Summary

Developed Countries

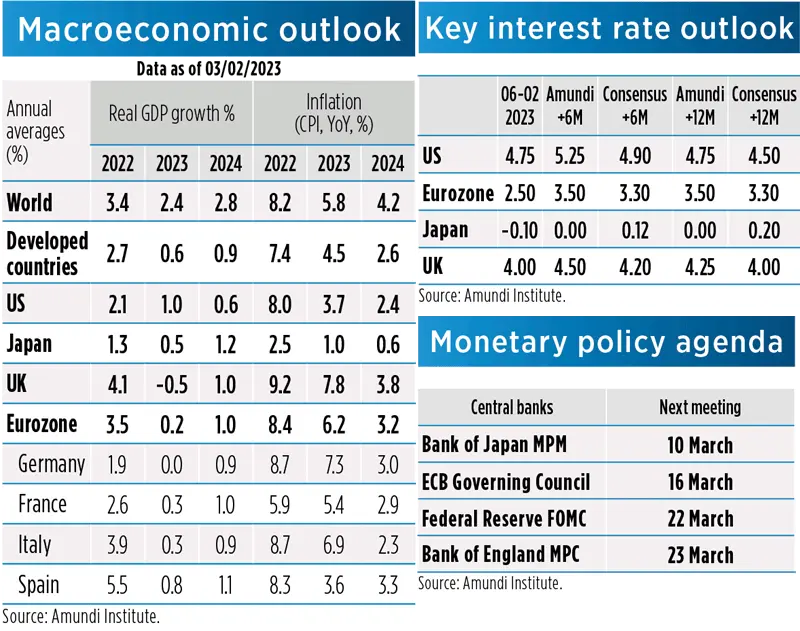

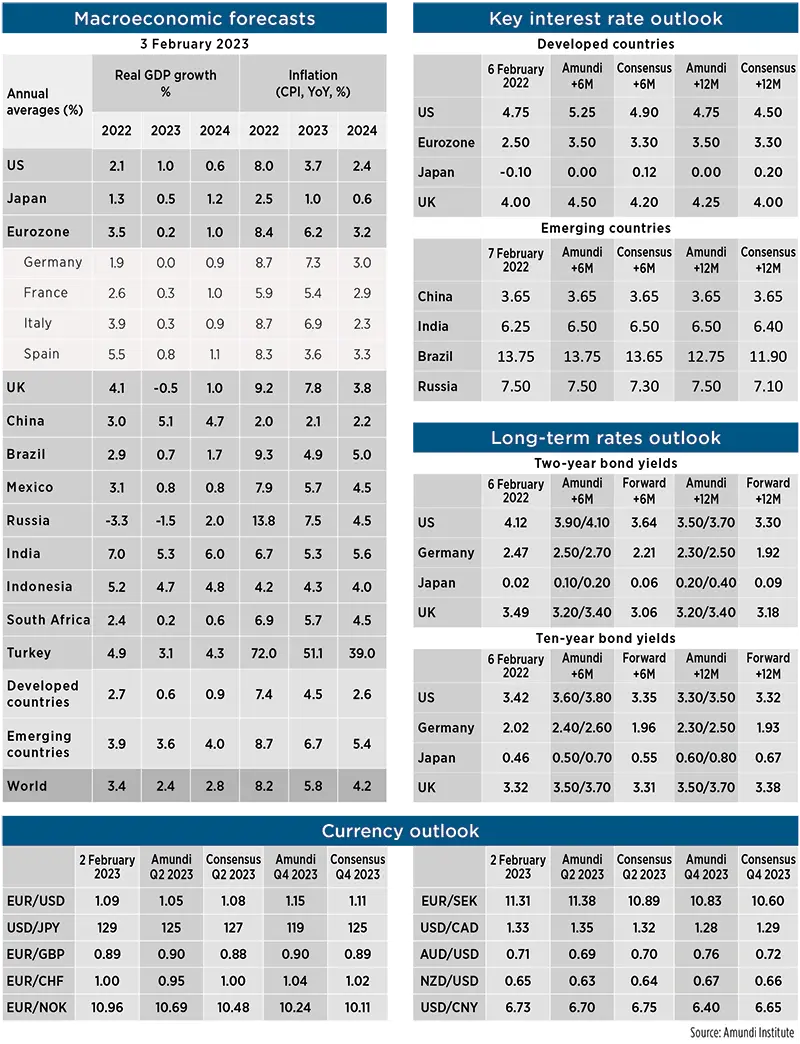

- United States: The US economy has been showing signs of deceleration, as the fiscal and monetary policy drag weigh on activity, although at different intensity. Although some upside surprise may come from a stronger-than-expected Q4, we keep seeing significant growth deceleration unfolding, driven by weakening domestic demand and global growth. Growth will remain significantly below potential on average in 2023-24, with particular weakness in H2 2023, implying heightened recession risks. Inflation seems to have peaked and have moved to a lower monthly regime, yet we expect stickiness in underlying inflation, with the core index declining more slowly than the headline one.

