Summary

Key Takeaways

In the current geopolitical context, the recently updated version of Japan’s GX transformation plan aims to minimise policy uncertainty and encourage private sector businesses to speed up their efforts.

Japan is taking a hybrid approach, using a public-private partnership model based on industry policies, which makes it less susceptible to political risks.

The Japan GX strategy is built around aligning climate, energy, and industrial policies. It has three goals:

– Achieving the Net Zero commitment by 2050 in accordance with its NDC.

– Delivering economic growth while bolstering Japan’s industrial competitive advantage.

– Secure stable energy provision.The USD 1 trillion investment rivals the size and ambition of the US IRA and EU Climate Finance plan and clean industrial deal.

The strategy paves the way for actionable transition finance solutions that are essential for driving real-world emissions reductions:

– “Bold” proactive investments using the proceeds from GX Economy Transition Bonds

– “growth-oriented” carbon pricing

– New financial support schemes from the GX Promotion Agency.Substantial tailwinds are expected for clean energy solutions in Japan and across Asia.

Investors can play a key role in this transformation by seizing opportunities related to economic growth in clean energy and energy-efficient industrial activities, as well as new financial mechanisms such as Transition Bonds.

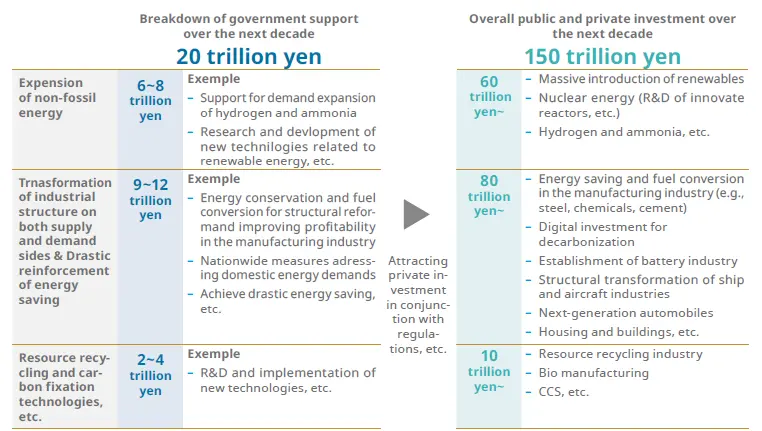

Japan set its first “Green transformation” strategy (known as “GX strategy”) in July 2023 and upgraded it as “GX 2040 Vision” in February 2025. The government has demonstrated a bold ambition to foster the establishment of clean supply chains. The GX Promotion Strategy aims to spur up JPY150 trillion (USD 1 trillion) of public and private sector investment over the next 10 years. The goal is to sustain industrial competitiveness while simultaneously decarbonizing the economy1. The government front-loads JPY20 trillion (USD 133 billion) in subsidies, tax incentives, and R&D support by issuing the GX Economy Transition Bonds as the first sovereign issuer2. Carbon pricing will follow from FY2028. This timeline is meant to reduce policy uncertainty and incentivize private sector businesses to accelerate their efforts.

Source: MOF, Japan Climate Transition Bond Framework

Unique Approach Based on Public-Private Partnerships

The governments of major economies have adopted climate strategies with varying degrees of intervention in the private sector. The EU employs a top-down approach, advancing behavioral change in business by setting strict rules and regulations, e.g., the EU taxonomy, SFDR and CSRD, with EUR 528 billion (USD 549 billion) of budget committed over 10 years3. In contrast, the IRA in the US extends indirect financial support to clean energy businesses mainly through tax incentives. The bottom-up approach catalyzed private investments4. The aggregate budget size is USD 369billion over 10 years, though the Trump Administration has ordered all agencies to pause the disbursement of funds5. Japan is particularly ambitious with over 3% of its annual GDP allocated to the low-carbon transition, which is comparable to the EU and higher than the US-level before Trump election.

Japan takes a hybrid approach, using a public and private partnership model based on industry policies, which makes it less susceptible to political risks. Japan has a successful experience with this model in rebuilding the devastated economy after World War II. We are now witnessing a revival of this unique collaboration in implementing the GX strategy.

