Summary

Markets: a tug of war between inflation fears and optimism

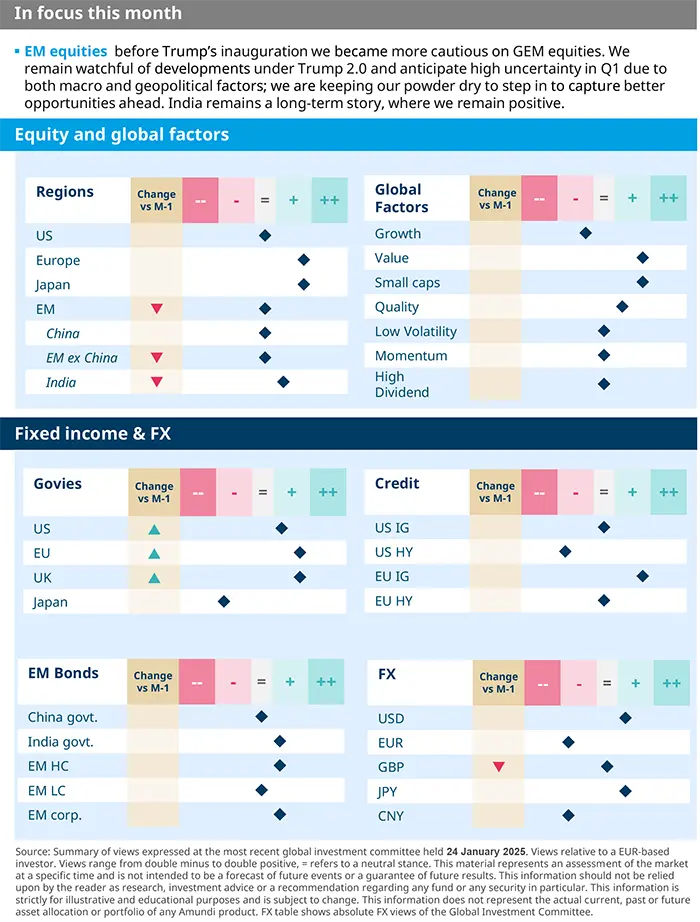

The Trump 2.0 era is upon us and markets have already become extremely sensitive to inflation data, a trend that will likely last in the coming months. Higher inflation sensitivity has also turned equity/bond correlation back to positive. Markets are currently influenced by two opposing forces: the prospect of Trumponomics reinforces the narrative of US exceptionalism, while the imposition of tariffs introduces uncertainty into global supply chain dynamics and inflation trajectories. As the battle between these two narratives will keep volatility high, investors should focus on:

Earnings trajectory amid US fiscal policy, tariffs and AI. While fiscal loosening and deregulation may provide a temporary boost to GDP, the negative effects of tariffs and reduced immigration are likely to weigh on economic performance in the last part of the year. Tariffs will also impact corporate earnings, with potential risks of revisions in H2, while short-term focus will be on how the recent announcement of a new low-cost AI model by Chinese DeepSeek could affect global players.

Asynchrony in central banks' actions. The Fed is on pause, with cuts likely to come later in 2025 if inflation data retains a downward trend. In Europe, we expect both the ECB and the BoE to cut rates sooner, while the Bank of Japan (BoJ) remains in the hiking mode.

US dollar volatility, rising oil prices and China’s stimulus are key themes for Emerging Markets. Uncertainty remains high amid high geopolitical risks and expectations of Trump’s tariffs.

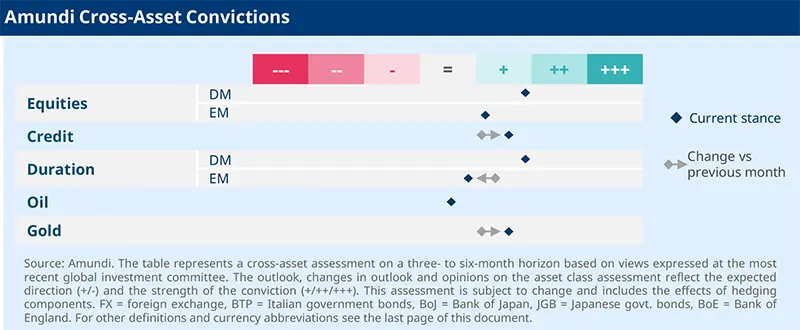

From an investment perspective, the backdrop remains mildly supportive for risky assets thanks to a resilient growth outlook, accommodative central bank policies and abundant liquidity.

