Summary

TOP CONVICTIONS

1.

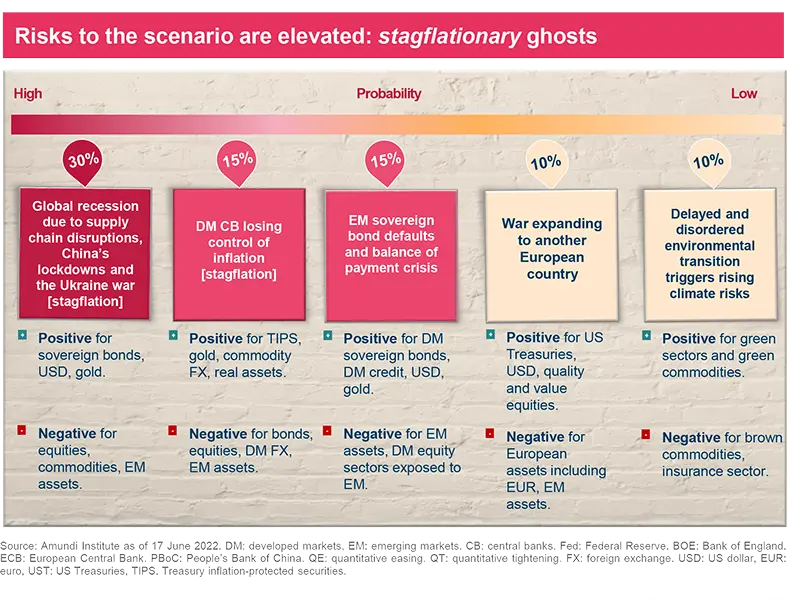

The H2 economic outlook will feature divergences in growth, inflation and policy mix across regions. Stagflation risk will be a common feature across Developed Markets (DM). In addition, since there will no longer be a synchronous global cycle, country risk is back.

3.

Inflation may be close to a peak, but will stay high due to deglobalisation, supply bottlenecks, high commodity prices and upbeat US wage growth. A psychological dimension is also kicking in.

5.

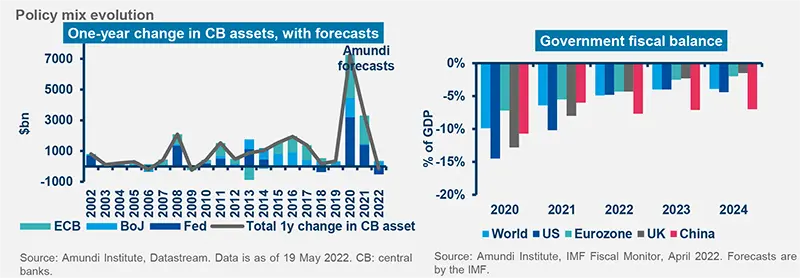

Fiscal stimulus is mostly behind us, with some country specific room available, particularly in Europe and China. In the United States, fiscal space is non existent ahead of mid term elections.

7.