Bold Financial Support Programs for Decarbonization Efforts and Clean Value Chains

Government Budget Allocation (Unit. USD mil)

Source : METI Sector-Specific Investment Strategy Ver.2, December 2024

Over the next ten years, Japan is targeting at JPY150 trn (USD 1 trn) of public and private GX investments. METI, the Ministry of Economy, Trade and Industry, orchestrates the transformation of the economy through two financial support programs: the «Sector-specific Investment Strategy» and the Green Innovation Fund, GIF. The former is to extend financial support to 16 designated areas including: electric vehicles (EV, FCV, PHEV, and HV), storage batteries, power semiconductors, industrial process conversion in the hard-to-abate sector, perovskite solar cells, and floating offshore wind facilities. The government budgeted more than JPY 4 trillion (USD 26.7billion) in FY 2022 to 20246. The latter focuses on R&D in new technologies and the commercialization efforts. The size of the GIF is JPY2.7 trillion (USD 18billion). Hydrogen-related projects, e.g., directhydrogen reduction and large-scale marine transportation, account for over one-third of the total allocated amount7.

Clear Roadmap on Carbon Pricing

The ministry has also launched a “Growth-Oriented Carbon Pricing” plan8. The goal is to make the value added of GX services more visible and support the

establishment of GX supply chains. The GX-ETS, an emissions trading scheme, will be fully operational in FY2026 with the mandatory participation of high-emitting companies. A levy will be applied to fossil fuel importers from FY2028. Then begins the phased introduction of paid auctioning of allowances to power generation companies in FY2033. Note that the GX JGBs will be redeemed from the revenue from the GX-ETS. METI has aimed to accelerate decarbonization efforts in businesses with complete policy visibility while giving an economic rationale.

Implementation Hub

In July 2024, the government established the GX Acceleration Agency, GXA, as the hub for effective strategy implementation by connecting public, industrial, and financial stakeholders for collaboration9. It will provide debt guarantees for GX projects, operate the ETS, and administer the fossil fuel surcharge. GXA will play an active role in research, policy discussion, and international representation.

Conclusion

The government revised the GX Promotion Strategy in February 2025 as “GX Vision 2040” against the backdrop of the heightened geopolitical risks and anticipated greater electricity demand from the extensive use of AI. The bolstered plan has raised action points to breed and commercialize GX businesses, reconsider the geographical distribution of industrial activities in light of decentralized renewable energy sources, and contribute to GX in Asian countries. Thus, it can lead to creating substantial tailwinds for clean energy solutions in Japan and across Asia as one of the most ambitious plans to align decarbonization goals with energy and industrial sovereignty, paving the way for actionable transition finance solutions.

Sources:

- Cabinet Secretariat, Grand Design and Action Plan for a New Form of Capitalism (6/2022).

- The first issuance was in February 2024. The government has raised JPY 3 trillion so far in 5 year and 10 year bonds. No significant greenium is observed.

- European Parliament, “Europe’s one trillion climate finance plan”, January 2020, https://www.europarl.europa.eu/topics/en/article/20200109STO69927/europ…, Morton Rose Fulbright, “The EU Green Deal explained”, April 2021, Financial Times article on August 1, 2022 , PwC “How the EU’s Green Deal is driving business invention” October 2024. In February 2025, the European Commission has proposed another EUR100 billion as the Clean Industrial Deal.

- Global Infrastructure Investor Association reported USD115 investments in clean energy and created 90,000 jobs in two years. “Two Years of the Inflation Redution Act: Transforming US Clean Energy”, September 25, 2024. https://giia.net/insights/two-years-inflation-reduction-act-transforming-us-clean-energy

- The pause is not fully effective on the back of a court injunction.

- METI, Sector-specific Investment Strategy, Ver 2.0, 12/27/2024

- “Green Japan, Green Innovation”, NEDO, https://www.nedo.go.jp/content/100957298.pdf

- The Upper House approved the revised GX Promotion Act that endorses the mandatory emissions trading on May 28, 2025.

- https://www.gxa.go.jp/en/