Summary

As long as inflation is not resurging, better growth should support equities. We favour a diversified*global approach and selective stories, such as India.

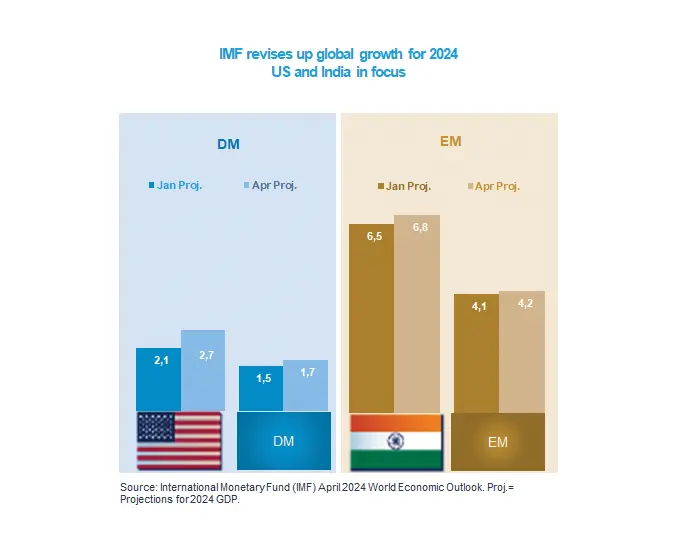

- With 2024 global GDP growth forecast similar to the numbers of 2023, the IMF is no longer expecting a slowdown.

- While less optimistic than the IMF, we have also just increased our global growth forecast to 2.8%.

- Equities may prolong their rise, conditional on continuing disinflation. Global equity and India in focus.

The IMF’s April World Economic Outlook has revised up the growth forecasts to 3.2% real GDP growth in 2024. The 2024 forecast was 3.1% in January and 2.9% in October 2023. Indeed, the global economy (and, in particular, the US economy, key to global financial markets) continue to show surprising resilience to the rapid interest rate hikes of 2022-23. While not as optimistic as the IMF, we at Amundi have also increased our global GDP growth forecast, with higher growth expected in particular in the USA. As long as disinflation continues, even gradually, this higher growth may continue to support equities. A global approach including Emerging Markets could be favoured moving forward. India also stands out thanks to its high growth profile, among the highest in EM.

Actionable ideas

- Global equities

Despite significant regional nuances, improving global growth expectations should translate in generally positive profit growth, supporting global equities in general. -

Emerging Markets and Indian Equities

From a cyclical standpoint, the growth differential between advanced and emerging economies still favours the latter. Moreover, some emerging economies, such as India continue to offer a very positive long-term growth outlook.

This week at a glance

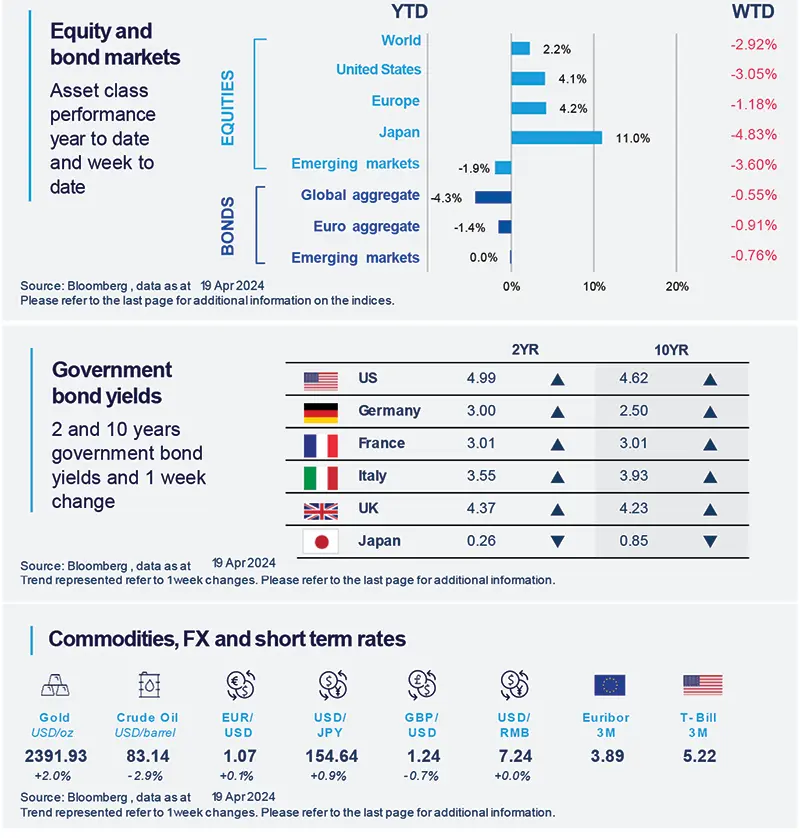

Bond yields increased, with most of the movement occurring Monday after strong US retail sales. Stocks retreated due to the combination of strong US data with continuing geopolitical tensions in the Middle-East. However, movements on the dollar remained limited and oil prices retreated.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 19 April 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US retail sales growth in March came out stronger than expected by consensus

On Monday April 15, the release of retail sales data was upbeat compared to forecast by consensus. Retail sales advanced 0.7% in March (vs. 0.4% Bloomberg consensus expectations). The main driver was “nonstore” spending (which grew 2.7% mom). To signal, however, also strong sales by gasoline stations (due to higher gas prices), and general merchandise sales.

Europe

The third consecutive increase for the German ZEW expectations index signals hopes for recovery.

The ZEW Indicator of Economic Sentiment is a leading indicator for the German economy. In April, it marked its 3rd consecutive increase reaching its highest since March 2022. Such path signals that hopes for a European recovery are increasing. This improvement in sentiment was evenly spread across sectors, although capital goods improved the most.

Asia

Chinese Q1 GDP stronger than expected, but we remain cautious.

Chinese Q1 GDP came in at 5.3% YoY, much higher than our forecast. However, nominal growth was much lower and we don’t see evidence of turnaround in China’s domestic demand.

Export growth, in contrast, surprised on the upside and the strength is likely to be sustained in Q2.

Key Dates

|

23 Apr Euro area preliminary PMII indices |

24 Apr German IFO Index |

26 Apr US Core PCE Inflation |