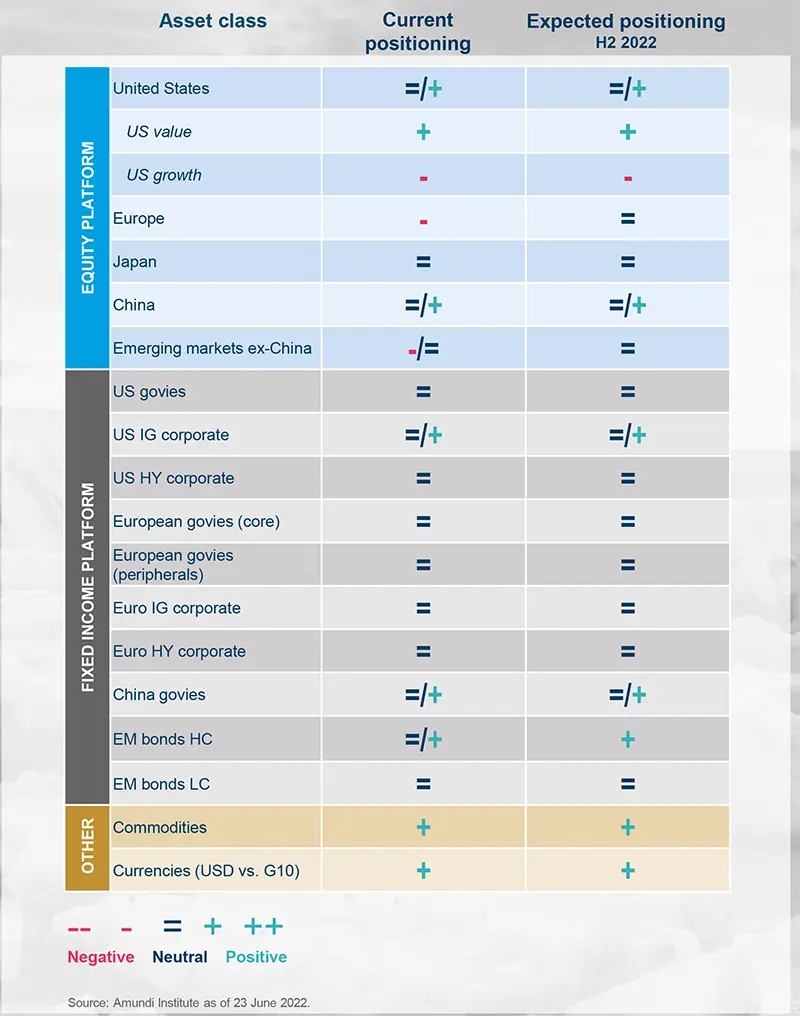

We are cautious on DM equities , as the earnings outlook remains to optimistic. Tactically, we favour US over EU equity and China should benefit from an economic rebound in H2. Quality, value and dividend stocks should outperform.

9.

The search for yield at all costs is over. In credit, we favour US IG credit, as Fed action should not significantly affect demand supply dynamics.

2.

The US economy is heading for a soft landing, while the Eurozone is fragile, hit by rising energy prices. China growth should rebound in H2, thanks to policy support.

4.

Central Banks will act to curb inflation at a time of slowing growth, high debt and fragmentation risk in financial markets. They will not go too far, and markets have already priced in most of their new hawkish stance.

6.

The depth of the equity sell off has helped absorb overvaluations but it has not incorporated a deterioration in corporate fundamentals. Risks remain in the growth space. The buying signal for risky assets will depend on bond yield's capacity to stabilise. Although the global repricing is still underway, this prospect does not appear so distant.

8.

In fixed income, some value is back in government bonds. It is time to move to a neutral duration stance and play monetary policy divergences. Chinese bonds remain good diversifiers.

10.

Unstable cross asset correlation dynamics will require investors to seek additional diversification in commodities, currency and alternative strategies that exhibit low correlation with equities and bonds.

IN SEARCH OF A NEW POLICY MIX AMID RISING RISKS

Assessing the key themes for investors in H2 2022

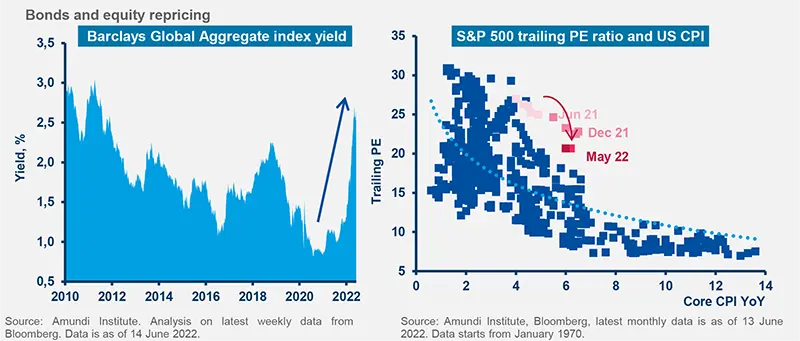

We started the year with expectations of strong growth and high inflation throughout the first part of 2022. The Russia-Ukraine war accentuated the inflationary trend, now well above Central Bank (CB) targets, which is now set to persist longer than expected. This triggered a sharp repricing in financial markets, starting with bonds where the amount of global negative-yielding debt plunged from over $11tn at the start of the year to below $2tn as of mid-year. The repricing has also widened to risky assets, particularly those areas of extreme valuations in the growth space. Moving into H2, it will be key to assess the growth / inflation pattern and the policy mix.

