Summary

Tech sell-off and bond temptation

The second quarter of the year is becoming increasingly painful for tech stocks, recalling memories of the 2000s tech bubble bursting. The repricing of a more aggressive Fed stance has been brutal, real yields rose – the rate on 10-year TIPS has turned positive for the first time since 2020 – and on the nominal yields front, the US 10-year Treasury yield temporarily reached the 3% threshold, falling close to 2.75% on economic growth concerns. Rates are now at a level that could call for a recalibration of asset allocations. The key themes to follow to detect future market directions are:

- Stagflationary risks: The growth inflation battle is evolving unevenly at the global level, with the main theme being the shift from rising inflation and robust growth to lower growth and persistently high inflation. To account for this, our main scenario already pencils in regional divergences (technical recession for the Eurozone vs. US growth moving below potential, but no recession in 2022).

- China’s economic outlook: For 2022 we see growth at 3.5%, given the broad slowdown in economic activity since March, the extended lockdown in Shanghai and restrictions expanding into other regions. These will harm growth, particularly in Q2, while we expect a rebound in H2, thanks to more incisive policy support.

- Central banks: In their fight against inflation and, most importantly, to preserve their credibility, central banks will continue to focus on communication while de facto staying behind the curve. In this battle, the ECB is facing more significant challenges than other CBs: the impact from the Russia-Ukraine conflict and from financial conditions tightening will be uneven across countries. High debt levels and higher economic risks on the euro periphery may impact the ECB’s room for manoeuvre.

- Markets and earnings growth expectations: We believe earnings expectations remain too optimistic across the board. We expect US EPS growth to be in the 5-9% range, supported by buybacks (consensus is at +9.8%) and for Europe to potentially enter a profit recession.

All of this means that it is difficult to see an imminent end to the current weak market environment and, as such, while keeping an overall neutral risk stance, we believe some adjustments are warranted.

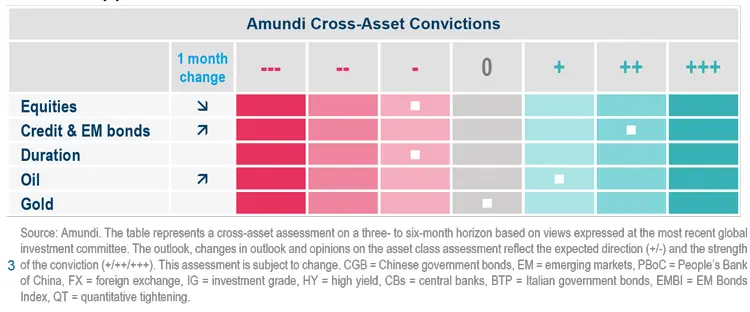

- From a cross-asset perspective, we believe investors should further increase diversification while not increasing risk. To achieve this, we have become slightly more cautious on equity – in particular regarding Europe, and while we are more positive on US investment grade credit, we maintain our relative preference for US equity amid the more resilient growth expectations for the US economy and higher earnings growth potential in the US equity market. We are also positive on oil for diversification purposes and as a hedge against the still-high geopolitical risk.

- In bonds, we have further reduced our short duration stance – in Europe in particular, but also in the US, and we believe investors should move towards neutrality. After the recent moves, the risks on nominal yields are now more symmetric, as on one side, inflation poses upward risks, while on the other, geopolitical and economic uncertainty favour downward moves. In credit, we continue to focus on quality and we are more cautious on higher-risk segments in Europe. We maintain our positive view on EM bonds in hard currency due to their attractive valuations and exposure to commodity exporters. Regarding currencies, we continue to hold a positive view on the US dollar vs. the euro.

- Uncertainty regarding equities remains high as markets reprice the earnings path ahead. Regionally, we continue to favour the US vs. Europe while we remain neutral on EM. While maintaining our preference for value, we continue to increase the quality tilt. In EM, we have become more cautious on Asia due to inflationary pressures and expensive valuations, while we remain positive on Brazil, UAE and Indonesia. In China, most of the bad news is priced in: an economic rebound, coupled with more benign regulation, should pave the way for a rebound in H2.

Although the ‘great repricing’ in equities and bonds may not be over yet, we are likely to see some pause and a continued rotation inside the market as it awaits more clarity on the inflation/growth outlook. In these uncertain times, investors should continue to focus on bottom-up selection as this will help in finding the most resilient names, but they should also look for opportunities that may have been excessively penalised during the repricing phase.

