Summary

Key takeaways

Much less fiscal policy support will likely constrain domestic demand and higher-for-longer interest rates will make monetary policy even more restrictive.

The Eurozone economy has stagnated over the last three quarters, although growth in the second quarter was marginally positive due to strong idiosyncratic growth in one or two smaller countries. The countries that are more dependent on services, such as France and Spain fared better, compared to Germany and Italy, for instance, which rely more on manufacturing and exports. Nonetheless, soft data and leading indicators suggest the services sector is unlikely to remain resilient. Preliminary PMI data indicate demand weakness is spreading to services, although activity is stalling rather than contracting at this stage. Forward-looking employment indicators – wage offers for new jobs – also suggest some moderation in labour market strength. Employment, however, remains strong and this should support demand near term.

1. Reduced fiscal support will add to already weak domestic demand

In 2022 and 2023, energy-related fiscal support measures amounted to about 2% of GDP (ECB estimates*) but, next year, we expect this support to be reduced and, together with the return of fiscal rules, should reduce aggregate fiscal support to an average of less than 1% across the Euro area (ECB estimates*).

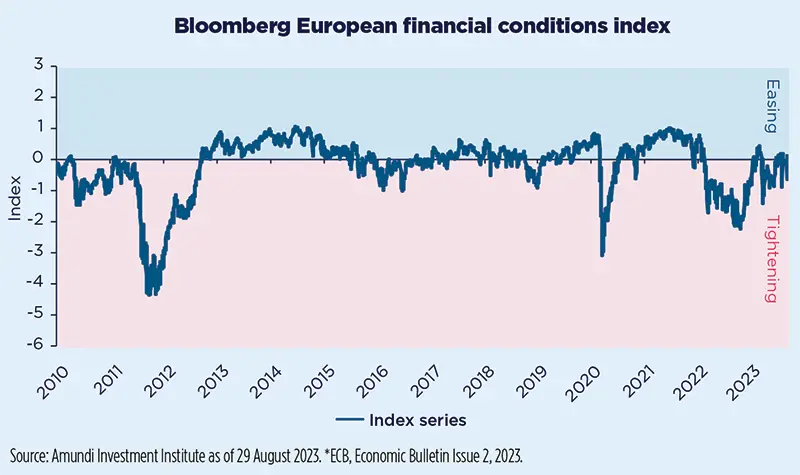

Moreover, with the ECB not expected to reach its inflation target until sometime in 2025, monetary policy is likely to remain restrictive throughout most of 2024. Consumption has been supported by a strong labour market, but the recent buoyancy in nominal wage growth has not been sufficient to restore losses in real compensation since 2021. With wage growth expected to moderate, the stock of excess savings is reduced and, with credit conditions tightening, consumption will remain subdued and will not be a source of private demand growth.

In addition, investment is also expected to decline due to weakening demand, a higher cost of capital and tighter credit conditions. More EU support for the green transition and NGEU funds will provide some stimulus but it will not be material in the near term. External demand will exacerbate domestic weakness, due to slower global growth. Global trade will likely weaken further, to below 1.4% Q4/Q4 after a broadly flat 2022, recovering modestly to 2.6% Q4/Q4 next year, which is still below the long-term average of above 3.5% since the early 2000s. Headline inflation has declined due to favourable base effects but, with the recent uptick in oil prices, the slowdown should be more moderate for the rest of this year. Core inflation will remain sticky, especially as services inflation remains well above levels consistent with the central bank’s target. We expect the core inflation rate to remain close to current levels of around 4.5% in Q4.

2. Growth divergence across the Eurozone will narrow as policy support wanes

None of the factors that have supported demand this year will be as supportive next year.

The four largest countries have seen marked differences in domestic demand during this recovery, but with country-specific factors expected to be ironed out and policy tightening becoming more uniform, we expect these growth differences to narrow and progressively converge to subdued and below-par quarterly growth patterns, resulting in annual average growth rates below 1% in 2024, with downside risks more pronounced in some countries. At a country level, we expect Germany to show the weakest performance among the four main countries. Germany, and Europe in general, will have to recalibrate lower growth expectations in China (the second most important destination for German exports and a key supplier to the German manufacturing sector). But Germany has also to face the challenge of its energy dependency. Among the other main countries, Italy has benefited from government incentives for investment, a recovery in exports and resilience in consumption linked to its lowest unemployment rate in the last ten years. But a tighter policy environment and lower external demand, both from its important trading partners within the Eurozone and outside, will lead to a significant moderation in growth. France will also move to below-trend growth because of weaker external demand, but we expect inflation to remain under control and a recession in 2024 should likely be avoided. Spain has been the laggard among the four main Eurozone countries in catching up to its pre-pandemic levels; we expect a more buoyant quarterly growth profile for the rest of this year compared to its peers, but a more challenging environment next year due to tighter financing conditions and the withdrawal of energy price support measures.

The ECB is set to remain hawkish

We expect the ECB to remain on the hawkish side. The ECB is facing a dilemma: inflation versus growth. The question for the central bank is (1) whether inflation is still too high to risk a halt to tightening, or (2) whether the economy is already weak enough to curb price growth on its own. Indeed, the outlook in the Eurozone is deteriorating rapidly, with credit conditions tightening and high inflation continuing to weigh on demand. However, the job on inflation is not finished yet. Inflation has moved down from its peak but remains too high, even though the drivers of inflation are changing. External sources of inflation are easing, while domestic factors are now the main drivers of inflation in the Euro area. The ECB is closely monitoring the rise in wages and the strength of profit margins. The central bank has indicated that the rise in labour costs was the main reason for raising its inflation forecasts.