Summary

- Cryptocurrencies, like stocks, have had a good start to 2023 and clawed back some of the ground they lost last year following a series of spectacular incidents, including the Terra/Luna crash and the collapse of FTX. Just as the steep price declines of 2022 were no reason to write off cryptocurrencies, this rally should not overshadow their current limitations.

- The asset class is still in its infancy and is prone to extreme volatility. But its key value propositions – decentralisation and the immutability of transactions – are mostly intact. Their potential explains why some heavyweights in finance and other sectors have continued to build bridges between their traditional activities and cryptocurrencies, albeit prudently.

- The real challenge for cryptocurrencies is that their underlying blockchain technologies will soon need to cease being merely ‘promising’ and start delivering large-scale key services to the real economy. Unless this happens, it is difficult to see cryptocurrencies durably establishing themselves as a mainstream asset class.

- In addition to enabling cryptocurrency transactions, blockchains (and the tokenisation of assets) can also, and perhaps more importantly, bring efficiency gains in terms of transactions and the management of traditional asset classes, although there are many risks and obstacles.

Never waste a crisis

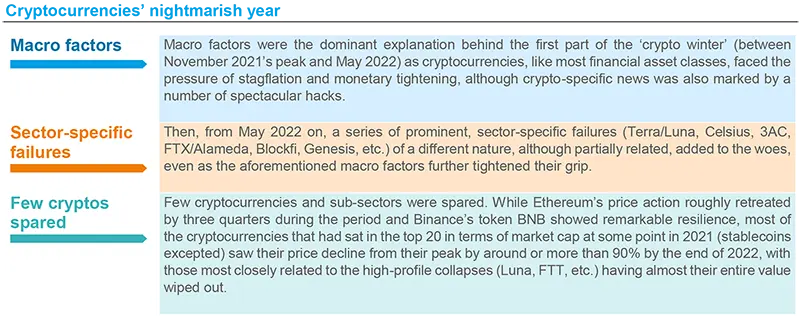

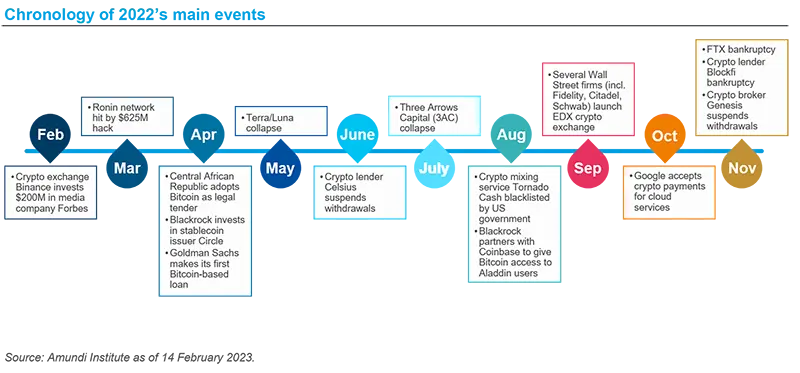

Last year, cryptocurrencies suffered sharp price declines and were hit by some spectacular incidents, notably the failure of Terra/Luna and the bankruptcy of FTX. At first glance, these seemed to vindicate some key reasons (extreme volatility and risks due to the market’s infancy and lack of regulation) why many observers and institutions had remained sceptical.

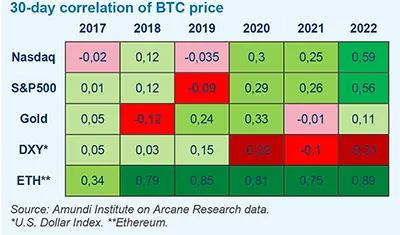

Moreover, a drop of more than two-thirds in the sector’s market capitalisation from its November 2021 peak could also be seen, first and foremost, as an amplified version of the broad-based falls across most asset classes. The same is true of a rebound that has seen Bitcoin jump around 45% since the beginning of the year, around 35pp more than the rebound in the Nasdaq. Cryptocurrencies’ lock-step moves with risk assets have thus disappointed portfolio investors looking for diversification.

Looking forward, the macro-financial backdrop may remain challenging during the first part of this year given central banks will raise interest rates further and investors have already anticipated a lot of potential good news. There may also be more sector-specific setbacks, for example if further revelations emerge about the exposure of other players to FTX or if there is negative newsflow regarding regulation, which is always a driver of volatility for the sector.

|

|

Macro factors may become a more positive influence in 2023, while sector-specific news flow could also improve

The global environment may become more favourable for cryptocurrencies later in the year if the much-expected ‘Fed pivot’ materialises. And most other central banks will tighten policy less aggressively than they did in 2022.