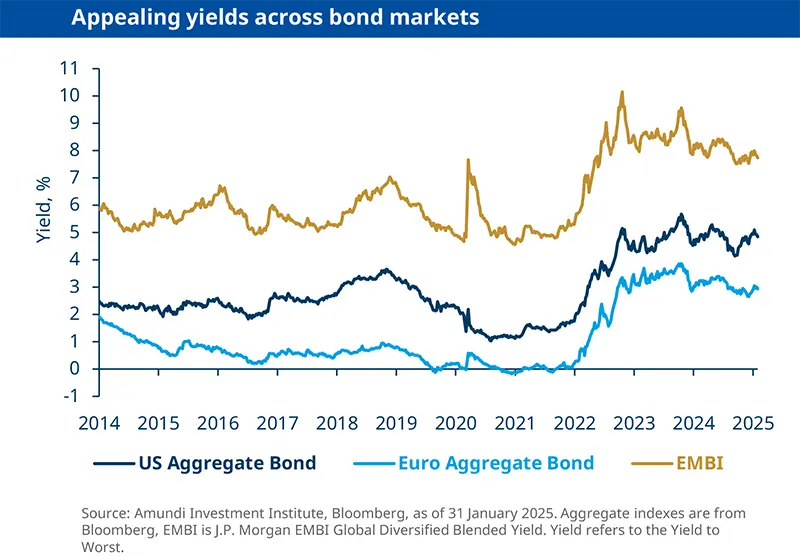

In fixed income, ongoing yield volatility calls for an active and tactical duration approach. Globally, current yield levels are historically appealing, so we have slightly increased our duration stance, particularly in Europe. In the US, while rates are attractive, we expect high rates volatility and favour the intermediate part of the yield curve on a risk-reward basis. We maintain a positive stance on global IG credit, where we have been seeking opportunities in the primary market. Overall, we continue to favour IG over HY and financials over industrials. We also like HY alternatives, such as leveraged loans, due to their more attractive valuations.

In equities, we are positive overall with a focus on global diversification to play the broadening rally. In the US, we prefer equal-weighted indices compared to the overvalued cap-weighted indices. We like financials and materials, and focus on companies likely to benefit from Trump policies but that remain unpriced, and defensives that have reasonable valuations. In Europe, with expected rate cuts and inflation moderation, we see potential in defensive consumer staples and healthcare stocks with price leadership, as well as quality banks with strong balance sheets and lower sensitivity to rate changes.

Emerging Markets (EM) continue to be a selective story. We maintain a neutral stance on global EM equities due to uncertainty surrounding Trump’s policies. In bonds, the outlook for EM HC debt is constructive. Overall, we favour local rates in nations offering high nominal and real yields, and that are less exposed to the new US administration's policies. We look for selective opportunities in HY credit, expecting no significant spread widening as new issuances are well absorbed.

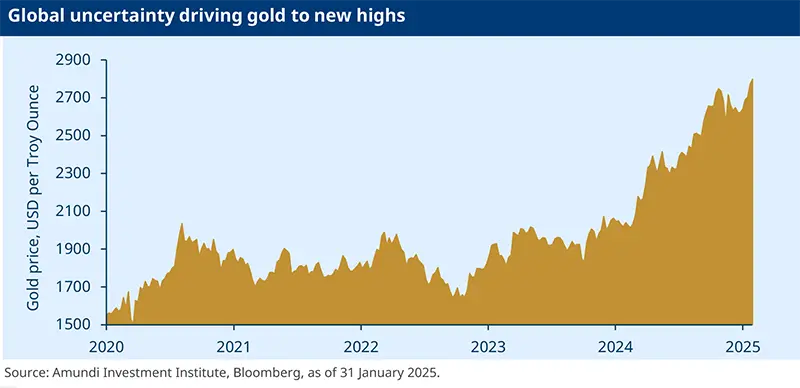

From an asset allocation perspective, the positive backdrop for risk assets leads us to maintain a mildly positive risk stance in global equities. We have also become more positive on Euro Investment Grade (IG) credit, while we moved to a neutral stance on EM debt. We believe investors should maintain a focus on equity hedges in the US market due to tight valuations and diversify with gold to better cope with the potential volatility arising from geopolitical and inflation risks.

With uncertainty looming from Trump tariffs to the impact of DeepSeek on AI we are focusing on global equity opportunities, diversifying with gold and maintaining a tactical approach to duration.

Three hot questions

1| What is your outlook for the US economy in 2025?

Our 2025 US GDP forecast is around 2%*. We believe it is prudent to factor in some of Trump's policy intentions, such as the implementation of tariffs – 10 % on all imports and an increase to 60 % on China – beginning in H1 2025, with effects on growth expected from H2 2025 to H1 2026. We also expect higher yields, which will impact the real economy, including consumption, housing and investment. While some pressures on investment may be mitigated by deregulation in the banking and energy sectors, as well as increased investment in AI, there remains uncertainty regarding Trump's position on the Inflation Reduction Act (IRA). Overall, the net effect of this entire package is likely to be negative for growth. Immigration policy will be crucial for labour supply, impacting wage growth and inflation, which we see at around 2.5% in 2025.

