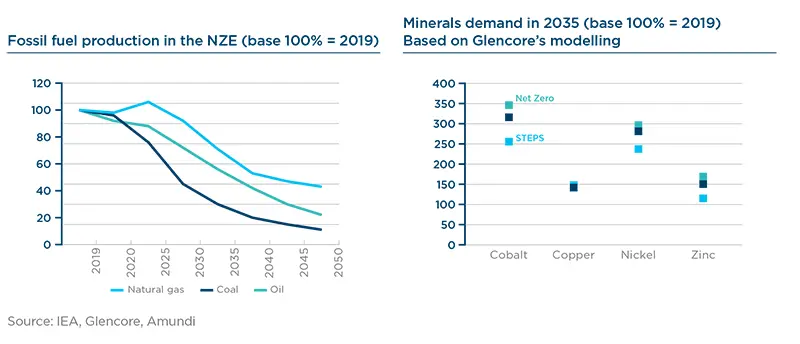

Oil & Gas: in this scenario, demand for hydrocarbons would decline at such a pace that sustaining production at existing fields would be sufficient to match the demand. This implies that there would be virtually no need for new (greenfield) oil & natural gas fields: a significant departure from the SDS. There is still a need for oil & gas upstream investments though. Global annual upstream oil & gas investments in 2021-30 remain 15% higher than the 2020 lows, but the investments required are almost twice lower than in the central case and are almost fully concentrated in sustaining the production of existing fields. Natural gas consumption has to decline too although it displays a relatively more resilient profile: in 2050, global consumption is still at c.40% of 2019 levels.

The NZE is also pivotal for the LNG outlook and the usefulness of this midstream activity for the low-carbon transition: contrary to the SDS, it has no longer room to grow in the NZE beyond 2025.

The mining sector appears has a key piece of the NZE puzzle: as the scenario boosts wind, solar, electricity grids and batteries, it requires a significant step up of the supply of critical energy transition minerals (eg, copper, lithium, nickel, graphite, cobalt, rare earths). Based on Glencore’s modelling of the IEA NZE’s implications for global demand for key minerals, we find that global demand for nickel would grow 1.2x faster in this scenario, and twice faster for zinc. This further highlights the risk of facing bottlenecks across value chains, and the important contribution of the mining sector to the energy transition through capital allocation into minerals that are critical for the low-carbon transition.

After the recent wave of net zero pledges, is the world on track?

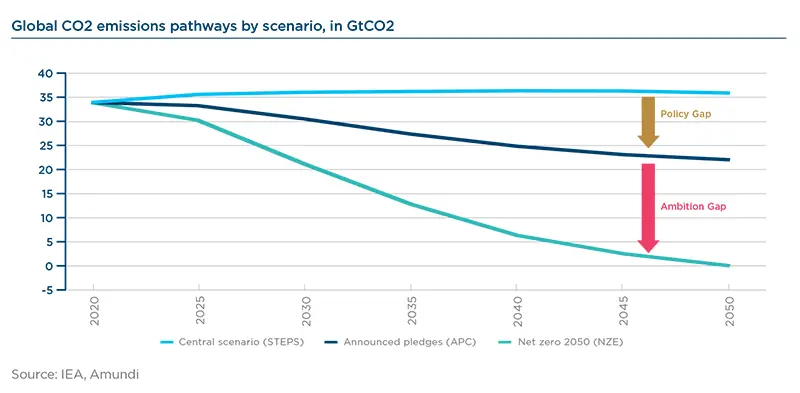

Not yet unfortunately. The central scenario of the IEA still points to flattish global emissions beyond 2025. And even assuming that governments would pass all the necessary policies to deliver fully and on time their net zero pledges, only 40% of the emissions gap would be closed, according to the IEA. In short, a significant policy and ambition gap remains.

The IEA NZE requires unprecedented efforts and perfect international coordination. The challenges must not be understated. We list five below:

