Summary

Key takeaways

- The Yen carry trade* is being unwound sharply due to weak US data and a hawkish surprise from the BoJ, with the Yen's dislocation from its fundamentals remaining large.

- Weak global growth and the BoJ on diverging path from most Central Banks in the world are tailwinds for the JPY. A fast trade-weighted appreciation, though, would require 1) recession or 2) a persistent hike cycle from the BoJ.

- The repatriation of Japanese foreign assets is not a material risk for now, but its potential for a large market impact always warrants attention.

The Yen’s great come-back

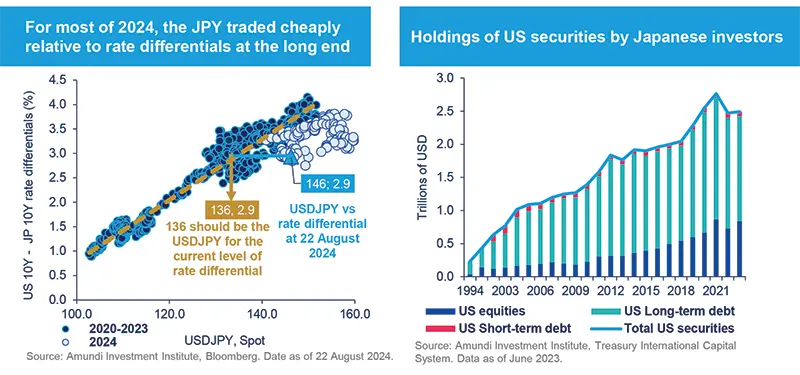

A series of weak US data in July questioned the market narrative of a soft landing and brought back fears of recession. This was the main trigger, although a hawkish surprise from the BoJ undoubtedly added fuel to what turned out to be an unusually sharp unwinding of carry trades funded in JPY. The amount of exposure of these carry trades was at an all-time high due to the low level of overall market volatility and the volatility of the JPY itself. So is it over? Our Q2 2025 target for USD JPY has been revised to 135 (from 140), and a gradual appreciation is expected from there - the Yen’s valuation remains cheap and its hedging properties in a slowing global economy have not budged by much. On the other hand, our view is that it is not yet time for cross-JPY adjustments to be too aggressive. For this, a much weaker global growth environment or a more pronounced hiking cycle from the BoJ would be necessary conditions.

The BoJ’s change in communication matters, but does not change the longer-term funding status of the Yen

| The July hike and the confidence the BoJ showed in sustainably reaching its inflation target bodes well for the eventual normalisation of its monetary policy. But its subsequent assurance that its hiking path would not be independent of market volatility (read Yen and the Nikkei) reinforces our view whilse Japan’s fundamentals are improving – particularly wage growth and consumption – these are not yet sufficiently firm. |

|

The uncertainty about the BoJ’s near-term policy path limits investors’ ability to short the JPY for now, but a sustained turnaround would require: i) a persistent hiking cycle – during the late 90s the BoJ hiked 200bps to limit the fall in the JPY; or ii) much more dovish major CBs. In their absence, the JPY will continue to be one of the main funding currencies. Paradoxically, higher Yen volatility will constrain the BoJ’s reaction function. Secondly, CBs will only turn more dovish than the market currently expects if the global growth markedly disappoints consensus expectations.

The Yen is largely a (US) recession trade

In a stable/rising growth environment, investors typically increase risk exposure and build up carry positions. This is what happened in 2023 and in the first half of 2024 and what pushed the JPY to multiyear lows relative to most major currencies. As growth stalls and corrects lower, however, market sentiment can change rapidly. Being long JPY is the equivalent of being long volatility and short carry, strategies that worked well during past recessions. The evidence for this also stems from the high sensitivity the JPY has to interest rate differentials at the long end, which is higher than the average sensitivity for G10 currencies. In the event of a US recession – not our base case – US long-end rates could fall further and USDJPY would register this through a depreciation.

Conventional market carry trades have been unwound

Most investors have closed short JPY positions, with non-commercial investors and asset managers turning net-long after being short for three years in a row. In principle, this limits the possibility of another fast squeeze higher, but it does not guarantee an imminent reversal either. Levered funds, while trimming their short JPY exposure compared to June levels, are still neutral given the drop in global market volatility. But another volatility event, including any hawkish BoJ communications, could prop up the JPY much faster than our 12-month baseline projection. This near-term uncertainty will make conventional carry traders more cautious than usual.

The repatriation of Japanese foreign assets is not a material risk for now, but its potential for a large market impact always warrants attention

With the BoJ still on a different monetary policy path relative to the rest of the world, Japanese institutional investors may have a different trade-off when it comes to capital allocation. They hold $2.5 trillion in US securities, which accounts for almost 10 per cent of the value of foreign holdings of US securities. Public and corporate pension funds along with insurers may gradually repatriate or again hedge their overseas exposure. More than an imminent trigger for the JPY, we see it as a medium-term support for further JPY mean-reversion to fundamentals.

Key take-aways from the desk

Laurent CROSNIER

Global Head of Forex, Amundi

We think that the Yen will continue to be supported by expectations of:

- Policy normalisation from the BOJ. Kuroda indicating that the neutral rate could be less than 2% is further supporting the Yen.

- Narrowing UST-JGB yield differential, to which the Yen is highly sensitive.

- High volatility in some EM FX, which is an additional headwind for carry trade strategies.

- Acceleration of Japanese public pension funds reallocation into domestic securities.

*Carry trades involve investors borrowing money in a currency (the funding currency) with low interest rates and then using those funds to invest in assets that offer higher returns in another currency.