Summary

Executive summary

Inflation dynamics drive monetary policy and financial market trends and play a key role in portfolio construction. Therefore, the ex-ante identification of a possible shift in the inflationary regime is needed to fine tune multi-asset portfolios. This is crucial in this post-Covid-19 recovery phase, as inflation is making a great come-back and investors are starting to question the sustainability of current market levels amid more persistent inflation. After decades of disinflationary trends, when interest rates stayed subdued due to central banks’ financial repression, globalisation, stagnant wages and China’s role in exporting deflation, the Covid-19 crisis has brought back inflation risks under the radar as the prevailing inflation regime shifts. A fragmented inflation puzzle is materialising, with differences among areas (inflation numbers are robust in the United States, United Kingdom and most of emerging markets, followed by the Eurozone, but are non-existent in Japan and very contained in China).

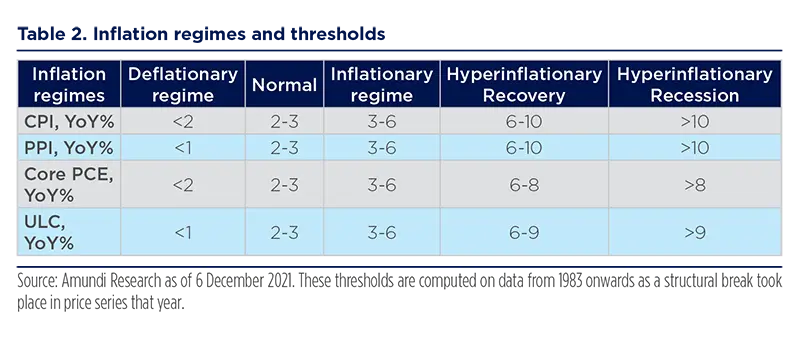

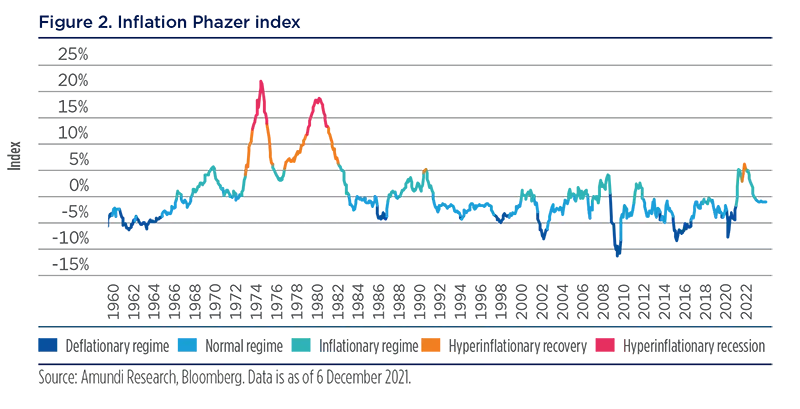

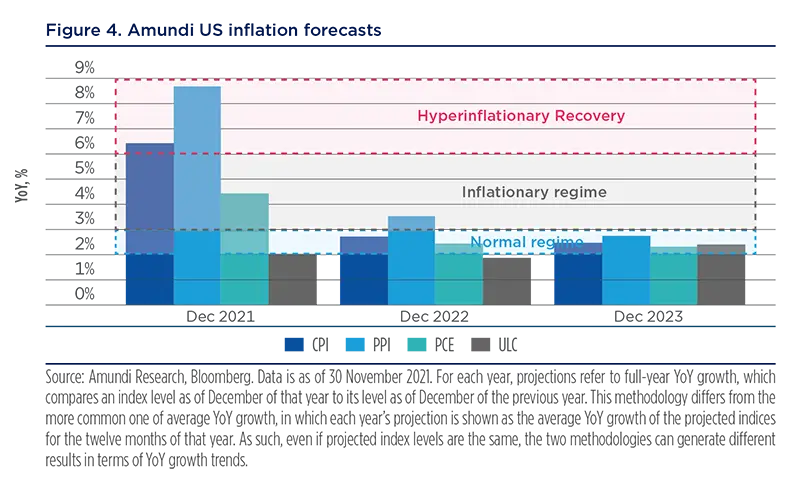

In 2021, we have entered a Hyperinflationary phase, with US CPI and PPI indicators in the 6-10% range on average. US CPI ended last year at 7.0% YoY, its fastest growth pace in almost 40 years. Such a scenario should persist in the first part of 2022, with inflation proving to be structurally higher than its pre-crisis levels. We foresee some normalisation of inflation trends from mid-2022 and, moving into 2023, we should fall back into a Normal inflationary regime (US CPI centred at 2.5%). In this situation, central banks will play a critical role in managing inflation expectations, particularly as we are at an inflection point. Central banks have already acknowledged that inflation is not transitory, but they remain behind the curve. There is a narrow window for action to ensure a smooth return to a normal inflation regime and communication will be key to avoiding major market selloffs. This task comes at a challenging time as markets are also assessing the health and economic impact of the new Omicron virus variant and its implications on inflation (particularly supply bottlenecks).

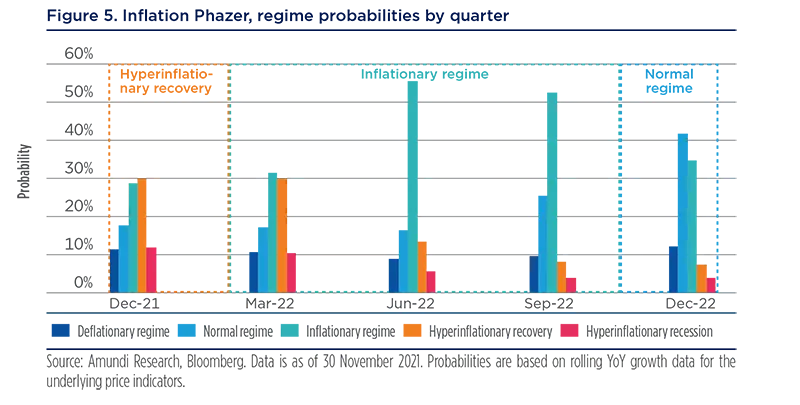

