Summary

Winds of war blow on economic outlook

The first month of the Russia-Ukraine war has driven volatility up across the board, though with some recent signs of stabilisation in equity markets. Europe is the area most exposed to the war – in particular, through the effects of higher energy prices, supply chain disruptions, and geographic proximity, but the commodity squeeze goes far beyond energy to include agricultural commodities and metals. Against this backdrop, safe-haven demand remains strong for gold while Treasury yields have recently been driven by higher inflation and rate expectations, with the yields moving upwards across the curve. While uncertainty on the war front remains high, markets are trying to assess what additional sanctions could be put in place against Russia or if the next diplomatic steps could become more productive – or, in the bear case, the risks of an extension in terms of time and geographical reach of the crisis.

At this stage, four hot questions are crucial to reassessing the investment stance:

- Are we heading towards a global recession? Taking into account the impact of the rise in commodity prices, we have revised down global growth by 0.5% in 2022 (now in a 3.3-3.7% range), but the impact is not homogenous across countries. The US, while not immune, appears to be more resilient to the shock than the EZ. A global recession should be averted while Europe is more at risk for a technical one.

- How high is the risk of central bank (CB) policy mistakes? The task of CBs is not easy and the potential for policy mistakes is high, especially at the ECB level amid a more uncertain economic outlook (also at a single country level) and rising risks of fragmentation in the Eurozone. It’s not easy for the Fed either. Despite hiking rates for the first time since 2018, it continues to stay behind the curve and it may have to adjust its policy path in an environment in which the inflation topic is hot in the political debate.

- What is the risk of a liquidity crunch? Liquidity has been deteriorating across all main asset classes, with market depth worsening across the board. While at the moment, we don’t see significant risk of a liquidity crunch, the need to remain vigilant and build liquidity cushions is high.

- Markets: How far along is the process of restoration of value? We confirm a cautious stance, but recognise that buying opportunities may open up in the near future and therefore we stay ready to tactically adjust our risk stance. While a process of restoration of value is under way, it is incomplete and fragmented. In particular, the real-life impacts of the movements from the Fed and ECB remain to be seen. This argues in favour of a bit of patience as additional volatility going forward will offer entry points.

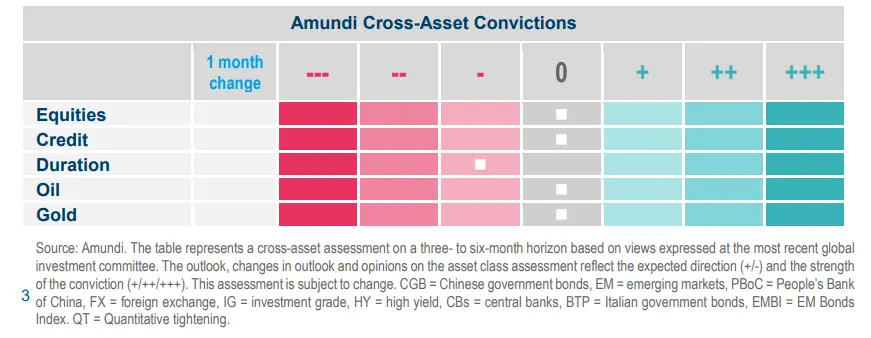

Against this backdrop, our main convictions are as follows:

- Long-term rates remain too low in a persistently high inflationary environment. Recent hawkish turns by CBs confirm that the rate direction is up. We continue to hold a short duration bias and remain tactical in adjusting our duration stance, as this can assist with hedging during periods of turbulence.

- In equities, we stick to a value tilt, with a further marked focus on quality as a way to navigate this crisis. It remains important to be highly selective and look at names with strong business models and the ability to pass through higher prices to consumers. At the regional level, the US should continue to be more resilient compared to Europe, given the higher risk of an earnings recession, and therefore we are turning relatively positive on US vs European equity. The outlook for Chinese equity is tactically more cautious, due to the heightened regulatory risks and extreme volatility.

