Summary

Valuations are now a little more attractive. However, the environment remains challenging, particularly in Europe. We remain cautious and more constructive on US credit markets relative to euro markets.

Global picture: we prefer the United States to the Eurozone

Credit markets are being driven today by two factors: the war in Ukraine and central banks’ tightening of monetary policies.

- With the war in Ukraine, the global economy is facing a double shock: rising energy and food costs, and a financial market shock. It is difficult today to quantify the impact of the war in Ukraine on the global economy. Forecasts remain subject to an extremely high level of uncertainty. The Russian-Ukrainian conflict and the accompanying sanctions imply an economic scenario with less growth and more inflation. The effects of slowing growth and accelerating inflation will affect Europe more than the United States. We have revised our growth prospects sharply downwards in the Eurozone to 2% on annual average. US economic activity is being little impacted by this war.

- Central banks are behind the curve: inflation is a global phenomenon. In February, inflation was close to 8% in the US and 6% in the Eurozone. The surge in prices of crude oil and other commodities will put additional upward pressure on near-term inflation. The Fed has far more “good” reasons to act than the ECB. In the Eurozone, inflation is being driven mainly by energy prices. In the US, inflation is broad-based. Companies are increasing their margins. Wages have risen at their fastest rate in decades, and demand is strong. In this context, we will have to monitor the end of strong central bank support.

Solid balance sheet but the impact of rising costs on margins needs to be monitored

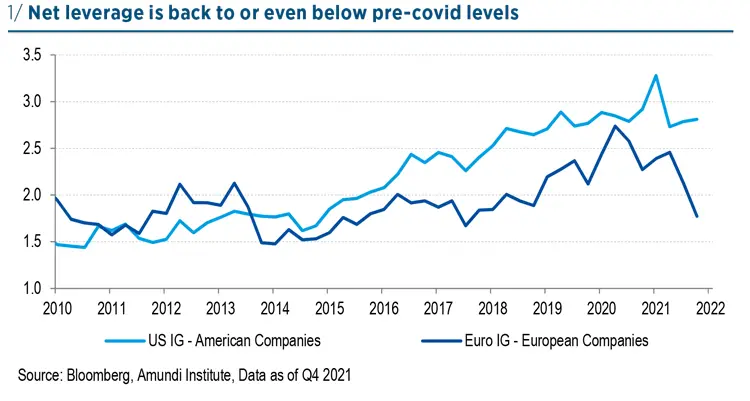

Companies are emerging from the Covid crisis with stronger balance sheet, thanks to unprecedented support from governments and central banks in response to this crisis. Indeed, companies have taken advantage of the strong recovery in economic activity, ultra-accommodative financing conditions, and the strong appetite of investors to strengthen their balance sheets. Well-rated companies have been very active in mergers and acquisitions, especially in the United States. However, low-rated companies have focused heavily on deleveraging. By the end of 2021, most companies’ net leverage had returned to 2019 levels or below, and companies were benefiting from a high level of liquidity. The maturity wall is well manageable for the next two years. This is key in an environment where central banks will raise rates.

For 2022, we are more comfortable with the outlook for US corporate fundamentals than European ones. The strong pricing power of American companies bodes well for nearterm operating performances. However, we are more cautious on the impact of rising energy prices on European corporate margins. Furthermore, we will be particularly attentive to the impact of rate hikes on financial conditions. The “easy phase” of the recovery is now over, and the “normal” phase will likely see a greater dispersion of corporate earnings.

