Summary

Developed countries

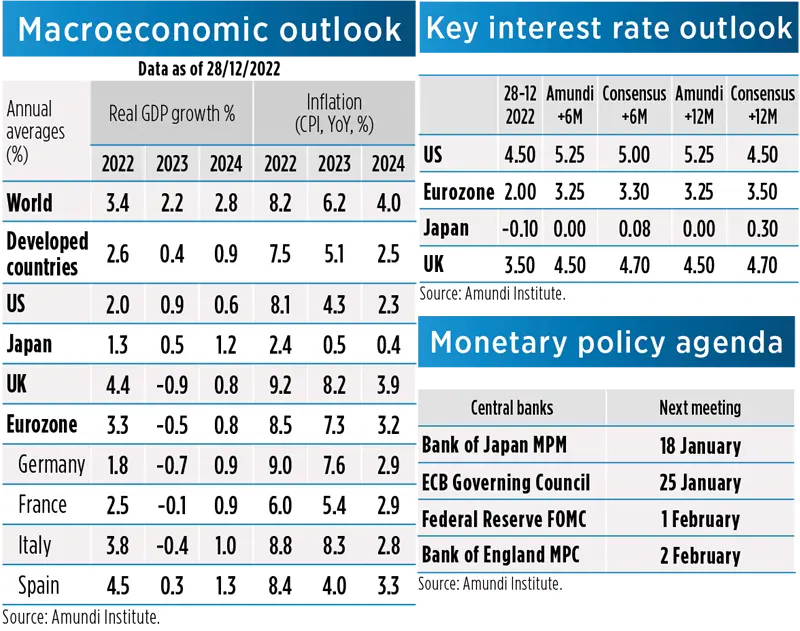

- United States: the US economy is showing signs of deceleration, with restrictive monetary policy starting to weigh on activity and progressively dragging growth below potential. We foresee increased recession risks in H2 2023, when we project stagnant growth and very weak composition of domestic demand, implying heightened recession risks. While inflation seems to have peaked, stickiness in underlying inflation may remain a key feature in the months to come, with core inflation declining slowly and remaining above target.

- Eurozone: we expect Eurozone GDP to contract in Q4 2022-Q1 2023 under the drag of the cost-of-living crisis, followed by a modest recovery over the spring-summer period, as decelerating inflation should start providing some relief to consumers, although still significantly above the ECB target. Tighter monetary policy will represent an headwind too. 2023 average dynamics will be weaker than previously expected, feeding into below potential growth in 2023-24. Risks related to the energy component remain prominent for both the inflation and growth outlook.

- United Kingdom: with upwardly revised inflation projections, in double-digit territory for a few months and above target for several quarters, we foresee a cost-of-living-induced recession playing out in the United Kingdom this winter, extending for a few quarters and further exacerbated by tight financial conditions. Also the recovery projected for 2024 will see the economy performing below potential. Risks are tilted to the downside, as the energy component remain a prominent downside risk for both the inflation and growth outlook.

- Japan: we maintain our below-consensus growth forecast of 0.5% for 2023, believing the uneven recovery should continue. Services sector led the improvement of December PMI, thanks to reopening. However, the manufacturing index stayed below 50 and is likely to resume its downtrend on weaker DM demand in early 2023. The catch-up effect from reopening can off-set only partially the slowdown of global demand. GDP is likely to contract in H1 2023 on softer exports. Meanwhile, we expect national core core inflation to climb further over the coming months and stay above the BoJ’s 2% target until mid-2023.

- Fed: the latest FOMC meeting slowed the pace of rate hikes from 75bp to 50bp, taking the Fed Funds target to 4.25-4.50%, while the projected Federal Funds rate was revised higher, to a median of 5.125% from 4.625% in September for end-2023. New economic projections saw a deteriorating outlook, with sharply lower GDP forecasts and higher unemployment rate and core PCE projections. Overall, the dots plot and Chair Jerome Powell’s press conference were hawkish, with Powell maintaining full commitment to fight inflation. This supports our expectations of 5.25% expected terminal rate.

- ECB: at its December meeting, the ECB hiked rates by 50bp to 2.0% (deposit rate). The Bank delivered a very hawkish statement. Inflation remains the main concern and top priority. The ECB foresees sticky inflation, with Eurozone inflation driven mostly by energy prices. Fiscal policy also plays a key role, while supporting demand. In the short term, we see pressure on core sovereign bond rates and on peripheral spreads. We revised our terminal deposit rate in the current hiking cycle to 3.0% from 2.5%, with risks tilted to a possible further upgrade.

- BoJ: at its December meeting, the BoJ surprisingly widened its YCC target band from +/-0.25% to +/-0.5% for ten-year JGBs, earlier than expected. This is de facto tightening, when yields tend to move upward. Political willingness to normalise monetary policy has increased. It is reported that the 2013 Joint Statement – by the government and the BOJ -- will be revised The final goal is unclear at the moment, but exiting from Negative Interest Rate Policy (NIRP) is likely. Before that, the BoJ has to abolish its YCC yield-target completely, or in a quicker move, scrap NIRP and YCC together in one go.