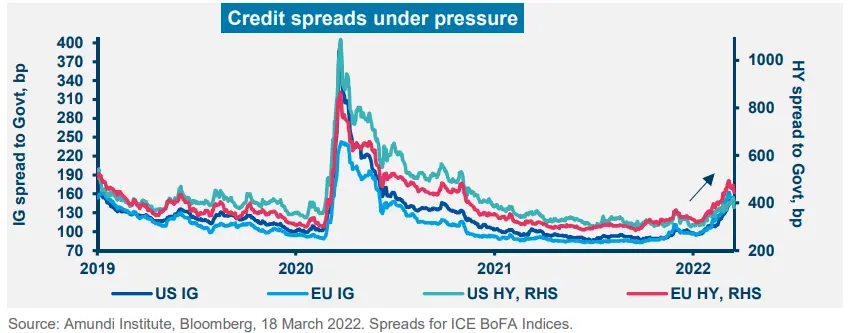

- In credit, risks are more related to liquidity than fundamentals at this stage. Financial conditions are tightening, so it’s important to stay on the lookout for liquidity risk. We are more cautious in general on the high yield space – in particular, in Europe, where a further widening of credit spreads is possible.

- Volatility will remain high, and despite strong market corrections, we maintain hedges in place against the uncertain outcome of the crisis. In addition, to build more resilient portfolios, investors should continue to focus on areas of diversification. With this aim, they could explore Chinese government bonds with a long-term perspective. Currencies can also play a role regarding diversification. Here, we favour the Swiss franc, given its appeal in times of market stress.

In conclusion, we believe it’s important to resist the temptation to go for an aggressive asset allocation, as visibility is still too low, and continue to look at portfolio construction through the inflation (and real rates) lens in the search for areas of resilience.

Amundi Institute Column

An investor view on the war impact in an era of regime shift |

||

| Pascal BLANQUE Chairman, Amundi Institute |

||

|

In the recent past, geopolitical crises have led to short-lived initial negative market shocks, followed by fast relief rallies on perceived positive developments leading to buying opportunities for investors. This time, however, the Russia-Ukraine conflict adds an additional element to the puzzle of higher fragmentation and higher inflation that will characterise the regime shift that I call the “Road back to the ‘70s”. In particular, investors should look at the four macro factors that will drive portfolio returns:

The re-adjustment of monetary policy expectations and the assessment of the economic damage from the conflict are driving the process of reordering of risk premia, which will eventually align with the new equibrium of the new regime. Therefore, in the search for entry points, investors will have to look at when valuations start to be consistent or even offer a positive attractive gap vs what the estimated equilibrium should be in the new regime (where stagflation is the core risk). Investors should resist the temptation to add significantly to government bonds. There is room for more flexibility in duration management, but the short duration trend is your friend. In the search for safety vs higher stagflationary risks, equities offer a space for stocks with bond features that could attain the status of “safe” core assets. These are names with high earnings visibility and low debt. |

||

As long as valuations do not significantly readjust to the new regime and to looming stagflationary risks, investors should stay on the cautious side.

Stagflationary risks in Europe |

||

| Monica DEFEND Head of Amundi Institute |

||

|

The Russia-Ukraine war is likely to affect the European economy mainly through two channels.

Investment consequences. We recommend a neutral stance on global equities. In FI, a recalibration is under way. Weak technicals, underlined by a combination of factors such as withdrawal of CB support, rising rates and economic growth pressure, call for a defensive allocation to credit. In addition, liquidity pressures and flight to quality mean upgrades for govies and cash. Finally, continued inflation calls for a positive tilt on sensitive assets in the form of inflation-linkers bonds, gold, some real assets. |

PPI = Producer Price Index, CPI = Consumer Price Index.

Don’t jump into the market, but play US vs Europe

|

Francesco SANDRINI |

John O’TOOLE |

Financial markets and the economic environment are being influenced by three broad forces at the moment: inflation and growth expectations, policymakers’ responses (fiscal and monetary) to these, and the evolving geopolitical landscape. We expect the first two to be increasingly affected by the third, therefore decreasing overall visibility on future economic directions.

Thus, this is not time to re-enter the market aggressively, despite recent signs of stabilisation, while investors should focus on liquidity, diversification (to include gold and commodities, among other assets) and finetune exposure with an eye on relative value opportunities. In addition, hedging and FX should be key pillars of portfolios, with a focus on political risks and flight-to-quality flows.