Against this backdrop, multi-asset investors need to act and rethink their portfolios, making them resilient to higher inflation. Targeting real returns becomes critical in a world of lower expected returns and higher inflation, and investors should be aware of the ‘nominal illusion’. To do this, investors should look at a broad set of asset classes that could prove resilient to inflation and help target real returns. Monitoring the evolution of inflation dynamics with sophisticated analytical tools such as the Amundi Inflation Phazer can help navigate a variety of inflation regimes and their investment implications. The different central banks’ reactions to desynchronised inflation is going to be a source of relative performance in an active asset allocation in 2022.

In an inflationary regime – which we foresee for 2022 – equity markets tend to be less supported than in the Normal inflation regime that has prevailed over the past three decades. They are also less supported than in a Hyperinflationary Recovery, as experienced in 2021. In this environment, equity returns should stay positive, but in the low single digits. Any inflationary pressure arising in a strong growth scenario favours cyclical stocks over defensive ones. As such, investors should tilt their portfolios towards value and quality sectors across equity markets. Stock picking is also an important part of the toolkit in order to search for those companies or business models with stronger pricing power within a coherent fundamental valuation framework. Across the fixed income space, inflation-linked bonds tend to outperform corporate bonds in an inflationary regime, as credit spreads usually widen in inflationary times. As monetary accommodation is withdrawn under an inflationary regime, interest rates tend to head higher and a short duration bias should be favoured.

Withstanding our central inflationary scenario, the risk of remaining in a Hyperinflationary scenario for longer than expected is not negligible. Moreover, the energy transition is an additional element to consider. This could increase inflationary pressures in the current decade as new technology is barely available and the demand for energy-transition linked commodities is rising. Therefore, investors may want to hedge against the risk of a Hyperinflationary Recovery continuing beyond Q2-Q3 2022. In this environment, cyclical commodities have proved the best performing asset class. Building some exposure to commodity currencies may also prove to be beneficial under this scenario, while in a Hyperinflationary Recession gold should be efficient for hedging. In summary, we believe that multi-asset investors have a broad set of tools to deal with stronger inflationary pressures. In 2022, they should focus on well-diversified asset allocation and rotate their portfolios towards those asset classes that can benefit from higher inflation.

