Summary

Confirmation of no recession for the Euro economy, improving business sentiment and the ECB going to cut rates should support European equities including small caps.

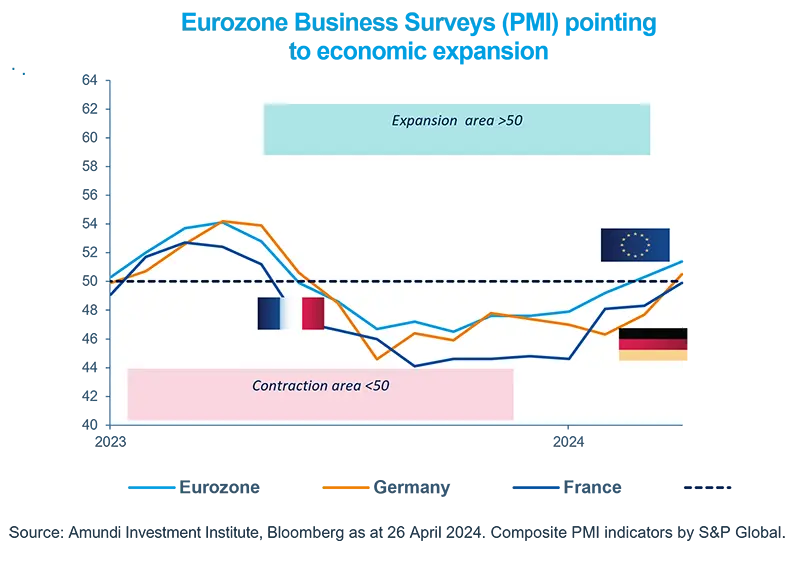

- Euro area business climate indicators are gradually picking up, providing a positive backdrop for European markets.

- Slightly better growth, disinflation and imminent rate cuts paint a relatively positive environment for Euro equities.

- The ECB starting to cut rates could also have a positive effect on European small caps later on.

Euro area real GDP barely advanced in 2023, in sharp contrast to the US economy which remained more resilient. Reasons included the higher European exposure to energy and manufacturing disruptions and weaker fiscal and consumption patterns. Nonetheless, relative to very poor expectations at the beginning of this year, European business climate indicators have repeatedly (yet modestly) surprised on the upside in recent months, a message repeated by this week’s PMIs. This points to a recovery, even if weak. This, combined with a more convincing downward trajectory in Eurozone inflation compared to the US, should allow the ECB to soon cut rates soon.

All in all, this background should continue to support European equities.

Actionable ideas

- European equities

The broadening of the rally in global equities provides an opportunity for European markets. Indeed, Europe offers an appealing complement to growth markets such as the US. -

European small cap equities

So far, the main segment of the European market to have taken advantage of the rally has been the large caps. With the ECB set to start cutting rates, European small caps could also benefit.

This week at a glance

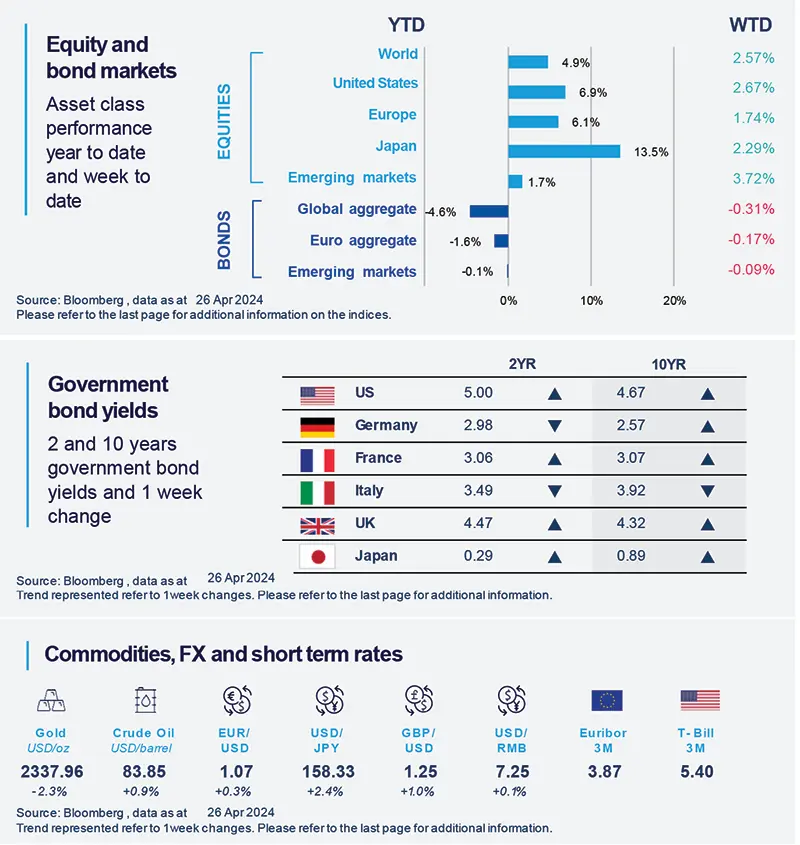

Bond yields increased, reaching new highs since the beginning of the year, on continuing positive economic momentum and fears of slower disinflation. Stocks recovered part of the ground lost in the previous week. The euro appreciated on positive macro data while oil advanced slightly.

Equity and bond markets (chart)Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.Source: Bloomberg, data as 26 April 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

Business activity slowed down a bit in the US (still expanding), while price pressures are still elevated.

While remaining in expansionary territory, the flash U.S. Composite PMI Output Index moved down to 50.9 in April from 52.1 in March, surprising on the downside. The slowdown reflected weaker manufacturing and services sector readings, with activity easing to three-and five-month lows, respectively. Price-wise, both input and output prices remain at historically elevated levels.

Europe

The April’s print for the PMIs in the Eurozone confirms signals that economy seems to be recovering.

April’s Flash PMIs confirmed signals from other indicators that the economy is better off. Indeed, the composite PMI grew to 51.4 (up from 50.3 in March), a 11-month high, mainly driven by services. Germany’s PMI had a very relevant improvement from March to 50.5 (10-month high). Price pressures are still relevant according to the PMIs, mainly due to wage increases.

Asia

Rate hike in Indonesia.

Bank of Indonesia hiked its policy rates by 25bps to 6.25%, in an attempt to support the rupiah. Considering the negative impact that the dollar’s strength and the potential Fed’s rate-cut delays is having on the local currency, this decision was not completely unexpected. Indeed, the recent sharp currency depreciation vs. the dollar could have resulted in higher future Inflation. Domestic Inflation is within the target and, barring any persistent currency turmoil, should remain there for the rest of the year.

Key Dates

|

30 Apr Euro area April |

1 May US ISM Manufacturing Index |

3 May US Employment Situation Report |