Summary

- Geopolitical dimension of the crisis: tensions stand at their highest point in years, after Moscow deployed 100,000 troops to its border with the Ukraine’s Donbas region. The geopolitical risk between Russia and the West remains deadlocked since Russia’s 2014 annexation of Ukraine’s Crimea peninsula and the consequent Western sanctions to Russia. Recent talks with NATO and the US have not yet produced any tangible results, with the Biden administration rejecting Russian demands to halt NATO’s expansion to the east. While these talks may continue and produce some results in the coming months, geopolitical risk may remain high in the short term, although a full-blown conflict is unlikely in our view. Moreover, possible sanctions for Russia are likely to remain, although we do not expect any major measures or escalation at this point. The Russian economy has increased its resilience since 2014, with a strong current account and its financial buffer has been built-up through international reserves. As a result, the country is better positioned – although not immune – to face new sanctions.

- Impact on local and global financial markets: Russian and Ukrainian assets have sold off as a direct spill-over of the tensions, although the impact on Russia and its currency has been mitigated by the good momentum of its economy thanks to elevated energy prices. However, if Russia-Ukraine tensions escalate further it could have much broader implications on risk assets globally. In fact this would be on top of the current pressures relating to ongoing high inflation expectations for 2022, sentiment indicators weakening due to the Omicron variant and Central Banks turning more hawkish and standing ready to act, as clearly stated by the Federal Reserve (Fed). Europe is the area to watch carefully: equity valuations are attractive and the value tilt of the market is an opportunity for global investors, but the area is dependent on Russia for energy and vulnerable to further rises in energy costs. Considering the evolution of the tensions at the Ukraine border and the global context, global multi asset portfolio investors should remain neutral in terms of risk allocation, keeping a short duration stance in fixed income and using hedging strategies for assets that could suffer most in the case of a deteriorating geopolitical situation. USD and Middle Eastern markets within CEEMEA could benefit in the context of ongoing tensions.

War of nerves between Russia and Ukraine, geopolitical risk back in focus

Despite a lot of military rhetoric over the last couple of months and tensions clearly building up, we consider a full-scale Russian invasion of Ukraine to be a low probability scenario, although an incursion at the boarder cannot been excluded, as well as the option that military forces on both sides will stay in the area for an indefinite amount of time, ensuring tensions remain constantly elevated.

We currently see three possible outcomes with a different likelihood of occurrence:

- 60% probability of a peaceful compromise, a relief for risk assets;

- 30% probability of a small-scale military incursion: further expanding the territory of the separatist controlled Donbas region, potentially building a land bridge to connect to the annexed Crimea region and recognising Donbas as independent state. The impact may depend on the scale of any intervention, but markets have priced a lot in already with a big correction of Russian equity and increased volatility globally;

- 10% probability full scale invasion: occupying a significant part of Ukraine, including the capital Kiev, and installing a pro-Russia president. This can be considered a tail risk, but would trigger much higher volatility in risk assets and supporting safe heaven assets for hedging geopolitical risk such as the USD.

Clearly, the level of alarm is very high, particularly in the US, while EU official comments are less harsh on a relative basis considering the role of Russia in European energy supply.

We consider a full-scale Russian invasion into Ukraine to be a low probability scenario, a tail risk, but tensions will remain elevated in the short term.

Crippling economic sanctions are on the table, but Russia doesn’t perceive them to be an immediate threat as it does not believe the US will push hard for them, given the vulnerability of coalitions deciding such sanctions. Among the possible sanctions, switching off of the SWIFT payment system remains the most difficult to implement due to the gas trade between Russia and the EU. The most damaging sanction could be a ban on secondary market transactions for US companies, this may cause the index expulsion of Russia from both local currency (foreign ownership has already been cut from 33% to 20% in the last year), hard currency bonds and equities. This would cause more pain for the Rouble and all other tradable Russian assets. A scenario under which ownership of ALL Russian assets is prohibited is very unlikely, in our view. Sanctions are likely to be targeted at key export sectors. There will be little surprise if these targeted sanctions include existing debt (rather than new debt), especially considering Russian corporates and sovereigns are not heavily dependent on foreign investors.

Overall we think that the overhang of sanction risks remains, but the implementation of the harshest measures is unlikely, unless there is a further escalation of the military conflict.

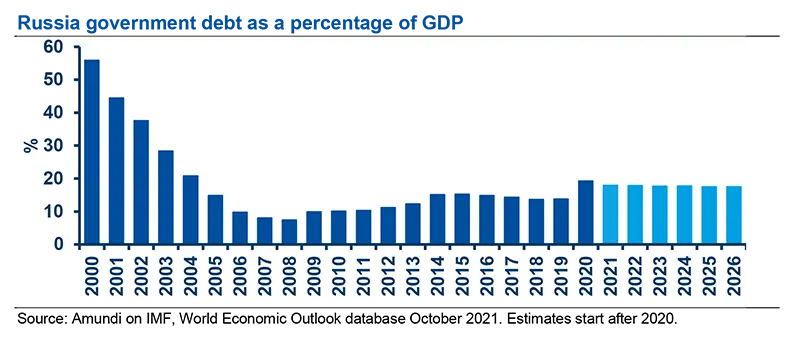

Today, the Russian economy is much better prepared to weather sanctions than it was in 2014 (when sanctions were imposed in response to Russia’s annexation of Crimea), but not immune. Russia has a very strong balance sheet with very low debt (public debt remained below 20% of GDP in 2020, and a vast majority of that is denominated in RUB), large current account surpluses and high external liquidity.