High conviction ideas

We remain neutral overall on equities but we seek tactical relative value opportunities. We are becoming more constructive on US vs Europe. A Fed with a strong commitment to fighting inflation in the short term is causing curve flattening that should benefit the US market, including some growth areas. Hence, we have implemented a coherent stock picking approach, reducing our value tilt in this phase. Heightened risks of a weakening earnings momentum in Europe call for a more prudent stance in the region. In EM, we stay neutral, and we have moved to neutral as well on Chinese equities amid exceptional volatility and risks from the renewed lockdowns.

While maintaining an overall cautious view on duration, we now think German Bunds could benefit from safe-haven flows and from European economic growth concerns stemming from the Ukraine-Russia conflict. However, the German volte-face on higher military spending is increasing the government’s funding projections. This may potentially increase bond issuance, thereby pushing yields up (also supported by the ECB’s recent hawkish comments). Thus, we are closely monitoring the situation and stay flexible.

On peripheral debt, we maintain our optimistic stance on Italian BTPs vs German debt. Although we acknowledge some pressures on BTPs from flight-to-quality moves in the market, we believe Italian fundamentals in terms of economic growth (thanks to NGEU funds) and political stability are strong. In China, while our long-term view on the diversification benefits of local debt remains, we believe the asset class is facing headwinds from the FX component due to risks of outflows in light of US-China tensions and the resulting weakness in the CNH.

Credit markets may be affected by increasing volatility, upwards pressures on core rates, and higher inflation. In addition, there are concerns about corporate earnings due to potentially weakening GDP growth in Europe. Collectively, all this may cause spreads to widen. Thus, we removed our marginally positive stance on EUR HY and stay neutral on IG and credit overall. Having said that, we believe corporate fundamentals at the moment are strong and balance sheets are healthy, allowing us to be vigilant in this area.

We believe the FX universe is increasingly driven by geopolitics and the macro-economic environment. Given the improving flows into CHF assets due to its protective features, we are now positive on the CHF vs the EUR. We maintain our defensive stance on the GBP vs the EUR owing to the increasing isolation of the UK regarding the US and EU. In addition, we are no longer positive on the CNH vs the EUR because we see the EUR gaining from any potential improvement on the Ukraine crisis front.

Risks and hedging

A higher inflation regime and tighter policies from central banks are the main risks to monitor in 2022 on top of the Russia-Ukraine conflict. The current environment underscores the need to maintain and adjust protections on risk asset exposure through derivatives and gold (tactical hedge).

We prefer relative value opportunities over making strategic bets at the moment, without increasing our directional risk exposure.

Credit is the first candidate for repricing: be watchful

| Amaury D’ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

As we see stagflation risks looming, we also believe divergences in US and European economic growth and inflation patterns could emerge. While in the US, inflation is driven by rising wages and higher commodity prices, in Europe, commodity prices are the reason. Consequently, future moves could be characterised by policy divergences and unpredictability. That said, CBs are staying happily behind the curves and now hawkish overtures from both sides of the Atlantic are some commonalities. Combine these hawkish tones with potential pressures on earnings and you get a situation where investors should tread cautiously regarding risk assets, despite strong corporate fundamentals. Government bonds should be considered for their protective nature in times of market stress, but keep in mind that the rate direction is up.

Global and European fixed income

While our long-term stance remains defensive on duration in core Europe, the US and UK, we are slightly less cautious amid markets’ flight to quality and repricing of Euro rates. On peripherals, given fragmentation risks, we are more cautious on Italian BTPs. Investors can tactically play opportunities at curve levels: here, we see flattening on the Euro yield curve, steepening in Canada/Australia. Elsewhere, Chinese duration exposure is providing some diversification, whereas US TIPS appear suitable for hedging. We are converging to a neutral view on credit through derivatives which also offer safeguarding features for portfolios. The uncertainty on the geopolitical front is generating high volatility, with a downward skew in particular for high beta cyclicals. Thus, we are slightly less positive on subordinated debt, cyclicals (energy, auto) due to potential fallout from economic growth weakening. Overall, investors should prioritise liquidity, be watchful of earnings deterioration and avoid leveraged areas.

