Summary

Hot debates

US: Engineering a slowdown

The effects of higher rates will start biting domestic demand during the next few quarters and investment stemming from incentives such as the IRA and CHIPS Act would only partly mitigate the slowdown.

The US economy has proven to be stronger-than-expected in 2023, with domestic demand supported by a strong labour market, excess savings and investment through government incentives, while inflation has been moderating consistently. The most recent activity and price data suggest that the services component may remain elevated through to the year end. Despite its resilience thus far, we continue to expect economic growth to slow notably over the coming quarters as the renewed surge in long-term Treasury yields compounds the impact of Fed tightening. The usual lags associated with monetary policy imply that the full impact has yet to materialise. And this effect will be amplified by a further tightening of financial conditions stemming from the recent increase in bond yields across the yield curve.

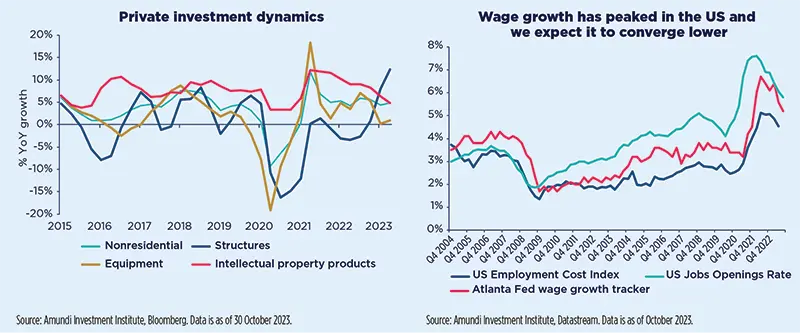

As a result, we still expect the economy to experience a mild recession in the coming quarters. The imbalances in the labour market are narrowing and wage growth is moderating. This process of easing labour market conditions should lead to a continued easing of wage pressures and a decline in unit labour costs. With the depletion of excess savings and less support from wage growth, consumption will continue to moderate. On the investments side, the deterioration in capex intentions points to a weak outlook for equipment investments, while the boom in non-residential structures (equipment, intellectual property products) seems to have lost momentum recently, though there will be some support from government investment in infrastructure. There will likely be more investment stemming from incentives provided by the IRA and CHIPS Act, though this remains difficult to estimate. This could provide more support for investment than the typical deceleration seen during economic downturns, but not enough to offset the consumption downturn.

Regarding inflation, core inflation should converge towards the Fed’s target by the end of next year. Core inflation momentum has steadily declined with ex-shelter inflation already close to target. Shelter inflation is also expected to moderate further from here. Barring further and persistent shocks in oil prices, headline inflation will appear somewhat sticky over the next few months and then converge towards target by the end of next year.

Europe: redefining policies in an era of challenges

There is a difficult balance to strike between the need to stimulate investment to accelerate the energy transition (and increase potential growth) and the need for fiscal discipline (to reduce debt ratios).

Structural challenges are mounting: an ageing population, rising energy costs and the need to finance the climate transition and foster IT innovation. Short-term market conditions are favourable. On the economic front, still high saving rates should support the economy. On the debt side, interest rates below nominal GDP growth make debt/GDP ratios manageable, while the long maturity of debt (7-8 years) has limited the impact of rising rates.

However, the dynamics of long-term debt are not yet under control. The European Commission (EC) considers that the phasing out of exceptional support measures for households to combat the energy crisis is insufficient to reduce the public deficit, particularly in France and Italy. And this is at a time when EU countries have not yet reached an agreement on the new fiscal rules proposed by the EC. If an agreement is not reached by the end of March 2024, the Eurozone will not have a credible budgetary framework before the European elections next June. Finally, macro-financial conditions will not always be so favourable. The rise in nominal GDP has been driven more by inflation than by real GDP growth, which is not very healthy. Moreover, rising interest charges will gradually be reflected in the average cost of debt.

There are nevertheless a number of reassuring factors. Public investment, which is stagnating in the Eurozone, should be supported by an acceleration in the release of NGEU funds (less than 30% of these funds have been allocated so far). And today's investment will determine tomorrow's potential growth and competitiveness. Moreover, an agreement to reform the European electricity market has just been reached that will make it possible to contain electricity prices and accelerate the deployment of renewable energy. It also shows that France and Germany are capable of finding compromises, despite the points of contention between them. This is encouraging for the fiscal rules under discussion. Finally, the European Central Bank (ECB) is now able to combat the financial fragmentation resulting from the uncontrolled budgetary excesses of an isolated State. So, EU countries are more incentivised to act together.

Emerging markets in a fragmented world

While EM may struggle in a challenging global environment, there are nonetheless advancing structural factors that can benefit some peripheral countries.

In an environment of weak global demand, Emerging Markets (EM) are likely to soon enter a cyclical downturn phase. Despite China’s pronounced deceleration and a tighter policy mix across the board, EM as a whole has displayed remarkable resilience, with GDP growth for 2023 being repeatedly revised upward. This growth has been driven by large countries such as India, Mexico and Brazil. While a broader softening of growth is expected, it is unlikely to spiral into a general recessionary scenario and a mild recovery is anticipated by mid-2024. Next year, EM growth is expected to decelerate to 3.6% on average from around 4% this year. Importantly, the growth premium in favour of Emerging Markets over Developed Markets is projected to continue widening. Asia is set to register the strongest contribution to world GDP once again.