Big picture in short

The end of the ‘Great Coincidence’ for the policy mix

| Pascal BLANQUE Chairman, Amundi Institute |

The age of the ‘Great Coincidence’ in the policy mix is over. Budget deficit reductions are near, and will be accompanied by diminished household savings and greater pressure on corporate profits in light of wage negotiations. The widespread belief that fiscal spending is effectively unlimited (i.e., the fiscal ‘free lunch’) is going to be severely tested. On the monetary side, we’re witnessing the end of ultra-cheap money. Central banks have had to hike rates and drain liquidity in this time of looming stagflation, but will maintain a benign-neglect tilt and allow inflation to run to preserve growth. While the public debate has been focused on the monetary side, we should look at the overall policy mix to understand the novel role of monetary policy. I see three possible scenarios moving forward:

- Continued fiscal expansion and monetary normalisation. This is difficult, insofar as monetary normalisation is a fiscal space ‘killer’, making large debt burdens unsustainable. Moreover, policymakers should consider a safety net for further manoeuvring in case of recession. The main risk here is timing: monetary authorities could turn off the taps too quickly; and fiscal authorities could intervene too late. In markets, this option implies further repricing (towards the downside) on risky assets, particularly on interest-rate sensitive stocks.

- Central banks remain behind the curve for some time in order to accommodate a renewed fiscal impulse. This is the best way to optimise the growth/inflation trade-off, and to engineer a controlled economic slowdown. Here, investors should look to combat inflation through dividend equity and real assets.

- Fiscal expansion and complete central bank accommodation, uprooting all inflation expectations, to levels most people today have never before been confronted with.

Think of this as a ‘70s style regime, with high inflation, nominal growth, market-led corrections in nominal rates, adjustments in all risk premia and valuations at equilibrium. Investors will have few places to hide except in cash and real assets.

While public opinion is mostly focused on the first option, I believe the second or third are more likely. Fiscal spending must target critical new sets of public goods (the energy transition, social and strategic autonomy) and central banks will have to accommodate these priorities. This is particularly true in Europe, where monetary authorities have to fill the void left by the lack of credible budgetary rules. The worst-case scenario is full-blown stagflation. If nothing is done on the fiscal side, then mechanically there will be a tightening in the policy mix, reversing the trend of the past few years.

Central Banks have had to hike rates and drain liquidity in this time of looming stagflation, but will maintain a benign-neglect tilt, and allow inflation to run to preserve growth.

NATO expansion a watershed moment for geopolitical order

|

Didier BOROWSKI |

Finland and Sweden have announced their intentions to join NATO, ending decades of neutrality/non-alignment. This is a tectonic shift, with major consequences for the regional geopolitical order. Both countries immediately concluded that the Russian invasion of Ukraine could threaten their sovereignty. The Swedes and Finns are, however, careful to point out that their membership is defensive and primarily aimed at increasing their security. As evidence of this, Sweden is putting two conditions on its candidacy: no NATO base and no nuclear weapons on its territory.

Finland and Sweden are of strategic interest to NATO. Sweden’s high-tech equipment enables intelligence gathering in the entire Baltic Sea region. Finland has nearly 900,000 reservists, who could provide a significant defence force for NATO. During the accession process, which could take a year, the two candidate countries are not protected by Article 5 of the NATO Treaty, which provides for mutual assistance by member states in case of aggression. That’s why the US and the UK have already stated that they would support both countries in the event of an attack in the interim.

President Erdogan threatens to veto their membership, probably because he wants to leverage the absence of a veto for some benefit. In all likelihood, the Turkish president wants to secure the delivery of US military equipment to his country. Moreover, Erdogan is asking the two countries to abandon their support for the PKK rebels, who are hosted in their territories.

Russia called their membership applications to NATO a “serious mistake” with “far-reaching consequences”. Russia has cut gas supplies to Finland, but has neither the means nor the desire to confront NATO. Retaliatory measures could, however, take many other forms (cyber-attacks, intimidation measures such as airspace violations, etc.).

Our view: The invasion of Ukraine has affected the medium-term growth prospects of Sweden and Finland (uncertainty shock). Their accession will help restore the confidence of local economic actors and could encourage foreign investment. Furthermore, the application process should accelerate a reflection on the need to strengthen European defence.