Unpacking inflation trends

Inflation trends tend to go hand in hand with economic growth. Together, they drive monetary policy and financial markets and define debt sustainability. As such, the ex-ante identification of inflation regimes is needed to fine-tune asset allocation choices, both tactical and strategic, as inflation regimes tend to persist overtime. We have developed a disciplined approach to the taxonomy of inflation regimes in which we cluster price dynamics by building on US data starting from 1960. Then, we use this dataset to screen the overall cross-asset universe. This proprietary framework is called Amundi Inflation Phazer.

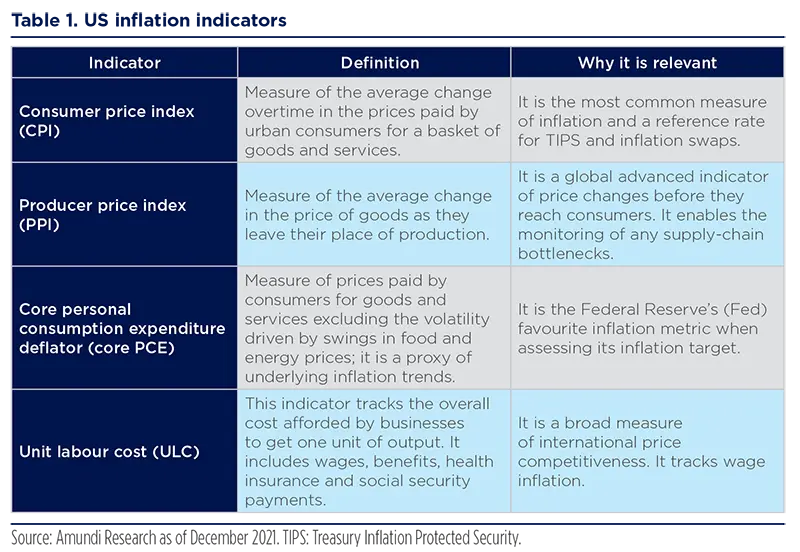

The main goal of our Inflation Phazer is to identify the most relevant recurrent inflation regimes and assess their likelihood over our forecasting horizon. The resulting asset allocation depends on this probability distribution, favouring the combination of assets that is expected to perform best in the inflation scenario deemed most likely to materialise. Within such a framework, we have identified different inflation regimes by using the following variables as discriminating factors:

- Consumer price index (CPI);

- Produce price index (PPI);

- Core PCE (personal consumption expenditure); and

- Unit labour cost (ULC).

Inflation regimes are identified by using a technique similar to the one used for our Advanced Investment Phazer (AIP), that is, a clustering algorithm applied to the above inflation indicators, whereby different periods of these time series are classified into groups. Each group displays similar features to the underlying indicators and represents an ‘inflation regime’. Based on our own macroeconomic forecasts, we assign forward-looking probabilities to each inflation regime and link it with possible investment solutions. We find that asset classes tend to perform in a recurrent and consistent way under each inflation regime, allowing the identification of a favoured asset allocation depending on the prevailing regime.

Asset classes tend to perform in a recurrent and consistent way under each inflation regime, allowing the identification of a favoured asset allocation depending on the prevailing regime.

Amundi’s AIP has indeed been developed with a view that economic cycles condition financial markets, not only in terms of risk and return, but also in terms of cross-asset correlations and exposure to the relevant macro-financial factors. We also believe that inflation regimes are key to fine tuning the risk exposure and rotation within each macro asset class when it comes to portfolio allocation. Indeed, price dynamics condition the main asset classes at different levels. Equity, fixed income, commodities, and FX all show different sensitivity to prices, depending on the level, persistency and causes of such dynamics.

Five inflationary regimes to have in mind

Based on the four variables identified above we have identified five inflation regimes.

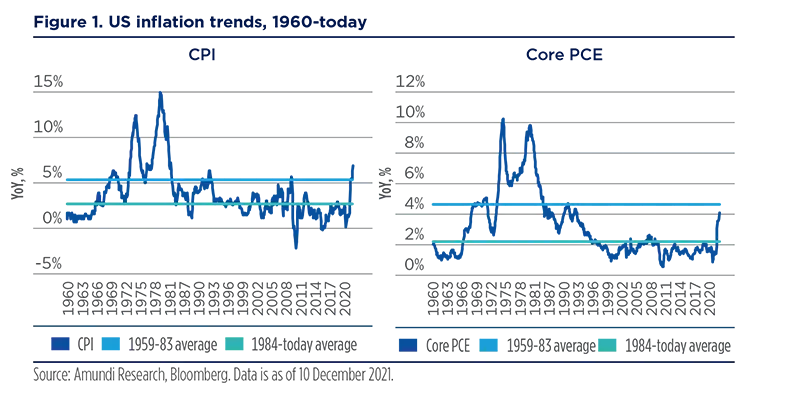

In order to identify historic inflation patterns, we analysed the main US inflation indicators since 1960. Within the entire data sample, we identified two different periods for US inflation trends:

- 1960-83, mostly featured by the 1970s Great Inflation phenomenon, when average G7 inflation was close to 9.0% and significantly higher than 3.5% in the 1960s. In turn, this period can be broken down into two sub-periods: 1960s-early 1970s – before the Great Inflation materialised – and the Great Inflation period itself, from the early 1970s until 1983. The reasons behind this move lay with the oil price shocks and excessively loose policy in the run-up to the Bretton Woods system of fixed exchange rates ending.

- 1984-today, often referred to as the post-Volcker era, as then Fed chairman Paul Volcker took dramatic steps to rein in the runaway inflation that had been sapping the strength from the US economy since the mid-1960s. He did so by switching the Fed’s policy from targeting interest rates to targeting money supply. The days of ‘easy credit’ turned into the days of ‘very expensive credit’. Price stability was reached in 1983 up to current times.

We identified two different periods for US inflation trends: 1960-83, mostly featuring the 1970s’ Great Inflation period, and post-1983, often referred to as the postVolcker era.

According to our analysis, the Great inflation period (1970s) stands out as being mostly Hyperinflationary, either paired with strong growth (Hyperinflation Recovery) or with economic recession (Hyperinflationary Recession). In the post-Volcker era, the US economy experienced a succession of the other three – less extraordinary – inflation regimes, as indicated in the chart below which shows the evolution of the Inflation Phazer Index.

Inflationary and Hyperinflationary Recovery regimes in 2022

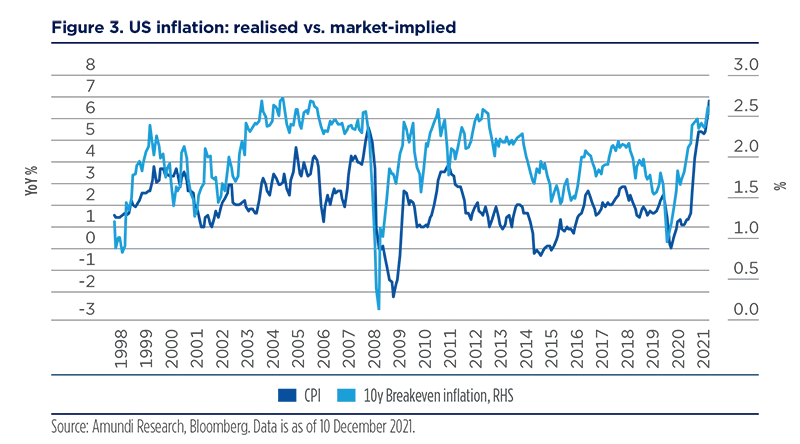

Inflation has been back in focus for investors since the start of the post-Covid-19 recovery. The combination of strong economic growth, aggressive fiscal and monetary stimulus (comparable only to the post-WWII accommodation), pent-up demand and supply-chain bottlenecks have triggered an inflation pick-up to levels not experienced for decades. Realised inflation and inflation expectations have already reached the upper bound of the range in place during the past few decades.

Inflation is back in focus in the post pandemic world, with inflation figures not seen for three decades.

Current US inflation trends have seen strong price rises due to supply-demand imbalances (e.g., supply-chain bottlenecks and disruptions, as well as strong pent-up demand), alongside other re-opening-related base effects. Wage growth has materialised (US average hourly earnings were up 4.8% YoY in November) and may accelerate further in 2022 as the labour market tightens. As shown in figure 4, we expect December 2021 YoY growth for US CPI and PPI in the 6-10% range, hence falling into the Hyperinflationary Recovery regime, while inflationary pressures should recede as we move towards 2023.