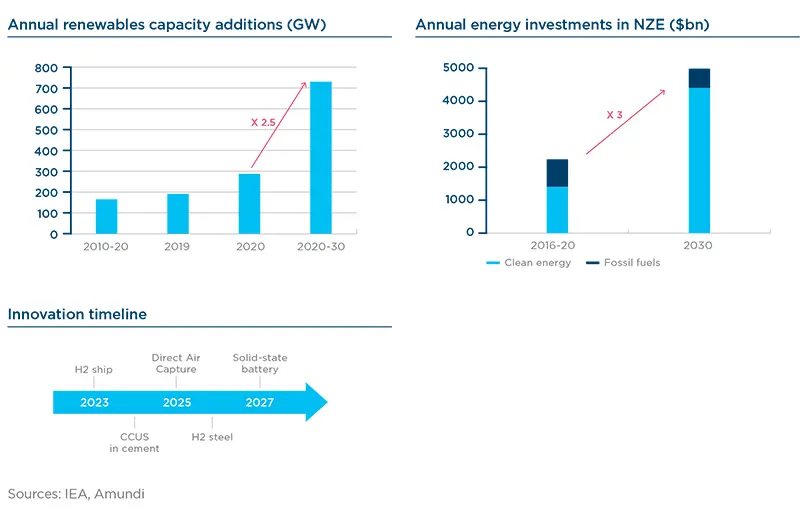

1. The industrial challenge: the required ramp up of industrial capacities is staggering. The annual capacity additions of renewable power should be 2.5x higher than in 2020 throughout 2030. Some corporates’ strategies appear up to the challenge and some oil & gas companies start contributing to the effort, but a perfectly timed deployment is needed throughout value chains (minerals) and systems (grid stability and grid connections) to avoid bottlenecks. Another sobering number: the electricity production needed to feed hydrogen electrolysers by 2030 is equivalent to China’s incremental electricity needs over the last decade.

2. The financing challenge: the IEA NZE is a capital-intensive scenario. Energy investments rise from 2.5% to 4.5% of GDP in 2030 with clean energy investments needs three times higher than in 2016- 20. A ‘brown-to-green’ capital allocation shift is far from enough. We estimate that ‘freed’ fossil fuel investments would cover only 9% of additional clean investment requirements.

3. The innovation challenge: while the bulk of CO2 reductions by 2030 come from technologies which are already in the market (eg, wind/solar, EVs), 2/3rd of incremental reduction beyond 2030 depend on technologies that are still under development: solid-state batteries, CCUS, green hydrogen, direct air capture. The IEA NZE counts on their market introduction before the end of the decade implying a full time-to-market of 15-20 years, whereas it took 30 years for solar PV and li-ion batteries to make their way to the market.

4. The international policy coordination challenge: although the IEA NZE assumes different CO2 prices between developed and emerging markets, a perfect policy coordination is required to share the costs related to the ramp up of new technologies (subsidies) and avoid tensions around competitiveness issues, especially for sectors exposed to international trade.

5. Societal acceptation of behavioral change measures: breaking habits is not an easy thing. In France, some departments moved back on speed limitations for cars, and Swiss citizens recently (narrowly) voting down a climate law that included taxes on car fuel and flight tickets. Social acceptation of climate policies remains a key challenge.

Key NZE challenges in three charts

Breaking the inertia of the energy, industrial and financial system raises unprecedented challenges which can feed skepticism; the same skepticism faced by solar, wind and electric cars some years ago before these technologies turned mainstream. Any effort will count in the 1.5°C climate change mitigation battle.

What Amundi/investors can do?

As an investor willing to play its part, the IEA NZE scenario provides a number of reference points and target values that can be used in:

– stewardship / engagement activities,

– investment processes,

– investment solutions.

In a subsequent paper to follow, we will delve deeper into the mechanics of integrating net zero for investors, across the entire value chain: asset allocation, investment, reporting and engagement. Here, we focus on implications for our engagement activities.

Engaging for corporate net zero alignment

Interestingly, the IEA Net Zero scenario was the reference used by a Dutch Court recently to order the oil & gas major RD Shell to cut its carbon footprint by 45% by 2030: a number ‘aligned’ with the emissions cut required in the IEA Net Zero scenario for all fuels (including coal).

While interesting, we have general reservations with such a one-fits-all approach that consists in translating an absolute reduction requirement at a systemic/macroeconomic level onto corporates. We believe that efforts deployed by corporates need to be assessed within its specific business and geographical context. This is why we prefer using sector specific indicators and regional pathways, whenever available, to inform our engagement with corporates.

In that regard, the IEA scenarios offers many indicators to test the level of alignment of corporates’ decarbonisation targets and practices. This includes:

– New sector decarbonisation pathways for key emitting sectors.

– Target levels for key decarbonisation levers by sector: eg, low-carbon technology penetration rates, annual energy efficiency improvement rates.

– Economic assumptions for commodity prices (eg energy, CO2) and activity growth.