- BoE: at its latest meeting, the BoE hiked rates by 50bp. As in previous meetings, the vote was split, but this time with a higher gap between the dissenting opinions, as two members opted for no rate hike, while one opted for a 75bp move. The meeting failed to produce any meaningful surprise on rates guidance, essentially unchanged, on the expected economic outlook in light of latest fiscal announcements, and on QT. Following the latest rate hike, we confirmed our expected rate path and the expected terminal rate, which is likely to peak at 4.5% in our baseline scenario.

Emerging countries

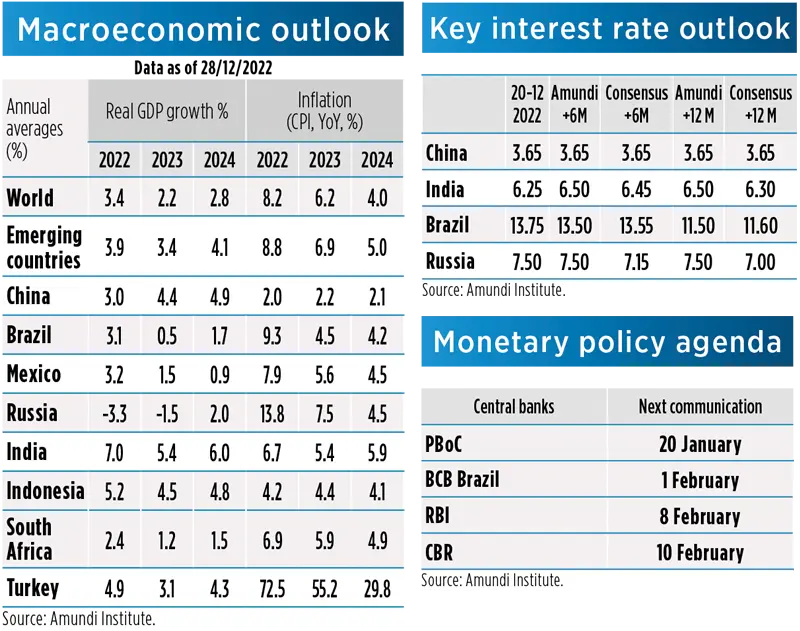

- China: officials announced to drop quarantine rules for overseas visitors on 8 January, right before the Chinese New Year holidays (22 January), much earlier than we expected month ago. A full reopening now looks likely by end-Q1. The reality is bleak at the moment. Economic growth plunged again in November. Bearing in mind the faster reopening, we expect production to resume in February and a meaningful recovery to follow in March and Q2. The rebound of consumer demand will drive up core inflation, but PPI and energy disinflation will contain overall inflation at around 2%.

- Asia: central banks in South Asia continued their monetary policy tightening, although in some cases at a slower pace compared to their most recent decisions (e.g., Philippines and Indonesia). Asia is lagging behind in terms of monetary policy normalisation because inflation picked up later and less sharply than in other EM regions, such as Latam or Eastern Europe. Although none of these central banks has announced any pause in its monetary policy conduct, we expect that the end of the monetary policy action is almost mature with a few rates hikes still in the pipeline across the region.

- CEE3: except for Romania where it stabilised in QoQ terms and accelerated in YoY terms, Q3 real GDP figures showed that economies continued to decelerate sharply, both in QoQ and YoY terms. Double-digit inflation is here to stay for long and will prevent central banks from cutting anytime soon. Elevated inflation, tight monetary policy, (partial) removal of supports on energy and gas prices as well as fiscal consolidation in some countries will add further tailwinds to growth in the coming months. We expect Czech Republic and Hungary to enter recession as early as Q4 this year.

- South Africa: even though Q3 real GDP figures were higher than in Q2, the country had a tough month, with strong volatility on bonds and FX markets. President Ramaphosa was embroiled in a corruption scandal known as “Farm gate”. After the parliament voted against impeachment, South African assets regained ground. Ramphosa has been reelected as ANC leader, but he is not off the hook yet, as there are other ongoing investigations in the matter by the SARB, the public protector, and the South African police services. All eyes will be focused on 2023 to see if the reform agenda is progressing.

- PBoC (China): the PBoC left policy rates unchanged in December. As the reopening path is confirmed, we do not expect any further rate cuts. The central bank has no urgency to hike rates either. Inflation will be contained at below 3% throughout 2023. The likely increase in effective rates on improved growth outlook will lead to moderate tightening of financial conditions. Signals from the annual economic conference suggests the PBoC will step back from broad easing. Targeted monetary easing will continue, via structural lending tools and special financial programmes.

