Summary

Searching for bright spots in a trickier phase

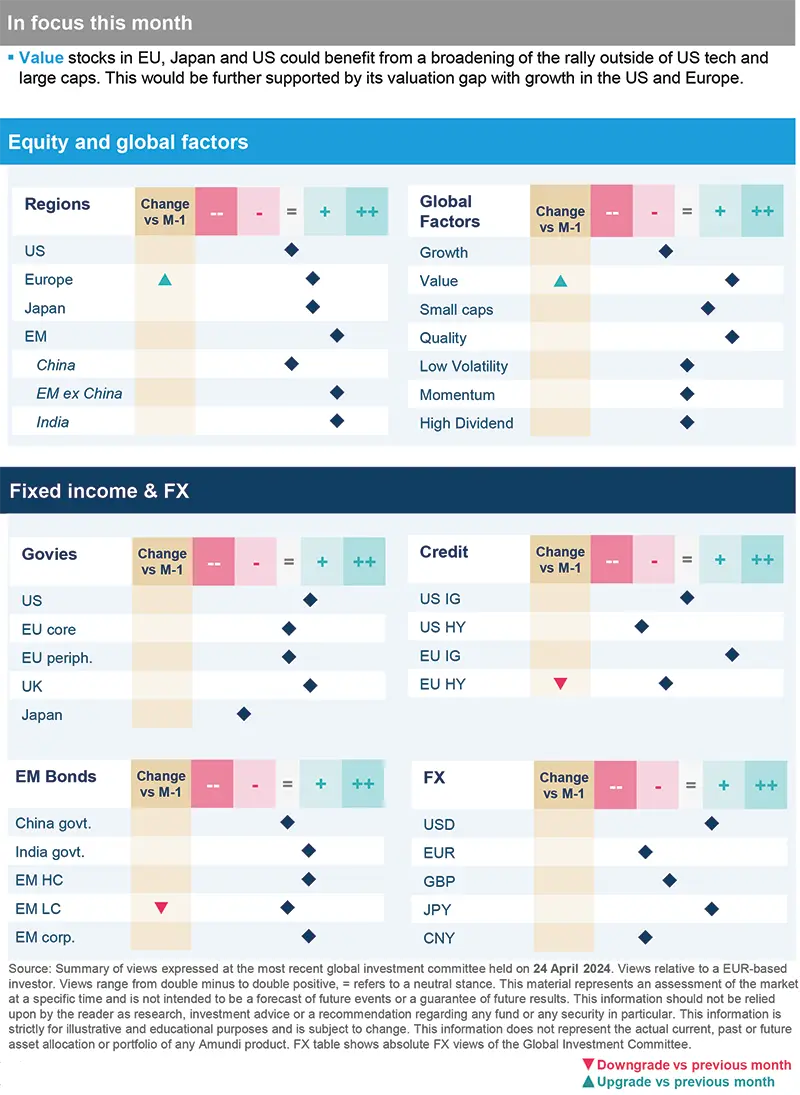

As uncertainty on Fed policy and inflation fronts persists, we think bright spots can be found in attractively priced equities, and investment grade credit. EM bonds are attractive from a medium term perspective.

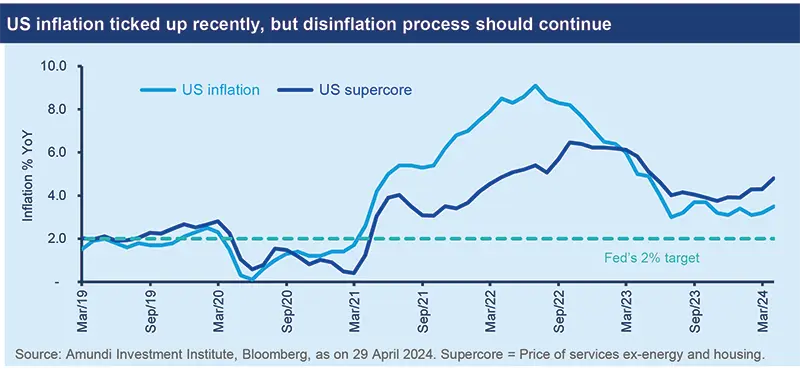

Recent inflation and growth data from the US indicates continued strength in the economy, leading us and various institutions including the IMF to revise up US growth. We see the current strong momentum to continue into Q2 but expect a deceleration in H2, without negative growth in any quarter. Data on the inflation side also points to stickier prices, with upside risks from the recent geopolitical escalation (oil). This opens a difficult phase for central banks such as the Fed for which we expect fewer rate cuts but higher uncertainty around policy actions. In addition, investors should assess the following factors:

- The dichotomy in US economy. Small business vulnerability to high rates vs large business resilience and the low income households fragility vs the high income strong consumption are key features of this cycle. Higher for longer rates will further increase these vulnerabilities. We still see the Fed cutting rates but at a slower pace, with a small risk of no cuts.

