Summary

Play the desynchronization of the cycle

Dramatic price action has taken place over the past weeks in equities and bonds, following hot inflation prints, central bank (CB) actions and rising concerns over economic growth. These events are a reminder of the regime shift, in which we are witnessing the resurgence of stagflationary risks and central banks trying to assert their credibility. Going forward, growth, inflation and central banks’ policies will continue to drive markets:

- Growth: We were already expecting a deceleration of growth at the start of the year, but we are now moving to a marked slowdown, particularly in the euro area, with the risk of a technical recession. This is mainly due to weak private consumption and investment in Europe (which is most impacted by inflation). In contrast, in the US stronger private consumption and investment should continue to support growth. But we expect a marked slowdown and rising recession risks for 2023. The market is going to focus on the growth path and, in particular, on any signal of deterioration in the US outlook.

- Inflation – not yet at the peak, with different drivers in the US and Europe: The expected peak in inflation has been postponed, while the peak level has moved higher than initially thought. The inflation drivers are different in the US and Europe, with inflation more demand-driven in the US, while in Europe, the primary reason for inflation has been supply constraints, with the energy shock from the war further exacerbating the outlook. In an environment of slowing growth, inflation should also slow.

- Central banks have the difficult task of restoring their credibility: In general, monetary tightening is more effective when inflation is driven by strong internal demand. However, when inflation is caused by external factors (supply constraints), then CB tightening is not very successful in taming inflation. Thus, there is more scope for tightening in the US, while the ECB is in a worse position as it also has to address EU fragmentation, as signalled by the announcement of a dedicated anti-fragmentation tool by the ECB. Overall, we believe that when inflation peaks and attention turns to growth trending lower, central banks will likely pause and deliver less than initially stated.

Against this still highly volatile backdrop, investors should stay diversified and avoid adding risk as the market repricing, although advanced, is not over yet. This is the time to move towards high-quality areas and resilient business models that can preserve margins. In particular:

