Summary

The autumn hard vs. soft landing puzzle

The summer season has temporarily brought some sunshine to investors as the main equity markets had been rallying until mid-August. Supporting this trend was a series of assumptions on key themes driving the market: inflation was assumed to be at its peak and starting to recede; growth was assumed to be on a soft landing path; and central banks were assumed to have done most of the work needed.

Back in June, we thought a rebound was in sight as the market had oversold amid a still-resilient US economy and this underpinned our preference for the US equity market within an overall cautious to neutral equity allocation. The main story supporting the market over the summer was the expectation of a possible pivot by the Fed, after its more-hawkish-than-expected actions so far. In a ‘bad news is good news’ scenario, the negative quarterly US GDP number supported this narrative. With Q2 earnings season still showing positive trends, the buoyant market environment has translated into looser financial conditions, further complicating the task for central banks. Now that the Fed has reasserted its hawkish stance, we are starting to see some further downward movements, which we think may continue as markets have further to go in the repricing of higher real rates. At this point, we see no positive triggers to keep the rally going, while there are rising risks moving into autumn amid a gloomier economic backdrop. To cope with this environment, we believe investors should adjust their asset allocation stances. In particular:

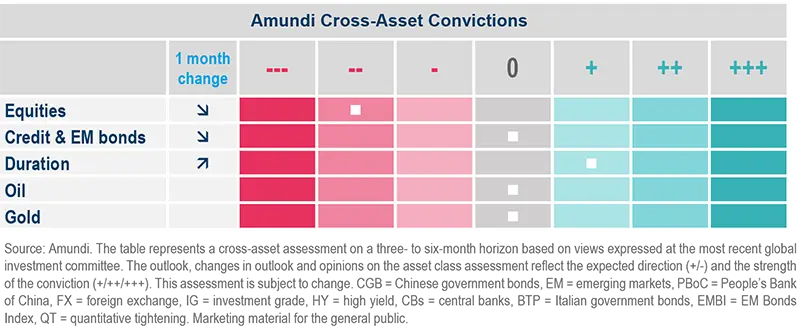

- It’s time to reduce equity exposure and become more defensive. While a global recession may be avoided, after the recent rally there are no elements supporting a positive stance in equity markets while risks are increasing. Taking into consideration the factors that may bring volatility in the short term (CBs’ communication, news flow related to the energy crisis, some global macro weakness), we have started to move to a more cautious stance on equities.

