Summary

Looming divergences and the great asset repricing

We are witnessing significant divergences in the economic outlook (we have revised down the EU and Chinese economic outlooks vs. the more resilient US economy) and in market performances. In particular:

- Inflation expectations – short-term peak vs. long-term rise: While short-term inflation may start to decelerate, the long-term view is increasingly showing that sticky inflation (e.g., shelter inflation) remains high (harder to reverse) in light of geopolitical risks and the supply chain stress amid Shanghai’s lockdown.

- Recession risks: The US economy remains solid while the Eurozone is the most exposed to stagflationary risk. We will most likely see at least a short-lived recession in H2, triggered by Germany and Italy, while France and Spain might show some resilience. In China we see the official target of 5.5% growth for 2022 as being difficult to reach.

- Central banks on diverging paths: The Fed might join the club of CBs raising rates by 50bps in order to move to a neutral policy stance as rapidly as possible, while the ECB will be even more data dependent. The BoJ remains in its easing stance, and in China the PBoC remains ready to cut the key rate.

- Earnings – still strong expectations (with regional differences) vs. weak consumer sentiment. This is certainly a key earnings season to watch as any sign of strength from corporates, signaling a further inflationary push, may add pressure on the Fed to act. In Europe the earnings season will focus on guidance as a profit recession is increasingly likely on the back of the effects of the war though these are not likely to be reflected in this season’s numbers.

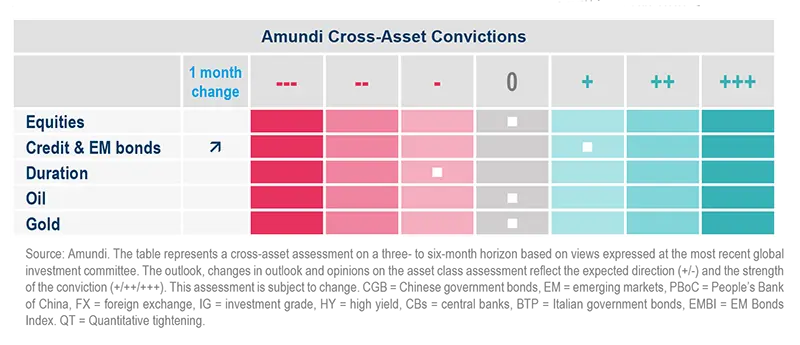

From an investment standpoint, while investors should maintain a neutral risk stance, there is room to play these divergences across the different asset classes:

- In bonds, the market has moved fast in repricing a more aggressive stance from the Fed. The initial moves were concentrated on the short part of the curve, but more recently the 10-year part has also started rising further, with the 10-year yield reaching the 2.9% level. While longer term the rate trajectory remains upwards, it no longer makes sense to remain as short as we have been in the recent past, especially on the front end of the curve given the latest market movements, and therefore we are tactically adjusting our duration stance. There is room to play tactical relative value opportunities and curve opportunities in Australia and Canada, as well as in France, where the uncertainty over the presidential election outcome has driven spreads higher.

- In FX, the rise in commodity prices should benefit the Brazilian real vs. the US dollar, while the Russia-Ukraine conflict continues to benefit the Swiss franc vs. the Euro. We also favour the USD vs. the Euro.

- Equities remain favoured vs. credit at this stage, but within equities selection is key. The approaching earnings season appears more challenging for Europe, for which we keep a short relative bias vs. the US as the latter should prove more resilient. We continue to hold the view that a combination of value and quality (with a less cyclical bias and a tilt towards financials and more defensive value) is the best way to find opportunities in names that could have less volatile earnings and be less sensitive to rising rates. The growth repricing (down), especially on the most extremely valued names, is not finished yet, in our view.

- In credit, we remain cautious and have moved further towards less risky names across the fixed income dedicated allocations. In our search for income, we are becoming more positive in EMBI. After the recent yield rise, the EMBI market should be supported by the stabilising US 10-year yields, oil gradually moving down and the improving EM-DM gap. The EMBI composition, tilted towards LatAm and towards commodity exporters, is also a positive contributor.