- Europe shows a clearer picture vs US allowing the ECB to start cutting earlier. Here as well we see slower rate cuts and also highlight that divergences in Central Bank actions will require FX to be closely monitored.

- Emerging markets offer bright spots to consider. Asian economies in particular prove overall much more resilient and more autonomous/driven by regional forces. India remains a bright spot and a structural growth story.

- Rising geopolitical risks will affect overall market visibility. With inflation risk in focus, geopolitics is increasingly relevant for oil prices, while demand for gold as a safe-haven diversifier could support the metal.

Markets seem to have priced in much of the good news on resilient growth and slowing inflation, and there are risks to consider. Investors should focus on these bright spots that could provide better risk-return:

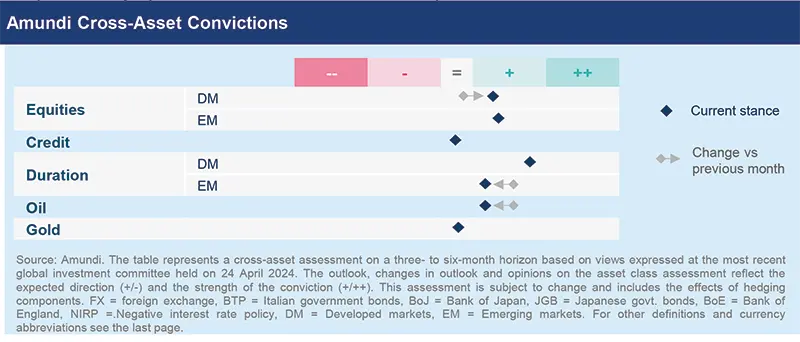

- In cross asset, we maintain a slightly constructive view on risk assets but focus on resilient market segments. US duration offers potential but we continue to diversify into Italian BTPs. On Japanese bonds, however, we are cautious. In our view, Euro high quality is the brightest spot in credit. We also like EM debt for carry, but we slightly reduced our stance as sticky EM inflation lowers the potential for further rates compression. In equities, we are positive on Japan and now also on the UK. We did some recalibration in EM towards our long term convictions. While we are positive on India, Indonesia and South Korea, we reduced the stance on Korea slightly but turned positive on Mexico.

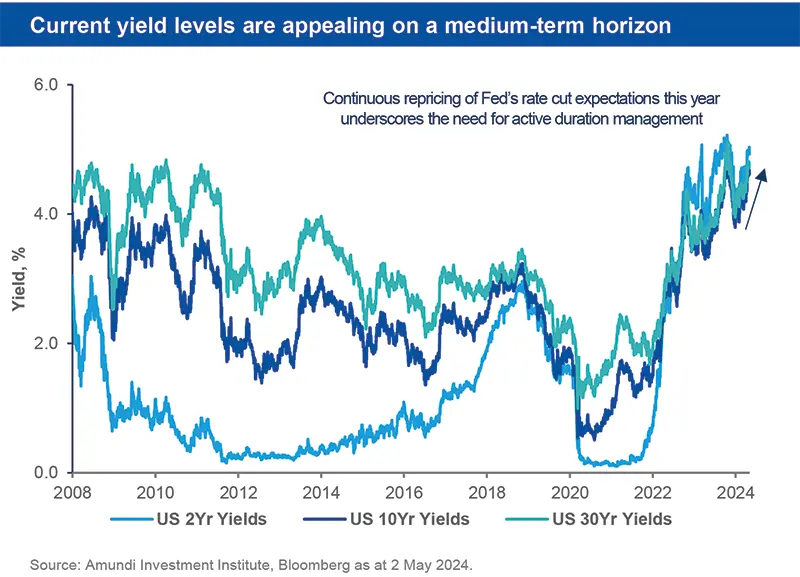

- With an active duration stance overall, we have reduced our expectations of Fed rate cuts owing to strong US growth and inflation. However, rates volatility would remain high. There is good value in the short to intermediate portion of the US Treasury curve. In Europe, we are neutral on duration, positive on UK but cautious Japan. Selection is important in credit, leading us to maintain our preference for investment grade (IG) over high yield (HY), both in Europe and the US.

- In equities, there are signals of rotations within equity markets, that favour global equity approaches. We expect top-of-market earnings to decelerate in the US, supporting a catch-up of the rest of the market which should favour an equal weighted approach. In Europe, we stay balanced and slightly raised the tilt towards defensives through utilities. Overall, we are positive on industrials and consumer staples and cautious on tech and consumer discretionary (slightly less though).