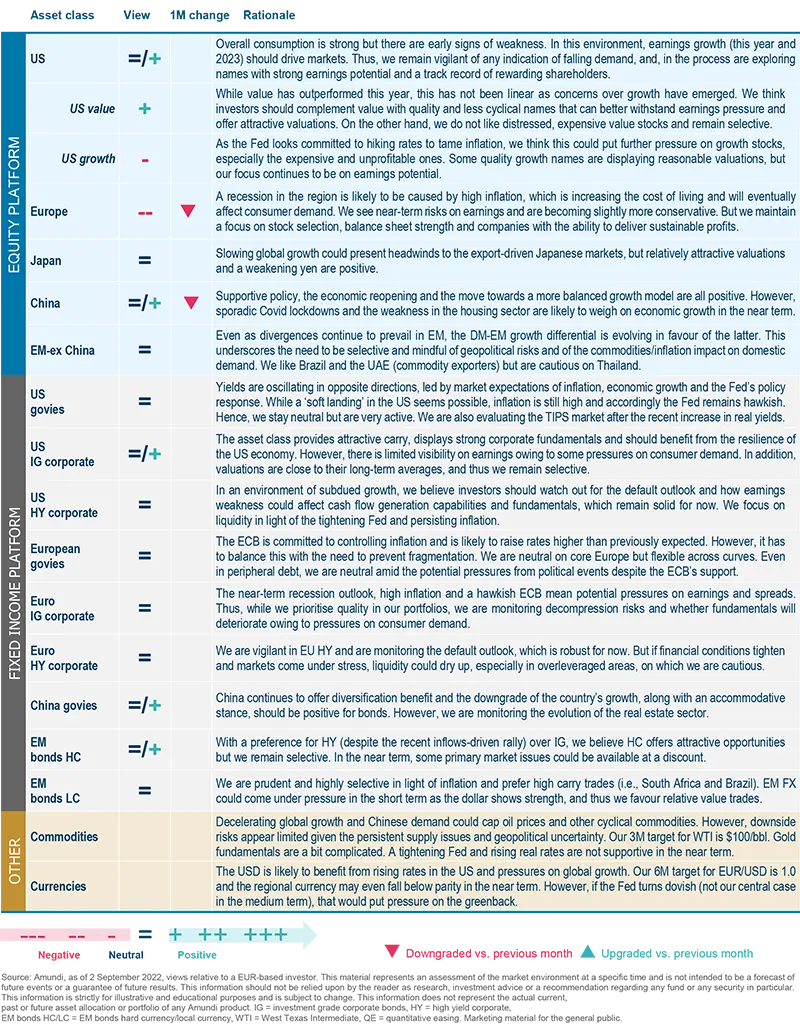

- In equities, we keep our preference for the US vs. Europe and also for China, though on China to a lower extent than before amid the volatility driven by Covid restrictions and a weak housing sector. Even if the US economy is decelerating, it remains far more resilient than Europe. With contracting margins, squeezed consumers and decelerating economic activity, there is a limit to how much pricing power and top-line growth companies can deliver. While Q3 corporate results should be resilient, we could see earnings turn negative in 2023. As a result, overall we are now more defensive than before and particularly selective.

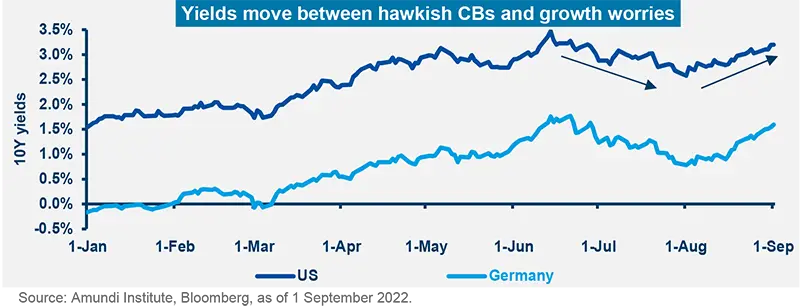

- Bonds are back, but an active approach is paramount given the still-high uncertainty. After the great repricing in the first half of the year and as we move to an environment with a higher risk of recession, government bonds are worth looking at as yields are now more appealing. Here we recommend a tactical approach to duration management, considering markets are being driven by both inflation and growth expectations, pushing yields in different directions depending on the prevailing narrative. In credit, we remain cautious, particularly on the high yield segment. We favour the investment grade space and the US over the Eurozone, as US fundamentals are at less risk of deterioration thanks to the more resilient economy. We emphasise that an active management approach in bonds is key at this stage amid the risks of a further pick-up in inflation due to energy prices and supply chain disruptions, possibly leading to a more hawkish Fed stance than is currently priced in by the market.

- Emerging markets (EM) offer selective opportunities. Despite the macroeconomic headwinds, we do not see systemic risks for EM though we believe there is a higher probability of an idiosyncratic crisis, therefore a highly selective approach is needed in the EM space. Downward revisions to EM have been more subdued than for DM, confirming the growth differential in favour of EM despite the downward revision of China. In terms of investment opportunities, overall EM equity appears cheap and earnings expectations are stabilising. We look for opportunities in LatAm (Brazil) but are cautious on some Eastern European countries (Hungary and Poland). In the EM debt space, there are some interesting income opportunities and our preference is for hard currency bonds, in particular those in the high yield space.