- Diversification remains crucial. We believe adding real asset exposure in areas more resilient to inflation (infrastructure, loans with floating rates and real estate) and using strategies that offer low correlation compared with traditional asset classes could help navigate this unfriendly market environment.

To conclude, as the great asset repricing unfolds, investors should be ready to adjust their allocations to deal with inflation. So far, we have seen most of the repricing taking place in bonds. We expect more to come in the longer part of the curve and in the most fragile equity markets, those where recession risks are on the rise (for example, European equities). However, the divergences in the markets will offer opportunities to tactically calibrate risk towards the most resilient areas.

Amundi Institute Column

Is the Fed behind the curve?

| Pascal BLANQUE Chairman, Amundi Institute |

Judging by the current environment in the US, by any reasonable measure of inflation the Fed has fallen “behind the curve”. Inflation is running rampant well above its 2% target, suggesting the Federal Open Market Committee (FOMC) should be hiking rates more rapidly to suppress price increases. Addressing this notion of being “behind the curve”, St. Louis Fed President James Bullard offers two interpretations:

- Taylor-type monetary policy rules suggest the Fed is lagging by approximately 300 bps; and

- On the other hand, the two-year Treasury yield is at 2.47%, indicating the gap is not so wide. Nevertheless, the central bank must hike rates in order to deliver on its forward guidance.

Since the 1960s there have only been two other times when core PCE inflation was as high as it is today. The first was in 1974. Back then, the Fed downplayed the monetary factors that contributed to price rises and kept its policy rate relatively low. Consequently, it fell behind the curve, causing volatility in the real economy, higher inflation and multiple recessions.

In 1983, it did not wish to repeat its mistake and kept rates high in the face of declining inflation, eventually leading to the 1990-91 recession. Today we are closer to a 1974-style scenario, characterised by high, persistent and self-perpetuating inflation, a low ex-post real policy rate and nominal rates trending upwards with no way to stabilise the volatility in the real economy. It is also true that policy normalisation entails a high recessionary risk. The Fed must decide between killing inflation at the risk of triggering a recession now, or buying more time for nominal growth to increase, with a hefty price to pay later on. It is likely that it will sway towards the latter.

Investment convictions

In terms of investment implications, there is an ongoing global repricing of risk under way. Although it started on the short end, the final leg will occur on the long end via a steepening of the yield curve, signalling an inflection point for risky assets. The performance of equities and bonds will deteriorate or even reverse, provoking a widespread underperformance. The repricing point in equities should see a tilt toward value and quality, which points to an outperformance in these sectors.

Further repricing in equities and credit, signalled by a plateauing on the 10-year portion of the curve, would give a more comfortable signal that it is time to rebuild risk.

As the Fed tries to balance inflation and growth, investors should bear in mind that a repricing of rates would have consequences on bond and equity portfolios.

Fed quanititative tightening (QT) and cross-asset pricing

| Monica DEFEND Head of Amundi Institute |

Lorenzo PORTELLI Head of Cross Asset Research |

1Q completely changed the Fed’s course of monetary policy and forward guidance. As demand-driven data kicked in, the CB was forced to become more aggressive on hikes and balance sheet shrinkages. Going forward, consumer prices will force the Fed to act and eventually curb demand-inducing softlanding in order to prevent structurally higher long term inflation expectations. The side effect of this new policy will be a liquidity drain in the ongoing asset reflation regime, providing a less friendly environment for financial markets.

The logical outcome will be a sort of readjustment in financial market levels to the new framework, and the process will drive a reassessment of multiples and valuation metrics to lower levels. Previously, the Fed’s balance sheet expansion to $9tr slashed the long end of the curve and lifted the P/E. The $3.4tr injected during the lockdowns and the post-Covid recovery was only the final stage of a multi-year process.

Expected impact on the markets (also see table below)

- Monetary policy normalisation (Fed B/S back to the pre-Covid level) will generate a contraction in valuation multiples and lift UST 10Y rates above 3%.

- Viewed through the lens of different metrics and tools, the financial environment will take equities and fixed income into expensive territory, with sell-offs likely in both areas.

