Summary

Emerging markets offer opportunities in regions such as Asia, led by strong economic growth, domestic demand and favourable geopolitics.

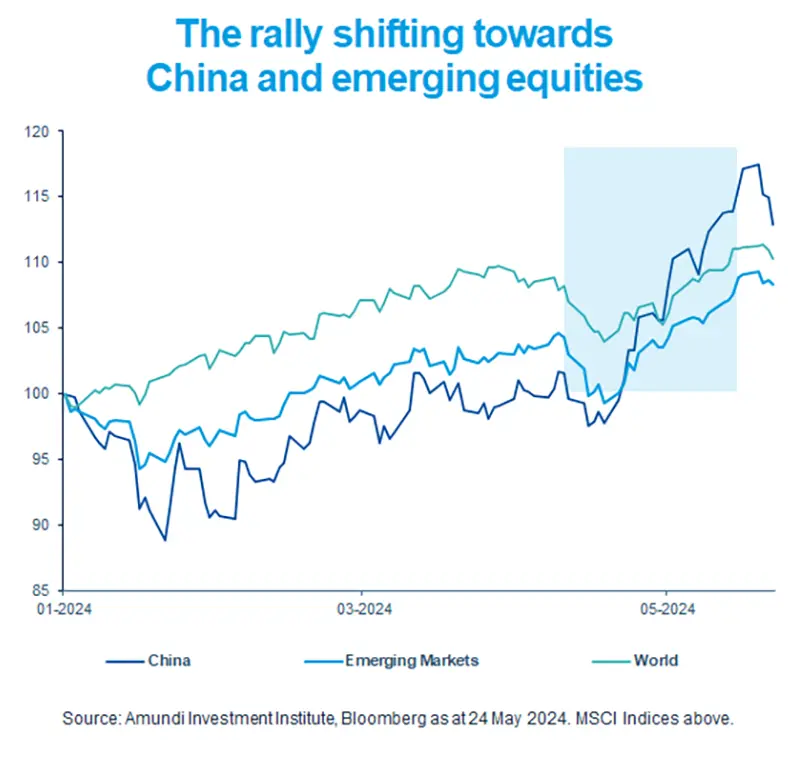

- The equity rally has moved to China and Emerging Markets, which have outperformed since Mid April.

- Supportive policy measures in China aimed at stabilizing the housing market came in earlier than expected.

- Emerging Markets equity remain relatively cheap compared to developed markets.

After a choppy start to the year, Chinese stocks rebounded strongly since mid April. This rally has been driven by multiple factors, including rising market interest for the Chinese technology sector and the new recently introduced support measures from Chinese policymakers aimed at reducing housing inventories and stimulating demand. While these measures may not be innovative and may have temporary effects, they have provided a positive surprise in terms of timing.

Emerging Markets are relatively cheap compared to other markets. In the search for opportunities, investors will have to assess all aspects of economic growth, domestic demand and geopolitics, collectively referred to as geoeconomics.

Actionable ideas

- Emerging Markets equities

The outlook for emerging markets equities is positive as these economies should continue to grow faster compared to the developed markets. - Asia equities

Asia may offer a diversified* range of opportunities with interesting stories for example in India, Indonesia and Korea.

This week at a glance

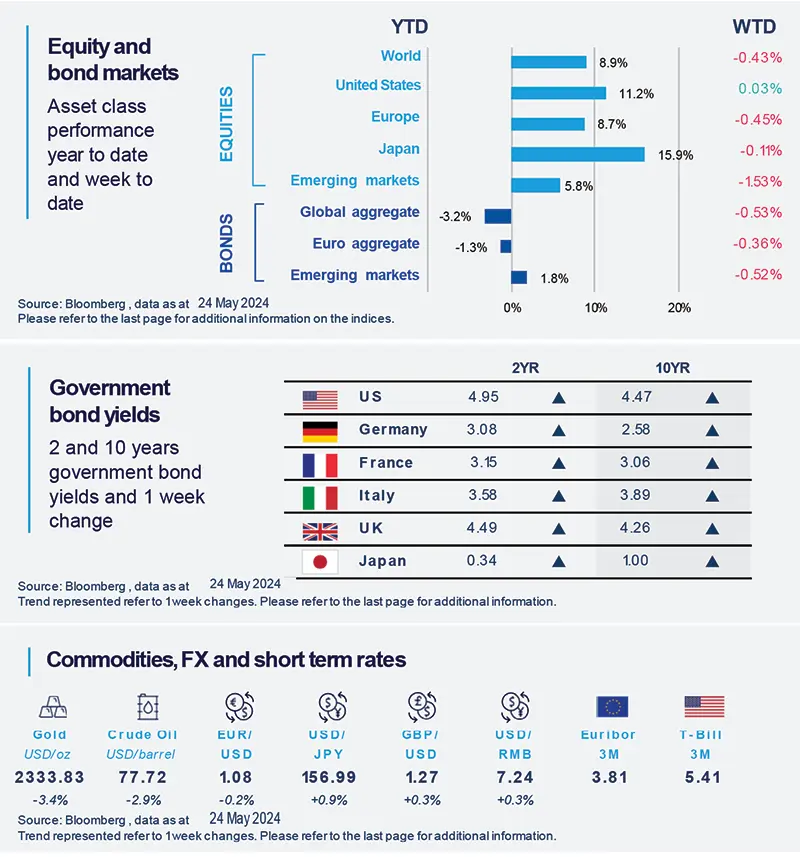

Global equities declined over the week on concerns that the Fed may delay cutting interest rates. This affected sentiment in most stock markets, and, also led to an increase in bond yields. Oil prices declined amid worries related to US oil demand, while gold also ended the week lower.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 24 May 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Institute Macro Focus

Americas

US manufacturing survey improved in May.

The manufacturing PMI rose in May compared with the last month. This signaled a modest improvement in business conditions, driven by contributions from output and employment components of the survey. However, new orders were weak. In addition, manufacturers reported the largest cost increases in one-and-a-half years due to higher prices for inputs of commodities as well as rising labor costs. But optimism around future output increased.

Europe

Eurozone manufacturing stabilised in May.

Manufacturing PMI increased in May to its highest level in the past 15 months. This was above market expectations. New businesses saw a smaller decline but employment trends remained weak. Companies responded by cutting their purchasing activity. On the supply side, we witnessed limited supply chain pressures and delivery times reduced. On a positive note, companies were more optimistic about the future.

Asia

Japanese surveys showing marginal improvement.

A preliminary survey for manufacturing and services sectors rose for the third consecutive month in May. This has been driven by a strong rebound in the manufacturing sector, whereas services activities declined slightly from April. Overall, the survey

indicates a better economic momentum in the second quarter of the year, in contrast to the weak environment seen in the first quarter.

Key Dates

|

29 May CPI: Germany, Australia |

30 May US GDP, EZ unemployment |

31 May GDP: France, Italy, India, Canada |