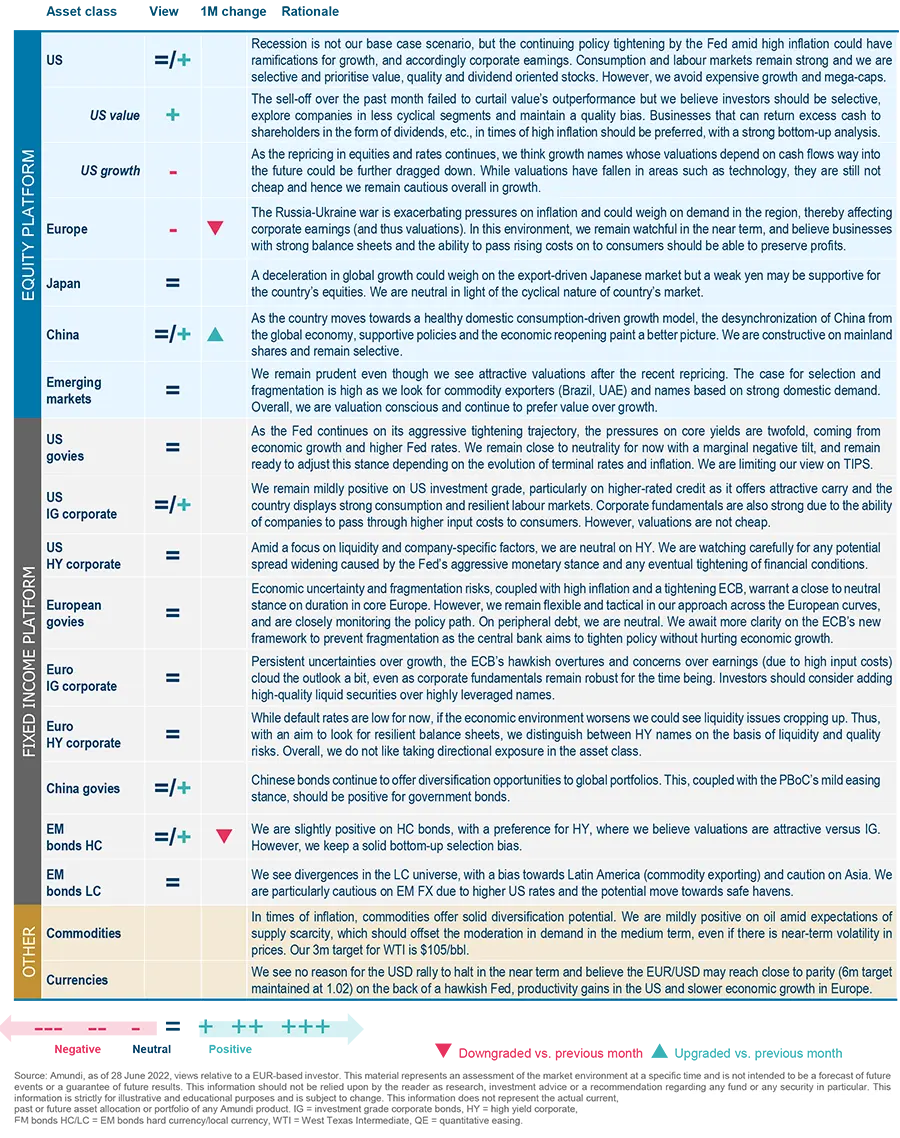

- The recent bond sell-off makes this asset class selectively more attractive, as CBs’ hawkishness is now priced in and at a certain point, they could be forced to do less to avoid a recession or further fragmentation. The current levels are also becoming more attractive for investors such as insurers and pension funds and that could cap the potential further upside in yields. We are more positive than before and close to neutrality on duration in the US and core Europe, but keep an agile approach overall. In euro peripheral debt, we remain neutral and are closely monitoring the fragmentation risks.

- Credit – we recommend moving towards higher quality credit and being more selective in general across the credit spectrum (IG and HY), given some concerns over earnings. However, our regional preference for US IG remains in place in light of the strong consumption and labour markets in the country. This should help deliver better economic growth.

- Equities – we keep an overall vigilant stance and given that in Europe further earnings downgrades are not fully priced in, we are cautious due to the headwinds from high inflation, which could dampen consumer demand. The US, on the other hand, should fare relatively well and we maintain a preference for the US. In terms of style, investors should opt for the less cyclical areas in equities in value, quality and dividend oriented stocks. Companies with strong balance sheets and pricing power, as well as the ability to pass rising costs on to consumers and preserve margins, should do well.

- We are becoming slightly more positive on Chinese A shares as these appear more insulated from the developed world, where stagflationary risks are surging. We also expect this asset class to benefit from the reopening of the Chinese economy and the stimulus in place.

- For diversification purposes, investors should consider commodities and strategies with low correlation to equities and bonds. On currencies, we keep our preference for the USD versus the Euro and, to a lesser extent, for the Yen.

Big picture in short

Central banks in search of credibility

| Pascal BLANQUE Chairman, Amundi Institute |

Western monetary policy has executed an impressive U-turn in the space of a few weeks. The Federal Reserve announced the biggest interest rate increase since 1994 and the European Central Bank is gearing up to hike soon. There was market turmoil, investors questioned the credibility of central banks and the probability of recession began to rise. The greater the gap between what central bankers say and what people believe, the higher may be the cost of bringing inflation under control since significant monetary policy tightening will be needed to rein in expectations about how fast prices will rise.