- Eurozone: We upgraded our Eurozone growth outlook. While we still expect weakness and activity contraction over winter, we expect it to be less profound than previously feared. Notwithstanding the modest upward revision, headwinds for the Eurozone economy remain significant. Over the spring-summer period we expect some growth recovery, even if modest at this stage, helped by decelerating inflation and improved sentiment. Tighter monetary policy will represent a clear headwind, keeping growth below potential in 2023-24. Risks related to the energy crisis seem to have receded, but remain prominent for both the inflation and growth outlook.

- United Kingdom: With persistent inflation projections -- seen above target for several quarters -- we foresee a cost-of-living-induced recession playing out in the United Kingdom during early 2023, extending for a few quarters. Fiscal and monetary policy will weigh on growth too. Although we improved slightly our outlook, we see all headwinds as still present for the UK economy. With some modest recovery to follow, we see the economy running below potential also in 2024. As for the Eurozone, energy crisis risks remain prominent for both the inflation and growth outlook.

- Japan: The first signals for 2023 growth performance are mixed and for now we keep our below-consensus growth forecast of 0.5% for 2023, with an uneven recovery taking shape. The strong external-oriented manufacturing sector will be, on one side, hit strongly by weakening global demand, as shown by business surveys. On the other side, China’s reopening has been favouring Japan as one of the most important targets of Chinese travelling abroad. In the meantime, December national CPI data confirmed the gloomy picture painted by Tokyo CPI (4.0% YoY, strongest growth in around 40 years), making though the BoJ job tougher.

- Fed: Inflation has been declining over the past several months against a backdrop of moderate growth, but with inflation still high and indications of continued supply-demand imbalances, monetary policy still has work to do to bring inflation back to 2%. We expect the Fed to raise the Fed Funds rate to 5.25% in March before pausing for a few months. Fed officials have emphasised that the focus should shift from ‘how fast’ towards ‘how far’ rates need to rise and how long those levels need to be maintained. Our scenario now includes a contraction in economic activity in Q3 and a rapid decline in inflation. Now, we anticipate the first rate cut in December, while previously we were expecting it in January.

- ECB: At its February meeting, the ECB hiked rates by 50bp and pointed out their intention to deliver another 50bp raise in March. Both the statement and the press conference were hawkish, despite the ECB no longer sees upside risks in its inflation forecasts. Our baseline expectation is for the ECB to hike by 50bp at its March meeting and follow up with 25bp hikes in May and June. This means a terminal rate of 3.50% before summer, above market expectations, currently at 3.25%. The persistence of core inflation will pressure the ECB, with core CPI close to 4.5% in the third quarter according to our scenario.

- BoJ: After the surprise move in December, the BoJ held its policy unchanged at the January meeting. Expecting tepid recovery in 2023 and frontloaded inflation pressures in H1, we believe the goal of policy normalisation is to exit Negative Interest Rate Policy (NIRP) without additional rate hikes. We expect the BoJ to terminate YCC in March and NIRP in June. Risks to our forecasts are skewed towards a delayed ending of NIRP.

- BoE: The BoE delivered a 50bp hike at its February meeting, with the Bank Rate now at 4.0%. The split vote over the decision was expected, as seven out of nine policymakers backed the 50bp move, while two members preferred no rate hike. On rates guidance, the MPC signalled a likely reduction of the hiking pace to 25bp at the upcoming meeting. When referring to future moves, the minutes dropped the reference to “forcefully” (understood as meaning 50bp rate hike increments). We confirm our expectation for the terminal rate of this hiking cycle, which is likely to slow to 25bp moves from March, with a peak still at 4.5% in our baseline scenario.

Emerging Countries

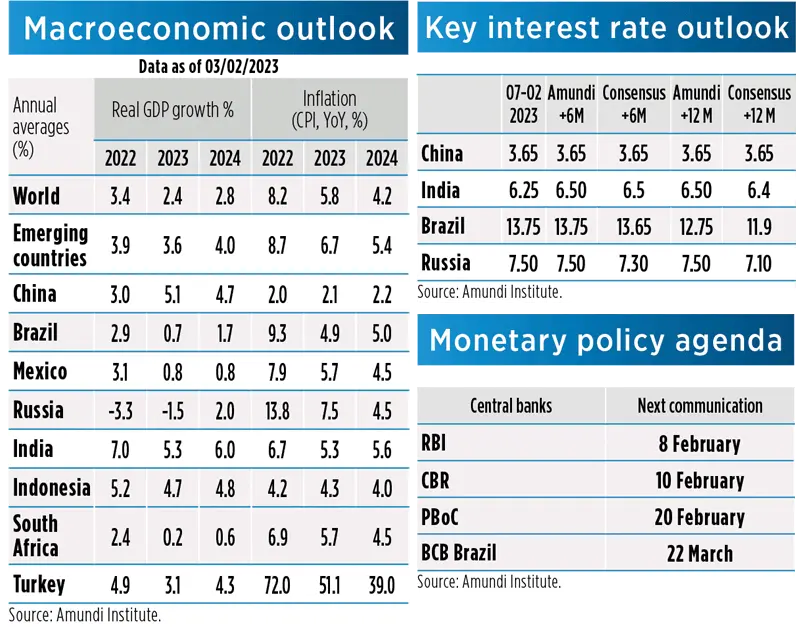

- China: On the back of stronger-than-expected Q4 2022 GDP, more resilient monthly data (retail sales), and a rebound in high-frequency indicators on rising mobility, we upgraded our 2023 GDP forecast from 4.4% YoY to 5.1%. The rebound happened earlier than expected and earlier than the Chinese New Year holidays. On the other hand, the housing sector performed poorly again in December, paving the way for some weak stabilisation in 2023. Again, the property sector will barely offer support to the economic growth this year.