In 2022, we expect to see persistent inflationary pressures for the first three quarters of the year – especially in the first quarter – with some normalisation unfolding from Q4. Higher labour costs are expected to keep inflationary pressures supported in 2022, while some pass-through should occur from producers to consumers. As such, most of 2022 should fall under an Inflationary regime.

Most of 2022 should fall under an Inflationary regime.

The consolidated probability of falling into one of the three inflationary regimes in 2022 is 70-85% in the first three quarters of next year. In 2023, we expect inflation to fall back into a Normal regime. However, the likelihood of falling into an Inflationary regime in 2023 is also not negligible. This is something that multi-asset investors should have in mind when building their portfolios.

Asset class performance under different regimes

Once the probabilities of falling into each inflation regime are calculated, we assessed their investment impact, identifying the most favoured asset classes and areas under the most likely regime, as well as possible hedges against alternative scenarios.

A Normal regime is the most favourable for equities, as it usually features healthy economic growth and often occurs in recovery times following an economic contraction.

Equity and commodities under different inflationary regimes

Historically, a Normal regime has proved the most favourable for equities, as it usually features healthy economic growth and often occurs in recovery times following an economic contraction. Accommodative monetary policy can also be supportive for risk appetite. In this regime, gold is the only asset class that provides (slightly) negative returns.

When the regime switches to Inflationary (our expected prevailing regime for 2022), central banks move to a tightening mode as inflation is above-target. This calls for a reduction in portfolio risk allocation and a rotation into inflation-sensitive asset classes. As interest rates rise, equity markets tend to be less supported than during a Normal regime, resulting in positive returns, albeit single digit, as investor risk appetite fades. According to our simulation, China is the best performing equity market in an inflationary regime, being the only one to return a double-digit performance.

For the first quarter of 2022, we foresee a high probability for the current Hyperinflationary Recovery regime persisting and, more generally, as inflation should stay higher than in pre-Covid-19 times, the risk of falling into Hyperinflationary phases is not negligible. Therefore, investors need to consider both hyperinflationary regimes and hedge against them.

A Hyperinflationary recovery features strong economic growth and buoyant performance of equities and cyclical commodities.

Asset class returns differ significantly during a Hyperinflationary Recovery and Hyperinflationary Recession regimes. The former features strong economic growth and the buoyant performance of equities and cyclical commodities. According to our analysis, the latter should also be the best performing asset class during a Hyperinflationary Recovery scenario. On the other hand, gold is the only asset class to provide negative returns under this scenario.

In contrast, a Hyperinflationary Recession features economic contraction alongside strong inflationary pressures, often originating from a supply-side shock. As such, equity markets tend to return deeply negative performances, with defensive investments (e.g., gold and Japanese equity) providing positive returns.

Finally, a Deflationary regime occurs in times of economic recession, when all equities and commodities provide negative returns, except for gold as investors turn to safe heaven assets in search of protection.

Value and cyclicals are favoured in inflationary scenarios

Inflation trends and future developments are also relevant for second-level asset allocation. These phenomena have sound historical evidence within the equity space, where the most cyclical styles (such as value and size) and sectors (cyclicals versus defensives) have historically been correlated with the evolution of market inflation expectations. Any inflationary pressure in a strong growth scenario tends to favour cyclical stocks over defensive ones.

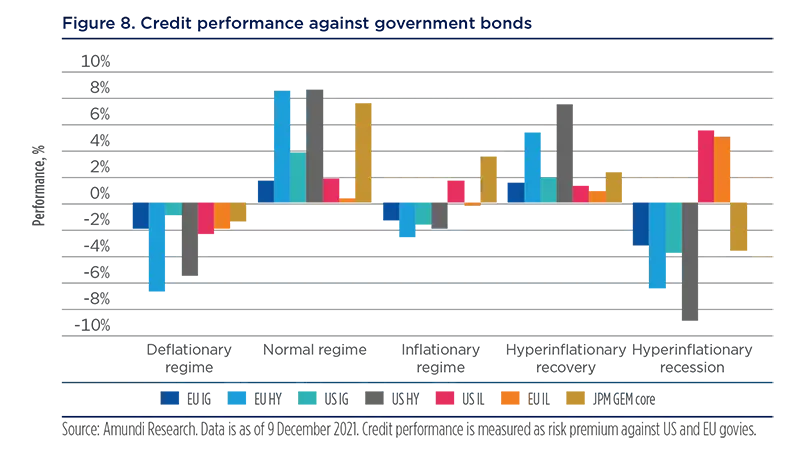

As for equities, the Normal regime tends to favour the most appealing returns which also applies to credit markets.

