Summary

- Stagflationary environment in Europe and the energy crisis – We expect a winter recession in the Eurozone due to the higher cost of living, particularly higher energy and food prices, which will affect consumer demand. Geopolitical tensions with Russia are exacerbating this inflation given Europe’s reliance on Russia for its energy needs.

- European response – Although we have seen some country-specific fiscal support measures lately, the EU is now mobilising its institutional powers to frame a collective response (discussions on price caps, taxing some energy sectors, etc.). While these measures may help shield consumers from the effects of higher energy prices in the near term, they may be inflationary in the medium term.

- ECB policy – The bank’s priority in the near term will be to control inflation, which is affecting the cost of living, especially for the most vulnerable sectors of society. It is also concerned about inflation expectations becoming unanchored. As a result, we may see aggressive rate hikes at the ECB’s upcoming policy meetings, along with a continued commitment to prevent fragmentation in the Eurozone and avoid spreads from rising above its comfort level.

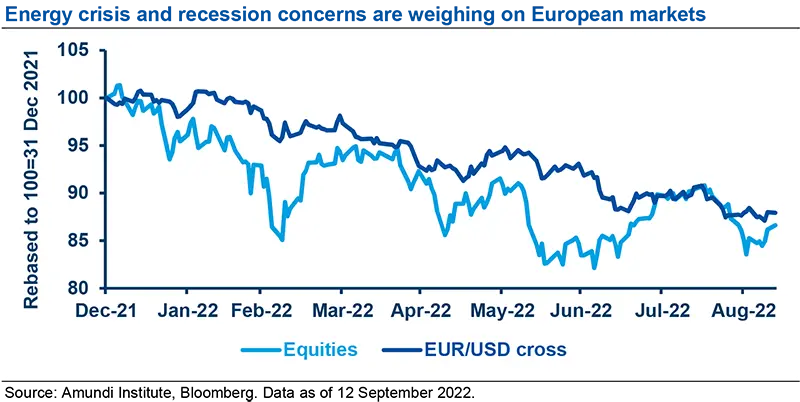

- Market impact – A recession would obviously affect European equities as falling consumption impacts corporate earnings and rising rates affect valuations. Furthermore, a weak global economy would be negative for European companies because of their large international operations. In particular, we think investors should look for quality characteristics in companies that are able to withstand the current environment. On the other hand, we are slightly positive on US duration amid the economic slowdown, with an overall neutral stance.

Is stagflation a highly likely scenario, or will the European economy enter a recession this year? How will governments respond?

Our central scenario is of a winter recession with high inflation, following a stagflationary shock via a significant deterioration in terms of trade and high imported inflation. So far, the stagflationary environment is confirmed as we have been revising up inflation and downgrading economic growth. The future direction is also stagflationary as inflation is expected to move higher, whereas growth is expected to decelerate and even contract. In our central scenario (no severe gas rationing, reduced energy demand due to price determined demand destruction), the Eurozone would face a tough winter, as consumers scale down consumption (cost of living crisis) due to budget constraints and companies face a margin squeeze, which leads them to suspend major non-essential investment plans. In addition, domestic demand contracts, leading to GDP contraction for two or three quarters, and then a gradual and shallow recovery, with the energy issue remaining unresolved at the end of winter. Under this scenario, governments may extend fiscal policies to protect the most vulnerable parts of the economy (vulnerable households and companies) in a targeted way (i.e., only part of the energy increase is passed on to consumers) and enforce some energy consumption reducing measures. They may also consider light rationing of energy on services, households and industry, but without major shutdowns implications.

Europe is facing a stagflationary environment under which we expect a recession, led by contracting demand owing to the higher cost of living.

What would the stance of the ECB be in such an environment? Would it hike policy rates aggressively even if stagflation or a recession scenario materialises?

In light of the very high level of inflation, we expect the ECB to maintain a hawkish stance and keep hiking rates in the coming months to avoid an unanchoring of inflation expectations and to support the euro, especially in the context of a resilient US economy despite the recent rate hikes. While the ECB has downgraded its growth projections for this year and next, it has raised its inflation forecasts for 2024 amid soaring energy and food prices, strong demand in the services sector after the reopening and continuing supply bottlenecks. In addition, inflation may rise further in the near term as price pressures have continued to strengthen and broaden across the economy. As a result, the ECB is much more concerned about the risk of inflation expectations becoming unanchored than about downside risks on economic growth. We also believe that the bank is determined to “frontload” rate hikes and to “normalise” policy rates rapidly. The recent decision to hike rates by an unprecedented 75bp was a step in that direction. However, the bank was careful to clarify it will maintain a meeting-by-meeting approach and remain data dependent. Quantitative tightening is also not on the cards in the short term.

The ECB seems more concerned about high inflation than about the impact of its aggressive tightening on economic growth.

How likely is it that the EU will survive the energy crisis during the coming winter? What should governments and the EU do to ensure the region survives this crisis?

The EU is facing a severe challenge from the energy crisis and needs to tackle this issue in a collective manner. As was the case during the Covid pandemic, it is generally in the moment of a crisis that major policy steps are implemented at the EU level under an integrated and coordinated approach. So far, the energy crisis stemming from the war in Ukraine has been tackled in a more fragmented manner by individual countries, with limited coordination at the European level. However, it is now becoming evident that the EU will tackle the problem at an institutional level, as is reflected in the ongoing discussions on price caps and on defining a common approach, etc. The EU will likely have to coordinate at supranational level along a few main channels: energy prices (reform of the energy market) and energy price caps; eventual coordinated fiscal measures to finance price caps; and energy transition plans for energy independence.