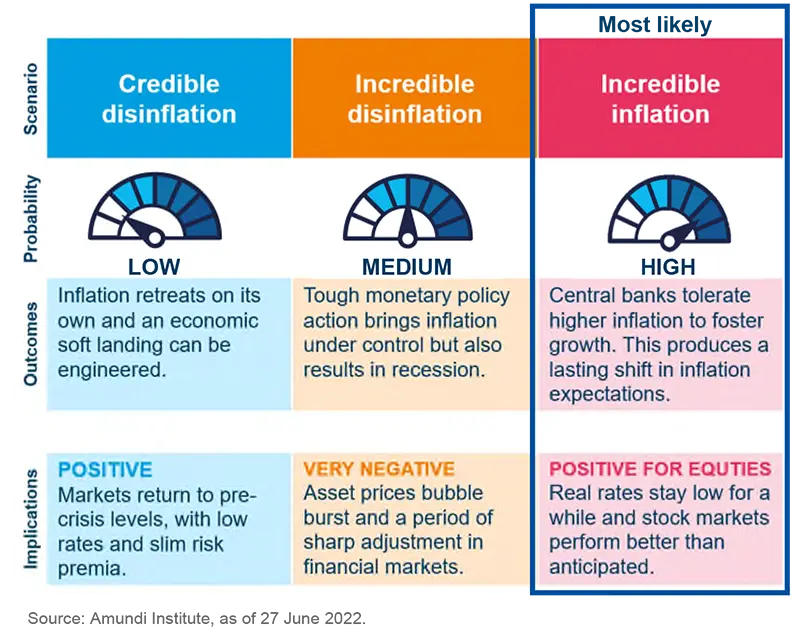

Most people today have never before been confronted with sustained periods of high inflation. The current collective memory has instead been shaped by an environment where central banks were more concerned about undershooting their inflation targets and were free to act to support growth. However, the decades of low inflation had less to do with monetary policy and more to do with other factors (coincidences), such as China’s entry onto the world economic stage, which depressed international labour costs. Now that inflation expectations are becoming unanchored, a new approach is needed. I see three main scenarios:

-

‘Credible disinflation’: The recent collective memory of low inflation prevails, and central banks’ credibility is restored. In this scenario, an economic soft landing could be engineered. Financial markets would return to the pre-crisis situation that was characterised by relatively low rates and slim risk premia. This is more or less what is priced in today, although there have been setbacks in certain overvalued asset classes and market segments. This scenario does not appear likely, unless inflation retreats on its own, a development that would represent good luck on par with the series of coincidences that delivered the low inflation of recent decades.

-

‘Incredible disinflation’: Central banks started out too far behind the curve, and are racing to prevent long-dormant inflation memories from resurfacing and becoming entrenched. Monetary policy actions would be painful for markets and economic activity, but necessary to curb inflation. In this scenario, investors should take shelter and wait out the storm. There would be a recession and asset price bubbles would burst, but then there would be a return to normal. This is a viable option but policymakers probably lack the resolve to fight this long and hard battle.

-

‘Incredible inflation’: Central banks have not fallen behind the curve by chance or by mistake, but are undergoing a profound change. They will tolerate higher inflation to foster nominal growth. This implies a structural change in the public’s psychology as well, and higher inflation expectations would become the norm. In this case, equities would do better than feared and real rates would remain low for some time, postponing – but not eliminating – the recession risks. In this scenario, investors should look to tackle inflation through real assets. This is a credible alternative to the current consensus view.

The greater the gap between what central bankers say and what people believe, the higher the cost of bringing inflation under control may be.

Stay cautious with preference for China and US

| Francesco SANDRINI Head of Multi-Asset Strategies |

John O’TOOLE Head of Multi-Asset Investment Solutions |

The repercussions of the Russia-Ukraine war, energy demand/supply dynamics and CB rate hikes are creating a double whammy for markets. Even as we see pressures on growth, upward pressures on inflation have been building for quite some time (financial repression), and collectively this will affect corporate earnings, particularly in Europe. Policy manoeuvres add another layer of complexity that will tighten financial conditions.