Rising recession risk amid high inflation

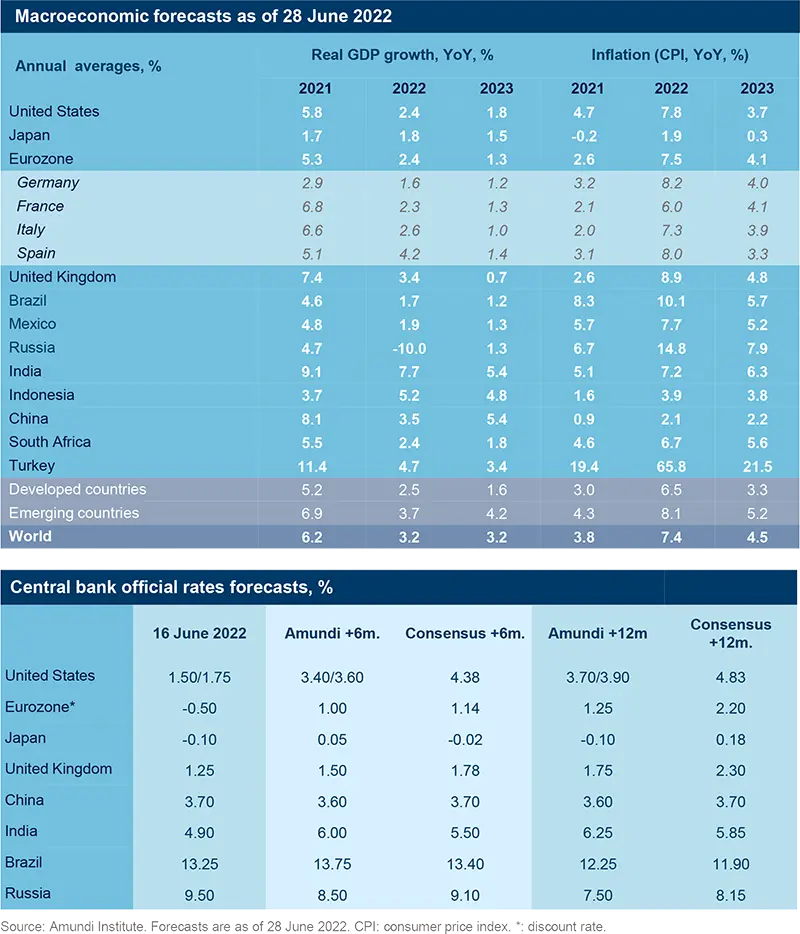

We expect economic momentum to slow in H2, as inflation acts as a regressive tax on consumers with huge divergences across regions, countries and sectors. However, we do not foresee a global recession. Inflation might be close to peaking in most areas, but we expect the inflationary environment to persist in 2022 and 2023.

- The US economy is set to slow to below pre-crisis levels, though it will avoid stagnation under our main scenario. In this respect, we need to monitor mortgage rates, corporate earnings and wage rises to get a clearer picture of economic fundamentals.

- The Eurozone economy is facing tougher challenges. Growth should stagnate in 2022, with huge divergences. Germany and Italy may actually experience a technical recession due to their dependence on Russian energy, while inflation should close the year at 7-8%. Two dynamics to look out for are energy prices – the main inflation driver – and food prices.

- We are cautious on China’s prospects, although the worst is likely behind us. We expect full-year growth below the government’s 4% target due to the fallout of Covid-19 curbs, with the bottom probably being hit in Q2 and a recovery in H2. Divergences have heightened across Emerging Markets (EM). In this respect, we favour commodity exporters and countries with significant policy room, e.g., Brazil, South Africa and Indonesia, while countries highly exposed to the Russia-Ukraine war and commodity importers look less appealing (more on section: Geopolitical shocks and EU Strategic autonomy).

New policy mix and policy mistakes

The policy mix will hold the key to the cycle. CBs’ task will be challenged by a combination of slowing growth and high inflation. They will need to coordinate their efforts with fiscal authorities, as the Covid-19 era budget ‘bonanza’ is likely to be over, but wide divergences are likely across regions. On one side, China has ample room to be accommodative, while Western CBs are tightening aggressively to tackle high inflation. We foresee further Fed rate hikes for 175 bp overall, on top of what has been done in H1. The ECB will start its hiking cycle aggressively in July, while putting in place an anti-fragmentation tool to prevent excessive peripheral spread widening. EM countries are split on the policy front: a few are in control of inflation, while others are not. The latter include Eastern European countries, stuck with high rates of inflation. We believe the most likely option is some fiscal expansion such as the Next Generation EU plan in Europe and a little extra stimulus in the United States amid the upcoming mid-term election, coupled with some CB tightening, though it will remain ‘behind the curve’. The outcome would be still high inflation accompanied by a controlled economic slowdown, yet with increasing risks on the economic front. Such a combination would lead to a difficult market environment, which demands the inclusion of inflation-sensitive stocks and some geographical rotation. A policy mistake – no fiscal expansion, coupled with full monetary normalisation – is one of the main risks to watch out for, as this would end the cycle.

