Summary

- The investment landscape has become riskier. The escalation in geopolitical tensions between Russia and Ukraine, with Russian military forces entering the Donbas region, adds to the uncertainty regarding central bank actions to fight inflationary pressures. Volatility has risen in both bonds and equities which, overall, remain quite resilient amid still-good economic data. Energy prices have jumped amid risks of supply shortages, with oil moving towards $100/bbl.

- At the time of writing, some sanctions against Russia have already been announced by the UK (on five banks and some high-net-worth individuals) and Germany is now withholding the certification on Nord Stream 2. Sanctions could become more harsh in case of further military escalation, and they can be disruptive, notably on banks and settlements. On this front, common ground is still to be found in Europe. The coming hours could be decisive (see also the US position on this front).

- Europe is clearly more vulnerable regarding this geopolitical clash. However, here, we don’t see the risk of recession, but inflationary pressures will mechanically intensify with higher commodity prices, increasing the risk of stagflation and challenging ECB actions. The need to diversify the energy supply and gain autonomy in strategic sectors has become critical and urgent in the European political agenda as well as the need to increase common military spending for defence.

- This backdrop calls for increased caution regarding asset allocation and portfolio construction through a reduction in credit risk across the board, more protection on risk assets, and some tactical readjustment on duration, which can play a hedging role in fixed income portfolios.

- Overall, we reiterate a prudent approach on risk assets, with a preference for equity – in particular, the value segment – vs credit, and an increased focus on liquidity risk, which has become critical at this juncture due to the end of ultra-easy money.

Russia and Ukraine escalation: recognition of the self-proclaimed republics and possible reactions

After weeks of rising tensions at the Russia-Ukraine border, Russia took a step, further recognising the two separatist republics of Luhansk and Donetesk and moving “peacekeeping forces” into the region. While this move was somewhat expected, it certainly adds further uncertainty regarding the economic path ahead and financial market performance.

At this stage, our base scenario is for a limited scale of intervention, not a large-scale invasion, but the probability of the latter has clearly risen.

At the time of writing, some sanctions against Russia have already been announced by the UK (on five banks and some high-net-worth individuals) and Germany is withholding the certification on Nord Stream 2. Sanctions could get more harsh in case of further military escalation, and they could be disruptive, notably regarding banks and settlements. On this front, common ground has still to be found in Europe. The coming hours could be decisive (see also the US position on this front). For further insight regarding our views on sanctions, see our recent Investment Talk “Russia-Ukraine tensions: geopolitical risks add volatility to risk assets”.

Macroeconomic implications and the energy crisis

Europe is naturally more exposed than the US. Rising energy prices, and in particular gas prices, are the main short-term economic threat. But with the end of winter in sight, most countries are less vulnerable than a few months ago.

It is also worth noting that:

- On the financial side, European banks have reduced their exposure to Russia since 2014.

- On the trade front, links are quite limited. Russia does not play an important role in global supply chains (outside the energy sector).

- While an increase in tensions is possible, a military conflict with NATO countries looks very unlikely.

Initial sanctions will probably be moderate to make room for much stronger sanctions in case of an invasion of Ukraine.

In the short term, the crisis is expected to cause a confidence shock in Europe that will weigh on domestic (household/business) demand. However, the economic links with Russia and Ukraine are not strong enough to jeopardise the recovery and cause a recession in the Eurozone. The latest PMI surveys indicate that growth is solidly anchored, especially in services.

On the other hand, inflationary pressures will mechanically intensify as a result of higher oil & gas prices, and further pressure on food prices as well.

Inflation pressures may intensify, in particular on energy and food, increasing the risk of social tensions and adding pressure on wages.

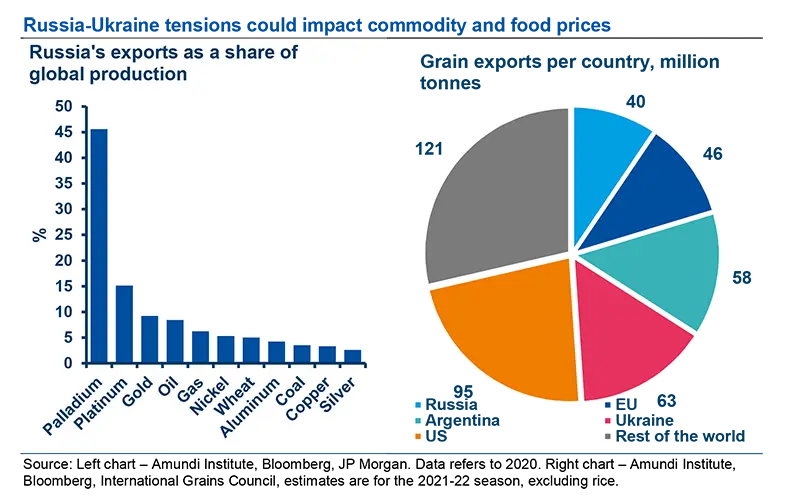

Russia and Ukraine are two of the world’s largest grain exporters. Russia has global leadership in some commodities, such as nickel or coal. It is the third-largest producer of oil globally and one of the world’s top exporters of fertilizers. An escalation of the conflict could disrupt some commodity markets, adding uncertainty to the global inflation outlook.

Given the already high level of headline inflation, social tensions are more likely to materialise and exacerbate wage demands.

The ECB should therefore be very cautious at its next policy meeting, ensuring that all options remain open.