Looking ahead, the probability of downside risks remains high while the inflationary environment is confirmed. A further fundamental deterioration could trigger another correction, with the second-round effects of monetary policy on the economy being the potential catalyst for de-risking. Therefore, this is a time to keep a cautious view and be vigilant towards the evolution of the economic backdrop.

Big picture in short

Three hot questions for investors

| Monica DEFEND Head of Amundi Institute |

Are we moving towards a global recession?

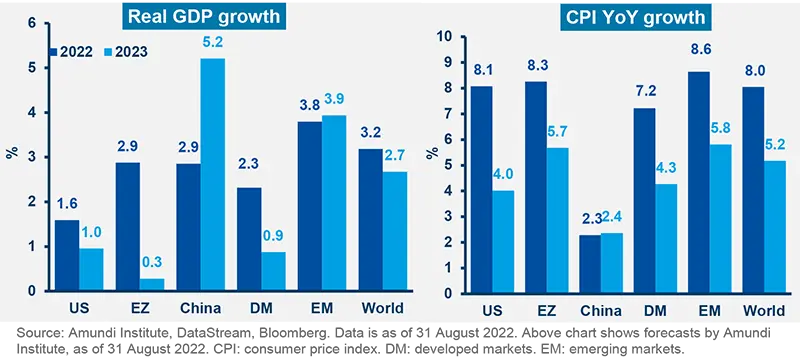

The growth outlook has certainly darkened over the summer, with the risk of gas rationing in Europe, a China slowdown and the technical recession in the US in the spotlight. Our central scenario has become gloomier, with downward revisions to our GDP forecasts for the US, the Eurozone, the UK and China. In Europe, a stagflationary shock looks to be a certainty, and the increasing challenges on the gas front imply that it will be prolonged, with both the last quarter of this year and the first quarter of 2023 showing negative GDP growth. In the US, a soft landing still looks to be within reach, but the risks of recession for mid-2023 have increased. The deterioration in US economic activity is not yet a product of the ongoing Fed tightening, and labour market is still strong although cracks are starting to appear. The Q2 GDP reading marked a technical recession, but the most recent estimate of it and of gross domestic income still point to an expanding economy. These inconsistencies in the data further complicate any assessment of the health of the US economy. On the China front, growth has been revised down further. The housing recovery is now foreseen to be much weaker than previously expected, but the picture is still one of recovery. For the rest of the year, we see the continuation of the post-Covid reopening and the supportive policy mix being the main drivers of the economic rebound, but the risk of recession in China should also be on investors’ radars as short-term challenges persist.

Is inflation cooling?

Inflation remains high, with CPI YoY at 8.5% for the US (down from 9.1% in June) and 8.9% in the Eurozone (up from 8.6% in June). As the global economy decelerates, bottlenecks and price pressures are easing, but remain high. This should push down goods inflation but services inflation is still picking up, causing overall inflation to stay high, although declining at different speeds across the world, with energy inflation being the key source of divergences. The Eurozone currently faces the most significant challenges. Inflation should reach a near double-digit peak in winter and then decelerate from 2023. Higher natural gas bills (the natural gas price is more than seven times higher than a year ago) may be followed by other increases. Overall, we expect inflation numbers to remain volatile and this will further complicate CBs’ assessments of the effectiveness of their actions.

What should we expect from central banks?

Central banks remain committed to fighting inflation, as recently reaffirmed during the Jackson Hole meeting, where the hawkish message sent to the market was that curbing inflation is the top priority. However, as history has shown, CBs should not declare victory too early. With high wage growth far from the desired level and hot, albeit decelerating, inflation, the Fed will raise rates above the neutral level and we now expect a 75bp hike in September, followed by 25bp in each of the following three FOMC meetings, leading to a terminal rate of 4%. The ECB will also fight inflation and may raise rates too much. The July decision to hike rates by 50bp rather than the previously announced 25bp, drop forward guidance and become completely data-dependent went in that direction: namely, to frontload and make the best use of the limited window of opportunity before growth becomes impaired. The TPI announcement indirectly supports this more active strategy. Our expectation points to hitting a terminal rate of about 1.5% at year-end. A 0.75% hike in September is now on the cards.