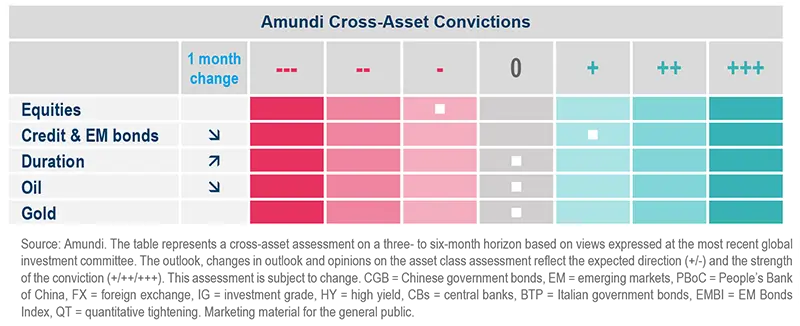

We think investors should explore relative value and play the divergences: stay cautious in European equities, and selectively benefit from the resilience of the US and the economic opening in China. On duration, neutrality and agility are the way forward. In addition, the positive correlation between equities and bonds underscores a need to diversify via non-traditional avenues such as commodities (e.g., oil, gold).

High conviction ideas

While we are marginally cautious on equities, primarily due to our stance on Europe, we stick with our regional preference for the US. Europe is more affected by the Ukraine crisis and the resulting impact on inflation and demand and weakness in corporate earnings. In EM, as we look for relative value opportunities, we are turning positive on China (vs. India, owing to the inflationary impact of commodities) due to its desynchronization with the global economy and accommodative policies.

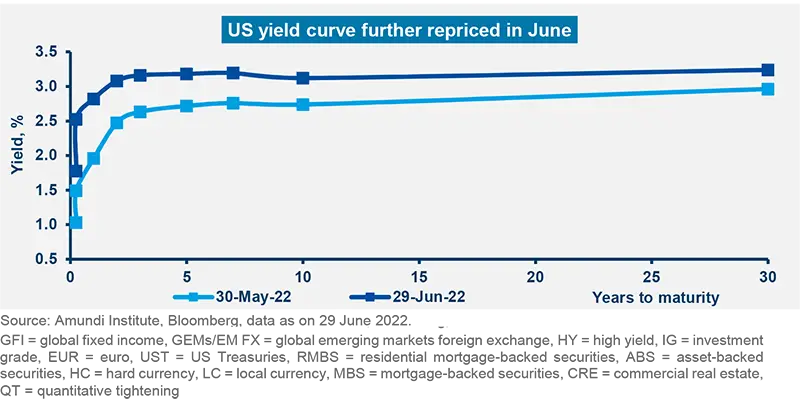

In fixed income, as core yields in the US and Europe have risen substantially and economic growth concerns have emerged, we have been reducing our cautious stance on duration (US, core Europe) and moving towards neutrality. However, amid the uncertainties over the inflation path and CBs’ terminal rates, we remain flexible. In the UK, we no longer believe in the steepening of the 2-10Y curve. The flattening of global yield curves, as a result of significant increases in shortterm yields due to hawkish CBs, could put upwards pressure on short- term UK yields. We recommend investors stay active across curves and geographies to take advantage of any future opportunities.

On euro peripheral debt, we are less constructive than before on 10Y Italian BTPs. A hawkish ECB and the general move towards higher core yields has caused some volatility. We are closely watching the ECB’s efforts and communication to avoid fragmentation in the Eurozone. Elsewhere, we think the Fed’s resolve to tighten policy could affect EM bonds, where we are now neutral, but the situation is dynamic and we remain watchful. In credit, we continue to think US IG offers opportunities amid the earnings resilience, strong consumption and corporate fundamentals in the country. However, we are wary of taking directional calls in the HY segment due to the risks of spread widening and a further increase in defaults. There are opportunities to gain from the spike in volatility, but we remain selective.

