Summary

PBoC’s stimulus has enthused the markets and is a welcome step. For a lasting impact on the economy, we believe additional fiscal measures are essential to encourage consumer spending and improve labour markets.

- Chinese markets rose sharply on the back of optimism around stimulus measures announced by the PBoC.

- The bank reduced its policy rates, cut the reserve requirement ratio and made it easier for people to buy second homes.

- We continue to monitor these developments with a positive bias and remain constructive on broader EM.

Chinese stocks staged a sharp rebound followed by monetary stimulus and liquidity-boosting measures announced by the People’s Bank of China (PBoC). President Xi Jinping’s Politburo also asserted its commitment to achieve economic growth targets. Sentiment was so strong that markets erased all their losses, sending the index into positive territory. The monetary easing and slight changes to housing policy signal a renewed effort by China to support the economy. However, on their own, these measures are unlikely to reverse the structural problems. A lot depends on whether a robust government-backed stimulus package materializes. If consumer-oriented fiscal measures are introduced, we think economic growth expectations for the next year could improve. Otherwise, the market rally may be short-lived. For now, these moves have improved the sentiment.

Actionable ideas

- Divergences in emerging markets

Robust growth expectations in emerging markets, strong consumption and export potential support the case for EM such as Latin America (Brazil).

- Asian equities

Asia is home to many structural stories with a growing population and strong demographics. Countries such as India, Indonesia, South Korea offer potential for long term returns.

This week at a glance

Stocks in most markets and notably in EM rose owing to optimism around Chinese stimulus and better-than-expected US growth. Expectations of continued easing by the Fed and ECB also supported sentiment. In contrast, oil prices fell on concerns over excess supply from Saudi Arabia.

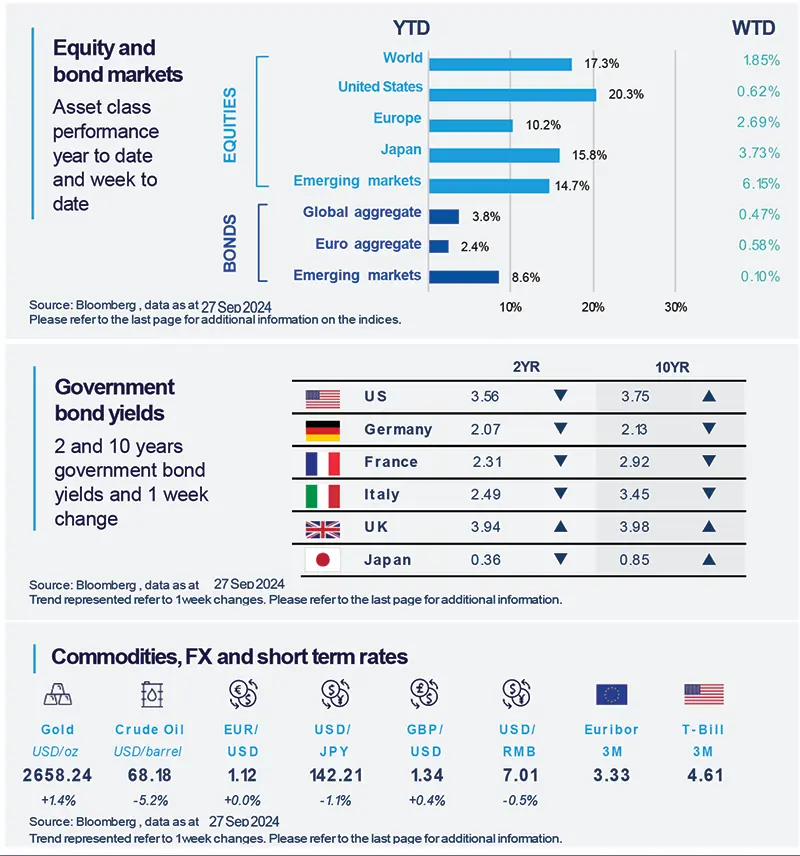

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD) All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 27 September 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency. *Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US Bureau of Economic Analysis revised Q2 GDP

The revisions to GDP growth and related data show the US economy grew even stronger than previously thought. Growth was also based on more solid grounds and almost all domestic demand drivers such as consumption and investments were stronger than previously reported. Interestingly, the household savings rate was revised higher, showing a consumer behaviour less at odds with income, which was also revised upwards.

Europe

Eurozone credit growth weak but shows signs of improvement

Euro area bank lending increased in August, mainly reflecting an uptick on the household side, whereas lending to non-financial corporates remained more muted. Mortgage lending to households was up and consumer credit also rose. On the corporate side, we saw limited improvement, coming mainly from long term loans. Overall, data suggested that demand for credit, while still weak, is gradually improving.

Asia

LDP Elects Ishiba as Japan’s Next Prime Minister

Shigeru Ishiba, a former defense minister and longtime rival of ex-PM Abe, won the leadership race of Japan's ruling Liberal Democratic Party on Friday. As Japan’s next PM, Ishiba is likely to adopt a more hawkish stance on both economic and foreign policies. He advocates the creation of an "Asian NATO," supports the further normalization of the Bank of Japan’s policies, and favours the introduction of a capital gains tax.

Key Dates

|

30 Sept UK GDP, Japan retail sales, China PMI |

1 Oct CPI: Euro area, Indonesia |

4 Oct US labour markets, Mexico unemployment |