Building stagflation-proof portfolios

In a fragmented world featuring high inflation, a growth slowdown and falling global liquidity, investors need to look for sources of positive real return and gain exposure to assets that can protect against high inflation and low growth. Investors should look for opportunities that may arise from a de-synchronised cycle and different paths in fiscal and monetary policy. At the same time, they should increase portfolio diversification, including strategies on currency markets and strategies targeting absolute real returns, while carefully monitoring liquidity conditions.

Following the great asset repricing of H1, the strong relative appeal of equities versus bonds has eroded and bond investing is becoming more attractive. For H2, we think investors should opt for a balanced / cautious allocation to risk assets, while focusing on increasing the diversification axis.

In fixed income it is time to move tactically to a neutral duration stance and play divergences in monetary policy. However, we believe it is not yet time to go overweight duration. We may reach such a position if growth disappoints and CBs become more accommodative. On peripheral bonds, we maintain a neutral stance and remain watchful on the ECB’s action. Inflation-linked securities and floating rates are part of the toolbox for building portfolios that are resilient to inflation.

The search for yield at all cost is over. In credit, investors should focus on quality and low-leverage companies, and areas resilient to a slowdown, such as US IG. Investors can find opportunities in selective EM bonds with the potential to deliver positive real returns. Our preference is for hard-currency debt and selective HY. The low appetite for local debt could selectively turn more constructive for those countries at the end of their tightening cycle. Chinese bonds are another appealing area in the search for diversification, as the People’s Bank of China (PBoC) has not embarked on unorthodox policies and is currently easing, in contrast with the West.

Equity repricing has helped clean up some excess valuations. Moving into a late cycle with inflation pressures, investors should focus on resilient businesses within those sectors more correlated to inflation dynamics. At a regional level, US equities appear more resilient than EU ones, as we foresee a profit recession in the EU. Yet, the US equity market is not cheap, despite the large correction.

In terms of styles, value, quality and dividends are a good mix. Value should benefit from rising real rates, peaking inflation and eventually wider HY spreads. Finally, dividends usually follow inflation and represent a key component of returns when inflation is high. While staying neutral overall in EM equities, we are becoming positive on Chinese equity. This should benefit from the reopening of the economy, which should recover in H2, and A-shares are insulated from the developed world. On a medium- to long-term perspective, equities remain the engine of returns. They will normalise and be more aligned with fundamentals in a range of 5-7% growth at best.

As the negative correlation between bond yields and risky assets – with bond yields leading - logically reasserts itself in a more inflationary regime, the buying signal for risky assets will depend a lot on the capacity for bond yields to stabilize at least. This may prove not such a distant prospect though the global repricing still does not seem at completion.

Regarding real assets, we favour real estate and infrastructure as an inflation hedge and private debt with floating rates, while we are more cautious on private equity markets, amid some areas of excess valuations. Given currently high geopolitical tensions, commodities – especially oil and gold – could be a good short-term hedge against geopolitical risk.

On currencies, we believe the dollar should stay strong and hit parity against the euro based on both a fundamental and technical basis. Meanwhile, we expect the renminbi to stop weakening and improve in the medium term. More generally, we are constructive on EM currencies.

