Summary

Something has to give in a regime shift. Be prepared, there will be opportunities for value investors.

The great divergence

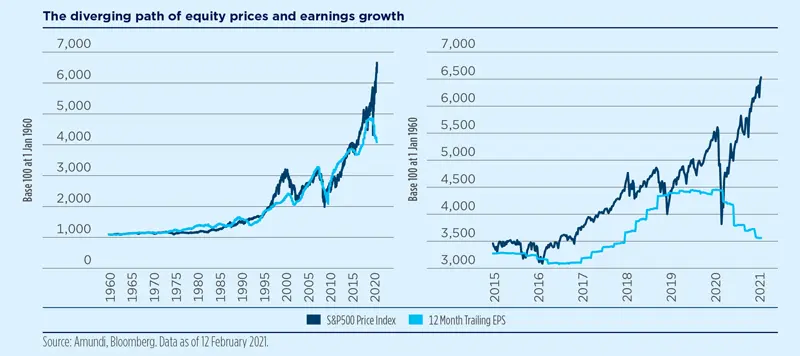

It’s been one year now since the Covid-19 pandemic disrupted the world. It changed our lives, but financial markets seem to have side-lined this dramatic event as a temporary pullback, which was quickly recovered and forgotten as most risk assets achieved new highs. Hopes persist that a “here and now” vaccine will rescue the global economy and overshadow unexciting recent economic data and the uncertainties of the virus cycle. This translates into an unprecedented divergence between markets and the real economy, raising questions about the sustainability of current valuations.

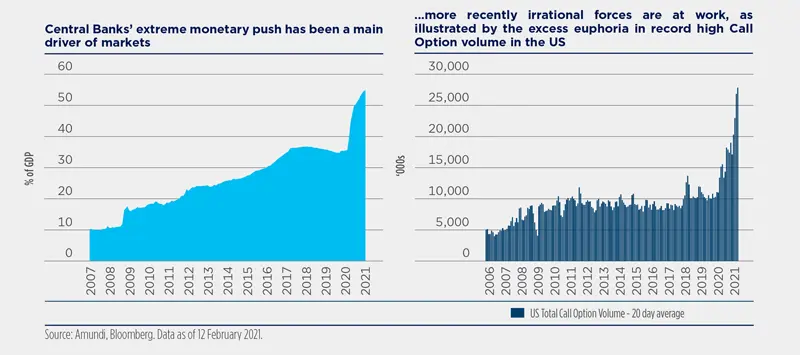

Central banks’ extraordinary monetary reaction to disinflation, and then deflationary tensions, has been the key market driver of the regime that followed the Great Financial Crisis. This has sanctioned the victory of monetary/liquidity factors over real factors. The dominance of the monetary factor and, most recently, the rise of irrational forces in the market, psychological drivers leading to further market exuberance, is resulting in the temptation to give up on traditional valuation metrics or to “adjust” absolute valuation indicators in order to justify the current extremes in the market.

Don’t give up on valuations and fundamentals

A sign of the times is the fact that even Nobel prize-winning economist Robert Shiller has recently worked on revising his own CAPE indicator to try to make it more accurate and consider interest rates when valuing equities. The new indicator, the Excess CAPE Yield, gives some comfort in the current valuations for equities: no major markets are flashing red in terms of valuations versus bonds. This, however, does not answer the question of whether there is still absolute value in equities, puzzling the most the reading of where markets are today.

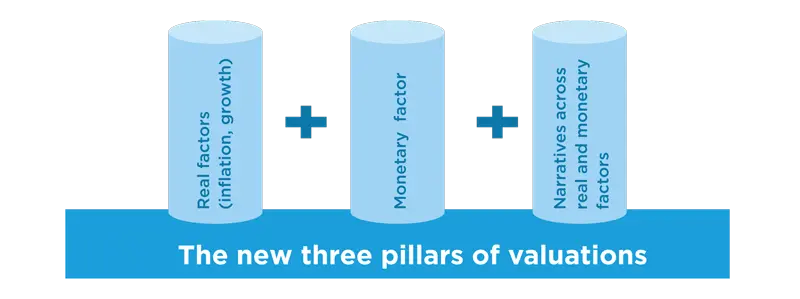

Despite this rising scepticism regarding the traditional investment approach based on long-term horizons and valuations, we believe that a long-term perspective is key for investors, and this is even more relevant when we live in a period of transition towards a possible new regime, such as the one we are facing today. What investors need is to enhance their investment approach to include other elements that go beyond traditional economic variables (such as inflation, growth and earnings). In this respect, they also need to consider the monetary factor (policies at work that can distort market behaviour) which remains highly relevant in the current environment and, in addition, a third element: market narratives that can affect either economic variables or monetary policy. In fact, narratives can confirm the direction of the market, but can also push it in a different one.