Investment consequences :

Prefer a neutral stance on US equities.

Short-term positive on the USD, USD weakness in the medium term.

2| What are your views on DM central banks?

The US Fed faces an uncertain outlook, with a high expected fiscal deficit and possible labour supply shocks, which will weigh on the inflation outlook. We expect three cuts this year (Fed Funds upper target at 3.75% by year-end). The ECB will face less uncertainty, as US tariffs loom, clouding the economic outlook. As such, policy rates should be reduced steadily. We expect five 25bp rate cuts overall in 2025, with the policy rate at 1.75% by mid-2025. In the UK, progress on disinflation has been slow and the government’s fiscal constraint is tight, meaning that growth could be weaker than expected. Hence, the BoE should cut at least four times, with the bank rate at 3.75% by year-end. The BoJ hiked rates by 25bp to 0.5% in January and we see another 25bp hike this year.

Investment consequences :

- Steeper US curve, 5-30y steepeners.

- Tactical duration management, adding duration overall

3| What are the implications of higher US yields on default rates?

As Trump's policies are likely to result in a higher deficit and increased inflation expectations, Treasury yields could test the 5-5.25 range if growth weakens further. While higher interest costs alone may not significantly impact defaults, a slowdown in economic growth and weak cash flow could lead to an increase in defaults, particularly among CCC-rated issuers, whose EBITDA has been declining over the past couple of years despite relatively benign growth dynamics.

Investment consequences :

- Positive in Credit IG

- Neutral in HY

The US Fed faces an uncertain outlook, with a high expected fiscal deficit and possible labour supply shocks, which will weigh on the inflation outlook

MULTI-ASSET

Risk on, but with hedges and gold

| Francesco SANDRINI Head of Multi-Asset Strategies | John O'TOOLE Head of Multi-Asset Investment Solutions |

Now is the time to diversify across multiple axes: regions, styles, adding gold, and seizing regional and curve opportunities in bonds.

We continue to expect a benign overall economic outlook, with DM countries running at different speeds and China stimulating the economy in an effort to mitigate structural downtrend and tariff risks. In the US, economic growth is normalising, but Trump policies raise uncertainties on various fronts – risks of labour supply shortages due to restrictive immigration policies, tariffs and fiscal policy. In the Eurozone we expect some modest and heterogeneous recovery with downside risks linked to tariffs. All in all, this paints a benign but uncertain outlook, which leads us to remain positive on risky assets, while at the same time we believe investors should increase hedges on equities and favour gold to enhance diversification.

Therefore, we maintain our positive stance on global equities. We believe it is important to diversify by regions and styles. Growth opportunities are more prominent in the US, while Japan and the UK offer more value-oriented investments. The Eurozone still faces significant challenges, but much of this risk is already priced into valuations which remain appealing compared to the US. We remain close to neutral in EM equity and are cautiously optimistic on China, due to its appealing valuations and expectations of policy support.

In fixed income, we remain positive on the 2-year Treasury and maintain our view of a steepening yield curve in 5-30 year maturities. We maintain our positive stance on EU rates and UK rates as well, and we remain cautious on JGBs. We also remain positive on Italian BTPs versus German Bunds. In credit, we have become more constructive on European IG credit due to strong demand and solid fundamentals. In EM debt, we have moved to a neutral stance on EM local debt as disinflation slows and the capacity for EM central banks to cut rates is fading, while we remain neutral on hard currency debt.

We actively diversify the overall allocation with currencies by keeping a preference for USD vs CHF and for JPY vs CHF. We keep a cautious view on the trade-weighted EUR as Eurozone is weaker and the ECB is dovish. In EM, we still like BRL but we are no longer positive on INR.

FIXED-INCOME

In Trump 2.0, bonds will be a key income engine

| Amaury D'ORSAY Head of Fixed Income | Yerlan SYZDYKOV Global Head of Emerging Markets | Marco PIRONDINI CIO of US Investment Management |

Trump 2.0 policies are likely to diverge from current market expectations as 2025 unfolds. Inflation will be a key factor in evaluating the Fed's trajectory, with Trump’s policies potentially limiting future Fed easing unless a significant growth shock occurs. At current levels, global fixed income markets provide attractive yields, serving as a buffer against macroeconomic and monetary policy uncertainties, which makes them appealing as income generators and portfolio diversifiers. Global investors should also look at opportunities in Europe, which offer higher visibility on the ECB's direction and in EM hard currency debt. Here the outlook remains positive, supported by attractive absolute yields, although careful country selection is key.