Rotate risk allocation from equity to IG credit

| Francesco SANDRINI Head of Multi-Asset Strategies |

John O’TOOLE Head of Multi-Asset Investment Solutions |

Mounting inflation concerns, along with geopolitical tensions, quantitative tightening (QT) and Covid restrictions in China are creating two main risks. One is related to the liquidity drain from QT and another to corporate margin compression, implying we should not ignore the risks of a profit recession, which is currently not priced in by the markets. On a positive note, consumption remains strong, labour markets tight and corporate balance sheets healthy, particularly in the US.

As a result, investors should consider playing the relative resilience of the US, in particular adding into US IG credit, while becoming more cautious in cyclical equities, especially in Europe. For diversification purposes, we continue to be positive on commodities and we are now positive on oil, where the tight supply will continue to support the bull market, despite the deceleration of demand due to the slowing economy.

High conviction ideas

We have a defensive stance in DM equities, where we are cautious on Europe and play the relative preference for US equities against Europe. This reflects a desire to be less cyclically exposed in this phase of slowdown and avoid the areas most exposed to the effects of the Russia-Ukraine war. We are neutral in EM equities, but we acknowledge the impact of Covid restrictions on Chinese growth, and remain vigilant there.

On duration, we maintain a slightly cautious stance in the US, while globally we continue to explore opportunities at cross-country and curve levels. In Europe, we maintain our relative preference for Italy vs. Germany in the 10-year maturity, while we have closed our positive stance on France vs. Germany as the political risk premium faded after the elections. We believe in the steepening of the UK 2-10-year curve, as the BoE has displayed slightly dovish tendencies in light of the deteriorating outlook. 2Y yields currently price in aggressive tightening, but could move lower. The 10y yield should rise on the back of QT.

We have removed our positive bias for the Australia 10Y vs. the UK, as the surprising rate hike by the Reserve Bank of Australia due to inflation pressures suggests a more hawkish stance vs. the BoE’s dovish tone.

After becoming constructive on EMBI last month, we are further increasing our preference for credit and EM bonds by adding a positive stance on US IG. This is based on the US’ solid macroeconomic background, positive corporate fundamentals (solid balance sheets with high liquidity levels and coverage ratios), low risk of refinancing debt in the near term and stable leverage. Valuations also seem more attractive following the recent spread widening. Sentiment remains cautious on risky assets, but in the case of widening, US IG would be the most resilient, in our view.

We continue to seek opportunities in the currency space as the divergences in economic and inflation patterns and monetary actions offer attractive themes to play. In particular, we continue to be cautious on the EUR vs. the JPY and the USD. EUR valuations are less appealing vs. the greenback considering the current inflationary pressures. We maintain our positive view on CHF/EUR and our bias for the USD vs. CAD as the latter is a cyclical currency that can be damaged in a decelerating growth environment. We are no longer constructive on the USD vs. NZD, as after the NZD depreciation there is space for a technical rebound. In the EM FX space, we see potential for the BRL to outperform.

Risks and hedging

Increasing stagflationary risks and still-present geopolitical tensions suggest investors should maintain or even increase hedges. Hence, we think investors should keep their protection on credit while readjusting hedges on the US equity markets in search of cost-efficient options that can enhance their overall protection.

Mounting concerns on the economic outlook call for a reallocation of risk from equity to quality credit, which looks more appealing after the recent repricing.

Fixed income now selectively more attractive

| Amaury D’ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Inflation and the economic growth outlook continue to be the key themes for bond investors. Central banks have started to act to tame inflation, with the Fed committed to delivering, but still datadependent to prevent a hard landing of the economy. For the ECB, the task is slightly more difficult as the region is directly impacted by the continuing war in the form of higher energy prices and the risk of additional sanctions, which could exacerbate inflation even further. After the great repricing in government bonds, we have been increasing our duration stance in a move towards neutrality and we remain cautious on the higher risk credit space.

Global and European fixed income

We continue to adjust the duration stance in a move towards neutrality, but we retain different regional views. In particular, we believe that the ECB may deliver less tightening than the Fed due to the higher risk of a recession in Europe. As a result, we are less cautious than before on UK and Euro duration, where we have a slightly short to neutral stance, while we maintain a short duration stance in the US. For diversification purposes we also maintain a positive view on China duration and selective EM bonds. We also continue to play curve opportunities globally, in particular in the Euro, Canadian and Australian curves.

The main debate in corporate credit is whether the risks related to earnings, higher rates and inflation are appropriately reflected in prices. We think not all segments are pricing in these factors. Consequently, we are reducing our credit risk stance, becoming more cautious on the higher risk space of the credit market, such as corporate hybrids, and we prefer higher grade credit with short to medium-term maturities. Geographically, we are more constructive on US vs. Euro IG credit, amid the better fundamentals in the US.