- Ultimately, the market’s response will depend on how successful the Fed is in managing the slowing growth and profit cycle. In any case, the current outlook is not favourable for a re-rating of P/E multiples.

| QT timeline | Annual B/S reduction ($ tn) | Cumulative B/S reduction ($ tn) | P/E contraction1 | Fed balance sheet/total UST publ. debt | UST 10y2 |

| 1y forward | 1.14 | 1.14 | 5.1% | 25.8% | 2.90% |

| 2y forward | 1.14 | 2.28 | 18.9% | 22.1% | 3.11% |

| 3y forward | 1.14 | 3.42 | 32.7% | 18.3% | 3.40% |

___________

Source: Amundi Institute, 19 April 2022.

1. Price/Earnings adjusted for balance sheet expansion: distance from average considering mean reversion,

2. UST 10y rates targets according to Amundi Macro Nelson-Siegel model and current debt levels.

Relatively play EM bonds, US vs. European equity

| Francesco SANDRINI Head of Multi-Asset Strategies |

John O’TOOLE Head of Multi-Asset Investment Solutions |

Upward revisions to inflation are causing CBs to accelerate their tightening programmes. While the ECB is cautious due to the high level of uncertainty around growth, the Fed seems keen to reach to its neutral policy rate as soon as possible. Geopolitics is adding another layer of uncertainty to markets, which are already feeling the impact of stagflation, driven by upward pressure on commodities.

Such divergences in policy actions due to the nuances prevailing in these regions open the door for investors to exploit relative value opportunities in duration and FX. They also point to the importance of not increasing risk and being aware of valuations to identify attractive bets, including in EM. Finally, investors should look to strengthen their hedges in credit and equities, and maintain a well-diversified stance.

High conviction ideas

Our stance is neutral on equities but we seek relative value opportunities favouring the US over Europe on account of resilient consumer demand and solid labour markets in the former. In addition, in Europe, as the earnings season unfolds, we see risks from higher producer prices and margin pressures. As volatility has declined recently, we believe investors could exploit this relative value opportunity through options. On EM we are neutral, but we are carefully evaluating whether the Chinese government’s more accommodative stance can offset the effects of the new Covid-related lockdowns.

On duration, we are cautious in USTs as we continue to believe in the upward movement of yields despite the recent increase. Our flexible and active stance allows us to explore opportunities across yield curves in other regions as well. For instance, we are now constructive on 10Y French (OAT) vs. German govt bonds (Bund) on account of attractive carry and OAT’s cheap valuations when viewed from a historical perspective. Similarly, we remain optimistic on Italian BTPs over Bunds but believe the longer maturity segment now offers more scope for spread tightening. We are also positive on 10Y Australia vs. 10Y UK because Australian inflation has so far been contained compared with the UK, thereby limiting the onus on the Reserve Bank of Australia to raise policy rates. In EM bonds, we think the CNY is facing some near-term headwinds due to geopolitical tensions with the US (causing outflows) and the deterioration of the economic outlook. As a result, we are no longer positive on the local govt. debt. On the broader EMBI, however, we are now constructive, given its high carry, attractive valuations and tilt towards Latin America and commodity exporters. But we are monitoring the risks from default rates in HY countries.

Corporate credit, both US and EUR, will likely be affected by higher core rates and potential impact on earnings. Overall, we remain neutral for now, with a slightly positive outlook on IG vs HY, on account of valuations concerns in the latter, particularly in US HY. Our FX views are reflective of our economic projection and its subsequent impact on the respective currencies. We are now cautious on the EUR vs. the USD and the JPY. The US/EUR interest rate differential and inflation pressures in Europe could weigh on the euro. Secondly, we are positive on USD vs. the CAD and the NZD, given that a potential increase in US real yields would support the greenback. Finally, we maintain our view on CHF/EUR on account of the franc’s safehaven status, and remain cautious on GBP/EUR. In EM, we are now positive on BRL/USD as the former should be supported by the strength in commodity prices.

Risks and hedging

Economic headwinds and geopolitical risks mean investors should enhance their hedges. We think investors should keep their protection on US HY and add safeguards on European credit. Even in equities, there is scope to protect European and US exposures, particularly amid the risks from the Fed’s hawkish overtures.