Not surprisingly, policy decisions by CBs are affecting FX markets. We are less constructive on JPN (vs. the EUR) now after the Japanese central bank decided to stick to its easing stance, which should weigh on the yen. But we maintain our positive view on CHF/EUR and our cautious stance on EUR/USD amid the wide interest rate differential in favour of the US. The dollar should continue to do well against the CAD. In EM, although we stay cautious on FX in general, we remain positive on the BRL vs. PLN and HUF. The real should benefit from higher commodity prices whereas Poland and Hungary are commodity importers and physically close to the Ukraine crisis.

Risks and hedging

Hedging costs have been rising because of a significant increase in volatility. We recommend investors evaluate the cost-efficiency of hedges and maintain protection on credit, FX and equities. Investors should build protection keeping in mind the potential risks of the upcoming earnings seasons and recession (limited for now).

While markets have already seen repricing in equities and yields, we do not think this is over yet. Instead of adding risk, investors should try to benefit from the diverging economic outlooks globally.

Govies and investment grade credit in focus

| Amaury D’ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Inflationary pressures, persistent bottlenecks and tightening financial conditions might lead some DM into recession. CBs are acting aggressively to control inflation, and as a result short-term rates are likely to go above the neutral rate. The main questions for markets are how much monetary tightening is essential and what the effect will be on consumer demand and corporate earnings. On yields, we may see some further volatility, but current levels are more attractive considering the direction of growth is down and inflation is reaching its peak. On credit, there is a need to consider more quality assets in the portfolio, and stay clear of high-risk, leveraged areas.

Global and European fixed income

We remain close to neutrality on duration in general but keep a flexible stance across geographies and curves due to the ambiguity on terminal rates, inflation and economic growth fears. For instance, in Europe and the UK, we are slightly cautious to neutral, but remain defensive in the US. In breakevens, we believe the aggressive Fed stance could cause upward movements in real rates, and hence we are no longer positive there. In peripheral debt though, we stay neutral as we monitor the evolution of ECB policy and how the central bank addresses the issue of EMU fragmentation through its yet-to-be-clarified anti-fragmentation tool. Chinese bonds continue to offer diversification opportunities. In credit, there are selective opportunities to benefit from new issue premiums. In general, we prefer US IG over EU and believe fundamentals are robust, but we could see some weakening as growth and liquidity concerns percolate through to risky segments. Thus, investors should maintain sufficient buffers and move away from risky names towards quality Arated, more liquid securities.

US fixed income

Even as the Fed continues to aim for a ‘soft landing,’ we think the slowdown in economic growth may be a factor the CB will pay attention to as it tries to balance taming inflation without hampering growth. We also believe employment and consumer demand remain strong and this should prevent a recession in the near term. Thus, while markets are already pricing in a high degree of Fed tightening, the risks remain two-way for yields. Hence, we are close to neutral, but remain very active. In consumer assets, agency MBS seem to have recovered from the QT fears and we think selectively, they offer good value. In corporate credit, we emphasise quality, and in the process limit our spread duration. This is important because credit valuations (IG and HY) are close to their longterm averages but certainly not cheap (as a group) and these could be affected if liquidity dries up. Thus, liquidity and company-specific factors are a priority.

EM bonds

Amid an overall cautious stance, we believe EM growth will moderate in 2022, with a rebound in 2023. We are slightly less cautious on duration given the moves seen this year. In HC, valuations are more attractive in HY compared to IG. With regards to LC, selectivity remains crucial amid the inflation uncertainty, and we are cautious on EM FX. At regional level, we favour countries exposed to the commodity cycle (LatAm and South Africa).

FX

We are bullish on the dollar owing to expectations of higher rates, although we are watching movements closely. On the EUR, JPY and CNY, we remain cautious. In EM, commodity exporting FX (MXN, CLP) benefit from higher prices but Eastern European FX are being weighed down.

While volatility may persist amid the uncertain growth/inflation outlook, the current level of yields make the government bond space more attractive than before.