New 1.5°C-aligned sector decarbonisation pathways: raising the bar

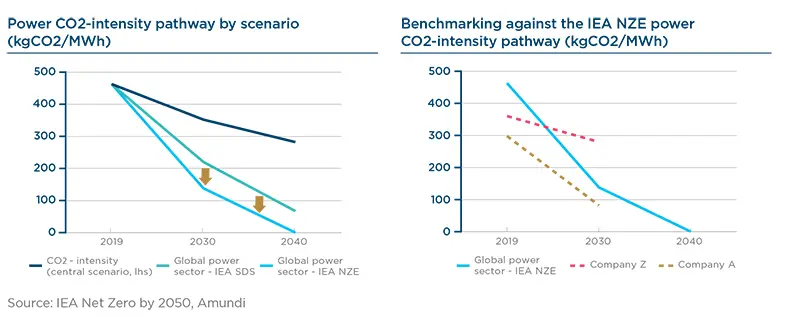

Sectoral carbon-intensity pathways remain one of the most useful tools available currently to benchmark the level of ambition of corporate decarbonisation targets.

Positioning corporate decarbonisation targets against these pathways allows us to identify companies lagging behind and to concentrate our engagement efforts.

While there has been a bunch of net zero 2050 pledges made by corporates over the past years, we expect companies to 1) set interim targets, that 2) converge towards the sectoral average.

The example of the power company Z is particularly noteworthy as it shows that the risk of compromising the overall sector efforts can also come from companies with a current better-than-average CO2-intensity if they have too soft decarbonisation ambitions.

Amundi supports the Business Ambition for 1.5°C campaign of the Science-Based Target initiative (SBTi), and will keep advocating the use of sectoral decarbonisation approach (SDA) for target setting, once the SBTi adds new 1.5°C-aligned sector pathways.

‘Alignment’ does not say it all: towards contribution assessment

The ‘alignment’ assessment exercise is useful but cannot say it all. As we seek CO2 reductions in the real economy, equally important in our view is how our investees intend to ‘align’ itself. Indeed:

– A corporate can ‘align’ itself via M&A actions to reshape the CO2-intensity of its portfolio of assets. While such actions can be useful to de-risk portfolios from an energy transition standpoint, it has virtually no direct contribution to global net zero efforts as problematic assets only change hands.

– A corporate can appear perfectly aligned today while at the same time not doing any additional contribution to global net zero efforts. As highlighted earlier in this paper, the IEA Net Zero is largely about investing in low-carbon solutions.

Reference points and target values in the IEA NZE can be used to assess the contribution to this scenario, both for sectors with and without sector specific decarbonisation pathways.

Setting dividing lines: what is needed, what is not needed and what is needed not to have

We believe that for the transition to net zero to be orderly, it has to be demand-driven. This requires to ensure a timely retrofitting or repurposing of the existing stock of energyconsuming assets on the one hand, and that new energy-consuming assets being developed match stringent low-emissions criteria, on the other hand.

Through our engagement activities, we want to ensure that companies:

- contribute to the development of the low carbon solutions needed on a fair share basis, and

- do not compromise the net zero efforts by developing assets that will lock in unabated fossil fuel demand and generate carbon emissions outside the net zero carbon budget, or by missing an opportunity to retrofit or repurpose existing assets.

In that regard, we differentiate three types of assets or actions discussed in the IEA NZE, as follows:

1. What is needed: the scenario lists asset types that need to be scaled up to deliver the required CO2 reductions. This includes for instance the development of wind and solar, electric vehicles, carbon capture & storage, green and blue hydrogen, or zero-carbon-ready buildings. This also extends to practices such as voluntary limiting business flights. The development of such assets and practices directly positively contribute to the NZE scenario. Therefore, we will keep pushing companies to contribute to their wider development or adoption.

2. What is necessary not to have: the IEA NZE scenario lists a number of developments that it is necessary to avoid if we want to keep the world on track with the remaining carbon budget. This category typically includes new approvals for unabated coal plants as early as this year (2021), but also new fossil fuel boilers from 2025, non-LED lighting solutions from 2030 and new cars powered by combustion engines from 2035. Some countries have starting adopting consistent public policies. For instance in the UK, all new homes will be banned from installing gas and oil boilers by 2025, and a ban on the sale of new petrol and diesel cars by 2030 was also announced. The development of such assets beyond the prescribed timeline directly compromises the net zero scenario designed by the IEA by locking in fossil fuel demand outside the remaining carbon budget. In the absence of local regulations, we therefore expect both sponsors and manufacturers of those assets to align with net zero recommendations. Consistent with this approach, Amundi has excluded from its investment universe coal developers since last year. Our engagement is focused on stopping the development of such assets and pushing corporates to review their plans.

3. What is not needed: as a second derivative of the constraint placed on the demand, the IEA NZE scenario shed light on some assets whose development would not be needed if energy-consuming sectors achieve the required transformation. This includes new oil and gas greenfield developments and new natural gas liquefaction plants for instance. Unlike the precious category, the development of such assets does not directly compromise compliance with the carbon budget. However, these developments still represent a potential wasted opportunity to allocate capital towards low-carbon solutions and a potential risk of stranded assets. Our engagement therefore seeks to push companies to review the financial attractiveness of such projects using assumptions consistent with a net zero scenario.