CENTRAL AND ALTERNATIVE SCENARIOS AND RISKS

GEOPOLITICAL SHOCKS AND EU STRATEGIC AUTONOMY

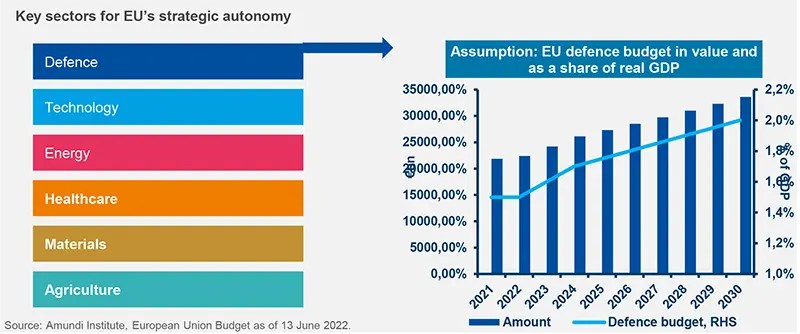

Green transition to play a key role on the road towards EU autonomy

With the Covid-19 crisis and Russia’s invasion of Ukraine, the 21st century has started to reflect the early 20th century with WWI. These events will have long-term repercussions and once again involve Europe. Most likely, they won’t lead to the end of globalisation, but to a redesign of its shape and structure. The rise of China, and its emergence as a world power instead of the United States, is a major turning point. Since the Berlin Wall fell, the United States has enjoyed a hegemonic status – militarily, politically, economically and culturally. This period could be regarded as a convergence of economic models around financial capitalism, Western values and liberal democracy. 20 years after China joined the WTO and after a stable government was restored in Russia, not only it is clear that these two countries do not intend to adopt the American model, but rather they are reaffirming their strategic independence. So too are many emerging countries which refused to sanction Russia. We are slowly moving from a Pax Americana – globalisation and geopolitical framework centred around the US financial market and regulations, the dollar and NATO – to a regional framework organised around spheres of influence.

Europe’s willingness to play its own game is legitimate in this context, while being challenged by the arising tensions. The EU can choose to either stay anchored to the United States, with the risk of becoming involved in situations that hurt its own interest, or to foster more independence through policies of strategic autonomy and by building its own sphere of influence. If Europe wants to stay close to the United States without taking the risk of breaking up with China, it needs to strengthen its own sovereignty first.

De-globalisation and global trade

Reports of globalisation’s death are exaggerated. The services and digital goods trade keeps growing, while the manufacturing goods trade is decelerating, which is also needed to reach Net Zero by 2050. Europe, as the most open economy in the world, could still benefit from global trade. Yet it needs to ensure self-sufficiency in its critical value chains and sectors, and enhance its economic resilience via re-shoring or near shoring. Europe’s strategic autonomy does not mean isolation, but lower external dependency. It would be economically damaging to do away with the benefits of globalisation, but equally short-sighted to underestimate the costs of Europe’s dependencies.

Green investment

There is common ground in the pursuit of economic resilience and a just green transition. Although most of the debate is framed around geopolitics, security and defence issues, sectors such as agriculture, healthcare, energy and technology are key if the EU wants to become strategically autonomous. Significant capex is needed in this respect, as well as substantial shareholder capital and positive expected returns on invested capital over the long term. As such, investors should expect an overhaul of the incentive structure of private investment in sectors which are critical to reaching greater autonomy and a just green transition. Public funding guarantees and fiscal support as well as incentives for long-term shareholders could be implemented. To take into account the size and duration of the required investments, European fiscal rules and monetary policy have a role to play. Public investments or incentives to foster the EU strategic autonomy could be excluded from budget deficit rules and the issued sovereign bonds could be part of a dedicated QE by the ECB, over time transferring today’s liabilities via money transformation. The invasion of Ukraine by Russia and the geopolitical shocks that might occur in the future could accelerate the transition towards Europe’s greater autonomy, but will require a significant reshuffling of its investment and fiscal framework.

RISING EM FRAGMENTATION, CHINA SET TO REBOUND IN H2

Fragmentation will emerge across a variety of dimensions

In the aftermath of two key global events, such as the pandemic and the Ukraine war, it has become increasingly clear how EM are a varied universe offering different risk reward opportunities to investors. These two events have highlighted heterogeneous recovery dynamics and inflation trends. They have also contributed to the shift from a few established geopolitical blocks to a much more fragmented world.

Throughout the pandemic, EM have generally been more prudent on fiscal expansion compared to DM, even if the stimulus was sized differently across them. At the end of the first Covid-19 wave, the vaccination rates and governments’ tolerance towards the virus – spanning from zero tolerance to living with the virus – defined the economic recovery and the magnitude of the rebound, with Asia remaining on the side-lines in 2021 compared to Latam and CEEMEA.

Indeed, different levels of demand pressure and inflation dependence on food and energy prices have shaped inflation spikes differently across EM, once again stressing the rising fragmentation across the block. Accordingly, the monetary policy reaction function varied across EM, with Latam’s CB hiking first, as here fiscal expansion came earlier and was stronger than in other EM (e.g., Brazil, Chile), followed by the CEEMEA region. Asia remained at the window, with almost no inflation spike thanks to subdued demand and well targeted subsidy policies on the most volatile prices (food and energy).

