Summary

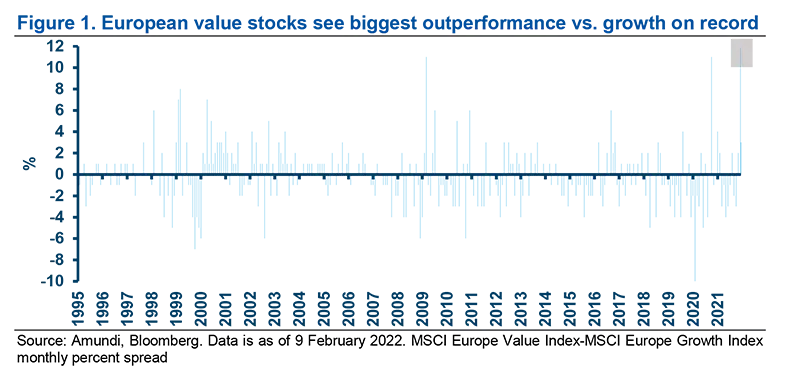

- January 2022 was a record month for European value equity, in terms of its outperformance vs. growth. The market’s reassessment of central banks’ actions after their hawkish turn has driven real yields higher and benefitted value stocks, while growth sectors such as technology, which are more sensitive to interest rates duration, have suffered. Energy is also doing exceptionally well amid the increasing energy and commodity prices.

- We see a continuation of the European value rotation in 2022, as the economic momentum remains supportive and we are entering a regime of more persistent inflation. However, the trajectory will not be linear, but while there might be pauses in this trend we do not anticipate a reversal. Instead, as the value vs. growth discount remains historically high despite the recent performance, we see room for a multi-year rotation, benefitting long-term investors.

- Investors should be selective. While the first part of the rotation has benefitted all value areas, the next phase will be more diverse. The more the rotation advances, the more investors will have to focus on selection and adopt a real returns mind set, which involves exploring companies that can preserve margins/earnings growth and continue to offer sustainable dividends.

- Dividend stocks and small caps could also offer opportunities in a higher inflationary environment and European equity is an attractive hunting ground. Dividend stocks, in particular, will be in demand as investors focus on real returns. Earnings tend to convert into dividends with an approx. one-year lag, so we believe that in 2022 we should see the full benefit of the strong 2021 growth.

Real rates repricing, the energy price resurgence and the cyclical recovery have driven the great rotation from growth to value in Europe, with a record month in Jan

January 2022 was a month of record outperformance for European value vs. growth stocks, and the trend is continuing in Feb, with the YTD performance of the MSCI Value Index (at Feb 9) at +5.1% vs. the -9.2% of the equivalent growth index (+14.3% of outperformance).

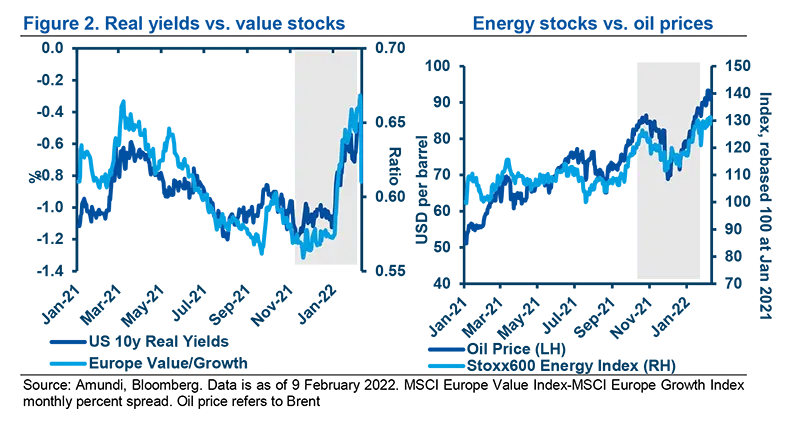

The rotation towards value and cyclicals was initiated last spring, when real yields made their first resurgence. However, since then movements have not been linear. The trend accelerated materially towards the end of 2021 and more so in January as a consequence of three factors:

1. Strong repricing of nominal and real interest rates at the global level.

The robust economic rebound and the inflationary forces that have materialised in recent months as a consequence of supply chain bottlenecks, pent-up demand, skyrocketing energy prices and wage pressure (especially in the US) drove strong rotations in equity markets, away from growth towards cyclical/value sectors. The recognition by central banks (mainly the Fed, but more recently also the ECB) of a more persistent inflationary backdrop has led to a material repricing in the market. Real yields jumped significantly after the Fed signalled in December a desire to start reducing its balance sheet and raising rates (with the first hike now expected at the March meeting and a total of about five hikes now priced in by year-end). In Europe the hawkish turn of the ECB in February opened the doors for the first interest rate rise in 2022. The turn in central banks’ actions towards a less accommodative stance comes in an environment of excessive valuations in growth/high-growth stocks, with these typically characterised by long duration and high sensitivity towards interest rates duration. As a result, more value-driven markets such as Europe have been outperforming YTD, and within the European market the top performers have been banks, with a YTD performance of +14.8%, while the more growth-driven technology sector has been the worst performer, with -13%1 .