US fixed income

Core yields will continue to fluctuate on the back of inflation, expected policy action, and investors’ search for safety. We acknowledge that domestic economic activity should be driven by strong labour markets, consumer earnings, and relatively easy financial conditions. These, coupled with subsiding winters and prospects for increasing energy supplies from other countries, should help offset the effects of rising oil on the US economy. Thus, we maintain a short bias towards duration but remain agile across yield curves. On the other hand, securitised assets (non-residential, CRE), and agency MBS offer selective opportunities. In corporate credit, we maintain a cautious attitude. Interestingly, we are noticing generous new issue concessions in the primary markets as companies look to raise credit in an environment of widening spreads. But, we prefer idiosyncratic factors (company-specific), underscoring the need for issuer-level selection and robust hedges.

EM bonds

In a fragmented EM world, we keep a defensive view on duration and remain watchful of liquidity risks due to the heightened volatility. This should allow investors to dynamically adapt, should attractive entry points materialise. In HC, we prefer HY vs IG while in LC, we are cautious on the FX front and highly selective. Commodity exporters could benefit from recent events. Hence, we actively explore sovereign/corporate bond areas that could benefit from rising energy prices.

FX

We remain positive on the USD and cautious on the EUR and JPY, but have reduced our defensive view on the yen, given its safe-haven nature under market stress. In EM, we our constructive on commodity currencies, owing to higher energy prices, and on select LatAm FX, such as MXP, CLP.

With limited support from policymakers (monetary and fiscal), credit spreads could widen, particularly if real rates start rising and earnings come under pressure.

In a more uncertain earnings path, US is favoured

| Kasper ELMGREEN Head of Equities |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Overall assessment

Market volatility has increased over the past few weeks, significantly raising risk premiums and widening the outcomes related to economic growth. Europe, with its proximity to the crisis, is more affected; the US less so. Now, the narrative is more of the same – more inflation, and even less growth that could weigh on earnings. In this environment, we continue to rely on bottom-up analysis and prefer to measure the effect of the war on upcoming data related to inflation, the economy and corporate earnings to assess future directions. But it is clear that inflation is here to stay in the medium term. Thus, through an overall balanced mindset, investors should exploit the fundamental analysis lever, along with value, quality and dividend themes to navigate stormy waters.

European equities

The European economy is most at risk, with the earnings outlook for European companies deteriorating. In this environment, we remain committed to exploring relative value opportunities presented by market dislocations. Clearly cyclical, economicallysensitive sectors, such as autos will be more affected, with severity depending on the duration and depth of the crisis.

Overall, we believe investors should consider increasing higher quality and stronger capitalised companies within cyclical as well as defensive sectors. Our preference for value as a medium term call remains. From a sector perspective, we remain positive on consumer staples and healthcare, and have upgraded our outlook for industrials, given attractive bottom-up names in this area. On the other hand, we are still cautious on information technology (slightly less) and have maintained our cautious view on utilities.

US equities

In the US, we don’t expect an economic recession to occur, as market liquidity is ample, along with strong labour markets and robust consumer earnings. However, we see pressures on economic recovery that could create difficulties for companies in meeting 2022 profit expectations. Thus, in our search for names, we continue to focus less on cyclical businesses and more on value, quality. We look for characteristics of operational efficiency (low capex/sales, low inventory/sales growth, low employee turnover). Secondly, we are constructive on companies that reward minority shareholders through buybacks and dividend payouts. In contrast, we believe as a group, growth prices vs value are still high and we avoid unprofitable growth names. At a sector level, we are constructive on consumer services over retail in discretionary. In banks, we are focusing on well-capitalised names that have reduced leverage and are more retail oriented with large domestic operations. These features should allow them to better navigate the crisis. In the tech sector, we explore reasonably priced quality names that are less cyclical, given that tech spending is generally less economically sensitive.

EM equities

The current disruption (higher commodity price, inflation) will not affect all EM equally. In this respect, Eastern Europe is the most exposed to economic spillovers, but LatAm could benefit from higher commodity prices (positive Brazil). We are also constructive on oil & gas exporters in the Middle East (UAE). In Asia, China’s position on Russia, its fiscal stimulus, and how the country deals with a renewed wave of Covid-19 cases are key points we are monitoring. At a sector level, we favour discretionary, real estate, and we maintain our tendency to increase value over growth.

Lower expected growth and looming stagflationary risks in Europe call for caution in the cyclical space and support the relative appeal of US equities, with a focus on quality and dividends.