Another positive catalyst in 2023 could be more mainstream banks’ and corporations’ announcements of bridges between their traditional activities and cryptocurrencies or digital assets. These may include new cryptocurrency investment products or support services, and various initiatives around payment and lending, possibly involving stablecoins (at least those that public authorities will come to terms with), and the tokenisation of existing assets. Other sectors could also see more interaction between their traditional products or services and non-fungible token (NFT) or Metaverse applications, even though the former would not necessarily be in the realm of digital art and collectibles as was the case in 2021. And there may be further developments for Web3 entities – decentralised web-based applications whose users are also owners through a governance system of digital tokens. These were in their infancy in 2020-21 and remain very centralised, with most of the tokens still in the hands of their founders. But they may gain more traction, either independently or through sponsorship by traditional real economy players.

Public actors might also enhance the status of specific cryptocurrencies, like Bitcoin, or digital assets in general. Notably, a number of observers see it as plausible that a few mid-size countries could make Bitcoin eligible for their reserves after small peers El Salvador and the Central African Republic made Bitcoin legal tender in 2021 and 2022. Some energy-producing countries could engage in cryptocurrency mining, while local or regional authorities within several countries could also boost cryptocurrencies’ status by allowing various official uses. Meanwhile, more governments may resort to cryptocurrencies for bilateral trade or to evade sanctions. While such moves would primarily have a signalling effect and would not be enough to trigger a sustained rally, they are likely to bring more fuel to one initially triggered by macro factors.

The coming year will also see advances in Central Banks Digital Currencies (CBDCs). Granted, these are different in nature from cryptocurrencies, as they do not necessarily rely on blockchain technologies and may sometimes even be partially developed in response to the challenge that cryptocurrencies, or at least private stablecoins, are seen to pose to national currencies. Nevertheless, CBDCs may foster new developments in digital assets that end up also benefiting cryptocurrencies and may make the public more familiar with peer-to-peer digital payments, which cryptocurrencies also facilitate. Moreover, some countries may rely on existing blockchains, or part of their technology, to develop their CBDCs.

Finally, if inflation remains above central banks’ targets, Bitcoin’s limited supply may start to attract more attention. While Bitcoin spectacularly failed to protect investors against galloping inflation in 2021-22, this was a period of dramatic rises in policy and market interest rates that pressured all asset classes. If inflation is high, but not rising, nominal interest rates will also likely stop climbing and may even fall a little. This is a much more favourable environment for an asset whose supply is finite and that has a long duration in essence, as its main attraction is its future potential rather than its current status.

Five reasons why recent setbacks may not mean the end of cryptocurrencies

1|

The recent crisis may, as crises frequently do, lower expectations to healthier, more realistic levels, separate the wheat from the chaff, and allow viable projects to continue to develop. A parallel with the 1999-2000 dot-com crash surely has limitations as, in the late 1990s, the internet was already more mainstream and was providing more useful services than cryptocurrencies today. But it is a reminder that some of today’s blue-chip tech stocks also experienced very brutal price collapses before thriving. Moreover, while most cryptocurrencies only have a short history, the approximate 75% peak-to-trough price decline of Bitcoin in 2021-22 was not its first and Bitcoin has already been declared ‘dead’ many times.

2|

Ethereum, the N°2 cryptocurrency, transitioned smoothly in September 2022 from a proof-of-work to a new proof-of-stake mining process, an expected event (yet previously seen as fraught with operational risks) that drastically reduced its energy consumption, making it much more ESG-compatible. As of today, nearly all major ‘Layer 1’ blockchains (intended for the deployment of ‘smart contract’ dynamic applications) are proof-of-stake, meaning that the energy consumption matter has become much more specific to Bitcoin than a broader cryptocurrency issue. Moreover, Ethereum’s transition will be followed by further upgrades which should bring more scalability and reduce transaction costs, while other major ‘Layer 1’ blockchains also have upgrades in the pipeline.

3|

Despite the incidents of 2022, the key value propositions of cryptocurrencies (decentralisation, the immutability of transactions and, for some of them, the predetermined limited supply) were left mostly unscathed. Indeed, many of the troubles involved centralised third parties, be they exchanges, lenders or hedge funds, that brought with them the typical rogue finance behaviour seen many times before in other asset classes, primarily excessive leverage, poor risk management or outright fraud. On the contrary, and most importantly, DeFi (which enables automated transactions between peers without trusted intermediaries) generally continued to function well, despite the fall in value locked. Some DeFi applications have proved vulnerable to hackers, yet this is a well-known and generally accepted risk to investors. Interruptions to mainstream blockchains’ transaction processes have only been very temporary.