- RBI (India): as expected, the RBI continued its hiking cycle in December, even though at a slower pace. The repo rate was raised by 35bp to 6.25%. RBI governor stated that further calibrated monetary policy action is warranted to keep inflation expectations anchored, break core inflation persistence, and contain second-round effects. We expect the RBI to hike again in February by 25bp to 6.5%, as real policy rates are already mildly positive or close to neutral, in line with what the RBI targeted at the beginning of its hiking cycle in May.

- BCB (Brazil): the BCB stayed on hold in December and did not kick off any easing cycle, with the Selic rate unchanged at 13.75%. Despite the risk around the inflation outlook looks balanced, the Copom emphasised the uncertainty related to the fiscal policy framework: on the upside, through additional fiscal stimulus to support aggregate demand and increase inflation expectations; on the downside, through the expected -- though uncertain -- reversal of tax cuts. Clearly next monetary policy action will depend on the future fiscal framework.

- CBR (Russia): at its December meeting, the CBR left its policy rate unchanged at 7.5%, sounding increasingly less dovish. While keeping its inflation forecasts unchanged, the CBR emphasised that pro-inflationary factors dominate over disinflationary ones, such as labour market tightness, elevated inflation expectations, weaker rouble, and potentially looser fiscal policy. Inflation continued to decline to 12.0% YoY in November, down from 12.6% in October. Given this increasingly cautious tone and inflationary pressures, we no longer expect any rate cut over the next six months and a potential hiking cycle in late 2023.

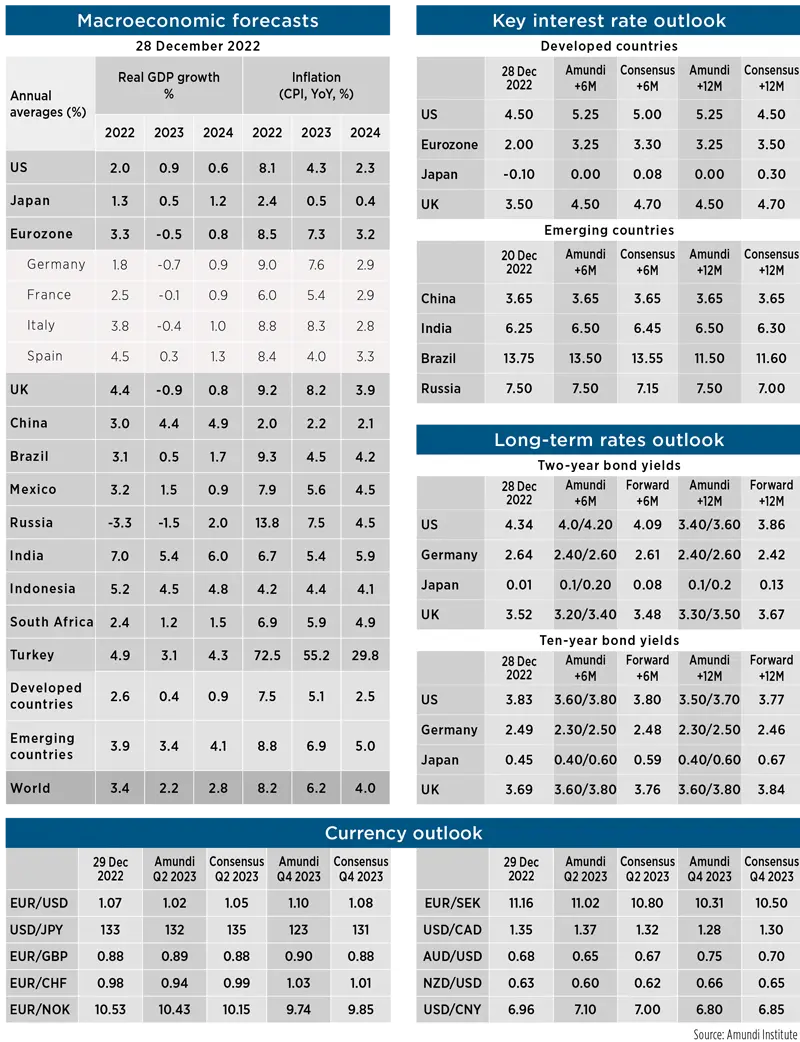

Macro and market forecasts

Disclaimer to our forecasts

The uncertainty around the macro forecasts is very high, and it triggers frequent reassessments any time fresh high frequency data are available. Our macroeconomic forecasts at this point include a higher qualitative component, reducing the statistical accuracy and increasing the uncertainty through wider ranges around them.

Methodology

- Scenarios

The probabilities reflect the likelihood of financial regimes (central, downside and upside scenario) which are conditioned and defined by our macro-financial forecasts. - Risks

The probabilities of risks are the outcome of an internal survey. Risks to monitor are clustered in three categories: Economic, Financial and (Geo)politics. While the three categories are interconnected, they have specific epicentres related to their three drivers. The weights (percentages) are the composition of highest impact scenarios derived by the quarterly survey run on the investment floor.