The hawkish turn in central banks’ tone has accelerated the value rotation. As inflation proves more persistent and real yields rise, we believe the value rotation will continue.

2. Skyrocketing energy and commodity prices.

The skyrocketing energy prices, in the context of global imbalances between supply and demand and rising geopolitical risk with the Russian/Ukraine tensions, have been particularly impactful in Europe. These have been pushing oil prices above 90 USD/barrel, benefitting the energy sector’s performance.

“Additional support to the value rotation comes from higher energy prices (due to imbalances and geopolitical tensions) and a continuation of the cyclical recovery.

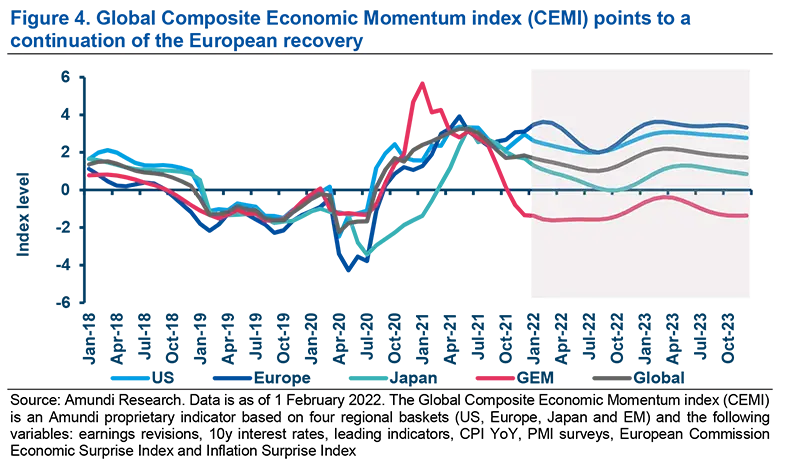

3. The cyclical recovery continues to prove strong.

Within the Eurozone, Germany is set to underperform the area’s average growth, while peripheral countries – which experienced a larger growth plunge in 2020 – should prove stronger and should also benefit from a rebound in the services sector in 2021. Data surprises have proved positive in early 2022 – especially in the Eurozone – despite the spread of the Omicron variant, further supporting our view of a continuation of the positive momentum.

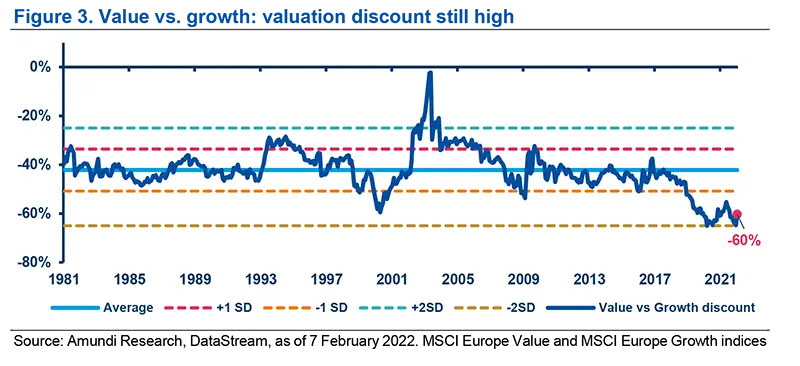

The value rotation still has further to go, as the valuation discount remains wide and economic momentum should rebound in H2

Taking a longer-term view, the valuation dispersion between growth and value remains at an all-time extreme level. We understand the reasons for the dispersion, which are related to the post-GFC regime (low growth, low yields, disinflation) and we have reason to believe that these have reached an inflection point. We believe there will be a mean reversion, and that a more inflationary regime such as the one we are entering into will be the trigger for this readjustment. Interestingly, despite the recent strong performance of value over growth, the former trades at a historically cheap level, close to two standard deviations below the long-term average trend, signalling that there is still room for a further recovery in this multi-year trend.

The value vs. growth discount remains very wide, despite the recent performance. As we don’t expect an economic slowdown, we expect this trend to continue.

Value as a style is pro-cyclical, and as a result is quite sensitive to the underlying economic momentum. For us, the key risk that could stop the trend towards value would be a marked slowdown in economic momentum. This is not our base scenario. While we expect a mild deceleration in the initial part of the year as a consequence of the Omicron variant and the impact on confidence due to elevated inflation, we expect a rebound in H2, with some normalisation of inflation figures and demand remaining robust.