Historically speaking, difficult decisions at the EU level have generally been taken in times of crisis, such as the NGEU during the Covid crisis.

If the EU enters a recession, will it trigger more political turmoil?

We could draw a parallel with the Covid crisis. While many feared that European countries would compete for vaccine supplies, the common interest prevailed at the end of the day. Moreover, all countries saw the effectiveness of a coordinated response. We agree that the nature of the energy crisis is not the same, but it is increasingly clear that Europeans want to act together to contain this energy crisis – the EU always makes progress in crises. For instance, the Next Generation EU (NGEU) plan would never have been agreed upon in the absence of the Covid crisis. Such a plan was considered highly unlikely only two to three months before its adoption.

In addition, if a coordinated approach prevails, and we believe it should, the ECB’s anti fragmentation tool — the transmission protection instrument — could be easily activated to contain financial fragmentation. Even in our worst-case scenario, if a severe recession is not avoided, the end of the EU is not on the radar.

While fiscal support for safeguarding citizens from rising energy costs would lower the inflation peak in the near term, financing these measures is difficult.

To what extent are the proposed energy supporting measure inflationary? (G7 price cap on Russian oil, bailout packages for utility companies and proposed stimulus packages to protect the general population from energy price hikes)

The introduction of price caps and limits to the pass-through of higher energy prices should have the effect of lowering the inflation peak and probably anticipating it. The overall result will be a lowering of the average inflation rate until the price caps are implemented. However, these measures are costly (depending on the difference between the capped price and the wholesale gas price) and need to be financed either by redistribution (e.g., a windfall tax on energy companies financing subsidies to the most vulnerable economic agents) or by government debt (deficit spending). While these measures would preserve growth by limiting the inflation surge, they may end up being inflationary in the medium term (demand remaining stronger).

Although country-specific support measures have been implemented, we are now seeing signs that EU will tackle the energy crisis at an institutional level.

Markets and investment implications

The market’s earnings expectations are too optimistic at the moment and do not fully discount a full recession in the Eurozone.

How bad would a Eurozone recession be and what would its impact on the stock markets and FX be?

The recession we expect for the EZ will be a real one, with a decline in domestic demand and possibly some increase in unemployment rates. However, a mild recession and the use of furlough schemes such as those implemented during the Covid-19 crisis could mean the area avoids a significant increase in the unemployment rate.

- Equities – Accordingly, this is definitively not good news for the region’s equities. Having said that, one should take into account the fact that European companies are very international. About 70% of sales are foreign sales and as a result global growth is key for European earnings, even more so than European GDP growth. When the global economy grows by more than 3%, the EPS growth of the MSCI Europe tends to be positive and vice versa. We have recently downgraded our forecasts for 2023 global GDP expansion to 2.7% (from 3.1%). This implies that EPS growth will most likely be negative next year, everything else being equal. However, market consensus expectations for EPS are about 2.2%. We think these need to be revised down. Interestingly, in a high inflation environment, earnings falls tend to be more muted than when inflation is very low. Thus, we do not expect a repeat of the -45% in EPS (for Europe) seen during the Great Financial Crisis. In the 1970s, a high-inflation period, the US EPS drawdown was about -10%. This is a first reference for the US. European earnings always fall more than US ones, because of the stronger cyclicality of the region’s indices. As a result, we think earnings in Europe will be revised down. This phase usually leads to higher volatility. Even if the market is cheap, this recession phase is not a good omen for European stocks, especially those in the Eurozone.

- The call for value and quality – We think the shift to value and quality still has more room to grow but this move will not be linear and should increasingly be driven by bottom-up selection. For instance, when analysed with MSCI indices, quality and value are quite complementary: value is cheap but is not immune in terms of earnings downgrades in a slowdown phase; quality is usually longer duration and benefits in a slowdown (or even in a recession), when low leverage and resilient margins become an advantage.

- FX – The structural shocks the Eurozone economy is facing today are unprecedented. Taking into account the fall in productivity, we are registering a sharp deterioration in the EURUSD fair valuation. In the case of a total shutdown of Russian gas supply and further rationing, the negative impact on fundamentals would extend further, leading the EURUSD to move below our short-term target of 0.94 and even get closer to the levels seen in the early 2000s. However, the Fed’s stance must be closely monitored because a policy U-turn (towards dovish) would likely bring an end to the USD bull run. The JPY, on the other hand, is the clear-cut loser in 2022, with the currency falling more than 20% versus the USD year-to-date. In addition, so far the negative effects of terms of trades (import prices staying strongly above the prices of Japanese exports) and the USDJPY short-term rates differential have been the dominant factors weighing on the yen. Going forward, we see global growth and US long-end rates as the key variables that could tip the balance in favour of the yen. When growth worries manifest even more, the US Treasury curve will likely invert further (with long-term rates likely diverging from monetary policy decisions) and the JPY will turn attractive relative to most peers. Thus, the fall in US long-end yields would be the main factor triggering a potential upside in JPY. There are some additional catalysts for yen strength in the form of a change in the Bank of Japan’s stance or any direct FX intervention.

If we see extreme gas rationing in Europe, economic activity will be affected and that could further weigh on the EUR.