Economic assumptions for careful business planning to avoid stranded assets and/or locking in emissions

As new assets are being built and existing assets are being upgraded, it is key to ensure that today’s investments decisions avoid locking in future carbon emissions outside the net zero 2050 budget. The IEA estimates that 30% of the key emitting assets in the heavy industry will face critical retrofitting/replacement decisions by the end of the decade. We therefore encourage corporates to stress test their investment and business planning decisions using the economic parameters of the IEA NZE. This includes a combination of fuel and carbon prices and sectorial activity growth assumptions.

Alignment of lobbying practices

The IEA lists a number of key policies needed to drive emissions reductions such as the introduction of CO2 prices in all regions, renewable fuel mandates, efficiency standards, or the phase out of fossil fuel subsidies.

Through investor initiatives or on a standalone basis, we will keep advocating for more ambitious policies. As we believe that corporates have a pivotal role to play too, this is also part of our climate engagement with them. We believe that it is important that corporates on the one hand withdraw their support to initiatives that oppose or intend to water down relevant low-carbon policies, and on the other hand disseminate best practices and alleviate fears by providing feedback to policymakers across the world on their experience in markets/countries with the most advanced policies.

Evolving scenarios: is net-zero the ultimate one?

For years, the IEA has been releasing various climate change mitigation scenarios with ever tighter carbon budgets: the 450 scenario, followed by the well-below two degrees (WB2D) and the SDS, and finally the Net Zero Emissions scenario.

The tightening of the associated carbon budgets has had significant implications for the sector emissions pathways and for the role that some technologies could play in the low-carbon transition. For instance, the role of natural gas has been gradually revised down. Back in 2017, the solution was pushed in the IEA SDS to decarbonize China’s economy for instance. The subsequent scenarios have been constraining global natural gas demand though which stands >20% lower in the NZE than in the central case in 2030.

With its level of ambition aligned with the most demanding objective of the Paris Agreement, the IEA NZE may be the last round of tightening. However, if the world fails to achieve the demanding carbon reductions in the coming years, the remaining carbon budget will further shrink, forcing ever drastic decarbonisation slopes for sectors. A company deemed ‘aligned’ today may no longer be in a few years. Some grandfathering could apply but we would in any case expect companies that move faster already today to be the one able to further revise up their ambitions over time.

Annex

|

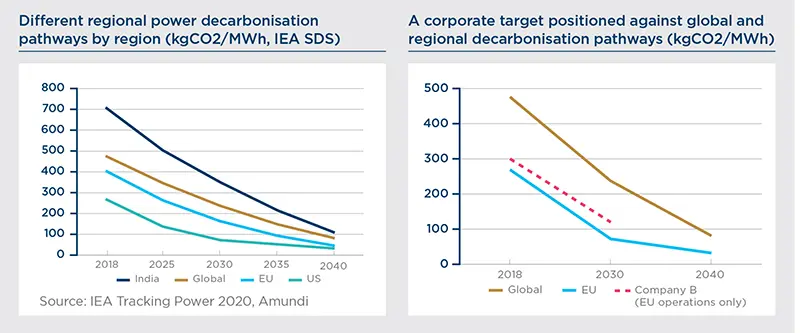

Discussion box Differentiation by geography is important too to contextualize our engagement and practices especially with corporates with regional rather than global footprints. For instance, the IEA NZE confirms that to hold the remaining carbon budget, all unabated coal-fired power plants must be phased-out by 2030 in advanced economies and by 2040 globally. Our coal phase out engagement is already aligned with this differentiated timeline. Detailed regional scenarios are not available in the IEA NZE unfortunately at this stage, but as shown in the charts below based on the IEA Sustainable Development Scenario, the global power generation decarbonisation pathway may appear tough for an Indian company and conversely lenient for a company with operations in the EU. Such information helps us to further contextualize our engagement and levels of expectations.

This is why we also believe that it is important to seek further granular reporting of CO2 emissions by business and by geography from corporates. |

Sources:

https://www.ipcc.ch/sr15/

https://www.ipcc.ch/site/assets/uploads/2019/11/SRCCL-Full-Report-Compiled-191128.pdf

https://www.ipcc.ch/site/assets/uploads/sites/2/2019/05/SR15_SPM_version_report_LR.pdf

https://www.iea.org/commentaries/a-closer-look-at-the-modelling-behind-our-global-roadmap-to-net-zero-emissions-by-2050

https://www.iea.org/reports/tracking-power-2020

https://www.glencore.com/media-and-insights/news/Climate-Report-2020--Pathway-to-Net-Zero

https://www.iea.org/reports/net-zero-by-2050