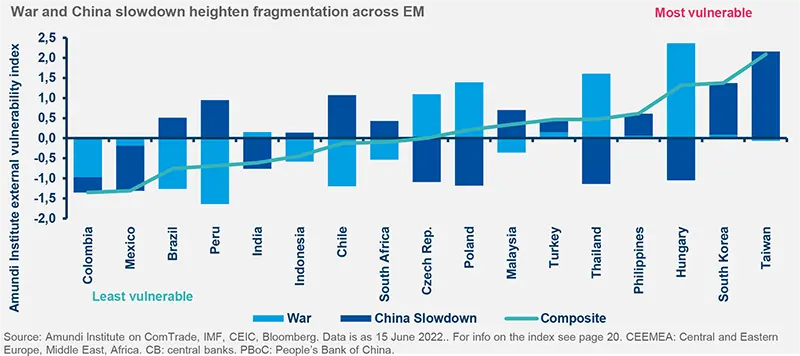

External vulnerability and Russia-Ukraine war

If a domestic factor such as inflation was the main monetary policy driver throughout 2021 and in early 2022, the global regime shift on interest rates has been pressuring CB to tighten or keep a hawkish stance for longer across EM.

Overall, EM external vulnerability has shrunk since the taper tantrum episode in 2013. However, when combined with fiscal stress – which increased sharply during the pandemic – in a world of rising rates, there could be idiosyncratic stories to monitor. Increasingly, idiosyncratic narratives matter and are turning into systemic episodes less often.

The impact of the Russia-Ukraine war has also been varied across EM, once again stressing how the EM world looks fragmented. Eastern Europe will suffer the most due to its direct trade and investment exposure with the conflict zone. On the other hand, the Middle East should benefit from high oil prices, partly offset by the food security issue. Latam countries – mostly net commodity exporters – could benefit from the higher export of oil, industrial metals and agricultural products. Asia’s connection to the commodity boom is mixed, with countries such as Indonesia or Malaysia set to benefit the most. However, this resilience depends on the ability of the two main Asian economies – China and India – not to incur in any secondary sanctions. This is the geopolitical dimension of fragmentation.

Focus on China

China presents a picture on its own, especially regarding its policy stance. Unlike other main global economies, China is on a monetary easing policy path, while fiscal policy remains supportive to restore household confidence and boost housing demand. The PBoC has accelerated its easing path, with the five-year loan prime rate cut by 15bp in May shortly after the mortgage rate floor was cut 20bp. A path of gradual easing is expected to continue in H2. Bigger support is also on its way on the fiscal policy side and is expected to add some 0.5-1.0 percentage points to real GDP growth in 2022 which should support a recovery in H2.

H2 2022 THEMES FOR THE GLOBAL ECONOMY

In H2 higher stagflationary risks will call for caution, but diverging economic and inflationary paths will offer opportunities.

INVESTMENT THEMES FOR H2 2022

AMUNDI ASSET CLASS VIEWS

1 CAUTION ON RISKY ASSETS, EARNINGS OUTLOOK IS WEAK

Current risky asset levels only discount monetary tightening

In 2022, the S&P 500 index has recorded its largest loss in the first five months of the year since 1970. As such, an assessment of whether the bulk of the risky asset correction is behind us is crucial. Our valuation framework suggests that, on one hand, investors have discounted the ongoing monetary policy tightening due to the high-inflation environment afflicting the global economy. On the other, current levels on equity and credit markets are not anticipating a profit or economic recession. Market narrative is not even fully discounting the deteriorating margin picture or the toxic mix of liquidity drain, deteriorating financial conditions and productivity disruptions that are emerging.

We stress the case for a cautious risky asset allocation during H2, waiting for more visibility on profits.

FOCUS: CORRELATION DYNAMICS

Unstable correlations offer room to search for tactical diversifiers

Looking at the evolution of correlation dynamics among the major asset classes over the past three years, we see that they have been highly unstable. In particular, in Q1 2020 the Covid-19 pandemic triggered a simultaneous significant rise in the correlation of risky assets (DM and EM equities, credit, EM bonds and commodities), with US Treasuries continuing to act as a unique diversifier together with Chinese aggregate bonds, amid the prevailing risk-off environment. In 2020 and in early 2021, the massive fiscal and monetary push, put in place to offset the economic damage from the pandemic lockdowns, acted as an additional force driving asset classes in the same direction.

Amid higher inflation, US Treasuries’ traditional diversifying role has diminished, while commodities emerged as a great diversifier; China’s equities and bonds also offer diversification benefits.

2 EQUITIES: LOOK FOR DEFENSIVENESS

Favour Value, Quality, and high and secure dividends

In 2022, the S&P 500 index has recorded its largest loss in the first five months of the year since 1970. As such, an assessment of whether the bulk of the risky asset correction is behind us is crucial. Our valuation framework suggests that, on one hand, investors have discounted the ongoing monetary policy tightening due to the high-inflation environment afflicting the global economy. On the other, current levels on equity and credit markets are not anticipating a profit or economic recession. Market narrative is not even fully discounting the deteriorating margin picture or the toxic mix of liquidity drain, deteriorating financial conditions and productivity disruptions that are emerging.