As we wait for more clarity on the economic cycle, we see limited visibility on earnings and hence, we have become more cautious in equities, upgrading duration.

Reduce risk amid high uncertainty

| Francesco SANDRINI Head of Multi-Asset Strategies |

John O’TOOLE Head of Multi-Asset Investment Solutions |

Markets retracted recently despite the better-than-expected Q2 earnings because companies released subdued guidance. We think the market’s earnings expectations are too optimistic, even after the recent downward revisions. As a result, we are more cautious on risk assets but do not think this is the time for structural de-risking. Instead, investors should adjust their exposure by adding safeguards in light of recessionary environment, particularly in Europe. Incidentally, this also makes us more vigilant on European equities and slightly less positive on China. On the other hand, there are opportunities to benefit from the different economic backdrops prevailing in EM. Overall, investors should explore a broad array of assets to keep a diversified stance (commodities, FX), along with sufficient hedges.

High conviction ideas

We are cautious on equities overall, even as we tactically downgrade Europe because the region is more exposed (than the US) to the worsening stagflation risks. Consequently, we remain committed to our relative preference for the US over Europe. This is because the stabilisation of real yields in the US, attractive valuations and a better environment for quality/growth markets should favour the US over Europe. In EM, we are constructive on China but believe the zero tolerance for Covid and the malaise in the housing sector will weigh on equities in the near term. In FI, we are now slightly positive on duration through US (after US 10Y yields moved above 3.0%) but are neutral on core Europe. At this stage, a hawkish Fed is supportive of curve inversion, which should create higher short-term yields and simultaneously put downward pressures on the long-term curve. However, this does not mean we are calling a US recession. In core Europe, there is a bit more ambiguity over the ECB’s policy moves. Together with controlling inflation, the ECB aims to avoid fragmentation in the EZ, for example, in Italy. We think the ECB will maintain its support for peripheral markets such as BTPs, allowing us to stay marginally constructive, but we are monitoring political events. In the UK, we are positive on 5Y real rates. We continue to believe that the BoE rate hikes priced in by the market are excessive given how weak the economy is, thereby putting less pressure on the extent to which real rates could rise. On EM bonds, we are neutral. Corporate credit is a mixed bag and while we favour US IG over EU, we are neutral overall. Even though there is a hint of investor confidence in Europe, we remain cautious on EU credit, but keep an active eye on high-quality segments. On the other hand, the US IG market is showing strong corporate fundamentals, a better economic outlook (vs. Europe), attractive valuations and the potential to stay resilient in case of a further deterioration in credit sentiment. However, it’s important to monitor the effects of inflation and CB policy on markets. Global divergences and geopolitical tensions (flight to safe haven) are creating relative opportunities in the FX space. In EM, we are now constructive on IDR vs. CNH as the rupiah could gain from the rate hiking cycle in Indonesia and inflows into the domestic bonds market, given the country’s improving fiscal position. We stay positive on Brazilian Real vs. some Eastern European commodity importer countries (Poland and Hungary). In DM, we are positive (but less so) on CHF vs. EUR given the persistent geopolitical risks, and on the USD vs. both the CAD and the EUR. With respect to the NOK, which has benefitted from a surprisingly hawkish Norwegian CB, we keep our positive view vs. the CAD. But we are monitoring the former as it is a cyclical FX which could be penalised amid a risk asset sell-off.

Risks and hedging

Risks around Q3 earnings and economic growth are growing and as a result we recommend investors keep in place all equity hedges on European and US exposures. Furthermore, the USD is likely to gain in the near term, supported by the Fed’s hawkish stance. Thus investors’ US hedges should reflect that.