- We have increased our duration stance and are now positive on Europe and the UK where CBs remain more dovish. We have become slightly positive on US duration and remain cautious on JPY.

- We are positive on credit, tactically adjusting our stance based on market conditions and new issuance opportunities. We favour Euro financials and subordinated debt, and IG over HY (favouring non-cyclicals and cautious CCC).

- In FX, we favour USD and JPY, neutral GBP, cautious EUR.

- We remain tactical on duration and continue to favour the intermediate part of the curve which offers a reasonable risk-reward.

- In credit, in a tight valuation environment, we are biased towards higher quality. We favour Financials over Industrials, and we are moving towards shorter issuer maturities.

- We like HY alternatives (securitised/structured credit, insurance-linked securities) given their more attractive valuations.

- We maintain a neutral duration stance with a bias to increment during market sell-offs.

- Our outlook on EM hard currency debt remains constructive, but we remain selective.

- We favour EM local rates in nations that provide high nominal and real yields while being less exposed to new Trump policies.

- We remain optimistic on HY credit and do not foresee substantial spread widening. We focus on sectors less exposed to potential sanctions/tariffs.

EQUITIES

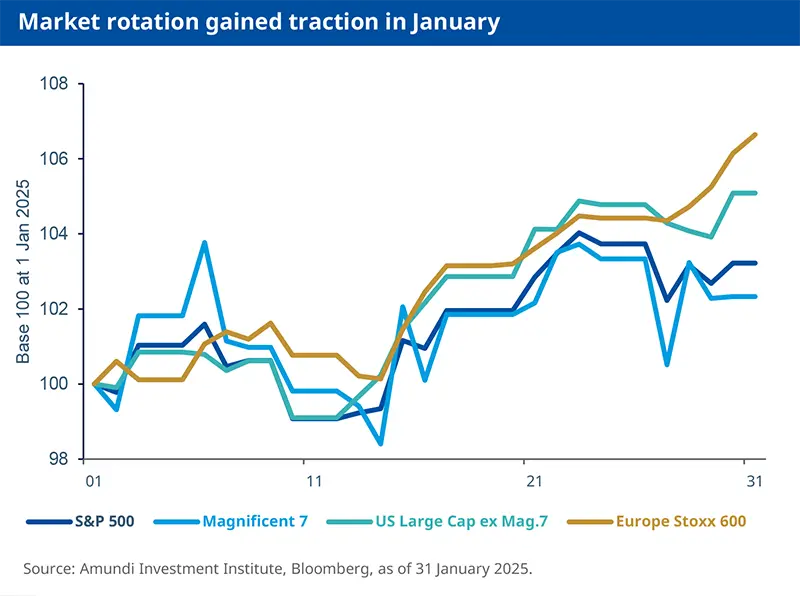

Market rotation in favour of Europe and US-ex mega caps

| Barry GLAVIN Head of Equity Platform | Yerlan SYZDYKOV Global Head of Emerging Markets | Marco PIRONDINI CIO of US Investment Management |

Recent volatility, driven first by uncertainty around interest rates and more recently by the DeepSeek announcement, has continued to favour a broadening of the rally, particularly in European equities and sectors outside technology. High valuations leave little room for disappointment; however, lower expected taxes for corporates and reduced regulation should benefit US domestic stocks and global companies with significant US operations. All eyes will now be on the earnings season, which could further support the continuation of the recent rotation. Against this backdrop, we continue to see opportunities in Europe, in US large caps-ex mega caps and financials, while remaining more cautious on Emerging Markets for the time being.

- The broadening of the market is benefiting European equities. From here, markets will focus on earnings direction and the potential impact of Trump’s policies.

- Sector-wise, we are positive on consumer staples and healthcare. We took some profit from defensive stocks, and we seek opportunities in luxury goods. We are cautious on technology and industrials. In financials, we focus on quality European banks.

- A shift away from the mega caps continues to be key as their high valuation levels are at risk from any possible reversal in risk sentiment, as seen with the DeepSeek announcement.

- We focus on companies that will benefit from Trump policies and look for defensives that have reasonable valuations.

- We favour materials and financials, particularly banks that are structural winners and can benefit from the higher yield curve and lower taxes. We are cautious on tech and consumer.

- We became more cautious on EM equities ahead of Trump’s inauguration amid high geopolitical risks. However, we acknowledge that valuations are attractive and may offer entry points moving ahead.

- Geographically, we favour the UAE, Indonesia, Malaysia and Greece, while we are cautious on Taiwan and Saudi Arabia.

- Sector-wise, we favour real estate, consumer staples and communication services and are cautious on Materials.

VIEWS

Amundi asset class views

Definitions & Abbreviations

Currency abbreviations:

USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint, INR – Indian Rupiah.