Focus on capital preservation and beware of counter trend rallies, notably when inflation is peaking.

3 EMERGING MARKETS: CHINA’S REBOUND IN SIGHT

Most negative factors are already priced in

Inflation is also a key theme across EM In the fixed income universe, we favour HC bonds in particular the HY segment, which should benefit from a strong USD and high oil prices We see less support for LC debt, which is more exposed to rising US rates and the ongoing monetary policy tightening across EM We remain cautious and tactically selective on EM FX as we move into H 2 due to USD strength, high inflation and weak macro momentum. We foresee selective opportunities across commodity exporter currencies, with improving terms of trade and stabilising or peaking inflation (Latam). Across equities, value is favoured in an inflationary environment and is concentrated in Latin America.

We favour Chinese equity and value markets such as Latam; in bonds, HC debt offers good entry points, as spreads currently price in most bad news and carry is high.

ESG INVESTING SUPPORTED BY REGULATION AND FLOWS

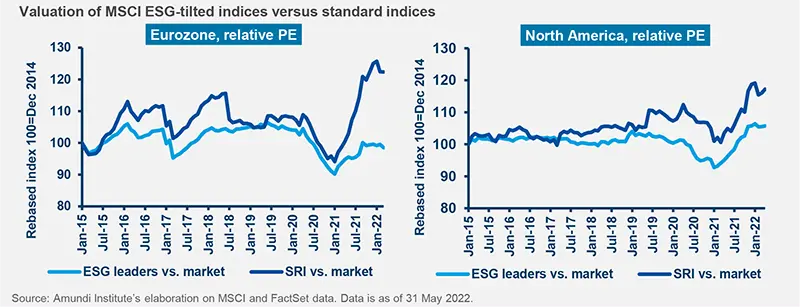

In recent years, ESG investing has emerged as a tidal wave sweeping away all investment approaches on its path. ESG-focused AuM has multiplied by 8.5 times in 2018-21 to reach $5.8tn*, with a staggering 208% growth last year. This extraordinary growth is spreading to every expertise (actively managed strategies, ETF, smart beta and factor investing), asset class (equities, fixed income, diversified investments) and markets.

The huge investor interest for ESG investing has created a demand-supply imbalance, triggering flow-driven price pressure on this market segment. These staggering amounts are sparking bubble fears, but popularity does not necessarily mean a bubble. Other factors, such as the valuation of ESG assets, the economic rationality of ESG, investment needs or the regulatory environment are an integral part of the overall equation and must be taken into account before concluding that a bubble for ESG assets exists or not.

From a valuation standpoint, the figure below compares the trailing PE ratio of the MSCI ESG-tilted indices in the Eurozone and North American regions over time to the trailing PE ratio of their parent indices. The different curves make it possible to directly assess the evolution of the ESG-tilted indices’ PE premiums that investors are willing to pay. The MSCI ESG leaders and MSCI SRI indices target respectively a 50% and 25% sector representation compared to the parent index, aiming to include companies with the highest MSCI ESG ratings in each sector. As such, SRI indices mainly consist of pure-player companies that are pioneers in their field of activity through the development of specific know-how or innovative technologies.

We find that most ESG assets are correctly valued on average. Nevertheless, some very specific assets usually associated with thematic strategies or green assets may be highly valued temporarily relative to the broader market. At end-March, we estimate the SRI PE premium at 23.5% and 17.2%, respectively, compared to their standard counterparts in the Eurozone and North America. These niches require further analysis to determine whether a premium is justified.

Beyond the pure valuation aspect, environmental, social, and governance considerations have fully reshaped the finance industry’s approach to sustainability. These extra-financial criteria have provided investors with a holistic approach to risk management, allowing a full understanding of the companies they invest into. Their contribution is such that ESG investing has become the new standard in the finance industry. Far from being a simple fashion phenomenon, we believe these changes are irreversible.

In addition, ESG investing benefits from a favourable environment, which also promotes its deep roots in our daily lives. It echoes a desire expressed by civil society to save the planet and act for the good of humanity. From a rationality standpoint, the challenges that society faces (i.e., global warming, energy transition, social inequality) require colossal investment and remain overwhelmingly underfunded. Lastly, the evolution of the regulatory framework (e.g., the SFDR in Europe) is a real support by creating a favourable environment for sustainable investments.

