Summary

- April meeting: No further acceleration of stimulus withdrawal was hinted at by the ECB in April. It confirmed both the previous guidance on QE (likely to end in Q3) and the policy sequence, with interest rates to rise at “some time” after QE ends. The ECB is likely to implement a gradual rate normalisation after the end of QE in an ever more data-dependent environment, given high uncertainty regarding the fallout of the Ukrainian conflict on growth and inflation. Flexibility has been emphasised as a valuable means to preserve the transmission of monetary policy and avoid fragmentation. We expect QE to end in Q3, as announced, followed by rate normalisation, with two hikes before year-end, followed by another in Q1 2023. When compared to markets, we remain in the cautious camp, as our macroeconomic projections attach an higher probability to a technical recession, at least in countries such as Germany and Italy, which are more dependent on energy supply and prices. Inflation is the ECB's top priority. The Governing Council is more sensitive to the risk of record inflation than to the growth slowdown. The ECB stands ready to act in the event of deteriorating growth prospects. However, we do not expect it to be proactive on this. We expect the ECB to allow government bond yields to rise and spreads to widen before shifting its monetary policy stance. For now, the ECB believes that financing conditions should remain accommodative despite the recent tightening.

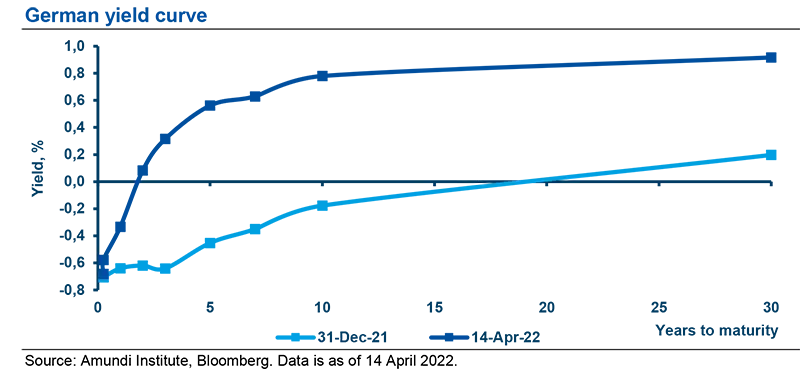

- Market reaction and investment implications: After Lagarde’s somewhat dovish press conference, European equity gained, with the Euro Stoxx 50 index up 0.5% on the day. Eurozone government bond curves steepened and peripheral spreads widened, with the ten-year Germany-Italy spread at 164bp. The euro weakened against the dollar, to 1.08 from 1.09. The ECB remains on a path to monetary policy normalisation, but behind the curve, with less room regarding growth than the Fed, given the ongoing economic slowdown in the Eurozone. The ECB has been preparing market participants regarding action through its forward guidance, driving up the ten-year Bund yield. The 0.8% level reached on the ten-year Bund yield is an important technical level that could lead to some consolidation near term. We are neutral on peripheral debt (specifically on Italy) for two reasons: Italy entered 2022 on strong footing, but the European growth slowdown will now be a drag for the country in the uncomfortable context of a huge debt pile. The silver lining is that the effects of the increase in the debt-to-GDP ratio which magnified during the Covid-19 crisis will be smoothed by an extension of its average debt maturity during the last QE exercise and a large decrease in the cost of debt, from around 4.5% to some 2.0% over the past 14 years. In addition, current rate and credit spread levels offer improved entry points after market retracement, reducing the relative appeal of Italian debt for investors hunting for extra yield. Regarding corporate bond markets, fundamentals remain favourable. Valuations remain slightly expensive despite some correction in Q1. Technically, the end of QE will put pressure on prices, but corporates will probably be able to adjust their issuance accordingly. The economic slowdown should affect earnings, which could drive spreads wider. However, we expect such widenings to be slow and smoothed by regular inflows of ALM-driven investors. On currency markets, we expect the euro to weaken against the dollar to 1.02 over the next six months, weighed on by the US-EU growth differential and the widening of US-EU short-term and real rate differentials.

What is your take on the April ECB meeting? What is your expectation regarding next moves?

After the hawkish surprises of previous meetings, no further acceleration of stimulus withdrawal has been hinted at in April. The ECB fully confirmed both its previous guidance on QE, which is set to end “some point in time” in Q3, and policy sequence, with interest rates to rise possibly, but not necessarily, after QE ends. Flexibility has been emphasised as a valuable means to preserve the transmission of monetary policy and avoid fragmentation. In June – when the new set of macroeconomic projections will be available – the ECB is likely to announce the exact month when QE will end. The ECB has kept encouraging an active fiscal policy, as this worked during the Covid-19 crisis. At the same time, it is likely to implement gradual rate normalisation after the end of QE in an ever more data-dependent environment, given high uncertainty regarding the fallout of the Ukrainian conflict on growth and inflation.

We expect QE to end in September, most likely. This should be followed by rate normalisation, which is likely to lift rates out of negative territory over the next few months, with two hikes before year-end, followed by another in Q1 2023, according to our expectations. When compared to markets, we stay in the cautious camp, as our macroeconomic projections attach a higher probability to a technical recession, at least in countries such as Germany and Italy, more dependent on energy supply and prices.

