Summary

What is your view on euro fixed income in light of the recent ECB move? Have you revised rate forecasts?

- September meeting: The ECB hiked its key interest rates by 75bp, driven by concerns about the risk of inflation expectations getting de-anchored. Inflation may rise further in the near term, as pricing pressures have strengthened and broadened across the economy. The energy crisis has worsened in the Eurozone, intensifying upside risks regarding the inflation outlook. We expect the ECB to keep a hawkish stance and raise rates further to avoid the unanchoring of inflation expectations and to support the euro.

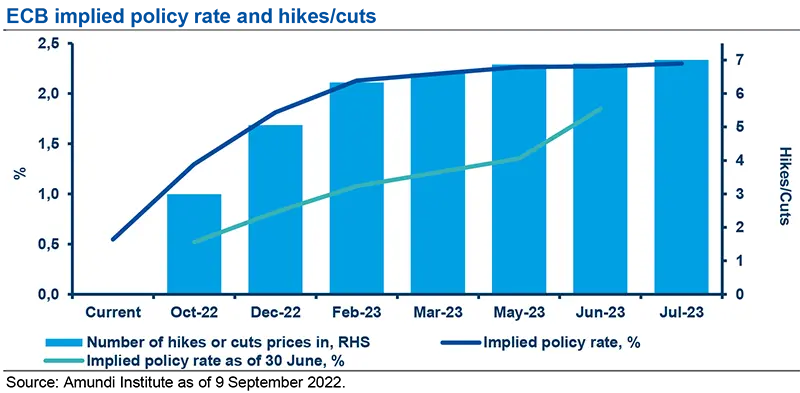

- Monetary policy expectations: The ECB is determined to front-load rate hikes and normalise rates rapidly. President Lagarde said that hikes should be expected at the next “several meetings” and “Several probably means more than two (including [the] September meeting) and less than five”. In any case, the ECB will continue to be data-dependent. We expect the ECB to hike rates by 75bp on 27 October, by 50bp on 15 December, and by 25bp on 2 February 2023. Quantitative tightening is not on the agenda though. Full reinvestment of maturing securities will continue for both the PEPP portfolio (until at least end-2024) and that of the APP for an extended period of time.

- Euro fixed income market: Sovereign core bond yields should keep rising. The question of the sustainability of the debt of the most fragile Eurozone countries could return to the agenda in this context of high inflation combined with expansionary fiscal policy. Following the September ECB decision, we upgraded our ten-year Bund yield target to 1.8-2.0% in 12 months from 1.3-1.5% previously. An overall short duration position has to be favoured. Uncertainty remains high, notably around the national energy plans and regarding their fallout on government finances, with subsequent issuance policy to be reviewed and, ultimately, rising debt/GDP ratios. We remain cautious on peripheral bonds, notably on Italy’s market, with the general election scheduled for 25 September and the Transmission Protection Instrument (TPI) not tested yet. We stay slightly cautious on euro credit, studying the impact of the different energy plans, which may lead us to revise our sector calls.

What is your take on the September ECB meeting and what could the next steps be?

At its September meeting, the ECB decided unanimously to hike its three key interest rates by 75bp. Hence, interest rates on the main refinancing operations, the marginal lending facility, and the deposit facility will increase to 1.25%, 1.50% and 0.75%, respectively. The move was in line with market expectations.

The ECB is much more concerned about the risk of inflation expectations getting de-anchored than about downside risks to growth, as shown by ECB staff projections. They raised their inflation outlook to above target at 2.3% in 2024, with upside risks. Inflation is now expected to average 8.1% in 2022, 5.5% in 2023 and 2.3% in 2024. Strong inflation is driven by soaring energy and food prices, strong demand in the services sector after the post-Covid reopening, and supply-chain bottlenecks. Inflation may rise further in the near term, as price pressures have strengthened and broadened across the economy. While wage dynamics remain overall contained, resilient labour markets and some catch-up to compensate for higher inflation should support wage growth. Most measures of longer-term inflation expectations currently stand at around 2%, but recent above-target revisions to some indicators warrant continued monitoring.

