Summary

Not a time to change course

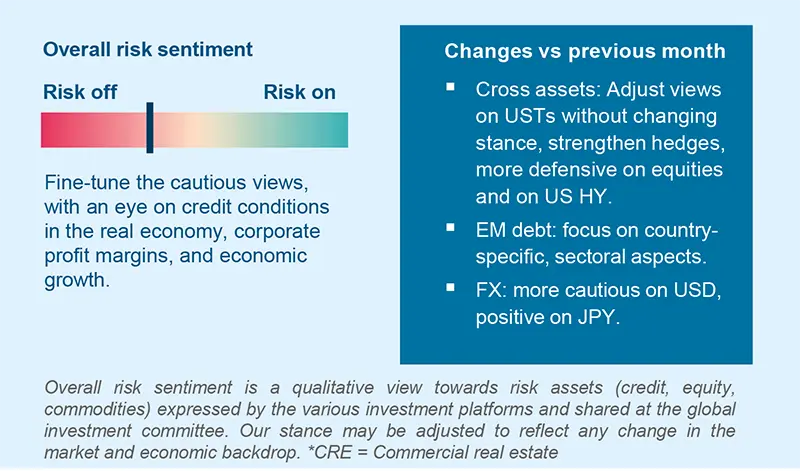

With inflation remaining above CB targets, excessive optimism priced into risky assets, and appealing short term bond yields, investors should fine tune their cautious stance and favour high quality assets.

The broader equity markets have digested the March turmoil, but the disruption continues to be evident in the US regional banking sector, which is not showing signs of recovery. Bond markets are starting to assess a higher probability of recession in the US and the potential that the Fed may start to cut rates later this year, as inflation tensions look to be slowing. On the earnings front, instead, market expectations remain too optimistic, signalling a disconnect between the recession risks bonds are pricing in and current equity valuations.

Against this backdrop of conflicting signals, we think this is not a time to change course: investors should remain cautious. Geopolitical tensions between the US and China, financial market stress, and confidence are other key elements to watch. While we do not see systemic issues, tightening financial conditions are increasing risks to the downside that are not priced into risky assets.

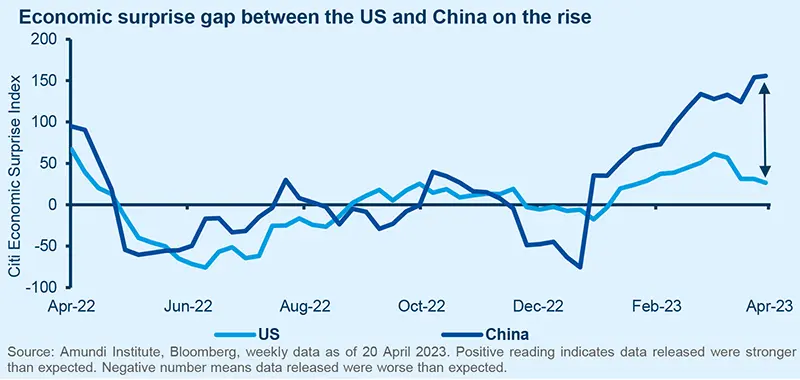

We expect a weak global growth outlook, with a US recession, a weak outlook in Europe, and a rebound in Asia from China’s reopening that will not be able to offset US deceleration. This is because the recovery in China has so far been skewed towards its domestic economy. However, inflation is decelerating but remains sticky in some core service components. With this in mind, we expect an additional 25bps hike in May by the Fed, which is likely to then pause, as recent tightening in financial conditions should limit the need for further action. In Europe, we expect the ECB to hike rates as inflation is a concern.

Without changing their cautious stance, investors should consider the following approach in building resilient portfolios:

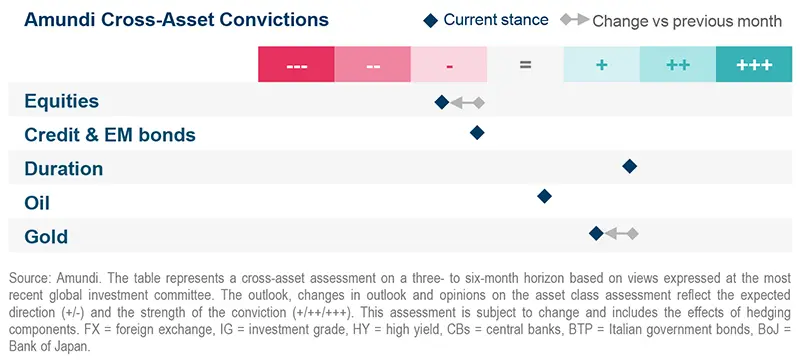

- In cross asset, a potential profit recession in the US underscores the need to stay positive on USTs. But given the backdrop, investors should consider partially moving their positioning towards shorter maturities that could benefit from a change in Fed policy. On credit, we stay cautious on HY -- now more so in the US, owing to expensive valuations. Even in equities, there is scope for a more defensive stance in Europe through adjustments in derivatives, but we see value in China. At the other end, investors should strengthen hedges and consider safe-haven FX (JPY). In commodities, gold presents an interesting case, but it is prudent to tactically book some profits.

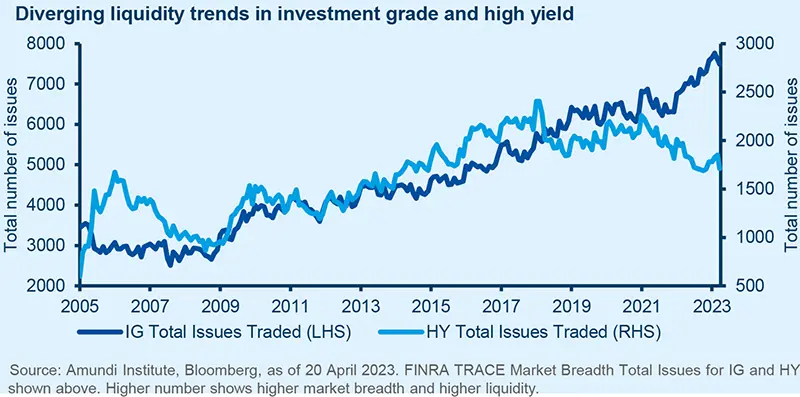

- Tighter financial conditions and a deteriorating economic backdrop call for a positive but active view on US duration. We look for opportunities across geographies. As such, we are slightly defensive in UK, and cautious on core Europe but may consider going neutral in future on the latter. In Japan, we are defensive but see curve steepening potential in Canada. US and EU HY are areas where we remain cautious. If the economy deteriorates, this could weigh on cash flows and liquidity could become an issue in HY. We also acknowledge pressures in US CRE and prefer multi-family real estate over office. On IG, we are selectively positive on names that are stable and can withstand rates-related and economic volatility.

- Odds of a US recession are not fully priced into equities and thus we maintain our prudent stances on the US and Europe. But we are positive on China, where economic growth has been upgraded. Japanese equities could be weighed on by a strengthening yen. Regarding FX, we are now neutral to negative on the US dollar.

- We selectively like EM LC debt in countries such as Mexico, owing to attractive carry and a stabilisation of inflation expectations, and on Indonesia. In HC, we focus on HY amid higher potential for rebound. EM corporate debt is also displaying attractive valuations vs EU/US credit. In equities, we have a more constructive stance on Brazil, owing to a pragmatic approach from President Lula. But, we are monitoring risks regarding fiscal reforms.

Three hot questions

|

Monica DEFEND |

Cyclical risks persist, as the odds of a US recession are on the rise, but they are not completely priced in by markets.

1| What is your view on a possible halt to the Fed rate-hiking cycle?

Since the SVB implosion, the ability of small and regional US banks to lend has changed. Pressure to boost profitability will force them to tighten lending standards and charge more when refinancing customer loans. Any pressure on liquidity could trigger more failures and, eventually, Fed rescues, forcing the central bank to cut rates. We see the Fed terminal rate at 5.25% and rates staying on hold for the remainder of 2023. A first cut is foreseen in 1Q24.

Investment consequences

-

Neutral US duration; in the short term, we see deeper curve inversion, whereas we expect bull steepening in the medium term.

-

EUR/USD target: 1.15 in 4Q23, 1.18 in 1Q24.

2| What could be the fallout of the OPEC+ production cut?

The production cut was unexpected and likely driven by concerns about global demand. As oil prices are highly sensitive to worsening growth and liquidity conditions, historically, production cuts triggered by falling demand have proved to be less effective in driving up oil prices. We see limited near-term price upside but expect oil markets to tighten earlier than previously anticipated. We do not foresee a sustainable breakthrough above $100/bbl for Brent.