How do you see the ECB balancing record-high inflation with slowing growth momentum and uncertainty related to the Russia-Ukraine war fallout?

Inflation is the ECB's top priority and it will monitor carefully any possible signs of de-anchoring inflation expectations. The Governing Council still seems more sensitive to the risk of record inflation than to a growth slowdown, although we perceived a more cautious stance during this meeting. “War is stoking risks to inflation in the Eurozone”, according to ECB President Christine Lagarde. She also recognised that “growth is set to remain weak as a consequence of [the] Russian conflict”. The ECB is “very attentive to current uncertainty”. The ECB stands ready to act in the event of deteriorating growth prospects. However, we do not expect it to be proactive.

We expect the ECB to allow government bond yields to rise and spreads to widen more markedly before shifting its monetary policy stance. “If the outlook deteriorated, or financing conditions became inconsistent with further progress towards the 2% target, the Governing Council would stand ready to revise the schedule for net asset purchases in terms of size and/or duration” (Minutes of the 9-10 March 2022 meeting). For now, the ECB appears to think that financing conditions need to remain accommodative despite the recent tightening. “Lending to households is holding up, especially for house purchases. Lending flows to firms have stabilised”.

We expect QE to end in Q3, as announced, followed by rate normalisation, which is likely to lift rates out of negative territory over the next few months, with two hikes before year-end, followed by another in Q1 2023.

How did financial markets react to the ECB’s announcement and the ensuing press conference?

During Lagarde’s somewhat dovish press conference, European equity gained, and the Euro Stoxx 50 index was up 0.5% on the day. Eurozone government bond curves steepened, with two-year Bund yields down 2bp, to 0.05%, and ten-year yields up 7bp, to 0.84%. As the ECB should stay behind the curve, the short end of the yield curve should see some relief while pressure will mount on the long end. Peripheral spreads widened, with the ten-year Germany-Italy spread at 164bp. The euro weakened against the dollar, to 1.08 from 1.09.

What are your expectations for the euro government bond market going forward and regarding the evolution of peripheral spreads?

With regard to core euro government bonds, the ECB is on the path to monetary policy normalisation, probably with less room on growth than the Fed, given the ongoing economic slowdown in the Eurozone. The ECB has been preparing market participants for such action through its forward guidance (e.g., on the end of PEPP and on the reduction of APP), which has been mirrored by the meaningful rise of ten-year Bund yields from -0.1% in early March to 0.8% currently. Such a 0.8% level for the ten-year Bund yield is an important technical level that could lead to some consolidation after the large market moves, before we see how growth and inflation outlooks are shaping up.

Fundamentals remain favourable in the Eurozone corporate bond market, with leverage under control and default rates being limited.

With regard to peripheral debt – notably Italy – we have become neutral, for two main reasons:

- Italy entered 2022 on strong footing, but now the growth slowdown in the Eurozone, magnified by the energy crisis related to the Russia-Ukraine war, will be a drag for the country, given its high energy dependence in a context of a huge debt pile. The good news is that the increase in the debt-to-GDP ratio experienced during the Covid-19 crisis (from 134% at end-2019 to 155% at end-2020) was offset by a lengthening of its average debt maturity (up by some two years) and a large decrease in the cost of debt, from around 4.5% to some 2.0% over the past 14 years.

- Replacement considerations. When rates were lower, any extra bp earned by investors when venturing into Italy in a QE context was worthwhile. Now, the story is different, as rate and credit spread retracement offers improved entry points, reducing the relative appeal of Italian debt.

What about the euro corporate bond market? How do you expect corporate spreads to perform amid a more hawkish monetary policy stance? What about default rates?

Fundamentals remain favourable, corporates have kept their leverage under control, and default rates are limited. Valuations remain slightly expensive even if some correction took place in Q1. Technically, the progressive ending of QE will put some pressure on prices, but probably corporates will adjust their issuance levels to accommodate this. We think the economic slowdown will affect earnings, which could drive spreads wider. However, we expect this widening to be slow and it will be smoothed by regular inflows of ALM-driven investors.

The 0.8% level of the ten-year Bund yield is an important technical level that could lead to some consolidation for relief considerations.

How do you expect the euro to perform over the next few months?

Eurozone growth will suffer more than that of the United States from the Russia-Ukraine war. The US-EU growth differential will join forces with widening US-EU short-term and real rate differentials and should keep the euro on the downside. Amundi forecasts a EUR-USD exchange rate of 1.02 over the next six months.

Definitions

- ALM: Asset and liability management. It is the practice of managing financial risks that arise due to mismatches between the assets and liabilities as part of an investment strategy in financial accounting.

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- Credit spread: Differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration possible embedded options.

- Default rate: The share of issuers that failed to make interest or principal payments in the prior twelve months. Default rate based on BofA indices. Universe consists of issuers in the corresponding index twelve months prior to the date of default. Indices considered for corporate market are ICE BofA.

- Quantitative easing (QE): QE is a monetary policy instrument used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- PEPP: Pandemic emergency purchase programme.