As we wait for more clarity on the economic cycle, we see limited visibility on earnings and hence, we have become more cautious in equities, upgrading duration.

More constructive in bonds, but selective in credit

| Amaury D’ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Elevated inflation, aggressive Fed and ECB, and market expectations are driving yields and risk assets. While the view that inflation could be brought under control caused some moderation earlier, the recent hawkish comments from policymakers have put upward pressure on yields. Deteriorating economic growth, particularly in Europe, is further complicating the environment. Thus, it is important at this time to understand to what extent, if any, central banks may revise their hawkish stances to help economies navigate the upcoming recession fears. This translates into a preference for an agile approach, and a focus on liquidity and quality across the board in risk assets. Opportunities are available in EM bonds but we suggest being selective.

Global and European fixed income

We have a close to neutral view on duration but maintain the flexibility to alter this stance. Thus, we reduce our cautious stance slightly on the US and remain neutral/marginally defensive in core Europe. Regarding semi-core and periphery, spreads are contained, but we prefer to remain neutral /cautious on peripheral debt for now. Elsewhere, we are exploring opportunities in the UK, where we are neutral, and in Japan (cautious), but we see diversification benefits in Chinese government debt. On breakevens, we upgrade our view slightly in the US and the Euro area. In corporate credit, we are mindful of spread decompression risk and suggest investors stay neutral. In addition, we favour quality (upper IG) and less risky debt higher up in the capital structure. Even in HY, we favour subordinated debt from IG issuers. We also think there are attractive opportunities in primary markets, i.e., financials in Europe, but investors should be selective and aware of the liquidity risks. At a sector level, we selectively like financials.

US fixed income

Markets are oscillating between the narratives of a decelerating economy and a hawkish Fed, which has managed to restore some credibility with respect to dealing with inflation. On the other hand, financial conditions have eased despite the tightening comments from the Fed. Thus, while we stay neutral on duration, we are very active and tactical in adjusting/upgrading our stance depending on the extent of yield movements. We are also monitoring real yields – after their recent upswing – to evaluate better entry points in TIPS. In credit, agency MBS spreads are back to fair value now, and thus we think investors may consider reducing their spread duration. We maintain selectivity in credit and we are tracking the recent rally in IG and HY, where valuations are now close to their long-term averages. While we are constructive in IG, we are cautious on HY owing to concerns on fundamentals and earnings. Overall, we keep an agile stance amid limited visibility ahead.

EM bonds

We are cautious on EM duration but acknowledge that monetary policy normalisation in EM is advanced vs. DM, hence there are opportunities in HC (prefer HY to IG). In LC, we are highly selective due to inflation uncertainty and the different tightening pace across countries, but we like high carry countries such as South Africa and Brazil. In China, we are monitoring the growth deceleration, geopolitical risks and government policies.

FX

The evolution of Chinese growth and geopolitical tensions in Europe are creating a complicated environment for FX. While the USD should continue to benefit from global uncertainties in the near term, EUR, GBP, CNH and other cyclical FX are likely to stay depressed. In EM, we like MXN and CLP.

GFI = global fixed income, GEMs/EM FX = global emerging markets foreign exchange, HY = high yield, IG = investment grade, EUR = euro, UST = US Treasuries, RMBS = residential mortgage-backed securities, ABS = asset-backed securities, HC = hard currency, LC = local currency, MBS = mortgage-backed securities, CRE = commercial real estate, QT = quantitative tightening

The market’s belief in ‘higher for longer rates’ and their subsequent effect on economic growth is creating opposing pressures on yields, calling for an agile stance.