Investment consequences

- 12 month Brent price target 90 95 /bbl.

3| Why have equities proved resilient despite a deteriorating economy?

Despite the recent banking sector stress, the MSCI ACWI index (global equity index) continued on its uptrend, thanks to prompt central bank intervention. However, cyclical risks remain, as the odds of a US recession are on the rise, but they are not completely priced in by markets. So, we believe the next step could be in favour of defensive stocks.

Investment consequences

- Caution on US confirmed.

- Quality becomes a core style, while value stays a long-term play.

- While we stay constructive on value and high-dividend stocks, investors should consider taking some profits in US and European value and high dividend stocks, and also keep a positive outlook on US MinVol.

Fine-tuning of the cautious allocation

|

Francesco SANDRINI |

John O'TOOLE |

The current backdrop calls for an active approach on US duration, where we repositioned our views slightly and turned more defensive on equities.

We see a deteriorating US economic environment amid the Fed’s slowing monetary tightening, rising costs of credit for the real economy, and stubborn core inflation, particularly in Europe. A weak US economy is unlikely to leave Europe untouched. Thus, we suggest maintaining a cautious tilt on risk assets, strengthening hedges, and utilising the safe-haven characteristics of USTs. On the last issue, the Fed is close to the end of its tightening cycle and this may create opportunities in the medium-term range of the yield curve. Nonetheless, investors should stay diversified, and consider preserving profits partly in areas such as gold, given the ascent this year.

High conviction ideas

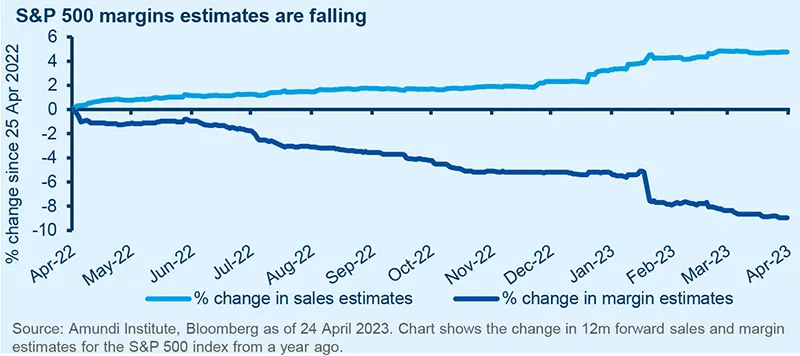

High valuations, falling profit margins, and decelerating economic growth keep us cautious in equities, where we reinforced this stance further through adjustment of our views in Europe. In EM, however, we are positive on China on the back of improving growth and cheaper relative valuations. But this path will not be linear.

In fixed income, higher recession concerns, but decelerating inflation and its impact on rate hikes call for a fine-tuning in US duration. We expect some bull-steepening of the yield curve, leading us to partially switch our positive views on 10Y UST towards the 2Y and 5Y segments. Even in Canada, we maintain our curve steepening stance. In Europe, the Swedish 10Y swap should do well in light of a vulnerable Swedish economy.

On peripheral debt, we maintain a slightly constructive view on the 10Y BTP-Bund spreads owing to strong technicals and expectations of ECB support. However, we are cautious on Japanese government bonds amid views that the BoJ will drop its yield curve control.

We remain cautious on corporate credit in general but shifted this stance from EU HY to US HY. This is mainly due to high valuations and the potential impact of higher real rates on funding costs for companies. We are also concerned about higher defaults in the US, given pressures on growth.

In FX, dollar weakness is likely to persist as the higher rate advantage of the US dissipates, allowing us to maintain our positive views on the EUR/USD and AUD/USD. On the other hand, we are now constructive on the JPY/CHF. The yen is an underappreciated hedge against global geopolitical risks. In EM, we like the MEX/EUR owing to its attractive carry and a positive balance of payments outlook. We also favour the BRL/USD and ZAR/USD (attractive valuations).

Risks and hedging

Potential for a more-severe-than-expected recession in the US led us to strengthen our hedges on equities. Also, while we slightly downgraded gold, we maintain that it offers strong diversification and downside protection in times of stress and geopolitical crisis. Finally, we are monitoring oil for any potential upside but stay neutral for now.