- We are positive on EM, but recognise that sentiment in bonds is less supportive due to a delayed Fed pivot/fewer rate cuts). However, yields remain attractive and so is economic growth. In hard currency, we prefer HY over IG due to better valuations and carry. The EM universe offers plenty of opportunities even in equities. We choose to be more selective in favour of Brazil, Mexico, Indonesia, India and Korea (slightly less than before). But geopolitical risks present a major overhang.

Three hot questions

|

Monica DEFEND |

Europe is displaying a clearer picture with respect to continued disinflation vs the US, and hence this leaves room for the ECB to act before the Fed.

1| What is your outlook for US and European growth?

We upgraded our US growth expectations from 1.8% to 2.3% for this year, but still see a deceleration in the second half. Inflation, which is key for the Fed’s decisions, could be sticky and disinflation slower than anticipated. But the overall disinflationary trend is likely to continue, albeit inflation volatility will remain high. We think Fed rate cuts will be fewer in number (than expected before), starting in H2. But uncertainty is high as the central bank is keenly monitoring incoming data. In EZ, we lifted our growth forecasts for 2024 owing to better trade and domestic demand, with divergences across countries.

Investment consequences:

- Equities: Favour US equal weighted over market capweighted; positive Japan and the UK

- Close to neutral/positive US duration

2| How do you view the Q1 GDP growth data for China?

Q1 GDP growth at 5.3% (YoY) was definitely above our and market’s expectations but this doesn’t change our cautious outlook (a similar sharp jump was witnessed in 2023 reopening). Given this better Q1, we revised up our full-year forecast to 4.5% but lowered our Q2 growth expectations to take into account reversal of consumption growth. Deteriorating capacity utilisation signal underlying weaknesses in domestic demand and persistent excess capacity. In addition, housing markets is not showing signs of stabilization.

Investment consequences:

- Neutral on China govies and equities

- Cautious on CNH

3| Do you expect the rally in gold prices to continue this year?

Gold prices have been rising despite prospects of a delayed Fed pivot and expectations of fewer rate cuts. Although we may see a pause in the near term, the metal could benefit from near-term doubts over disinflation process, geopolitical tensions and fiscal profligacy of governments. Increasingly, as the world becomes more multipolar, governments and central banks would like to diversify away from the dollar and gold could benefit from that in the long run. On oil, geopolitical risks in the middle east are supportive but we think the upside is still limited, given ample spare capacity.

Investment consequences:

- Gold: 6M target upgraded to $2,300/oz.

- Oil: 6M target $85/bbl for Brent.

MULTI-ASSET

Recalibrate amid an evolving global economy

|

Francesco SANDRINI |

John O'TOOLE |

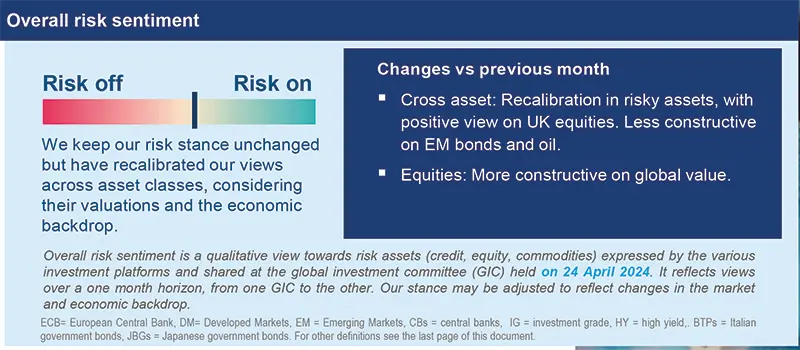

Amid better-than expected growth in developed markets, we keep a slightly positive risk stance, with a preference for equities over credit.

As the year progresses, we are getting more clarity on how economic growth and inflation are behaving in the developed world. Growth is resilient and inflation stalling but not resurging. Central banks are still expected to move towards cutting rates, albeit more cautiously. This backdrop is positive but is already priced in by the markets. Thus, investors should look across asset classes and within each region to adjust their stance and explore ideas offering robust risk-reward potential in Pan-Europe and EM.

In this economic environment, we turned slightly constructive on DM equities, mainly through the UK and our existing positive views on Japan, whereas we stay neutral on the US. UK markets should benefit from high dividend, low valuations and exposure to energy sector. In EM, we are positive on Asia. But we adjusted our views, becoming slightly less positive on South Korea and diversifying our stance in favour of Mexico.

