Summary

A mild US economic deceleration, interest rate cuts by the Fed and an improving earnings profile could further support the broadening of the rally outside the expensive US technology names.

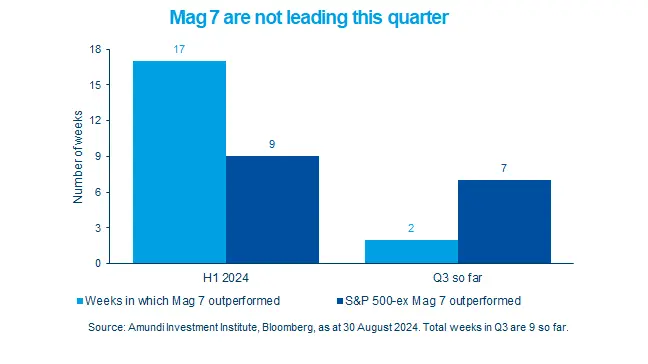

- The S&P 500 (excluding mag 7) has delivered strong gains this quarter, outperforming the large tech stocks.

- This is an indication of a rotation out of expensive names towards the rest of the market and small caps.

- Earnings strength, economic growth and Fed actions are important for this broadening of the rally to continue.

US equities are experiencing a broadening of the rally seen in the first half (H1) of the year. The performance of the seven largest US mega-cap tech-focused stocks (Mag 7) in H1 was strong, but these gains are now becoming more broad-based. In the quarter so far, the S&P 500 (excluding Mag 7) has outperformed the Mag 7 in the seven out of nine weeks. This is a result of multiple factors such as markets questioning the exuberance around artificial intelligence, corporate earnings and concerns over US growth. Increasing expectation of rate cuts by the Fed was also an important driver. This rotation out of the expensive sectors is likely to continue, but it may not be uni-directional and could be affected by volatility around US elections. Hence, it is important for investors to consider company fundamentals to generate potential sustainable returns.

Actionable ideas

- Equal weighted approach

When some segments of the markets are highly priced, a fundamentals-based approach or an equal weight approach may allow investors to benefit from market rotations. - Global equities

A multi-speed economic growth outlook calls for a global approach to equities in regions such as Europe, the UK and emerging markets.

This week at a glance

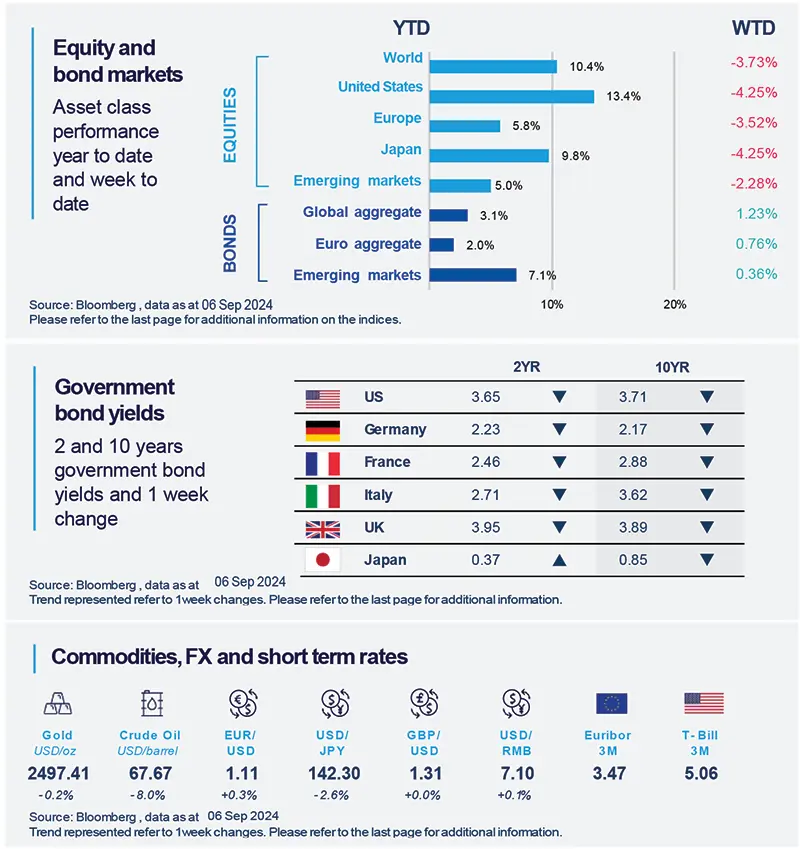

Equities declined, and bond yields were lower due to concerns over economic growth in the US and China. Expectations of rate cuts by the Fed also pulled yields down. Oil prices maintained their downward trajectory on concerns over excess supply and weak demand.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 06 september 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

Fed’s Beige Book signals easing labour markets

The latest Beige Book, a publication and survey of businesses and economic conditions in twelve districts, highlighted flat or declining economic activity in nine districts. Only three districts reported improving activity and that too marginally. Overall, employment indicators were subdued and a trend towards slower wage growth was also reported. In conclusion, this aligns with our view of a progressively moderating economy.

Europe

Eurozone (EZ) PMIs indicate soft activity ahead

Recent EZ PMIs (purchasing managers’ indices) confirmed that economic growth remains uneven and weak across countries and sectors. The final reading for August shows that the manufacturing sector is weak, and activity in the service sector is also giving signs of moderation. In addition, input costs inflation continued to ease, suggesting that the disinflationary process is well in place.

Asia

Indian growth moderated a bit but is well on track

Indian GDP grew 6.8% (year-on-year) in the quarter ended June, moderating in comparison with the previous four quarters. Household consumption was a strong contributor, indicating more inclusive growth than the last few quarters. Fixed investment was another key driver. This data doesn’t change our overall assessment, and we believe the country could continue to deliver robust economic growth this year.

Key Dates

|

9 Sep Japan GDP, China CPI |

11 Sep US CPI, UK GDP |

12 Sep ECB policy rate, India CPI |