Summary

Geopolitics

Tail risks to watch in 2025

We see geopolitical risks persisting as a base-case scenario for 2025 (see box). Below we share the main upside and downside risks to our base case that investors should take into consideration.

Tail risks

Trump could become more ‘geopolitical’. This risk could see the United States use tariffs and other means to reorganise the world in line with US interests. The United States could force countries to pick sides on China or deter aspiring new BRICS joiners. A bipolar world would be the result if implemented in full, although many middle countries are likely to resist picking sides for as long as possible. Efforts to devalue the dollar with a new ‘Plaza’-style agreement could also fall into this ‘geopolitical’ category, although today’s context makes this difficult.

The concept of ‘spheres of influence’ could take hold, with the United States expanding its sway both North and South while allowing Russia and China their zones. This scenario could result in a grand bargain with China, in which geopolitical and economic issues are settled by confining powers geographically.

Hybrid warfare escalation is likely, with more attacks on subsea cables and infrastructure, particularly in Europe and Asia, as well as in space, while assaults could also increase in the United States. A Russian projectile could hit NATO territory without casualties and Russia would say it was a mistake, leading to increased tensions.

Base-case expectations on geopolitics for 2025

- Geopolitical risks will remain high because of the power realignment underway and growing economic disruptions. It will require adaptability, hedging and diversification strategies.

- US domestic politics will be noisy, with the new administration aiming to implement “Make America Great Again” policies. This is likely to undermine some institutions and norms, but is unlikely to push US democracy towards breaking point. The administration will likely face trade-offs and constraints.

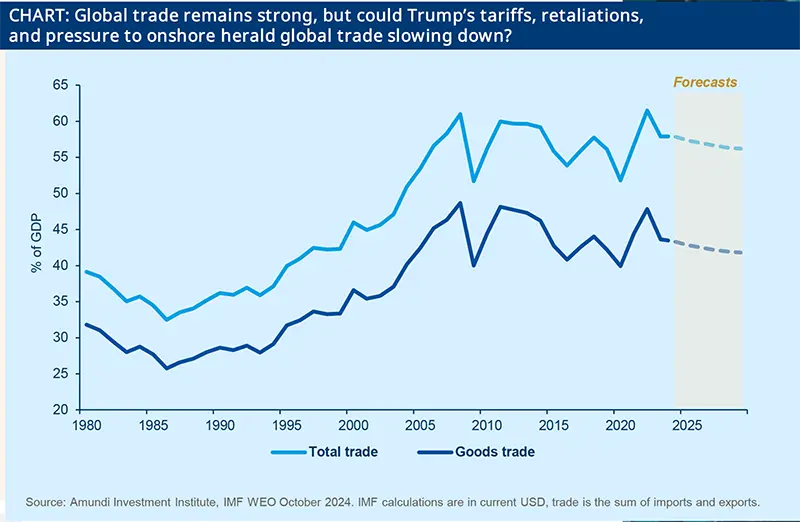

- The United States-China relationship will likely deteriorate further, with tariffs gradually being imposed and Chinese retaliation. Economic ruptures will increase geopolitical tensions, but in 2025 the focus is likely to remain on economics.

- China will focus on adapting to the new environment through domestic economic support and diversifying its trade relationships. Geopolitical muscle flexing will continue and the South China Sea risk will remain elevated.

- Talks between Russia and Ukraine will start in H1; a fragile ceasefire is more likely than a peace deal, but even that is difficult.

- Talks will dominate the Middle East on multiple levels.

- The United States-EU relationship will face a combination of intimidation and leeway, but the United States will more likely than not keep allies close.

- The EU confronts conflicting dynamics (e.g., fiscal consolidation versus the need for higher defence spending). Some upsides could result from the German election on the fiscal side and provide renewed leadership on the EU level.

- New winners will emerge as the world diversifies to adapt to changes in sanctions, tariffs and physical disruptions.

- All of the above will put upward pressure on costs, with ramifications for inflation expectations.

Upside risks include a more stable Lebanon, a surprising shift in Syria's governance, and a comprehensive peace deal in the Russia-Ukraine conflict that could lead to reconstruction and improved relations with Russia.

In the Middle East, risks involve potential United States-Israeli strikes on Iran's nuclear facilities, in response to Iran having significantly increased its nuclear capabilities. This could lead to regional destabilisation affecting UAE and Saudi Arabian oil infrastructure. A regime change in Iran could either lead to destabilisation or a less hostile Iran. In Israel and Syria, upside risks could arise from a more stable Lebanon and Syria under new governance.

In Asia, many paths could lead to escalation in the South China Sea, either because United States-China economic tensions intensify faster than expected or because there is an accident as a result of riskier naval operations. North Korea could still attack South Korea, although the likelihood has decreased due to South Korea's political shifts.

In Europe, the Russia-Ukraine war could escalate if Russia targets NATO or if the United States increases support for Ukraine because Russia refuses to settle. On the upside, a comprehensive peace deal, rather than just a ceasefire, could lead to reconstruction and improved relations with Russia, including the resumption of energy flows to Europe. A far-right government could be the outcome of Germany’s elections. EU countries could break with the United States as a result of US economic and political actions. The transatlantic relationship would falter, leading to either radical policy changes or further divisions within the Union.

This thought exercise aims to help investors be aware of possible scenarios, but it is not a comprehensive list of all possible (geo)political risks*. While markets may not be paying attention to some of these risks, these vulnerabilities or potential positive surprises can lead to strong short-term market reactions and bigger trends affecting market dynamics, should they play out.

** Please note this does not include ‘black swan’ events, as such events are, by definition, not forecastable.