Our stance on US duration remains positive. Yields have risen significantly since the start of the year amid market’s assessment of Fed actions. We acknowledge this hawkish assessment but continue to believe that rate cuts would still materialise this year. The picture is slightly more clear in Europe where we stay constructive, and even on Italian BTPs we are positive. But on Japanese bonds risk-return profile appears asymmetric, leading us to remain negative. Japanese growth and inflation are main risks to monitor.

On the other hand, European IG credit remains a bright spot to us. This segment should benefit from better valuations vs HY, and a clearer path of monetary policy easing by the ECB. In EM bonds, while we remain positive, we think stickier inflation in the US may lead the Fed to reduce rates by a lower than expected amount. This may affect US dollar and returns from EM bonds in the near term.

USD may benefit from a move up in US yields and a spike in rates volatility. Thus we stay positive on dollar in short term and are no longer cautious on the currency against the yen. However, yen should do well against the CHF, and the regional FX EUR/GBP is likely to benefit from better carry. In addition, we are constructive on INR/CNH and BRL/EUR.

Hedging for US duration and geopolitical risks is crucial, and oil provides an attractive backdrop for the latter. But after the strong oil price movements this year, we slightly reduced our stance on the commodity.

FIXED INCOME

Bonds remain attractive on a medium-term horizon

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

The latest US inflation readings have led the markets to assess the relevance of ‘higher for longer rates’ narrative as the Fed shows signs of delaying rate cuts. This more nuanced picture, has made US policy actions difficult. Consequently, this is a time to be very active on duration, and monitor inflation carefully. Bond yields are still attractive from a medium to long term perspective. And given that we expect rate cuts in the US and EZ to materialize this year amid a backdrop of weak growth, bonds offer strong value amid continued disinflation. In risk assets, quality is the way to navigate this environment, and investors may explore yields in high grade segments in developed and emerging markets.

- We believe EZ growth would be muted but slightly better than expected.

- This tricky situation calls for a flexible approach to duration. For now, our view is neutral overall, mainly through Europe. But we are positive UK.

- We like quality EU credit mainly through financials and subordinated debt. In HY, we are selective and becoming more cautious amid the recent spread tightening, in particular in low quality credit.

- Current nominal and real US rates levels support a positive duration stance with an active management approach to benefit from market movements.

- In corporate credit our preference is for IG vs HY. We are increasingly positive on shorter maturities amid flat credit curves. Sector wise, we prefer financials to non-financials.

- Securitised credit still offers long-term value, but we are selective after the recent strong performance.

- Sentiment has deteriorated a bit recently amid a more prudent Fed and its views on rate cuts. We remain positive on HC debt, while we are increasingly selective in LC.

- We continue to favour HY vs IG given the high carry.

- We like countries with good fundamentals, and those that are part of the global easing cycle such as Brazil, Mexico and Peru in LatAm. In Asia, Indian bonds should gain from inclusion in major benchmarks.

EQUITIES

Search for relative value in Europe and Emerging Markets

| Barry GLAVIN Head of Equity Platform |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

The rally this year has been led by optimism around tech and US large caps, and resilient growth so far. But stocks may see a breather now as the rally broadens towards other regions and segments. For instance, a slightly better growth outlook for Europe this year and more clarity on ECB rate cuts (vs the Fed), along with indications of bottoming out of the manufacturing sector could improve prospects for quality and value stocks in the region. However, earnings strength should be the key driver of future returns as valuations are full in select corners of the market. This is also true for Emerging Markets where country dynamics, geopolitical risks and inherent strength of the business models are all equally important criteria for us. Overall, we see opportunities in Asia (Japan, EM), US value and Europe.

- We maintain a balanced view, combining exposure to defensive and quality cyclical businesses. In the former, we are positive on utilities and staples.

- In cyclicals, we like industrials and discretionary but believe there are opportunities to trim the view after price movements in the recent past. In financials, select insurers have attractive valuations.

- Finally, the appetite for price increases and margin strength are crucial factors.

- We expect narrowing earnings growth gap between top of the market megacaps and the broader market for this year. This leads us to be positive on an equal weighted approach and on value.

- In financials, we like large cap names that show low credit risks. In defensive, our approach goes beyond the traditional sectors and we find defensive tilt through idiosyncratic cases.

- However, we are cautious on growth and large caps.

- The macro story for EM is well in place, but we prefer to benefit from the divergences in Asia, LatAm.

- In Asia, although we see better growth prospects in China, the underlying demand is likely to remain weak. However, countries like Korea, Indonesia (financials) and India (changes to global supply chain) look appealing. Brazilian valuations are also attractive.

- But we are cautious on energy, materials sectors.

Amundi asset class views

Definitions & Abbreviations

- Currency abbreviations:

USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.