In the longer term, this is a wake-up call that should strengthen the cohesion of European countries and their determination to increase their military spending to ensure their defence. Economically, this new crisis will encourage them to further diversify their energy supplies.

The ECB should be cautious and keep all options open.

Market reaction and implications for investors

Markets are starting to factor in the impact of possible economic sanctions on economic growth in Europe. Energy prices are rising amid risks of supply shortages, with oil moving towards $100/bbl.

Energy prices continue to be under pressure while demand for protection is pushing gold and credit risk insurance costs higher.

Risk-off mood prevailed in the market just after the announcement, with further falls in Russian assets and strong demand for safe-haven assets. Yet, equity markets overall appear more resilient as markets start to digest the recent developments.

- European equity markets are digesting the news with no major disruption, within weak risk sentiment. Equities have been trending lower recently, with the one-month performance of the Eurostoxx 50 at around -5.6% at 22 February while credit risk surged, with European HY CDS jumping to their highest level since November 2020.

- US 2Y breakeven, reflecting inflation risk, rose to 3.7%, a new record high since the inception of the series.

- Russian shares collapsed, with the MOEX index losing over 19% in the past five days and more than 30% from the October peak. The Russian ruble weakened against the dollar to around 80.

- Gold rose above $1,900/ounce for the first time since May 2021. Treasuries also rose amid demand for safe-haven assets, with the US 10Y yield moving to 1.92%.

Geopolitical risks are hard to price. They generally cause a drift higher during periods of volatility, creating an initial overshooting of the market in a search for protection, with possible relief seen once markets digest news flow.

Negative market sentiment affecting Russian and Ukrainian assets could continue and calls for limited exposure to Russian assets. Investors should look at:

- any further escalation on the ground, especially if there is an incursion into the rest of the Donbas region or any other areas that are currently controlled by Ukrainian forces; and

- economic sanctions and their magnitude, especially a sovereign debt trading ban, banking sanctions and possible, but unlikely at this stage, SWIFT usage.

Russian and Ukrainian bonds have been hit hard by this crisis across the board, with hard and local currency bonds under pressure. If there is no further escalation on the ground, we would expect to see prices stabilise at current levels, with no spill-over effects on global risk assets.

More importantly, global risk assets remain exposed to the risk of quantitative tightening. Geopolitical tensions add further uncertainty in an already-fragile environment, increasing the risk of stagflation.

All these factors mean that caution is required, and that’s why we had already recently moved to a more cautious stance, reducing our credit exposure (in particular, Euro IG) and adding hedges.

- At the regional level, we maintain our preference for value markets, such as Europe, while we are more cautious on US growth segments. Overall weakness in EM can offer selective opportunities. We have started re-entering EM with a focus in China equity.

- At the portfolio construction level, we believe investors should continue to play the inflation theme from both top-down and bottom-up perspectives. Bottom up, the focus should be on companies able to pass on prices both in our equity and credit selection.

- On the credit side, we have progressively become more cautious on IG while maintaining in the short term a still-constructive stance on EU HY.

- Top down, we favour exposure to commodities and oil while we also focus on increasing sources of diversification. With this goal, we are also positive on Chinese government bonds owing on their ability to diversify an overall global allocation amid the desynchronisation process between China and the US (targeted easing mode in China vs tightening from the Fed).

- In the FX space, we maintain a positive view on the USD, keeping some hedging on any potential surprise from the ECB, which could reinforce the EUR/USD rate.

- Hedging is increasingly relevant. We recently added protection to European equity markets. Yet, the idea that the local crisis could morph into a global situation suggests that we should add protection regarding US equity markets as well as US credit HY.

At this stage, we are not calling for a risk-off move in our allocation, but we remain ready to review our risk allocation stance based on how the Russia-Ukraine crisis develops (ie, should it last longer than expected) and based on higher inflationary pressure potentially affecting GDP growth more negatively than we note in our current forecasts.

Definitions

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- CEEMEA: Central and Eastern Europe, Middle East and Africa.

- Credit Default Swap (CDS): A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a loan default or other credit event.

- Credit spread: Differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration possible embedded options.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks are less correlated to economic cycles. Cyclicals sectors are consumer discretionary, financial, real estate, industrials, information technology, and materials, while defensive sectors are consumer staples, energy, healthcare, telecommunications services, and utilities.

- Dividend: A sum of money paid regularly (typically annually) by a company to its shareholders out of its profits (or reserves).

- FX: FX markets refer to the foreign exchange markets where participants are able to buy and sell currencies.

- High yield: High yield paying bond with a low credit rating due to the high risk of default of the issuer.

- Growth style: It aims at investing in the growth potential of a company. It is defined by five variables:

- long-term forward EPS growth rate;

- short-term forward EPS growth rate;

- current internal growth rate;

- long-term historical EPS growth trend; and

- long-term historical sales per share growth trend. Sectors with a dominance of growth style: consumer staples, healthcare, IT.

- P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its pershare earnings (EPS).

- Value style: It refers to purchasing stocks at relatively low prices, as indicated by low price-to- earnings, price-to-book, and price-to-sales ratios, and high dividend yields. Sectors with dominance of value style: energy, financials, telecom, utilities, real estate.

- SWIFT payment system: The Society for Worldwide Interbank Financial Telecommunication is a cooperative society that serves as an intermediary and executor of financial transactions between banks worldwide.