Summary

Key takeaways

Recent stress in parts of the banking sector will raise funding costs and reduce lending to many sectors. Now we expect the US economy to shrink by - 1.1% in 2023, driven by a contraction in domestic demand. Eurozone growth should stagnate amid inflation remaining high.

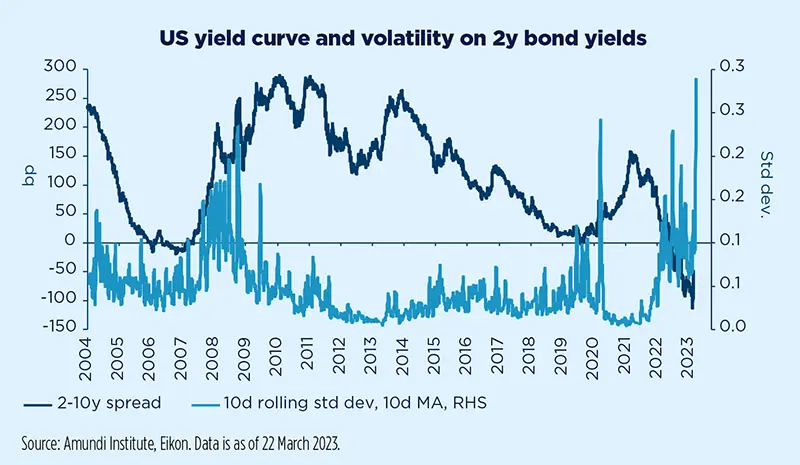

The recent stress in large parts of the US banking sector is significant. It adds to pressure on funding costs and profitability stemming from the fastest monetary tightening on record and the protracted period of an inverted yield curve. These stresses will constrain many banks’ ability to lend and will have a material impact on the outlook. As a result, we are revising our US forecast. We now expect a more protracted recession during the course of 2023 rather than mild weakness.

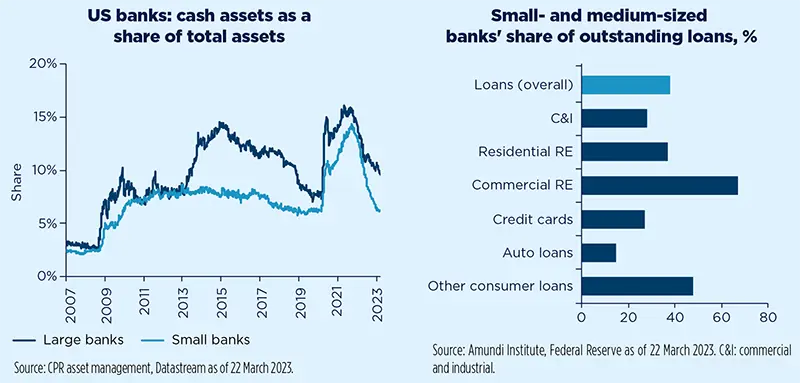

Small- and medium-sized banks account for a significant share of lending in the United States (some 40-60% of commercial real estate, residential real estate and consumer loans). These banks are under stress from deposit outflows and losses on their asset portfolios. Their ability to lend will be constrained by the inverted yield curve, with competition from higher rates on money market funds and short-maturity US Treasuries, as well as losses on low-yielding legacy assets and a higher cost of capital.

This effect will last well beyond the policy responses currently underway to stabilise the banking sector. While policymakers can reduce the risk of bank runs by expanding deposit insurance, they cannot reduce the cost of funding or limit losses on assets. Similarly, CB liquidity provision will reduce the pressure on these banks to sell assets, but it will not help reduce their funding costs.

Banks under stress has led to unprecedented volatility in market interest rates and market expectations of policy rates, volatility has been higher recently than during the GFC or at the start of the Covid-19 lockdown. Such a volatile environment does not bode well for the stabilisation of market funding for banks. It will also make banks more conservative in their lending. As a result, we view this as a structural decline in the availability of credit and the higher cost of credit to large sections of the US economy, and the continued impact of monetary tightening.

With an additional dose of tightening coming from tighter bank lending, policy rates will depend on the extent of the slowdown in activity, but we maintain our view that Fed policy rates will peak at 5.25%.

Similar effects of monetary tightening – pressure on deposit rates and valuation losses on asset portfolios – are affecting European banks, though in Europe we are not seeing extreme stresses in the banking sector stemming from the weak regulation and inadequate risk management that has affected some of the small US banks.

Forecasts revision

For the United States, we have moved from a projection of 0.2% Q4/Q4 growth to a contraction of 1.1% in 2023.

Reduced availability and a higher price for credit will reduce consumer spending and capex, and will constrain corporate growth and hiring, exacerbating the already weak domestic demand in the United States and the Eurozone.

In the United States, where we had expected the economy to suffer at least one quarter of contraction in the second half of this year, this new credit shock is a larger setback and will further exacerbate financing conditions for large sections of the economy. In particular, small businesses – which account for over 45% of employment (over 60 million workers) – will face acute financing pressures.

We expect the knock-on effects to ease pressure in the labour market and weaken consumption spending, which has been remarkably resilient until now. This implies more pronounced contractions in Q2 and Q3 and a recession in 2023.

Therefore, we have moved from a projection of 0.2% Q4/Q4 growth to a contraction of 1.1% in 2023. Among the main components, we expect real personal consumption expenditures to contract for at least two quarters, both residential and non-residential investment to decline, and an increase in savings. Labour market pressures should begin to ease and over time weigh less on cost-push inflation pressures.

Notwithstanding the deterioration in domestic demand, core inflation remains sticky this year and well above the Fed’s target, although sequentially it should normalise faster than before and get closer to its target by the end of 2024.

In the Eurozone, both consumption and investment spending were very weak in Q4 2022 and we had expected a weak 2023 even before the current financial stability concerns. Now, this additional headwind implies higher cost-of-funding and balance-sheet constraints for banks. With over half of the total credit in Europe provided by banks, this weakens the prospects of a recovery in the second half of this year. China’s reopening will provide a partial offset, but we would judge that this will not be sufficient to offset the weaker US outlook. We see limited upside for Europe and a continuation of stagnant growth with inflation remaining stubbornly high.