Persistently high costinflation forces central banks to aggressively tighten monetary policy

The maturity wall is well manageable for the next two years

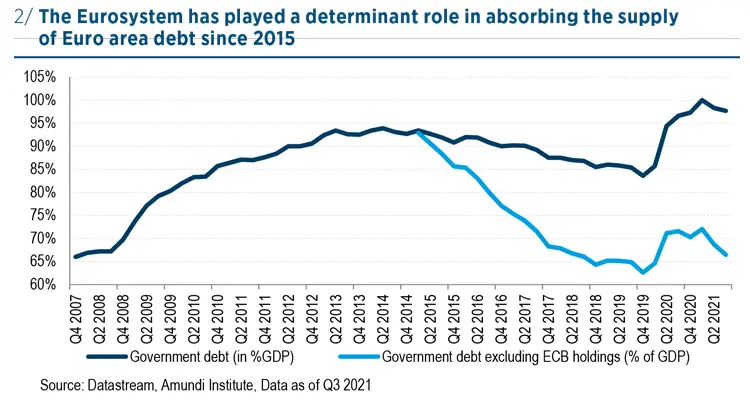

Euro credit technicals will be challenged by the end of the QE

EUR credit markets were resilient to the last hawkish surprise from the ECB, pointing to an early end of stimulus but also to a more flexible timing of first lift-off, depending on macro dynamics. Furthermore, the ECB “flexibility” tool option still counts only on PEPP reinvestments so far. Spreads were resilient to the latest sharp rise of bond yields, too, as the focus turns to the fiscal side and to possible response at EU level (in light of the pandemic effective experience) after recent announced supportive measures at national level to mitigate the impact of higher energy prices on consumers and companies. Furthermore, current ECB hawkish tilt is based on a baseline scenario that looks relatively optimistic in terms of expected GDP growth, still at 3.7% for 2022. Therefore, the ECB, which is data-dependent in calibrating policy normalisation and rates hikes, may be driven to re-assess a possible stronger impact on GDP growth from higher inflation. In this respect, market implied cumulated 12-month rate hikes (as this writing, at 86bps) have already been upgraded quite aggressively. Accelerated APP tapering, upward repricing of rate hikes implied on markets and no new tools introduced to counteract eventual fragmentation (apart from flexible PEPP reinvestments) so far represent a mix of more challenging technicals for EUR-denominated credit markets. Therefore, even more than in the Covid crisis, the fiscal policy reaction in terms of size and promptness, especially at the EU level, has the potential to become the real game-changer this time.

The ECB will end its QE in September

Euro credit valuations are more attractive but do not price a recession

EUR IG was the hardest-hit credit segment by cumulated effects of rates repricing in January, hawkish ECB surprises in February, and recent geopolitical escalation in Europe. In this respect, credit spreads increased well before meaningful signs of a slower economy appeared. Despite the return of spreads the last two weeks to levels not far from where they were before the Ukraine invasion, EUR IG valuations were the only ones to reach levels touched in the Fed QT & trade confrontation episode of 2018 and in China’s 2015 growth scare-driven phase among different credit markets. The eventual fiscal policy response, in light of the experience of the tools effectively used in the Covid-crisis, may result crucial in keeping valuations resilient from rising further to Covid peaks, as to some extent they already discount a downturn in economic trends while companies face this new crisis with repaired balance sheets and supportive fundamentals.

Credit valuation do not take into account a recession scenario

…And HY defaults cycle depending on policy mix dynamics

In the HY space current levels of distress ratios are still contained by historical standards, while the bank loan channel is finding support in abundant excess liquidity and high bank capitalisation. Geopolitical de-escalation is an obvious potential supportive catalyst, but state aid, liquidity lines and financial assistance all kept corporate insolvencies at bay during the Covid-crisis. Many of these tools are still an option for policy makers today. Conversely, monetary dovishness now looks much less likely as a candidate, given central banks’ focus on high headline inflation. Under its baseline scenario Moody’s did not change the previous expected trend, pointing to stabilisation over the next two quarters and then a move to 3% in 12 months in US and to 2.6% in Europe. Under this respect, we assess baseline forecasts from Moody’s underpinned by positive factors already mentioned above, but at the same time risks of a more severe impact on growth, and consequently on default prospects, have recently increased.

The default rate outlook will be sensitive to a deterioration in the economic environment. However, corporate fundamentals are solid