The country’s international reserves hit a new record, standing at 40% of GDP or $630bn. In addition, shortages in the oil and gas market have pushed energy prices higher, benefitting exports and fiscal revenues.

Different types of sanctions would have different impacts on the economy and could be affected with an immediate impact on economic sentiment via weaker FX, higher inflation and tighter monetary policy.

The situation is complex as it entails a global geopolitical dimension. We expect that the crisis would eventually de-escalate gradually, though we admit that this process might be non-linear and may take time. Recent talks between US, NATO, and Russia have so far failed to produce results, as both sides flagged fundamental differences. However, we are hopeful that continued talks will lead to some kind of agreement and we consider the willingness of the US and Russia to continue the bilateral dialogue as positive.

Overall, tensions between Russia and US / NATO will remain high in the near term with many headlines emerging which could result in increased market volatility.

The overhang of sanction risks remains, but the implementation of the harshest measures is unlikely, unless there is a further escalation of the military conflict. The Russian economy is much better prepared to weather sanctions than it was in 2014.

Investment implications: local impact, so far, but the major risk is of stagflation

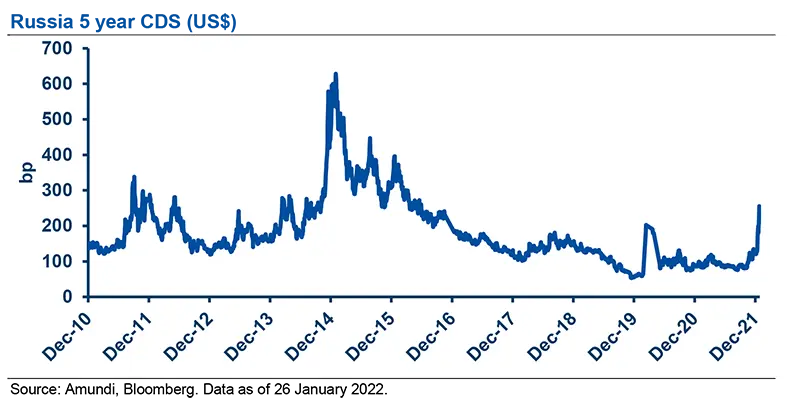

The deadlocked end to talks has caused a risk premium to emerge for Russian asset prices. Fixed income asset prices in both Russia and Ukraine have significantly adjusted. In Russia, credit spreads widened by approximately 100 bps to over 200 bps spread (5 year CDS) and local currency bond yields moved up by 100 bps to the 9.5% area (10 year part of the yield curve). On FX, the Russian Rouble (RUB) has proved to be much more resilient, depreciating only by 2.5%-3% in the last few days. In Ukraine, credit has had a more severe move with 5 year CDS widening at points by 250 bps to above the 900 bps level. The currency (Ukrainian hryvnia, UAH) has depreciated by 4% YTD versus the dollar and local currency bond yields increased by 250 bps (4 year maturity).

A risk premium has emerged for Russian assets. We believe that, at current levels, the market is already partially discounting some further escalation in the military conflict.

The Russian equity market has declined significantly, around 10% YTD (at the time of writing), despite supportive energy and broad commodity prices (around two thirds of the Russian market are commodity exporters). Russia currently trades at 12-months forward P/Es of around 5 and with dividend yields of around 12-13%, the implied cost of equity is above 20%. We believe that, at these levels, the market is already partially discounting some further escalation in the military conflict.

We expect, in the worst case, a major global, rather than local, issue could lead to significant volatility in risk assets.

The escalation of tensions between Russia and the Ukraine is coming at a delicate juncture for financial markets, currently re-pricing the Fed’s tightening of rates and the potential reduction of its balance sheet. Volatility has already increased since the beginning of the year, and we have seen strong rotations in the market favouring value and cyclical stocks, at the expenses of the most expensive and liquidity-driven areas of the market, such as growth stocks, cryptocurrencies or low quality credit securities.