What the narratives are telling us

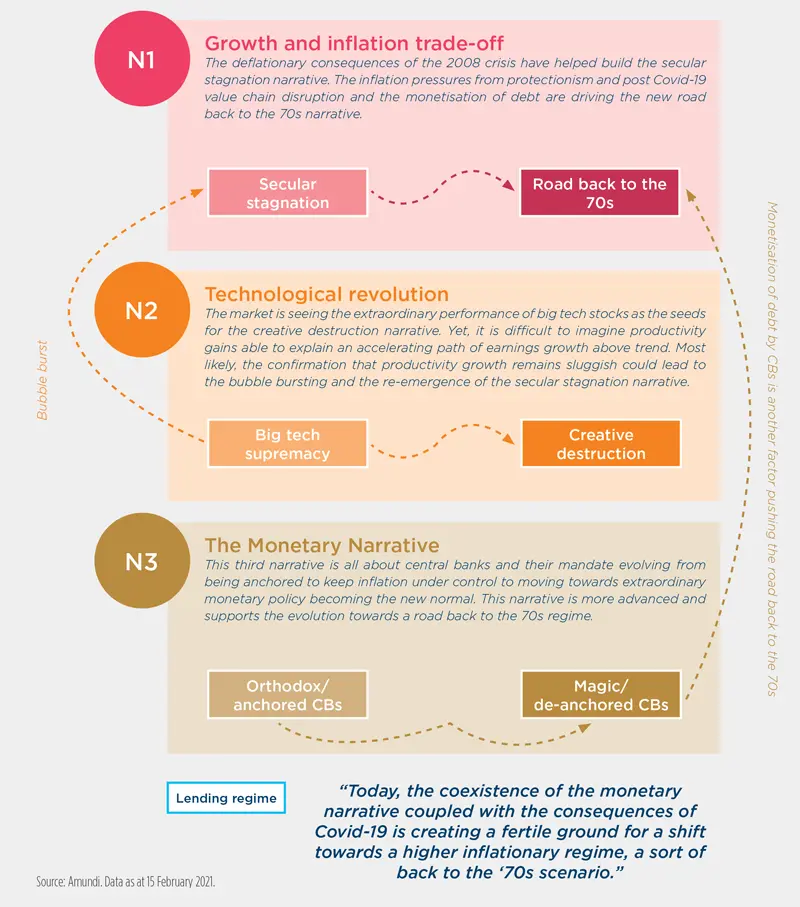

When there is a strong market detachment from the economic reality, as it is the case today, a prevailing narrative can signal a change in regime. This leads to an important turning point for investors.

Currently, there are three narratives driving markets. They are interconnected and dynamic as they evolves over time. The one that prevails will characterise the new financial regime.

The deflationary consequences of the 2008 crisis have strengthened the first narrative, the secular stagnation of foreverlow growth and low inflation. The foundations of this narrative rely on the long-term memory of what has been the effective story for developed economies throughout centuries into modern times, if we exclude the inflationary episode of the 70s (and to some extent the two world wars). The inflation pressures from protectionism and post Covid-19 value chain disruption, rising demand for a minimum living wage and the monetisation of debt are the seeds of the shift towards a higher inflationary regime, bringing us back to the 70s.

The second market narrative, that is currently sustaining the high valuations in equity markets, relates to earnings growth being pushed by technological disruption (the creative destruction narrative). However, the assumption that earnings growth will deviate upward from its historical trend, thanks to technological revolution, seems unlikely assuming the current trend in labour force growth, stock of capital and productivity and the high share of profits on value added. If this is the case, as we believe, growth will remain sluggish following the first post-Covid-19 bounce and may end up moving back to the “secular stagnation” environment, in which equity markets should readjust to the downside to absorb the current excess of optimism.

However, we believe that the prevailing narrative will be the third option, the monetary one, from orthodox/anchored to magic/de-anchored central banks. Today, for the first time in more than three decades narratives are explicitly expressing a preference for inflation as a way out from the current pandemic. Inflation has ceased to be a negative; it is a desire, as it can help make the debt burden originated by the crisis sustainable. In 2020, global debt has grown to USD24tn and now stands at 355% of world GDP. New priorities for populations and institutions are emerging. The huge debt pile that will weigh on future generations has to serve to help to fight climate change and make the overall economic model more inclusive, reducing inequalities. This mantra is vocal among politicians and central bankers globally and shared by the wider society. This leads to the dominance of the market narrative that pushes for a continuation of extraordinary monetary policy, with central banks further evolving their roles into new territories including green topics (see recent ECB members talking about decarbonising the ECB balance sheet) or targeting inequality (ie the Fed moving into the full jobs market target).

A change of regime often occurs with a change in the mandate of central banks, as it happened in the late 70s, with the arrival of Mr Volker at the helm of the Fed. The transition phase unsurprisingly sees the coexistence of previous and new mandates. This is exactly what we are starting to see today.

Narratives signal a possible turning point. Investors should make themselves ready for a process of rebalancing risk premia and portfolio construction re-design.

The interconnection of narratives…

…and their potential outcomes

Key take-aways for investors