Credit markets under different inflationary regimes

A Normal regime tends to also provide the most appealing returns for fixed income markets. Under such a regime, the riskiest segments (e.g., EU HY, US HY, and EM bonds) provide the strongest returns.

In an Inflationary regime, performance tends to be weaker and mostly negative. When monetary stimulus is being withdrawn, interest rates tend to rise and credit spreads widen, making inflation-linked bonds an attractive source of income and diversification.

In a Hyperinflationary Recovery, all credit asset classes return positive performances, with the riskiest credit segments still favoured. On the other hand, both Hyperinflationary Recession and Deflationary regimes featured negative performances across the fixed income universe.

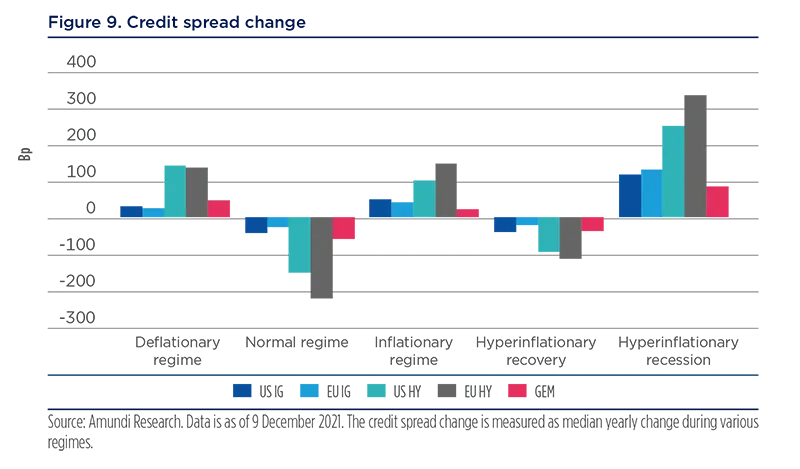

Under Normal and Hyperinflationary Recovery regimes credit spreads tend to narrow, while they widen under the remaining three scenarios. According to our analysis, credit spreads should be widest during a Hyperinflationary Recession.

Credit spreads should be widest during a Hyperinflationary Recession.

Multi-asset ideas for an inflationary regime

In multi-asset, we assess the inflation environment by combining medium-term forecasts – which are more stable – with short-term inflation dynamics, which are often more volatile. The latter are relevant for anticipating changes of inflation regime. Both financial markets and inflation-related instruments encompass highly anticipatory mechanisms. Hence, the evolution of the probability of alternative regimes is often the best indicator for capturing a change in expectations. As such, the majority of the increase in ten-year US breakeven inflation occurred in January-May 2021, even though inflation data continued to rise during the following months. As such, the timing of regime probability changes is key to avoid switching to an instrument too late, when the price movement, that is ultimately key to performance, has largely already happened.

Overall, investors have ample tools to skew the asset allocation of even a conservative solution to suit a regime of higher expected inflation. First of all, inflation-linked bonds may be the weapon of choice to protect portfolios against higher inflation. In the interest rates space, short-duration strategies are normally paired with ‘curve-shape’ strategies to capture changes in rate expectations, which tend to follow inflation pressures. Often investors refer to those strategies as ‘steepeners’.

Commodities are an important tool as well. In the FX space, commodity currencies are favoured if higher inflation originates from the commodity space. The Canadian dollar, Norwegian krone and Australian dollar may play a key role, as well as some emerging currencies such as the Colombian peso and Russian rouble. Relative-value forex can prove useful when inflation pressures affect only some regions, as might be the case nowadays with different price dynamics between the United States and Japan (long USDJPY) for instance. Among equities, investors may consider increasing exposure to cyclical or value sectors, such as energy, materials and financials, and playing their relative value against those sectors which are more vulnerable to interest rate increases (e.g., technology and ‘growth’ sectors in general). Finally, stock picking is an important part of the toolkit in order to search for those companies or business models with stronger pricing power within a coherent fundamental valuation framework.