Quality and earnings resilience in focus

| Kasper ELMGREEN Head of Equities |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Overall assessment

High inflation (aggravated by gas/commodity prices) and weak consumer sentiment are affecting real incomes and subsequently discretionary spending. However, markets seem to believe in an ideal scenario where the CBs will be able to control inflation without inflicting a meaningful recession. While we could see some near-term stability in multiples if yields stabilise, earnings will still drive the market’s direction in the medium term and this is where some cracks may emerge. As a result, our priority is to complement stock picking with a quality and value approach to identify companies that reward shareholders. We believe in the relative resilience of the US and China, but also recognise the geopolitical and economic headwinds faced by the latter.

European equities

We are a bit more selective now as earnings this year and next could be affected in light of the limited forward visibility. In this environment, investors should keep a balanced approach, focusing on attributes such as the pricing power of companies, their individual strengths vs. competitors and product differentiation. We also believe this is the time to prioritise balance sheet strength. At a sector level, we like defensive stocks in staples and defensive industrials. But common factors across our portfolios are how valuations correspond with the earnings capacity of a business and what’s the quality of those earnings. On the other hand, we raised our cautious stance on information technology and remain defensive on energy. Overall, we believe investors should stick to fundamentals and look beyond the near term.

US equities

The Fed has clearly indicated its resolve to control inflation, even if this means putting the brakes on the economy. On the other hand, earnings estimates still look too optimistic and will be revised down, though not soon enough because usually such revisions are not good at predicting a slowdown. We think in this environment investors should maintain a focus on earnings and valuations. On the latter, we observe that the traditional defensive sectors are expensive and offer little value with respect to long-term returns. We do not like such overvalued stocks and the ones in unprofitable growth. In general, we are focusing on companies with resilient operations and a strong track record of rewarding shareholders through dividends/share repurchases even during a recession. However, cyclicals, which are typically affected by a decelerating economy, have been battered. This is true particularly in the more quality-oriented areas of the market, which now look attractive. These valuations are a source of a major internal debate as we evaluate the extent of the recessionary impact by staying patient and selective.

EM equities

We are cautious on EM amid geopolitical risks (China/Taiwan/US), the current macro tightening cycle and the continuation of the war in Ukraine. However, attractive valuations and large divergences persist. Our main sector convictions are discretionary and real estate, plus a preference for energy. We favour countries such as Brazil and UAE at a time when we are slightly less positive on China due to near-term uncertainties. Finally, we increase our confidence on value over growth.

This has been a year of multiples derating in anticipation of the slowdown, which is reflected in weak leading indicators. Thus, we stay selective and are prioritising balance sheet strength.

Amundi asset class views

Definitions & Abbreviations

- ADR: A security that represents shares of non-US companies that are held by a US depositary bank outside the US. They allow US investors to invest in non-US companies and give non-US companies access to US financial markets.

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS.

- Capital structure: The combination of debt and equity used by a company to finance its operations. The higher up a debt in the structure, the higher quality it is because holders of this debt have a first claim to a company’s assets as compared to holders of lower-ranked debt.

- Curve flattening: A flattening yield curve may be the result of long-term interest rates falling more than short-term interest rates or short-term rates increasing more than long-term rates.

- Curve inversion: When long-term interest rates drop below short-term rates, indicating that investors are moving money away from short-term bonds.

- Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than short-term interest rates or short-term rates dropping more than long-term rates.

- Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash.

- Core +: This is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core + property owners typically have the ability to increase cash flows through light property improvements, management efficiencies or by increasing the quality of the tenants. Similar to core properties, these properties tend to be of high quality and well occupied.

- Core strategy: This is synonymous with ‘income’ in the stock market. Core property investors are conservative investors looking to generate stable income with very low risk. Core properties require very little hand-holding by their owners and are typically acquired and held as an alternative to bonds.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

- Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years.

- High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market.

- Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss.

- P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

- QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed at decreasing the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Rising star: A company that has a low credit rating, but only because it is new to the bond market and is therefore still establishing a track record. It does not yet have the track record and/or the size to earn an investment grade rating from a credit rating agency.

- TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

- Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.