Summary

- The European Central Bank raised its key policy interest rates by half a percentage point, with the deposit rate rising to 2.5%. It also announced its intention of delivering another 50 basis point rate hike in March. We expect the deposit rate to peak at 3.5%.

- Green tilt: The ECB plans to tilt its corporate bond reinvestments more strongly towards issuers with better climate performance. This is symbolically important but its corporate bond holding is relatively small.

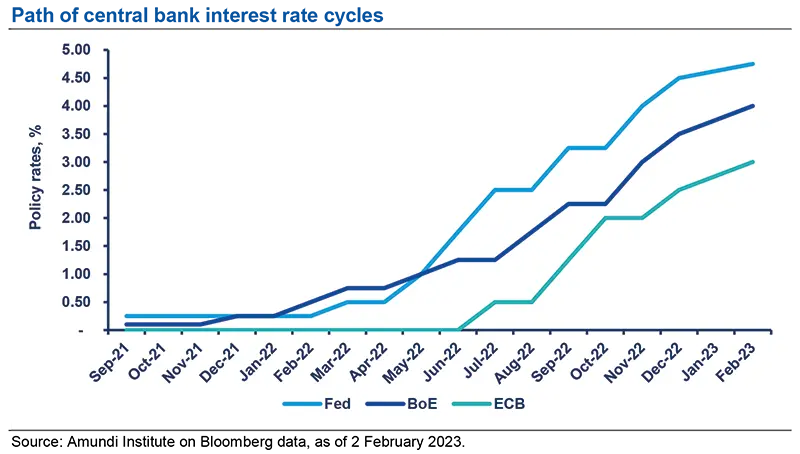

- Global monetary policy: There are strong similarities between the Fed, the ECB, and the Bank of England. All three say they are going to hike rates further but all remain data-dependent and aren’t pushing back against market expectations for the terminal rate.

- Investment implications: The ECB triggered a strong rally in bond markets with BTPs outperforming Bunds. The scale of the gains seems a little extreme to us. Credit is a good place to be.

What did the European Central Bank announce?

The European Central Bank raised its key policy interest rates by half a percentage point, lifting the deposit rate to 2.5%, and said it intended to deliver a similar rate rise in March because of underlying inflation pressures. It also gave details of how it will reduce its balance sheet. For corporate bonds, it plans to tilt reinvestments more strongly towards issuers with a better climate performance.

How does the ECB plan to reduce its balance sheet and how might this affect the balance between net bond issuance and demand in the coming year?

The Asset Purchase Programme portfolio will decline by €15 billion per month on average from the beginning of March until the end of June 2023, and the subsequent pace of portfolio reduction will be determined over time. After adjusting for ECB purchases, net euro zone government bond issuance is likely to jump from roughly €160 billion to €550 billion in 2023, most of which is expected in the first half of the year due to front-loaded activity.

Are there any euro zone countries that might face particular supply/demand imbalances in light of the central bank’s plan?

The increase in bond net funding will come from core and semi-core countries. The total for these countries will rise to €300 billion from €226 billion, while that for the euro zone periphery is expected to fall to €120 billion from €140 billion. Germany should contribute the most to the increase, by moving to €120 billion – nearly double last year’s amount. Net of ECB flows, which are turning negative after being positive last year, the supply of German bonds will rise from almost flat levels to roughly €155/160 billion.

What will be the impact of the other measures the ECB announced?

The central bank plans to gradually skew its corporate bond purchases toward “green” labels. This is symbolically significant because it is the first time that ECB is taking climate change into account when buying assets. But the impact will be very minor because it's holding of corporate bonds are small, and it will apply this criteria only on reinvestments on maturing bonds.

What’s the outlook for ECB policy?

Our baseline expectation is the ECB hikes by 50 basis points in March meeting, and follows that up with quarter percentage point hikes in May and June. This implies a terminal rate of 3.5% before the summer, higher than the market’s expectation of 3.25%. The persistence of core and underlying inflation will put the ECB under pressure with core CPI close to 4.5% in the third quarter in our scenario. An important takeaway from the February meeting was that the ECB no longer sees upside risks in its inflation forecast. How long governments continue to extend fiscal support to the economy and the rebound in the Chinese economy will be key drivers of price pressures.

How does that compare with what you expect for the Federal Reserve and the Bank of England, which also held policy meetings this week?

There are strong similarities between the trio. All three say they are not done hiking interest rates but they all remain data dependent and are not pushing back against market expectations of where this tightening cycle peaks.

Do you see more or less risk of recession in the United States, euro zone, and the UK given the monetary policy outlook?

There is less risk of anything more than a mild technical recession in the United States and Europe because there is a lower probability that the Fed and the ECB will tighten too much. Continuing wage pressures in the UK, however, imply a material risk that the Bank of England – which has just hiked rates to 4% from 3.5% - will need to stay on a tightening path for longer.

What are the market implications?

We believe credit is a good place to be.

This week’s central bank actions bode well for most asset classes near term, and especially bonds and credit as there is now a little more clarity on terminal policy rates.

In the case of the euro zone, the ECB sent a different message compared with the fairly hawkish tone it took in December. The central bank talked this time about the situation being more balanced, both on growth and inflation, even while reiterating that it would stay the course to ensure inflation fell back to its 2% target.

The market is anticipating that the ECB will be done with hiking once it has delivered another 50 basis points hike in March.

This has triggered a strong rally in bond markets, with BTPs outperforming Bunds. The scale of the gains seems a little extreme to us given some of the uncertainty that still persists. For example, we have yet to know the full impact of China’s reopening and core inflation is still high in the euro zone. Credit is a good place to be and there’s no doubt that volatility will continue its steady decline, helping carry.