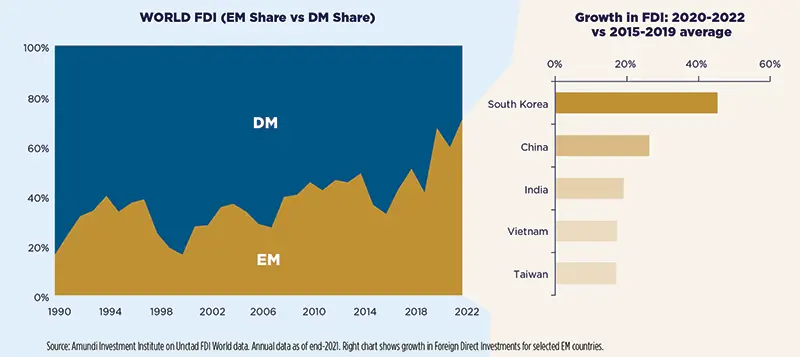

Beyond the cyclical downturn, there are structural factors at play that support EM. These factors include an incrementally higher global fragmentation, involving a great reallocation, near/friend-shoring, supply chain de-risking as well as the need for critical materials for the Net Zero Transition. Critical raw materials exporters sit mostly among EM (e.g. Chile, China).

Although fragmentation is costly, the subdued growth backdrop is expected to limit pressure on Inflation. EM Inflation mostly reduced in 2023, with few exceptions where the disinflationary trend is expected to accelerate over the next few months. In 2024, Inflation is projected to land in the upper part of Central Banks’ target ranges or mildly exceed them. However, upside risks to inflation remain, such as supply-side disruptions. Additionally, the current economic downturn, coupled with a tight labour market and worker shortages, is causing core inflation to remain stickier. Hence, complacency on inflation dynamics should be avoided and a prudent policy mix should be continued. Risks of fiscal profligacy or inefficiency need to be monitored, particularly in relation to the electoral cycle. Recent pressure from global financial tightening has prompted unexpected rate hiking. Yet, a reversal of the trend is not expected, and EM Central Banks are likely to continue cutting policy rates in a gradual manner given the present circumstances.

Video: Geopolitical Outlook with Anna Rosenberg

Geopolitics: More risks in 2024

Geopolitical realignment will also play out in 2024, with messy consequences

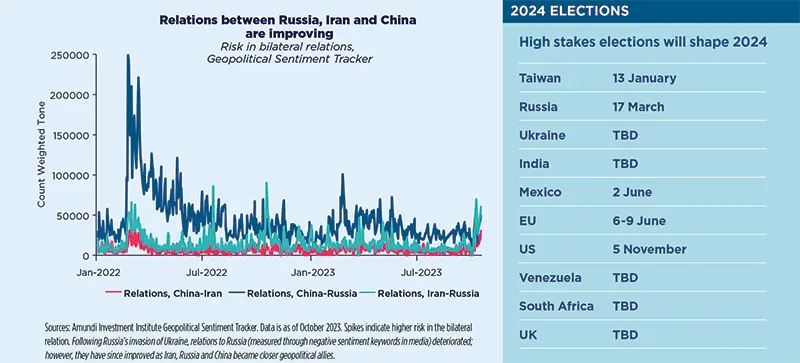

As 2023 draws to a close and the conflict between Israel and Hamas rages on, the geopolitical realignment underway is now in plain sight. The ruptures that have come to the forefront since Russia’s invasion of Ukraine and China’s emergence as a challenger to the US world order, will continue to play out in 2024. As global powers compete, most countries will refuse to be boxed into a bipolar world, but instead continue to prioritise individual needs. The US and the EU will lose influence as other powers rise. Regimes keen to undermine the US will seek to exploit this vulnerability and will work together to do so, while others will seek to improve their negotiating position. While the US will try to keep its allies close, its ability to do so will be constrained. On the one hand, the US is stretched by having to offer military support on multiple fronts. On the other, the possible return of Donald Trump to the presidency also threatens the US relationship with allies. The EU and UK’s efforts to position themselves anew for the geopolitical context will also be hindered by elections. We expect 2024 to be a year of transition, growing tensions and protectionism.

Higher odds for downside scenarios in 2024

There are higher downside risks to many geopolitical scenarios next year. While it is our base case that the current situation in the Middle East will not escalate into a regional war (supporting our oil view), an expansion of the conflict drawing in Iran would significantly alter the geopolitical environment to the downside. The expected outcome of elections in Taiwan – a more China-hawkish government – will see tensions with China rise. That, coupled with the dynamics of the US election and China’s faster-than-expected tech advance, will lead to further downsides for the US/China relationship. On the Russia/Ukraine war, Russia will be motivated to hold out for most of 2024 in the hope of a change in the White House.

Nevertheless, there are also some upsides

Despite bigger downsides, our base case remains that most of these tensions will not ‘boil over’ next year. Further, as investors, we need to spot the upside of geopolitics: there are the ‘winners’ benefiting from the need to diversify away from China and Russia, but also from China having to diversify away from the US. These are countries at the centre of new supply chain routes in Asia but also countries rich in natural resources in Latin America. There are also countries benefiting from new security treaties with the US, as these often come with investment ‘carrots’ beyond defence, like the Philippines. Then there are the countries gaining global influence, establishing themselves as new ‘poles’ in the multi-polar world, for example India. Rising US-China tensions mean that European investors in China are better positioned than their American peers, while for China, Europe also offers a better investment environment.