Our convictions for 2022

We are in a period of high realised inflation readings, with some of the key inflation drivers expected to be persistent, such as supply bottlenecks. Our medium-term assessment points to a structural moderation of inflation levels, with a higher equilibrium level than was the case over the past few years. Countries such as the United Kingdom and the United States are places where inflation numbers look to be the most persistent. As such, investors should maintain exposure to inflation-linked bonds in these two countries. In this environment, we expect interest rates to climb further. Hence, investors should maintain modest exposure to US duration.

We favour the US dollar over the euro based on the different levels of monetary tightening expected across the pond, while investors may consider curbing exposure to inflation-sensitive currencies (e.g., the Norwegian krone) due to the oil price correction. The sectorial bias in favour of cyclical and value themes has been reduced from the early-2021 levels, but it remains. In the current environment – and unless any stagflation fears emerge – exposure to financials could be a supportive hedge against rising rates. Regarding hedges, gold will not be supportive in any circumstance. Its performance will depend on central bank policy expectations and tolerance for higher structural inflation. Gold may work well in the current period of inflation surprises and while money supply remains abundant.

Conclusions

A sustained surge in inflation has not been experienced across advanced economies during the past three decades. As the inflation risk increases in the post-pandemic world, investors have little practical evidence and experience of how to position their portfolios during such times. The Amundi Inflation Phazer aims to provide a compass for identifying the inflation regime most likely to materialise over both the short and the medium term, as well as the impact that can be expected on major asset classes.

Multi-asset investors have ample tools to invest during times of rising inflation and to target real returns.

Our analysis indicates that a Normal inflation regime is the most favourable for risky assets. When transitioning from a Normal to an Inflationary regime, the portfolio stance should become more defensive. Although equities can provide positive returns under the latter scenario as well – albeit single-digit – credit spreads could widen under such circumstances, making inflation-linked bonds an attractive source of income and diversification.

Importantly, investors should also take into account two Hyperinflationary scenarios (Recovery and Recession), as the former has been observed throughout 2021 and is likely to persist in early 2022. According to our analysis, cyclical commodities should be the best performing asset class under a Hyperinflationary Recovery scenario, while gold is the only asset class to provide negative returns at such times.

Our analysis also has key implications on second-level asset allocation choices, especially within the equity space, as value and cyclical stocks tend to outperform when inflation expectations are rising.

Multi-asset investors have ample tools to invest during times of rising inflation. First of all, inflation-linked bonds may be a weapon of choice for protecting portfolios against higher inflation. In the interest rates space, short-duration strategies are normally paired with ‘curve-shape’ strategies to capture changes in rate expectations, which tend to follow inflation pressures. Commodities are an important tool as well. In the currency space, commodity currencies are favoured if higher inflation originates from the commodity space. Among equities, investors may consider exposure to cyclical or value sectors, playing their relative value against those sectors which are more vulnerable to interest rate raises (e.g., utilities and ‘growth’ sectors in general). Finally, stock picking is an important part of the toolkit in order to search for those companies or business models with stronger pricing power within a coherent fundamental valuation framework.

Definitions

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- Breakeven inflation: Breakeven inflation is the difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

- Credit spread: Differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration possible embedded options.

- FX: FX markets refer to the foreign exchange markets where participants are able to buy and sell currencies.

- Growth style: It aims at investing in the growth potential of a company. It is defined by five variables: 1. long-term forward EPS growth rate; 2. short-term forward EPS growth rate; 3. current internal growth rate; 4. long-term historical EPS growth trend; and 5. long-term historical sales per share growth trend. Sectors with a dominance of growth style: consumer staples, healthcare, IT.

- Quality investing: It aims at capturing the performance of quality growth stocks by identifying stocks with high return on equity (ROE), stable year-over- year earnings growth, and low financial leverage.

- S&P 500 index: It is a commonly used measure of the broad US stock market.

- Spread: The difference between two prices or interest rates.

- TIPS: Treasury Inflation-Protected Security (TIPS) is a Treasury bond that is indexed to an inflationary gauge to protect investors from the decline in the purchasing power of their money.

- Value style: It refers to purchasing stocks at relatively low prices, as indicated by low price-to- earnings, price-to-book, and price-to-sales ratios, and high dividend yields. Sectors with dominance of value style: energy, financials, telecom, utilities, real estate.