In an environment of decelerating economic momentum, we remain risk neutral and wait for better clarity before adding directionality.

Expect tighter financial conditions: vigilant in credit

| Amaury D’ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

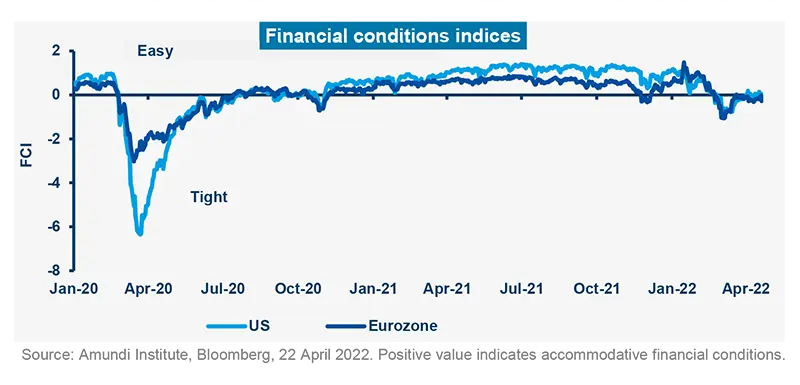

The current high inflation is a result of multiple factors, including years of underinvestment in physical capital (infrastructure, production capacity etc.), global reshoring and financial repression in the developed world. CBs are responding to inflation pressures but both the Fed and the ECB appear to be ‘behind the curve’, despite their hawkish views. Financial conditions have not tightened significantly so far, but they might if CBs are aggressive enough to curb inflation. Thus, a watchful, bottom-up stance on credit is required to prepare for future discrimination. On government bonds, investors should remain agile as they provide support in times of stress, although the long-term direction of rates is up.

Global and European fixed income

We have moved to a less cautious stance on duration in core Europe and the US as the uncertain economic environment is creating a move towards safe-haven assets. In addition, we look for tactical opportunities across the curve and geographies, enabling us to be positive now on Belgium, neutral on peripheral debt and defensive on UK duration. Taking a long-term view, we believe in diversifying duration exposure through China despite some near-term clouds.

In credit, spreads have retraced from the levels seen in early March and corporate fundamentals remain solid, but sentiment is fragile owing to high inflation, the recession risk (in Europe) and the less accommodative ECB.

We expect some decompression of spreads between IG and HY, wherein markets will distinguish high-quality credit from lower-quality credit. At a sector level, we are selectively constructive on banking, auto (slightly less than before) and energy, but cautious on consumer, utilities, transportation and chemicals.

Financial conditions have not tightened for now, but the tricky part for risk assets will come when an increase in real yields is accompanied by pressure on corporate earnings.

US fixed income

While US growth is likely to gradually decelerate closer to trend by year-end, we do not see any indication of a recession this year. Demand remains strong on the back of solid wages and savings, with some weakness in mortgage applications. We believe rates will increase in the long term, but it is vital to keep an active approach regarding duration amid the strong movements in the US yield curve. In securitised assets, we look for value in agency MBS, which have underperformed corporate bonds so far as investors price in QT in the former. But MBS are increasingly becoming attractive. We also look for selective opportunities in non-residential and CRE. Corporate credit valuations are within their long-term averages but we prefer idiosyncratic risks and believe there is no need to be overly pessimistic because issuer fundamentals are still robust. However, we maintain hedges and are watchful of liquidity risks.

EM bonds

Elevated inflation increases the probability of further policy tightening across EM, with the high dispersion across countries underpinning the need for selection. We remain defensive on duration but are slightly less cautious. In HC, we foresee some spread tightening now, mainly in HY. In LC, we favour commodity exporters, both corporates and sovereigns, in LatAm and South Africa that could benefit from the current trend of strong commodity prices, but we are selective.

FX

The market’s flight to quality is leading us to be positive on USD, but cautious on EUR. The current market expectations of two or three rate hikes this year priced in the EUR appear excessive. In EM, we are constructive on selective FX in LatAm (MXN, CLP) and Asia (THB), but cautious on the HUF.