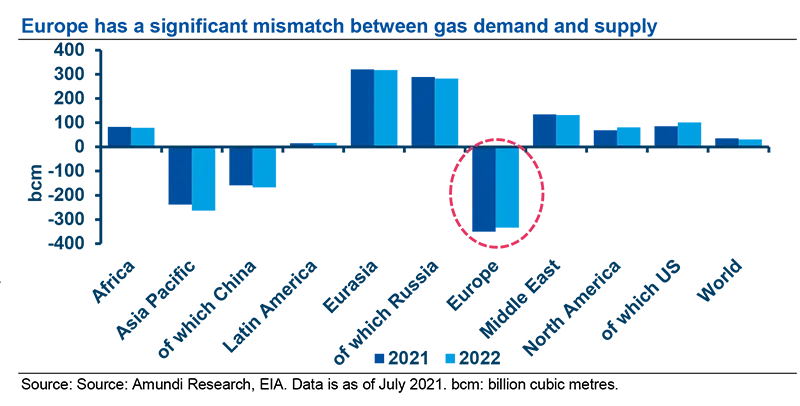

A Russian military intervention in Ukraine would also add uncertainty to the inflation and growth outlook. Inflation, this year, is already expected to remain elevated, and be higher than in 2021, and could be fuelled further by an increase in energy prices in the case of an accident. In Europe, the mismatch between gas demand and supply is already ample and could worsen further should Russia reduce gas supply, affecting energy-heavy industries in particular.

At the global level, tensions between Russia and the US / NATO add uncertainty to the growth and inflation outlook. The latter could be fuelled further by an increase in energy prices in the case of an accident raising the risk of stagflation.

The virus cycle has started to impact on consumption and manufacturing indicators, although – and this is positive news – the economic outlook has remained quite resilient in Europe, the area most exposed to a potential conflict.

Continued rising energy prices in the case of an escalation of tensions, could create concern for a stagflationary scenario, and therefore this is a risk that we will continue to monitor carefully.

In terms of strategies to deal with this more uncertain scenario, in which geopolitical risk is back with a force and markets are re-adjusting to higher real rates, we believe investors should remain neutral in terms of risk allocation considering constructive earnings revisions in many sectors, but be ready to reduce risk should the situation materially deteriorate.

Investors should remain neutral in terms of risk allocation considering the still constructive earnings revision in many sectors, and ready to reduce risk further should the situation materially deteriorate.

We continue to prefer value, cyclical and commodity-related stocks in equity allocation, maintain a short duration stance in fixed income and are particularly watchful of European markets, which have limited discounted actions from the European Central Banks. At a currency level, in light of the uncertainty related to the political situation, we think investors should be cautious on the RUB, despite the country’s strong current account and the currency’s attractive valuation.

Energy prices would go up significantly amid the risk of flow disruption from Russia, and the USD is likely to move higher on risk aversion. This should benefit Middle Eastern markets within CEEMEA, on a relative basis, as their currencies are pegged to the USD, a rise in oil prices would be supportive for them and their markets are dominated by local investors (especially in Saudi Arabia). On the other hand, Eastern European markets would likely suffer. While they are unlikely to be involved in a potential war, they would nevertheless be hit as the war would take place close to their borders, energy prices and inflation would go up, there could be a further potential refugee crisis and overall European weakness is likely. An additional point on East European markets is that some regional companies have business exposure to Ukraine and some Ukrainian stocks, especially in the agricultural sector, which are listed in Warsaw and have seen stock prices decline as a result of the crisis.

In conclusion, we believe investors should remain cautious during this phase, assessing developments on the geopolitical front and the reaction of Central Banks to uncomfortable inflation figures. They should also maintain well diversified portfolios, with hedging strategies in place, particularly for assets that could suffer in the case of a deterioration of the geopolitical situation, such as European equity, liquidity conditions or rising rates, such as the high yield market.

Definitions

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- CEEMEA: Central and Eastern Europe, Middle East and Africa.

- Credit Default Swap (CDS): A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a loan default or other credit event.

- Credit spread: Differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration possible embedded options.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks are less correlated to economic cycles. Cyclicals sectors are consumer discretionary, financial, real estate, industrials, information technology, and materials, while defensive sectors are consumer staples, energy, healthcare, telecommunications services, and utilities.

- Dividend: A sum of money paid regularly (typically annually) by a company to its shareholders out of its profits (or reserves).

- FX: FX markets refer to the foreign exchange markets where participants are able to buy and sell currencies.

- High yield: High yield paying bond with a low credit rating due to the high risk of default of the issuer.

- Growth style: It aims at investing in the growth potential of a company. It is defined by five variables: 1. long-term forward EPS growth rate; 2. short-term forward EPS growth rate; 3. current internal growth rate; 4. long-term historical EPS growth trend; and 5. long-term historical sales per share growth trend. Sectors with a dominance of growth style: consumer staples, healthcare, IT.

- P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its pershare earnings (EPS).

- Value style: It refers to purchasing stocks at relatively low prices, as indicated by low price-to- earnings, price-to-book, and price-to-sales ratios, and high dividend yields. Sectors with dominance of value style: energy, financials, telecom, utilities, real estate.

- SWIFT payment system: The Society for Worldwide Interbank Financial Telecommunication is a cooperative society that serves as an intermediary and executor of financial transactions between banks worldwide.