US fixed income

Given the amount of tightening priced in by the markets, particularly in the front end of the curve, and the high geopolitical and economic uncertainty, we think it’s wise to move back towards neutrality on duration, while keeping a tactical approach as market volatility is still high. Credit offers opportunities as corporate fundamentals are strong. Here we are selective, with a preference for financials over industrials. We are also actively tracking new issues, as they offer substantial concessions, but here too we look for idiosyncratic, bottom-up opportunities. We believe to tactically adjust their credit allocation stance, investors could use hedges through more liquid derivatives, as credit market liquidity is lower in a more volatile environment. We continue to seek value in securitised assets, as the ‘consumer’ remains strong in light of solid earnings and savings. We look for value in agency MBS as they could perform better than other areas of credit given some concerns around economic growth.

EM bonds

Within the EM bonds investment universe we keep an overall cautious stance. We maintain a short duration bias, but we are slightly less defensive than before. We favour HC bonds and believe valuations are more attractive in HY vs. IG, but with a selective approach. Higher commodity prices are supportive for exporting countries, and in this respect, LatAm has been proving more resilient as it is economically and geographically distant from the ongoing war in Ukraine.

FX

We maintain our positive view on the USD and are cautious on EUR, JPY and CNY. In EM, we are constructive on selective FX in LatAm (MXN, CLP), but cautious on the Eastern European currencies such as the HUF.

GFI = global fixed income, GEMs/EM FX = global emerging markets foreign exchange, HY = high yield, IG = investment grade, EUR = euro, UST = US Treasuries, RMBS = residential mortgage-backed securities, ABS = asset-backed securities, HC = hard currency, LC = local currency, MBS = mortgage-backed securities, CRE = commercial real estate, QT = quantitative tightening

The clouds on the economic horizon call for a move towards neutrality in duration and higher selectivity in credit, amid the diminishing liquidity.

Be mindful of excessive valuations and cyclical risks

| Kasper ELMGREEN Head of Equities |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Overall assessment

High inflation, the ongoing conflict in Ukraine, slowing economic momentum and the Covid lockdowns in China are causing volatility in the markets. This is happening at a time when forward earnings multiples have contracted from the levels seen last year, amid higher inflation and rates expectations.

Overall, the focus on valuations remain key, as the expensive areas of the market will remain under pressure. Less cyclical value and quality are the places to look for resilience. Our overall approach remains that of selection, with a focus on earnings sustainability beyond the near term. Regionally, the US remains favoured within the developed world

European equities

Challenges for the European markets continue. Higher inflation and slowing growth put pressure on company earnings, while rising rates put pressure on earnings multiples. We think current valuations do not price in a full recession, which is a risk for the Euro area.

In this environment, when the range of possible economic outcomes is wide and valuation dispersion is high, we think high-quality, lesscyclical value and defensive names are good options. As a result, we maintain a barbell approach. On the one hand, we favour defensive names in the healthcare and consumer staples (increased our bias) sectors. On the other hand, we are selectively exploring quality cyclical stocks in the materials and industrial sectors.

In doing so, we are mindful of the economic headwinds and keep our focus on non-disrupted business models. We also remain cautious in the information technology and utilities sectors.

US equities

Despite the recent weak economic growth data, a recession is not our base case because labour markets and consumer balance sheets remain strong. Yet, in a rising rates environment, the pressure on valuation multiples will remain. Hence, we maintain our quality and non-cyclical value tilt and we remain cautious on the high momentum/growth side of the market. We remain cautious on the mega-caps and are very selective and biased towards companies with high operational efficiencies, those that return cash to shareholders through buybacks and dividends, and can maintain earnings growth. We look for opportunities in energy and materials and we also like banks that display high returns on equity and selective consumer names. We believe the reopening would drive consumer spending, but we are monitoring labour availability and rising costs for companies and how that could affect margins and production. Interestingly, after the recent correction, selective technology names have become attractive, but we remain bottom-up in our approach and evaluate each name with respect to the quality of earnings. On the other hand, we are underweight mega caps and avoid unprofitable growth and distressed value names.

EM equities

Despite the high market uncertainty, EM valuations have certainly become more attractive, showing potential for appealing returns, but with strong divergences. Thus, we remain selective, favouring commodity exporters (Brazil, UAE) and domestic consumption stories (Indonesia). In Asia, we are becoming more cautious due to expensive valuations and renewed inflation pressures.