4|

Interest from heavyweights in the financial and other industries may have slowed somewhat, but has not stopped, be it for cryptocurrencies or, even more so, for digital assets and tokenisation. True, it was in 2021 when most of the spectacular events took place that brought traditional finance and cryptocurrencies closer, notably major crypto exchange Coinbase’s IPO on the Nasdaq and the launch of the first US Bitcoin futures-based ETF, two events that more-or-less coincided with the two historic peaks of the market. Yet 2022 also witnessed further developments on this front, with Blackrock acquiring a stake in Circle (the company issuing the USDC stablecoin) and the integration of its Aladdin platform with Coinbase. Several further experimental bridges were launched between digital and traditional assets by finance and banking actors, such as the issuance of digital versions of mainstream bonds, the possibility to borrow stablecoins against traditional collateral, or the use of cryptocurrencies as collateral for traditional loans. Thus, it can be argued that the very visible price pressure on cryptocurrencies has not stopped the quieter, yet potentially more disruptive momentum toward the tokenisation of assets.

5|

Regulation will certainly cause other temporary price setbacks but is more likely than not to be a positive in the end. While two years ago, the outright banning of cryptocurrencies in large, advanced economies was still seen as a possibility, the regulators eventually chose not to go down this road. On both sides of the Atlantic the need for comprehensive regulation for risk mitigation has been stressed (notably President Biden’s ‘executive order’ in March 2022 and the more advanced EU’s MICA regulation) and now appears more urgent following the FTX collapse. Yet fostering a competitive digital asset sector is more and more seen as a necessity to preserve the rank of national financial sectors in global competition. Regulating cryptocurrencies remains very much in the making and is complex, due to the many issues involving investor protection, money laundering, tax evasion, sovereignty, and energy consumption, which can lead to contradictions and be addressed by different agencies. Rules may also continue to lag the rapid advance of technologies. However, it is still only a matter of time before the sector becomes considerably more regulated than it currently is, something that will deter some investors, yet is likely to make the market look safer to others. On the other side, crypto bans by a number of emerging economies’ authorities often appear unconvincing, not watertight and have sometimes been reversed.

However, cryptocurrencies’ real economic utility still needs to be fully confirmed

Until regulation and technological advances credibly mitigate the many risks most frequently associated by the public with cryptocurrencies (mostly vulnerability to hacks and fraud, ease of use for criminal activities and potential environmental damage), traditional financial and other institutions will retain strong reasons to remain cautious. This does not mean, however, that even solving these issues will cut a clear path for cryptocurrencies to become a mainstream asset class. Indeed, aside from the aforementioned risks, an even more critical issue may be that most experiments to provide real-world services through public blockchains, however successful from a technical standpoint, have ultimately remained experiments. Many announcements have been made over the years in domains as diverse as finance, insurance, supply-chain monitoring and the certification of medical or university records. But they have so far mostly failed to attract enough participants or to create network effects drastic enough to be really disruptive to the way the sector works. Without the widespread use of public blockchains in the real economy and the associated non-speculative demand for their native tokens, investors could at some point stop believing in their potential and lose interest. It can be argued that Bitcoin may be an exception as, unlike other cryptocurrencies, it is seen primarily as a store of value independently from any role as a decentralised system for dynamic (‘smart contract’) applications. Even so, it is very likely that investor interest will wane unless the wider blockchain ecosystem becomes more used in the real world.

Regarding the financial sector, the tokenisation of traditional assets may end up being the real disruptor (rather than cryptocurrencies), but even that still needs to be proven. Blockchains and tokenisation can, at least in theory, bring key efficiency gains in terms of transactions and the management of traditional asset classes (be it financial or real). Indeed, trading and managing a tokenised certificate granting property rights to an asset allows for such advantages as instant settlement, unlimited divisibility, easy use as collateral, and the simple reconciliation of accounts, including for asset classes where such features are notoriously absent and where introducing them could be a revolution. Nonetheless, while these promises have been heard for many years now, and new projects regularly announced, the obstacles and risks (legal, technical, lack of network effect) have, as of today, prevented such technologies from really challenging the former, long-proven ones.

Blockchains, cryptocurrencies and tokenisation do have a lot of potential, be it in powering new types of decentralised organisations that can offer serious economic and social advantages, or in enabling new ways of trading and managing assets. The most likely outcome is that they will simply need more time to mature before becoming mainstream, as was the case for other technologies in the past. However, they could still turn out to be a dead-end (which could allow time for another cryptocurrencies bull market to last a few years but not much more). At this stage, nothing is proven either way and the jury is still very much out.