Diverging fortunes amid earnings reassessment

| Kasper ELMGREEN Head of Equities |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Overall assessment

Rising inflation and slowing economic growth (Russia’s invasion, supply disruptions in China) are likely to weigh on corporate earnings. Hence, in the current reporting season, we will pay special attention to forward guidance on demand trends and pricing power in particular. Pricing power, resilience of business model and strength of balance sheet is key for us at this point. Pricing power can arise from brands, intellectual property and other forms of product differentiation. The risk remains around valuations and, in this respect, a relative value approach is key. Overall, value (less-cyclical) vs growth, and at a regional level, US vs Europe are preferred given a benign impact on former’s earnings.

European equities

Current valuation dispersion is high, encouraging us to be selective and yet balanced given the risk outlook. Certain areas such as value remain attractive, even though we are now focussing more on the less-cyclical, defensive aspects because of the clear economic deceleration. One exception is the banking sector, which is cyclical but which we continue to like at this point. We also like attractive defensive stocks in the health care and consumer staples sectors. In general, investors should consider moving away from low-quality defensive areas to high-quality segments. Information technology remains overall less attractive, given strong valuation headwinds, especially given the rising interest rate outlook. In addition, we fear that some fundamental risks such as regulatory headwinds and very high profit margins are not sufficiently appreciated by the market. Overall, we stay very selective and rely on our bottom-up approach to identify names that can generate sustainable, long-term returns.

US equities

The US recovery should be driven by a strong labour market and solid consumer balance sheets, but inflation may affect disposable incomes. Interestingly, earnings are likely to increase due to inflation but, when rates rise, these earnings would be discounted by a higher cost of capital. So, some pressure on valuation multiples is expected. Thus, amid an overall quality, value bias, we are exploring companies with strong operational efficiencies and business models resilient to geopolitical risks, and those with a tendency to reward shareholders by returning excess cash (dividends, buybacks). But investors should avoid names with weak balance sheets. From a sector perspective, we are constructive on energy, materials, banks and healthcare. US banks are demonstrating high, stable returns on equity, and are investing in technology that should enable them to gain market share in the long run, although markets are not valuing this aspect appropriately, in our view. In addition, we are witnessing solid innovation in select healthcare companies and as such, some pockets of the sector look attractive. However, a careful selection process that helps uncover strong names remains a priority for us.

EM equities

Although current visibility is low, EM valuations allow us to see upside over the next 12 months, but divergences across countries are strong and we are selective. We believe commodity exporters (Brazil, UAE) and domestic consumption stories (India) could benefit. In China, as we watch authorities’ stronger stimulus, we maintain a more cautious stance from a near-term perspective, given that recent lockdowns are likely to impact economic activity. But the long-term growth story remains intact. At a sector level, we favour discretionary, real estate and value.

Amundi asset class views

Definitions & Abbreviations

- ADR: A security that represents shares of non-US companies that are held by a US depositary bank outside the US. They allow US investors to invest in non-US companies and give non-US companies access to US financial markets.

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS.

- Bear steepening of yield curve: Widening of the yield curve caused by long-term rates increasing at a faster rate than short-term rates.

- Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market. Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash. Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core + property owners typically have the ability to increase cash flows through light property improvements, management efficiencies or by increasing the quality of the tenants. Similar to core properties, these properties tend to be of high quality and well occupied. Core strategy is synonymous with ‘income’ in the stock market. Core property investors are conservative investors looking to generate stable income with very low risk. Core properties require very little hand-holding by their owners and are typically acquired and held as an alternative to bonds.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

- Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years. High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market.

- Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss.

- P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

- QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- QT: The opposite of QE, quantitative tightening (QT) is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Rising star: A company that has a low credit rating, but only because it is new to the bond market and is therefore still establishing a track record. It does not yet have the track record and/or the size to earn an investment grade rating from a credit rating agency.

- TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

- Trade-weighted dollar: It is a measurement of the foreign exchange value of the dollar vs certain foreign currencies. It weights to currencies most widely used in international trade, rather than comparing the value of the dollar to all foreign currencies.

- Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-tobook and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.