Summary

We believe the Federal Reserve will weigh the inflation numbers in the context of the weakening labour markets. We expect the Fed to continue to ease monetary policy.

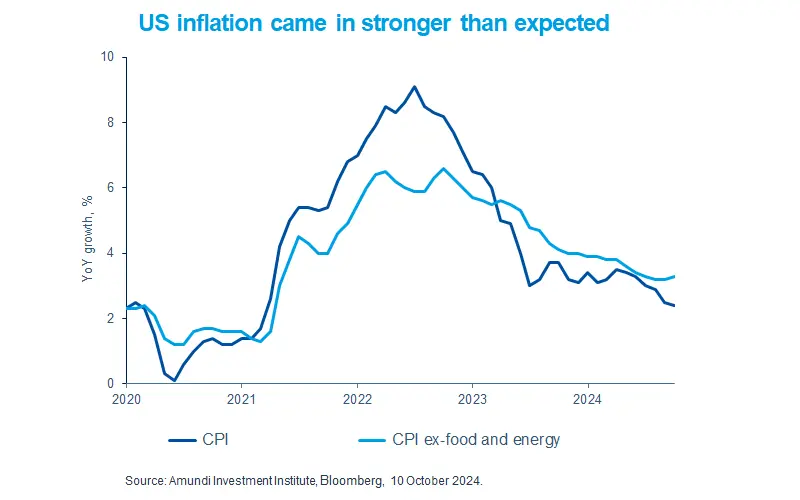

- While inflation for September was above market expectations, one data point doesn’t make a long-term trend.

- The latest number only reiterates our views of the challenges the Fed may face in taming last-mile of inflation.

- An outlook with Central Banks moving to cut rates is supportive for the fixed income asset class.

US consumer price inflation (CPI) rose above market expectations, underlining the pitfalls of assuming that inflation is completely dead. In particular, growth in the core CPI (CPI-excluding food and energy) accelerated to 3.3%. Having said that, the data is in line with our view of a gradual decline in inflation and an overall trend of a lower trajectory. But, as we have mentioned earlier, volatility around inflation numbers is likely to continue. From a monetary policy perspective, we maintain that the Fed will not look at these latest numbers in isolation. The trend still shows steady progress in controlling price increases. At the other end, the central bank will be mindful of any deterioration in labour markets and hence on economic growth. Our stance remains that the Fed is likely to continue to reduce rates, with an eye on incoming data.

Actionable ideas

- Global bonds

Slowing economic growth and falling inflation in developed world paints a constructive picture for government bonds in regions such as Europe and the UK.

- Corporate credit offers attractive income potential

Continued monetary easing by developed market central banks raises the appeal of quality credit in regions such as Europe and emerging markets.

This week at a glance

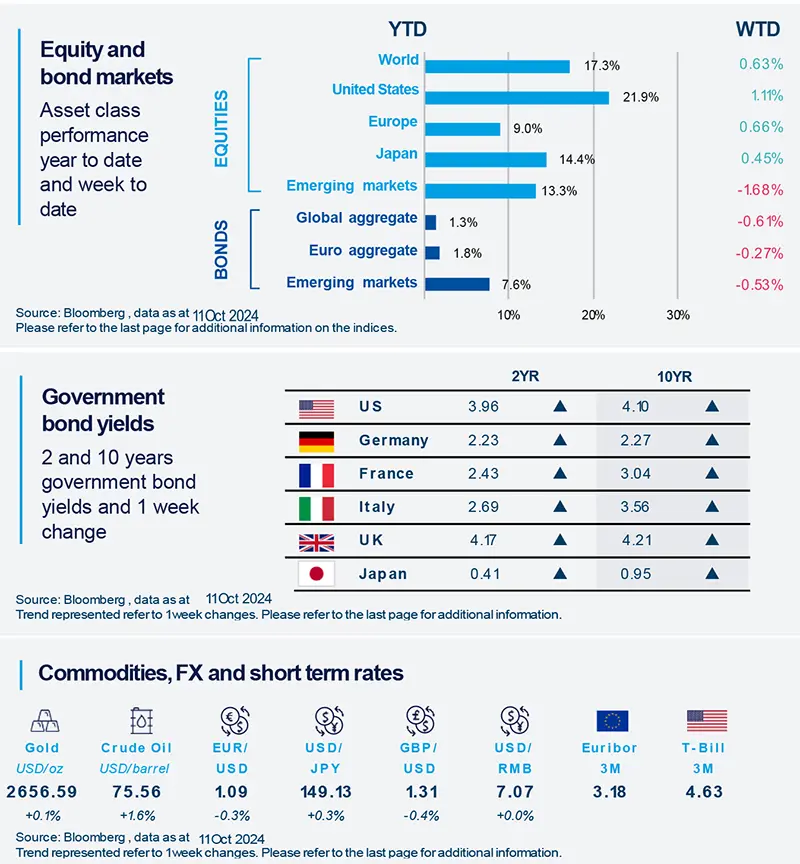

Equities rose over the week as markets digested mixed US economic data and prepared for the earnings season. Meanwhile, the US 10-year bond yields were back above 4%. Stronger inflation figures led the markets to reassess expectations on Fed rate cuts.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 11 October 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US inflation update and job market softening

In our view, recent data shows ongoing disinflation in the US, despite CPI slightly above expectations. Core inflation is still impacted by shelter costs, easing to 4.9% year-on-year. Shelter's significant weight in the CPI means it contributes notably to overall inflation. Meanwhile, weekly unemployment claims rose above expectations, suggesting a softening labour market, potentially influenced by recent hurricanes.

Europe

Eurozone investor sentiment surges

After several negative signals, the Sentix index for Eurozone investor sentiment unexpectedly increased in October. This increase, driven by improved expectations, comes despite ongoing dissatisfaction with the current situation, which has hit a new low after four months of decline. We think that while challenges suggest weak growth in the short term, the economic outlook should improve in the next 6-12 months as monetary policy is eased.

Asia

RBI holds rates steady

As expected, the RBI decided not to ease rates. Despite positive figures over the summer, Indian inflation is expected to rise to the upper end of the RBI's target range for the remainder of the year, hovering around 5% year-on-year. The recent softening of the economy aligns with our 6.8% GDP growth forecast for 2024. We anticipate the RBI may start rate cuts by year-end, but significant easing is limited in our view.

Key Dates

|

15 Oct Eurozone industrial production, India CPI |

17 Oct ECB rate decision, US retail sales |

18 Oct Japan Nationwide CPI, China GDP |