However, this rotation will not be in a straight line, and will be driven more by company-specific fundamentals and less by market directionality. We firmly believe that investors should focus on intrinsic cheapness rather than relative cheapness in search of opportunities independent of the market dynamics. Looking at the market right now, we see cyclical value opportunities in media and autos, while we see emerging opportunities in areas such as consumer and banks.

Selection will be key to finding the business cases with intrinsic cheapness and the ability to pass through rising prices. Media and autos are currently preferred, while we also see opportunities opening up in consumer and banks.

The most important point to stress here, especially given the recent positive performance of value, is to be selective rather than trying to make top-down macro calls on areas of the market. In particular, selection should focus on the impact of higher inflation.

In terms of corporate earnings, higher input costs mean either higher prices for end customers or lower margins for businesses. Hence, our focus is on buying those business models that have the pricing power to convert PPI to CPI.

We also view investments from risk, return and ESG perspectives, wherein our dynamic ESG process unleashes value down the road through engagement. We also see ESG as a pool of risk factors that allows us to identify whether the probability of risk materialising is high or not, enabling us to take the required actions. Our focus is always on the financial materiality of ESG KPIs. For example, if we are looking at a car maker we will assess the company’s objectives for electric vehicles because this is a key growth driver going forward. If we are analysing a bank, we will focus on the governance angle as banks with weak governance are more susceptible to litigation risks. Once we have assessed the ESG profile of the business, and the potential ESG trajectory taking a forward-looking view, we can then make valuation adjustments accordingly. Within our disciplined value framework, this typically means adjusting the margin of safety requirement or introducing liabilities in our balance sheet assessment.

In a higher inflationary environment, the European market’s opportunities include dividend stocks and small caps

Inflation is at the top of every investor’s mind. A key challenge for investors in 2022 will be to generate a “real return”, something that is becoming increasingly difficult. We believe that dividends and small caps could provide opportunities in this respect.

In the search for real returns in a higher inflationary environment, dividend stocks and small caps can offer opportunities.

Over time, dividends have grown in line (or even at a higher rate) with inflation. With some investors worried about impending higher interest rates and duration risks, dividend stocks can offer some respite from these concerns. Within the portfolio, we seek to invest in companies that we believe have strong financial firepower that will allow them to pay a sustainable dividend over the medium to long term.

As inflation infiltrates the economy, our focus on quality companies helps us to invest in those business models that have the pricing power needed to protect profitability. We always look for good quality companies (in terms of ROIC, supported by balance sheet strength, cash flow generation, dividend coverage and, of course, a robust ESG profile). Earnings tend to convert into dividends with a c. one-year lag, so we believe that in 2022 we should see the full benefit of the strong 2021 growth. Looking at the market today, we continue to find opportunities that meet these requirements in areas such as materials and energy.

Small caps are also sensitive to inflation expectations. However, investors need to be selective as earnings growth and liquidity could be affected in this segment.

Earnings tend to convert into dividends with a c. one-year lag, so we believe that in 2022 we should see the full benefit of the strong 2021 growth.

Conclusion

We are now past the initial euphoric phase of the rotation, when all things value were pulled up by the markets amid strong economic growth, a rebound from the lows of Covid-19 lockdowns and the initial repricing of interest rate expectations. While economic growth will remain robust, we might witness some weakening of momentum in an environment where inflation pressures persist, as well as some divergences and a change in policy stance from the central banks. The move towards value will remain a medium-term trend. The more the rotation advances, the more investors will have to focus on selection and adopt a real returns mind set, which involves exploring companies that can preserve margins/earnings growth and continue to offer sustainable dividends.

This is possible for companies that possess strong pricing power (brand portfolios, intellectual property, core competency, etc.) that allows them to pass rising costs on to consumers without affecting volumes. Overall, we are likely to witness an interesting phase in the near future, one where the value rotation will be non-linear and where the valuation dispersion in the markets remains high.

_______________

1 Source: Bloomberg, data refers to Stoxx600 sector indices, as at 9 February

Definitions

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclicals sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials, while defensive sectors are consumer staples, energy, healthcare, telecommunications services and utilities.

- Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than short-term interest rates or short-term rates dropping more than long-term rates.

- Quality investing: It aims at capturing the performance of quality growth stocks by identifying stocks with high return on equity (ROE), stable year-over-year earnings growth and low financial leverage.

- Value style means purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, as well as high dividend yields. Sectors with a dominance of the value style are: energy, financials, telecom, utilities and real estate.

- Growth style aims at investing in the growth potential of a company. It is defined by five variables: 1. long-term forward EPS growth rate; 2. short-term forward EPS growth rate; 3. current internal growth rate; 4. long-term historical EPS growth trend; and 5. long-term historical sales per share growth trend. Sectors with a dominance of growth style are: consumer staples, healthcare, IT.