Summary

Inflation remains the main driver of central banks’ policy actions. We could see more appetite for European bonds as the ECB looks on track to start cutting rates in June.

- Last week the ECB kept its policy rates unchanged but looks confident that inflation will return to targets gradually.

- In contrast, US inflation is showing some stickiness, but the Fed is likely to reduce rates this year.

- These decisions, among other factors, would affect markets globally, and commodities such as gold.

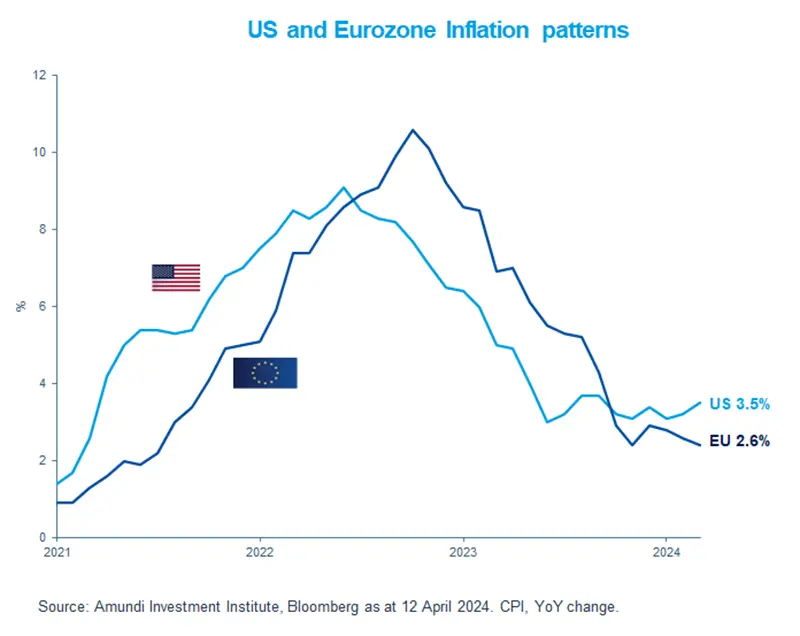

Macroeconomic data is further signalling divergences across the board. Inflation has again surprised on the upside in the US, where inflation dynamics are more related to the demand side. In Europe, instead, a faster slowdown in prices is materializing. Expectations on the growth front are also diverging. In the US, growth data and sentiment indicators point to a stronger than expected economy, amid resilient consumption. This has led economists to revise upwards growth expectations for the US, while for Europe growth is expected to remain anaemic, with divergences across countries. This growth/ inflation mix will obviously affect policy decisions. The Fed and ECB are likely to reduce rates this year and in doing so they would keep a close eye on inflation.

Actionable ideas

-

European quality bonds

The prospects of ECB cutting rates starting in June could be positive for quality corporate credit that can withstand a sluggish economic growth environment. -

Multi asset investing amid economic divergences

An environment of diverging growth and inflation across regions could offer opportunities across global asset classes, including gold.

This week at a glance

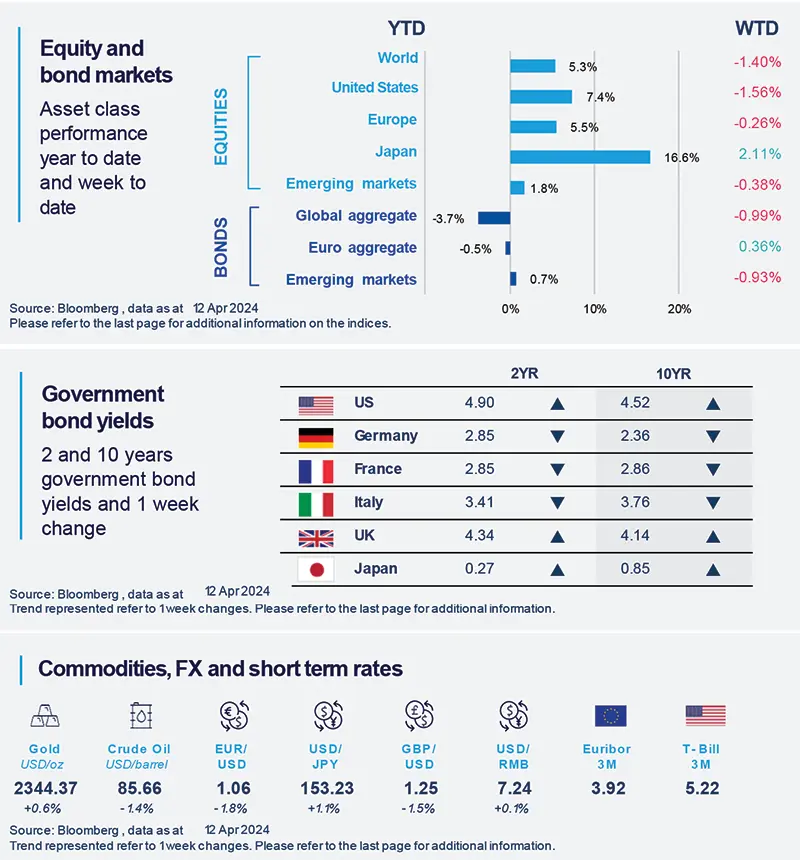

Stocks were mixed this week as inflation and central banks’ decisions remained in the spotlight, but Japanese markets were up. US yields rose after inflation came in stronger than expected. In commodities, rising geopolitical tensions in Middle East pushed gold prices to all-time highs.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 12 April 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

Inflation stickiness is confirmed in the US after latest data release

Both headline and core inflation turned out to be higher than expected by consensus in their March print (both up 0.4% mom vs. 0.3% expected), mainly driven by strong core services inflation. In yearly terms, headline inflation ticked up to 3.5% (up from the previous 3.2%) while core inflation remained stable at 3.8%. “Core” and “Super-core” inflation momentum still worries for its reacceleration.

Europe

The Bank Lending Survey for Q1 from the ECB shows mixed signals, but overall encouraging signs.

The ECB released its Q1 2024 Bank Lending Survey on Thursday. It posted mixed signals but overall a better environment for lending. Namely, the momentum for loans for house purchase improved, whereas there was only a mild negative move in demand for housing loans. For business loans the picture was slightly more negative, but banks expect it to improve in Q2.

Asia

Chinese inflation lower than expected.

China’s March CPI came in below expectations at 0.1% YoY. The country is edging towards broad deflation. While goods inflation has already been in deflation for a year, services inflation remains positive growing at 0.8% in March. Slowing tourism inflation and a fast decline in rent may potentially bring overall services inflation close to zero.

Key Dates

|

15 Apr

|

16 Apr |

17 Apr EZ and South Africa CPI |