In view of these elements, ESG flows should continue to drive the market, particularly outside the Eurozone, partly thanks to the upcoming evolution of the regulatory framework. However, irreversibility does not mean perpetual imbalance. Eventually, once equilibrium is reached, ESG assets will no longer benefit from this upward price pressure and should underperform the broad market because traditional market mechanisms will take over. By traditional market mechanisms, we mean the usual risk premiums, above all the carbon risk premium, which should fully occur because it represents a risk that is set to last.

The authors would like to thank Alexandre Drabowicz for his helpful contribution to this piece. *Source: Broadridge. AuM: assets under management. ETF: exchange-traded funds. EPS: earnings per share. PE: price-earnings ratio.

4 BONDS: MORE APPEALING FOLLOWING MARKET REPRICING

Bond yields have probably gone too far in discounting CB action

Despite intensifying growth concerns, inflation risks remain supported by higher-than-expected CPI prints, driving bond yields up, alongside the upward repricing of the expected rate increase path, both in Europe and in the US. The ECB’s hawkish turn is adding upward pressure on bond yields and peripheral spreads. This picture supports our expectation for a flatter yield curve and reinforces our cautious stance on periphery debt and EU corporate bonds, confirming our preference for US IG debt in credit markets.

The repricing in government bond yields has restored some value, favouring less negative duration positioning.

5 KING DOLLAR NOT YET READY TO BE DETHRONED

Play the highest quality carry; stay long dollar in H2

USD proved a good diversifier in 2022 and is up against most G10 currencies YTD. We think it is too soon to call for a peak, as uncertainty regarding Fed action remains high, supporting the greenback. We expect the USD to prove strong in H2, with both cyclical and structural factors supporting the move. Tighter US financial conditions would be a strong test for most G10 currencies. From a cyclical standpoint, JPY and CHF are the only alternatives to the greenback.

Slowing global growth and a hawkish Fed will support the dollar in the short term; we think it is too early to call for a peak in the dollar trend.

6 COMMODITIES: DISPERSION IS SET TO SOAR

Energy to lead in the short term, followed by base metals later

We expect oil prices to stay high for longer, as supply scarcity offsets moderating demand. OPEC should be unable to boost output or unwilling to lose spare capacity, while Russia’s production should erode due to EU sanctions. Elsewhere, US producers should stay focused on their energy transition, while Iran is unlikely to add much production in 2022. In contrast, the poor oil demand-price elasticity and China’s reopening should floor demand. Often in a super-cycle, the purgatory for base metals may be prolonged, as the segment digests richer valuations and a structurally slower Chinese economy. Waiting for green demand to take off, their cyclicality is a hurdle as global growth decelerates.

A diversified allocation may benefit from commodities’ highly heterogeneous drivers.

7 REAL ASSETS IN FOCUS DURING INFLATIONARY TIMES

Real assets have proven to be positively correlated to inflation

We are constructive on real assets due to persistently high inflation and slower growth momentum, as they have proven to be efficient portfolio diversifiers when CB hike rates and shrink their balance sheets. Another element supporting our view is the energy transition, which should support demand for some specific metals and energy segments. The green transition will also benefit natural resources and infrastructure investments. With reference to specific asset classes, our preference lies with infrastructure debt, thanks to its low beta to growth and its ability to generate stable cash flow.

We foresee opportunities in all real assets segments, while focusing on protection against inflation and on the generation of stable cash flow.

ECONOMIC FORECASTS

FINANCIAL MARKET FORECASTS

Definitions and abbreviations

Alpha: The additional return above the expected return of the beta-adjusted market return; a positive alpha suggests risk-adjusted value is added by the money manager compared with the index.

Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

Currency abbreviations: USD: US dollar, JPY: Japanese yen, GBP: British pound, EUR: euro, CAD: Canadian dollar, SEK: Swedish krona, NOK: Norwegian krone, CHF: Swiss Franc, NZD: New Zealand dollar, AUD: Australian dollar, CNY: Chinese renminbi.

Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years.

FX: FX markets refer to the foreign exchange markets, where participants can buy and sell currencies. High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market.

Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss.

PE ratio: The price-to-earnings ratio (PE ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

Quantitative easing (QE): QE is a monetary policy instrument used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

Quantitative tightening (QT): QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.

Yield curve flattening: An environment in which the difference (spreads) between yields/rates of short-term and long-term bonds of the same credit quality reduces.