- South Africa: Inflation is likely to return to the upper end of the central bank’s target range by the end of the first half of the year, but risks remain on the upside. After a rather resilient year in 2022, the growth outlook is weak. Household consumption is likely to continue to shrink, and the increasing frequency of electricity outages is likely to undermine growth even more. The SARB has therefore slowed the pace of its rate hikes, with an increase of just 25 bps at its latest meeting, no doubt for the last time. If conditions are right, it could begin a loosening cycle early in the second half of the year.

- Mexico: As in the rest of the Latin American region, economic has been slowing after a robust 2022. External demand has been softening in line with the cooling US economy, while Mexico’s tight labour market has kept domestic demand more resilient. Headline inflation peaked in Q3 2022. Banxico is in the fine tuning stage of its hiking cycle, pivoting to a slower tightening pace mindful of more sticky core inflation and the Fed action. Politically, the country is an oasis of peace compared to the rest of the region and a big potential beneficiary of near-shoring trends.

- Brazil: The economy has slowed visibly after robust growth over the first three quarters of 2022, as reopening has run its course and tight monetary policy started to bite the credit cycle more forcefully. We see GDP expanding by less than 1.0% this year compared to 3.0% in 2022. Inflation more than halved by December 2022 after peaking in April at 12.1%, which allowed the BCB to wrap up its hiking cycle in August already at 13.75%. President Lula’s less prudent than expected fiscal policy may complicate the central bank’s disinflationary battle, delaying BCB’s easing cycle (to Q4), while posing questions around the country’s debt trajectory.

- PBoC (China): The PBoC left policy rates unchanged in January. Based on the earlier-than-expected economic rebound, we do not expect any further rate cut over 2023. However, for the time being, the central bank has no urgency to hike rates either. Inflation will stay below 3% throughout 2023, staring at low levels and firming up on higher consumer demand. Having said that, signals from the annual economic conference suggest that the PBoC will step back from broad easing. A more and more targeted monetary easing will continue, via structural lending tools and special financial programmes.

- RBI (India): India inflation printed again below consensus in December across the board (headline at 5.7% YoY and WPI at 5.0% YoY), except for core prices that are still stubbornly little above 6.0% YoY. Food prices returned well within the RBI target, while energy prices remain high (11% YoY). Overall, the disinflationary path could allow the RBI to pause its hiking cycle in February. However, governor Shri Shaktikanta Das has reiterated its focus on core price dynamics. For the time being, we maintain our call for the final hike to occur in early February by 25bp, though with less conviction.

- BCB (Brazil): High for longer. The first and most aggressive hiker (starting in March 2021, 1200bp overall) and the first ‘pauser’ (August 2022) is most for sure not going to be the first cutter in 2023. That is because President Lula’s expansionary fiscal policy undermines the BCB’s contractionary monetary policy stance designed to bring inflation back to target. More so, the recent rumours on raising the inflation target will pressure inflation expectations to the upside. We see the BCB cutting rates only in Q4 and easing thereafter more gradually than previously envisaged, in line with the latest BCB forward guidance.

- CBR (Russia): The CBR left the policy rate unchanged for the second time at 7.5% at the December meeting. The signal from the CBR was neutral with a hawkish note. While current inflationary pressures remain subdued, pro-inflationary risks had increased due to supply-side constraints, labour market pressures, and looser fiscal policy. Inflation continued to decline to 11.9% in December from 12.0% YoY in November. We expect the CBR to remain on hold for the next six months or longer, and then start its tightening cycle depending on the geopolitics and local economic conditions.

Macro and Market Forecasts

Disclaimer to our forecasts

The uncertainty around the macro forecasts is very high, and it triggers frequent reassessments any time fresh high frequency data are available. Our macroeconomic forecasts at this point include a higher qualitative component, reducing the statistical accuracy and increasing the uncertainty through wider ranges around them.

Methodology

- Scenarios

The probabilities reflect the likelihood of financial regimes (central, downside and upside scenario) which are conditioned and defined by our macro-financial forecasts.

- Risks

The probabilities of risks are the outcome of an internal survey. Risks to monitor are clustered in three categories: Economic, Financial and (Geo)politics. While the three categories are interconnected, they have specific epicentres related to their three drivers. The weights (percentages) are the composition of highest impact scenarios derived by the quarterly survey run on the investment floor.