Balance liquidity, quality and EM carry

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Credit spreads are ignoring the upcoming economic weakness, but we believe it is imperative to focus on quality and liquidity.

Overall assessment

We are moving towards a challenging backdrop of weaker economic growth and central banks still focusing on inflation. Hence, investors should maintain a tilt towards quality in credit and selectively use carry in EM debt to build resilient portfolios.

Global and European fixed income

Decelerating economic growth and the ECB’s resolute stance against inflation make directional bets difficult. We are defensive on Japan and marginally cautious on duration in core Europe, but are assessing when to move back to neutral on the latter. Even in the UK we are slightly defensive. In the US, however, we are neutral and see curve steepening opportunities. We also maintain a small positive stance on Euro inflation. In corporate credit, spread volatility and cash flow uncertainty could increase. Thus, even though we maintain a slight constructive stance on credit mainly through EU IG and through UK IG, we are very selective. In particular, we like EU subordinated financials that offer higher returns. However, we are cautious on HY and hence think investors should consider keeping their HY exposure hedged.

US fixed income

In the real economy, if we look beneath the surface, many banks are tightening lending standards for consumers and companies, and this could have repercussions for overall consumption. The Fed, for its part, is sticking to the ‘higher for longer’ messaging. All this creates substantial volatility for rates, resulting in an opportune moment for active duration management. For now, we keep a slightly positive bias but are agile in adjusting this stance. On credit, we maintain a quality bias, with a preference for IG over HY. In the latter, we believe a more severe drawdown in earnings and cash flows is needed for defaults to increase. At a sector level, we prefer large financial companies to industrials, and favour high-quality businesses with low leverage over HY. In securitised credit, there is selective value in CRE, but we prefer multi-family to office/retail CRE.

EM bonds

In an environment where it is difficult to gauge market direction, we see some positives for EM FI in the form of a potential peak in US rates, a weak dollar, and better EM growth. While our overall duration stance is neutral, in HC, we are positioned to capture carry, focusing primarily on HY. On LC, we are constructive, owing to resilient FX and high carry. But we are selective in favour of countries such as Brazil, South Africa, Indonesia. We also view commodity exporters favourably.

FX

The fading US rates advantage leads us to be neutral to marginally cautious on the USD, but we are positive on the JPY and CHF. We are watchful on the EUR and instead like select EM currencies, eg, the MXN, BRL and Asian FX including IDR.

Chase earnings strength, not the rally

| Kasper ELMGREEN Head of Equities |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

We think this rally lacks strength because there are meaningful risks to earnings and margins that are not yet priced in.

Overall assessment

Equities do not seem to be pricing in earnings and recession risks completely and we think this is a big mistake. In select cases, however, downward pressures on margins are priced in, creating high dispersion and an attractive environment for stock-picking. Our road map continues to be that of caution, combined with quality and value, and exploring opportunities in EM where correlation with the developed world is low.

European equities

We are likely to see a deterioration in corporate earnings in the current quarter and beyond because companies are facing both cyclical and structural headwinds. This could result in casualties, and we aim to capitalise on such volatility to identify companies with strong balance sheets and an ability to defend earnings. Overall, we maintain a barbell-type approach by combining exposure to quality cyclical businesses and defensive stocks. At a sector level, staples and healthcare (positive now) are preferred, as these defensive stocks offer the prospect of capital appreciation and healthy dividends. However, in financials and industrials, where we remain constructive, investors should consider using the upside to book partial profits. But we maintain a preference for retail banks, due to the positive effects of high rates, and are monitoring the CRE sector.

US equities

Investors should consider building portfolios that are less economically sensitive in current times. For instance, in financials, we see selective value in depository banks and those with very limited capital market exposure. We also like large-cap winners that have stable customer deposit bases. Secondly, energy names are likely to hold up better even during a recession because the sector has already seen a drawdown. However, on other cyclical sectors, such as industrials and discretionary, we are cautious. Within defensives, there are businesses where valuations are very high. There are also other defensives with cheap valuations but weaker business models. Through our bottom-up analysis, we aim to identify companies where valuations are justified by their earnings potential: eg, in health care equipment & services. Finally, the outperformance of value vs growth should continue, but won’t be on a straight line.