Recently, the energy crisis has worsened in the Eurozone, intensifying upside risks to the inflation outlook. Gas prices have risen exponentially. More and more businesses and households will see significant impacts when renegotiating contracts due to the rise in energy prices. As a consequence, fiscal policies will be looser than previously expected, as rising energy prices are pushing European governments to support demand by capping prices and directly supporting households and businesses. Expansionary fiscal policies should prevent a collapse in demand, but Lagarde insisted on the need to target such support policies. High Eurozone inflation is mainly supply-driven and the tools available to the central bank are mainly aimed at cooling aggregate demand. As such, the ECB will have to raise rates further to avoid unanchoring inflation expectations and to support the euro, especially in a context where the US economy appears resilient to rate hikes.

The energy crisis has worsened in the Eurozone, intensifying upside risks to the inflation outlook.

The ECB baseline scenario is for stagnation in Q4 2022/Q1 2023 rather than for a recession. Economic growth projections have been cut markedly for the remainder of this year and through to end-2023. The ECB now expects the economy to grow by 3.1% in 2022, 0.9% in 2023 and 1.9% in 2024. The substantial slowdown expected over the remainder of this year will be driven by the following factors:

- Inflation will dampen spending and production;

- The strong rebound in services demand due to the economic reopening will lose steam;

- Weakening global demand due to tighter monetary policy globally; and

- High uncertainty and sharply falling confidence.

Given very high inflation, we expect the ECB to maintain a hawkish stance in the coming months. The bank is determined to front-load rate hikes and normalise policy rates rapidly. There was little indication regarding the level of the neutral rate (today, it is estimated to be far from the level needed to return inflation to 2%) and on whether the ECB will have to hike rates beyond their neutral level. ECB President Lagarde said: “We expect to raise interest rates further to dampen demand and guard against the risk of a persistent upward shift in inflation expectations” and “The further away we are, the larger [the] steps we are taking”. As such, hikes should be expected at the next “several meetings”. Furthermore, “Several probably means more than two (including [the] September meeting) and less than five”. In any case, the ECB continues to use a meeting-by-meeting approach and remain data-dependent. We expect the ECB to hike rates by 75bp on 27 October, by 50bp on 15 December, and by 25bp on 2 February 2023. Quantitative tightening is not on the agenda though. Lagarde specified that it will not be implemented in the short term. Full reinvestment of maturing securities will continue for both the PEPP portfolio (until at least end-2024) and that of the APP for an extended period of time.

We expect the ECB to hike rates by 75bp on 27 October, by 50bp on 15 December, and by 25bp on 2 February 2023; quantitative tightening is not on the agenda though.

What is your view on euro fixed income in light of the recent ECB move? Have you revised rate forecasts?

Sovereign core bond yields should continue to rise. The issue of debt sustainability for the most fragile Eurozone countries could return to the agenda in this context of high inflation combined with expansionary fiscal policy. Markets will be looking to test the effectiveness of the ECB's new anti-fragmentation tool. Following the September ECB decision, we upgraded our ten-year Bund yield target to 1.8-2.0% in twelve months from 1.3-1.5% previously. Given the ECB’s hawkish move and stance, an overall short duration position has to be favoured, notably for the belly of the euro curve. Uncertainty remains high, notably around the outskirts of national energy plans and their fallout regarding government finances, with subsequent issuance policies and, ultimately, rising debt-to-GDP ratios, potentially adding further impetus to the government bond market. Hence, we stay cautious on peripheral bonds, notably on Italy’s market, with a general election scheduled for 25 September and the TPI not yet tested. We stay slightly cautious on euro credit, as we continue to study the impact of the different energy plans, which may lead us to revise our sectoral calls.

Following the September ECB decision, we upgraded our ten-year Bund yield target to 1.8-2.0% in 12 months from 1.3-1.5% previously.

Definitions

- Asset purchase programme (APP): A type of monetary policy wherein central banks purchase securities from the market to increase money supply and encourage lending and investment.

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- PEPP: Pandemic emergency purchase programme.

- Quantitative easing (QE): QE is a monetary policy instrument used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- Quantitative tightening (QT): QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.