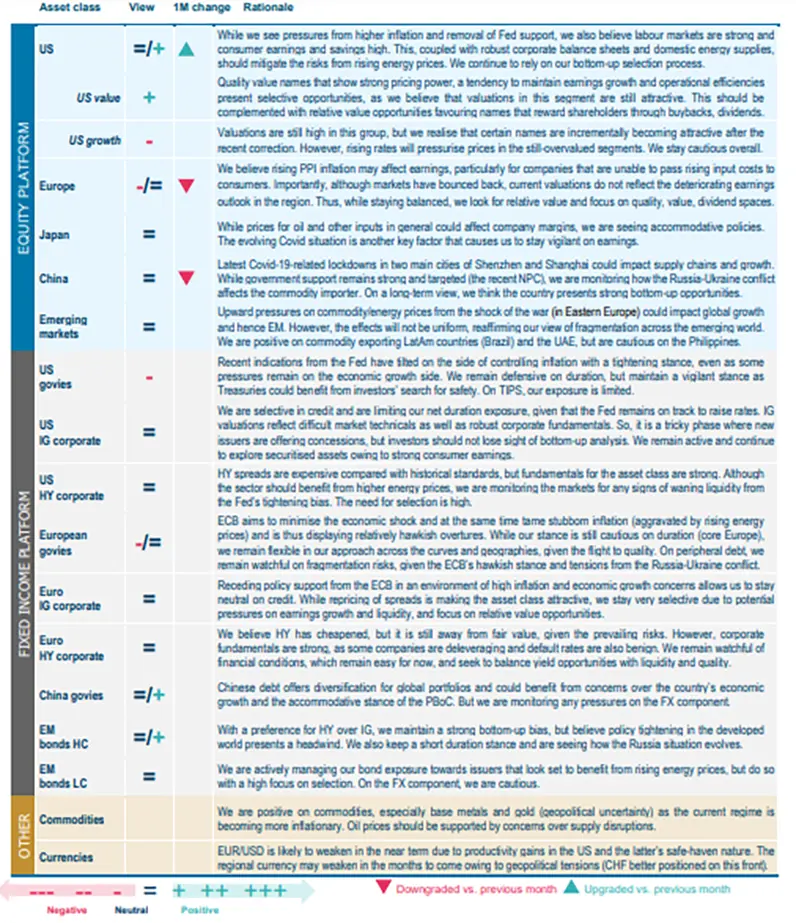

Amundi Asset class views

Source: Amundi, as of 24 March 2022, views relative to a EUR-based investor. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research, investment advice or a recommendation regarding any fund or any security in particular. This information is strictly for illustrative and educational purposes and is subject to change. This information does not represent the actual current, past or future asset allocation or portfolio of any Amundi product. IG = investment grade corporate bonds, HY = high yield corporate, EM bonds HC/LC = EM bonds hard currency/local currency, WTI = West Texas Intermediate, QE = quantitative easing.

Definitions & Abbreviations

- ADR: A security that represents shares of non-US companies that are held by a US depositary bank outside the US. They allow US investors to invest in non-US companies and give non-US companies access to US financial markets.

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS.

- Bear steepening of yield curve: Widening of the yield curve caused by long-term rates increasing at a faster rate than short-term rates.

- Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash.

- Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core + property owners typically have the ability to increase cash flows through light property improvements, management efficiencies or by increasing the quality of the tenants. Similar to core properties, these properties tend to be of high quality and well occupied.

- Core strategy is synonymous with ‘income’ in the stock market. Core property investors are conservative investors looking to generate stable income with very low risk. Core properties require very little hand-holding by their owners and are typically acquired and held as an alternative to bonds.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

- Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXP – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years.

- High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market.

- Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss.

- P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

- QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- QT: The opposite of QE, quantitative tightening (QT) is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Rising star: A company that has a low credit rating, but only because it is new to the bond market and is therefore still establishing a track record. It does not yet have the track record and/or the size to earn an investment grade rating from a credit rating agency.

- TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

- Trade-weighted dollar: It is a measurement of the foreign exchange value of the dollar vs certain foreign currencies. It weights to currencies most widely used in international trade, rather than comparing the value of the dollar to all foreign currencies.

- Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.