We believe it is key to remain cautious in unprofitable growth and expensive areas, while maintaining a core quality tilt.

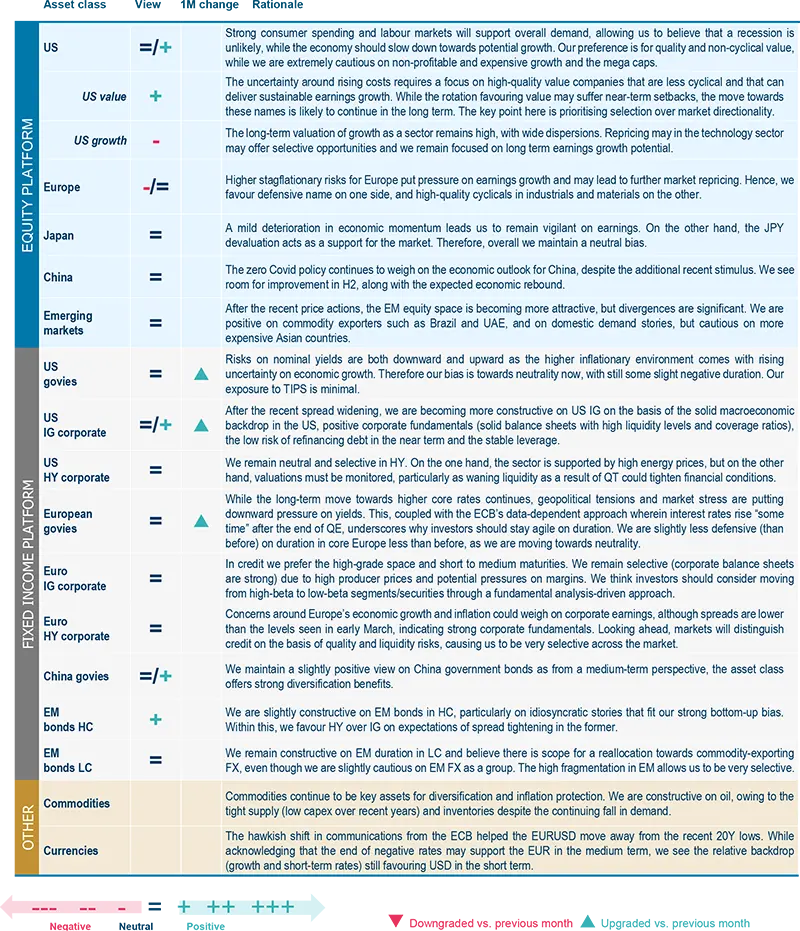

Amundi asset class views

Source: Amundi, as of 26 May 2022, views relative to a EUR-based investor. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future

events or a guarantee of future results. This information should not be relied upon by the reader as research, investment advice or a recommendation regarding any fund or any security in particular. This

information is strictly for illustrative and educational purposes and is subject to change. This information does not represent the actual current,

past or future asset allocation or portfolio of any Amundi product. IG = investment grade corporate bonds, HY = high yield corporate,

EM bonds HC/LC = EM bonds hard currency/local currency, WTI = West Texas Intermediate, QE = quantitative easing.

Definitions & Abbreviations

- ADR: A security that represents shares of non-US companies that are held by a US depositary bank outside the US. They allow US investors to invest in non-US companies and give non-US companies access to US financial markets.

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS.

- Bear steepening of yield curve: Widening of the yield curve caused by long-term rates increasing at a faster rate than short-term rates.

- Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash.

- Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core + property owners typically have the ability to increase cash flows through light property improvements, management efficiencies or by increasing the quality of the tenants. Similar to core properties, these properties tend to be of high quality and well occupied.

- Core strategy is synonymous with ‘income’ in the stock market. Core property investors are conservative investors looking to generate stable income with very low risk. Core properties require very little hand-holding by their owners and are typically acquired and held as an alternative to bonds.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

- Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years.

- High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market.

- Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss.

- P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

- QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- QT: The opposite of QE, quantitative tightening (QT) is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Rising star: A company that has a low credit rating, but only because it is new to the bond market and is therefore still establishing a track record. It does not yet have the track record and/or the size to earn an investment grade rating from a credit rating agency.

- TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

- Trade-weighted dollar: It is a measurement of the foreign exchange value of the dollar vs certain foreign currencies. It weights to currencies most widely used in international trade, rather than comparing the value of the dollar to all foreign currencies.

- Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-tobook and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.