EM equities

A strong Chinese recovery is likely to widen the EM-DM growth gap. Longer term, diversification of supply chains outside China would benefit other EM. However, we acknowledge geopolitical tensions and idiosyncratic risks in the EM world and thus rely on bottom-up analysis. For example, we like Mexico and believe Brazil’s fiscal plan supported by President Lula should be positive. But we are cautious on Malaysia, owing to valuations. At a sector level, we prefer discretionary and real estate.

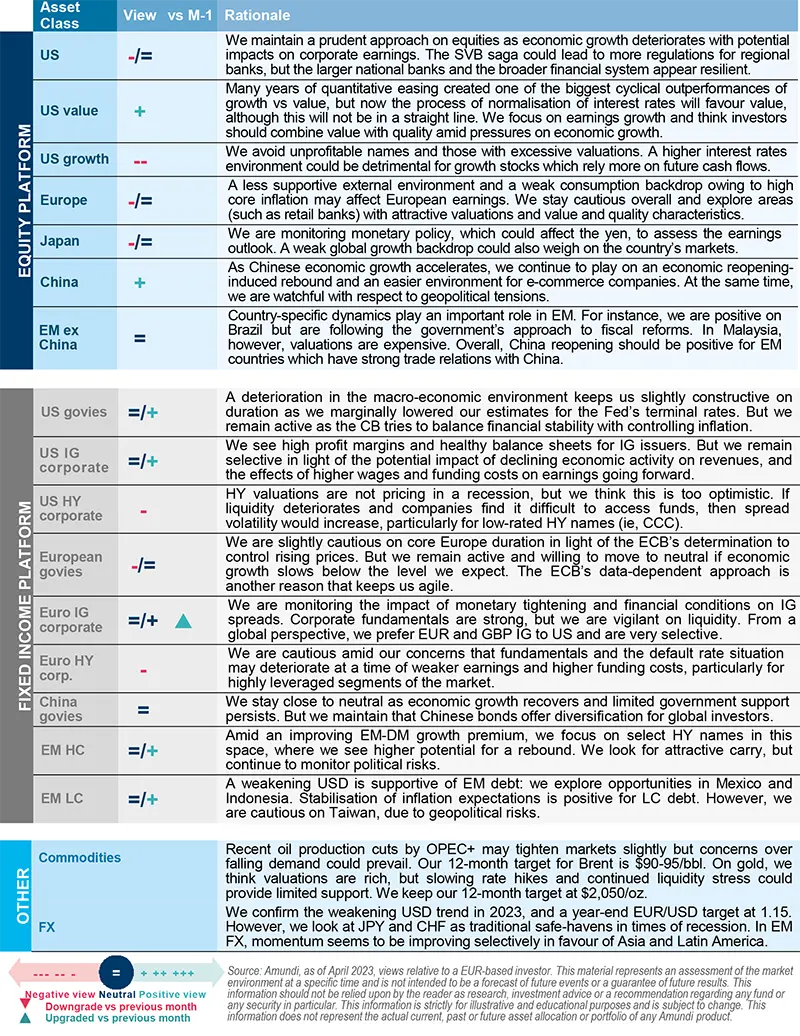

Amundi asset class views

Definitions & Abbreviations

- ADR: A security that represents shares of non-US companies that are held by a US depositary bank outside the US. They allow US investors to invest in non-US companies and give non-US companies access to US financial markets.

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS.

- Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash. Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core strategy is synonymous with ‘income’ in the stock market.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

- Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.

- Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than short-term interest rates or short-term rates dropping more than long-term rates. Bull steepening a change in the curve due to short-term rates falling faster than the long-term rates. This leads to a higher spread between the short and long term rates.

- Curve inversion: When long-term interest rates drop below short-term rates, indicating that investors are moving money away from short-term bonds.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years.

- High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market.

- Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss.

- P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

- NBFI: A non banking financial institution provides select financial services but doesn’t have a full fledged banking license.

- Net interest margin: It is a measure that compares a bank’s interest income from lending with its interest expense on its liabilities (such as bank deposits), expressed as a percentage of its assets.

- QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Non-SIFI: A systemically important financial institution (SIFI) is an institution that the US Fed and regulators believe would pose a serious risk to the financial system and the economy if it collapses. A non-SIFI is an institution that doesn’t fall in this category.

- TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

- Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.

- Yield curve control: YCC involves targeting a longer-term interest rate by a central bank, then buying or selling as many bonds as necessary to hit that rate target.