- Europe’s fiscal rules are too simplistic, prone to exacerbating economic downturns, and lack credibility after years of breaches.

- We propose changes to fix these problems and pave the way for a better balance between fiscal and monetary policies, which is essential in a high inflation regime.

- A more nuanced approach will promote Europe’s long-term growth prospects and debt sustainability. This will limit the risk premium on European assets.

Europe’s budget rules are in dire need of an overhaul. A new regime of higher inflation means the European Central Bank cannot on its own support growth or prevent fragmentation. But governments are hampered by fiscal constraints that are too simplistic and which, after years of breaches, lack credibility. We propose changes to fix these problems and pave the way for a better balance between fiscal and monetary policies. By promoting long-term growth prospects and debt sustainability, our suggestions would help limit the risk premium that investors demand for holding European public- and private-sector assets.

1. Replace most deficit-based rules with a spending rule and adopt country-specific, medium-term debt targets. (Likelihood: high)

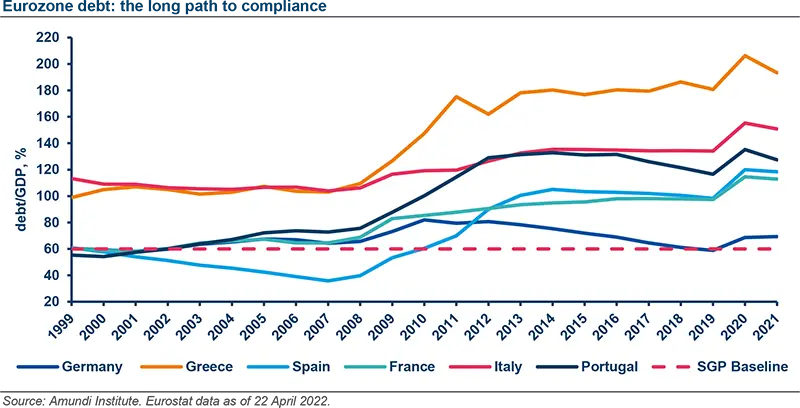

The Stability and Growth Pact’s deficit limit of 3% of GDP and debt limit of 60% of GDP could be designated as long-term targets. Country-specific, medium-term debt targets would then incorporate the possibility of different economic scenarios. These would be supplemented by a spending rule that ensures public expenditure rises by no more than potential GDP growth, with lower limits applied if fiscal adjustments are needed. Limited deviations would be allowed provided they are offset in subsequent years.

Advantage: This proposal avoids imposing harsh austerity during bad economic times and is easier to communicate than the current rules, which rely on unobservable structural deficits.

2. Exclude some investment in public goods from the spending rule. (Likelihood: high)

While this proposal may open the door to abuses, any public investment strategy will also need to overcome bureaucratic and political hurdles as well as implementation challenges. Exemption clauses in the spending rule could be linked to commitments to supply-side reform and depend on the size of investment schemes financed at EU level. Countries that comply with the Stability Pact would receive privileged access to these EU funds.

Advantage: There is a strong case for treating investment differently to current expenditure given the former should, in the long term, lead to higher output and tax revenue.

3. Improve compliance by giving independent fiscal institutions more powers. (Likelihood: probable)

There is room to give independent fiscal institutions, such as national budget watchdogs, more teeth, including the power to reject a budget. An EU institution that would define common methods and processes could oversee them. Giving the European Court of Justice jurisdiction over breaches of fiscal rules is probably inappropriate: the many international consequences of a sovereign default mean governments should retain the final word.

Advantage: This proposal would overcome the counterproductive nature of the current sanction process, which exacerbates problems for countries that are already likely to be in a dire economic and financial state.

4. Explore two-tier debt system and orderly sovereign default process. (Likelihood: low)

Debt of up to 60% of GDP could be senior, possibly with some guarantees from the rest of the EU, while any issuance above this threshold would be junior. The latter could be ineligible for ECB quantitative easing purchases, a feature that would minimise how much of this tranche is held by banks. An orderly sovereign default process would need to be set up for junior debt.

Advantage: This system would in effect create a non-politicised sanction system. A country that failed to comply with the Stability Pact would face higher borrowing costs, with interest rates determined by the market. This would remove the need for an EU decision on sanctions.

5. Bring fiscal and macroeconomic surveillance processes closer together. (Likelihood: moderate)

As fiscal adjustments are likely to have implications for intra-EU current accounts and changes in relative competitiveness, fiscal recommendations should account for this. For example, recommended adjustments could be toned down if they were likely to increase an already-oversized current account surplus that existed with other euro zone countries.

Advantage: This would strengthen the EU’s macroeconomic surveillance process, which is currently not robust enough and insufficiently focused on the problem of intra-EU imbalances.