A moment of truth for earnings

| Kasper ELMGREEN Head of Equities |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Overall assessment

We have been highlighting for some time now that valuations are not completely justified given the economic growth risks on the horizon, but this has only dawned on markets recently. Collectively, growth fears, aggressive tightening by CBs and high inflation led to the recent sell-off. Looking ahead, we think earnings growth may be impacted by the fall in disposable incomes, rising financing costs and higher input costs (earnings revisions may come down). However, this effect will not be felt equally in all sectors, regions and businesses. Companies that have pricing power and display product differentiation should fare better. Security selection is the key to long-term returns, while we also play regional divergences – preference for the US and China in the near term.

European equities

In a challenging environment for Europe, we believe rising input prices and rates will weigh on corporate earnings and valuations. We also note that valuation dispersion is high across sectors and think investors should maintain a barbell exposure, with defensive stocks (healthcare, staples) on the one end and value, cyclical names (materials, industrials) on the other.

However, it is important to stay balanced, maintain a quality tilt across portfolios and focus on companies’ pricing power and balance sheet strength. This is because businesses that are able to pass on rising input costs to consumers are likely to preserve margins. Thus, we maintain selection as our primary driver of risk. We remain cautious on IT and utilities, particularly in areas with expensive valuations and where we believe the risk return trade-off is not attractive.

US equities

The ‘wealth effect’ (loss of asset value that discourages discretionary spending), coupled with high inflation, may cause growth to slow but a recession is not our base case. The recent correction has reduced valuations, but multiples are not cheap and companies are still exposed to the risk of an earnings correction as margins are high at the moment. On the other hand, high inflation and slower growth are the consensus now, though are not completely understood by the markets.

We stick to our conviction on companies that reward shareholders through buybacks/dividends and maintain operational efficiencies in an environment of higher input prices. We see such companies in the quality, value segments of the markets that are reasonably priced. In addition, we are exploring profitable names in certain growth areas as they have become attractive following the correction, but selection remains crucial. However, we are cautious on unprofitable growth names and look for stable returns on equity. Value names and US banks demonstrate this characteristic, along with select names in energy, materials and healthcare. But we focus on the less cyclical and more quality oriented areas of the market.

EM equities

We maintain a prudent stance as global uncertainties remain. Attractive valuations, coupled with strong divergences, persist at country level, allowing us to be very selective and favour commodity exporters (Brazil, UAE). In China, sentiment has turned favourable, especially on the discretionary side due to an expected rebound in demand. Overall, we maintain our preference for value over growth.

Pricing power is key and this is not the time to compromise on balance sheet strength because it is only a matter of time before earnings come under pressure.

Amundi asset class views

Definitions & Abbreviations

- ADR: A security that represents shares of non-US companies that are held by a US depositary bank outside the US. They allow US investors to invest in non-US companies and give non-US companies access to US financial markets.

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS.

- Bear steepening of yield curve: Widening of the yield curve caused by long-term rates increasing at a faster rate than short-term rates.

- Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash.

- Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core + property owners typically have the ability to increase cash flows through light property improvements, management efficiencies or by increasing the quality of the tenants. Similar to core properties, these properties tend to be of high quality and well occupied.

- Core strategy is synonymous with ‘income’ in the stock market. Core property investors are conservative investors looking to generate stable income with very low risk. Core properties require very little hand-holding by their owners and are typically acquired and held as an alternative to bonds.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

- Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years.

- High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market.

- Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss.

- P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

- QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- QT: The opposite of QE, quantitative tightening (QT) is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Rising star: A company that has a low credit rating, but only because it is new to the bond market and is therefore still establishing a track record. It does not yet have the track record and/or the size to earn an investment grade rating from a credit rating agency.

- TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

- Trade-weighted dollar: It is a measurement of the foreign exchange value of the dollar vs certain foreign currencies. It weights to currencies most widely used in international trade, rather than comparing the value of the dollar to all foreign currencies.

- Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-tobook and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.