Summary

Key highlights

Insurers coped with rapid interest rate shift due to the Covid-19 crisis effects

- The Covid-19 crisis led to a notable shift in interest rates from historically low levels to an upward trajectory. This prompted a swift repricing of global bond markets, requiring insurers to adapt their fixed income investment portfolios accordingly.

- In many countries, insurance companies are regulated by authorities requiring them to set aside a specific amount of capital (“prudential capital charge”) based on the risks associated with their operations including the assets held in their financial portfolio

Reposition fixed income assets to accompany a rising interest rate cycle, while seeking prudential efficiency using the Matching Adjustment mechanism

- A rising interest rate environment provides more attractive yields for government and credit assets, but this leads to higher costs in terms of capital requirement.

- The Matching Adjustment (MA) is a regulatory provision that allows a reduction in the capital charge when fixed income asset cash flows are aligned (‘matched’) to anticipated liability cashflows.

- Hence, in this environment, there are opportunities to simultaneously improve the overall yield of the assets, and reduce capital requirement.

Case study: simulation of a Matching Adjustment implementation for a Singaporean insurer

- The simulated implementation of a 2-step approach involving a Matching Adjustment strategy for a Singaporean insurer’s portfolio showcased improvement in assets and liabilities alignment, reduced regulatory capital requirements, increased portfolio yield and enhanced prudential profitability

As we enter 2024, the financial terrain remains shaped by high interest rates likely to persist at least through the first half of the year.

In this article, we delve into the strategic adjustments that insurers must navigate in their fixed income portfolio allocation. These adjustments become increasingly crucial amid the challenges presented by evolving economic dynamics while concurrently ensuring effective management of prudential capital charges. Our exploration centers around a case study demonstrating a timely and practical application of the matching adjustment regulatory provision for an insurer operating under the Singapore RBC 2 regulatory framework within a context of a rising interest rate environment.

Insurers faced a complete reversal of the interest rate cycle

The prolonged period of low interest rates began as a result of the 2007 financial crisis. Successive rounds of quantitative easing brought short-term yields to nearly zero and, in certain regions, they even plunged into negative territory.

A prolonged low-interest rate era since the 2007 financial crisis

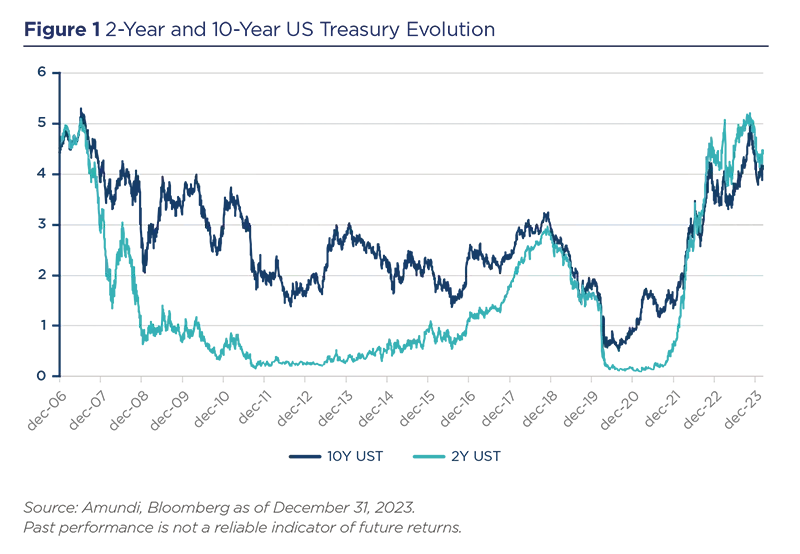

The prolonged period of low interest rates began as a result of the 2007 financial crisis. Successive rounds of quantitative easing brought short-term yields to nearly zero and, in certain regions, they even plunged into negative territory. As illustrated in Figure 1 below, during those 13 years, the yields of fixed income portfolios followed a similar trend, thereby impacting the liability-matching portfolios held by insurance companies. Initially, insurers maintained longer-duration exposures to preserve robust Asset and Liability Management Key Performance Indicators (valuations of assets compared to liabilities). Then, as anticipations of reduced central bank support heightened, insurers gradually widened their duration gaps. By the end of the Quantitative Easing phase, insurers held fixed income assets with significantly shorter durations than their liabilities, resulting in yields below long-term averages and objectives.

Impact of COVID-19, geopolitical tensions, and global inflation pressures

This prolonged low-interest-rate regime which lasted for 13 years, ultimately came to a halt following the COVID-19 crisis in 2020. The emergence of the global health crisis coupled with subsequent geopolitical tensions sparked global inflationary pressures finally leading to a great repricing in interest rates and catching many investors off guard. To fight against inflation, global central banks took a hawkish turn, resulting in unprecedented bond market volatility. As illustrated in Figure 1 below, by the Q3 2023, the 10-year US Treasury (UST) yield reached its highest level since the 2007 financial crisis, alongside record highs for the 2-year rate unseen since 2006.

This rapid regime shift prompted insurers to significantly reassess their fixed income allocation to realign portfolio yield in a context of rising rates while maintaining or enhancing regulatory capital efficiency.

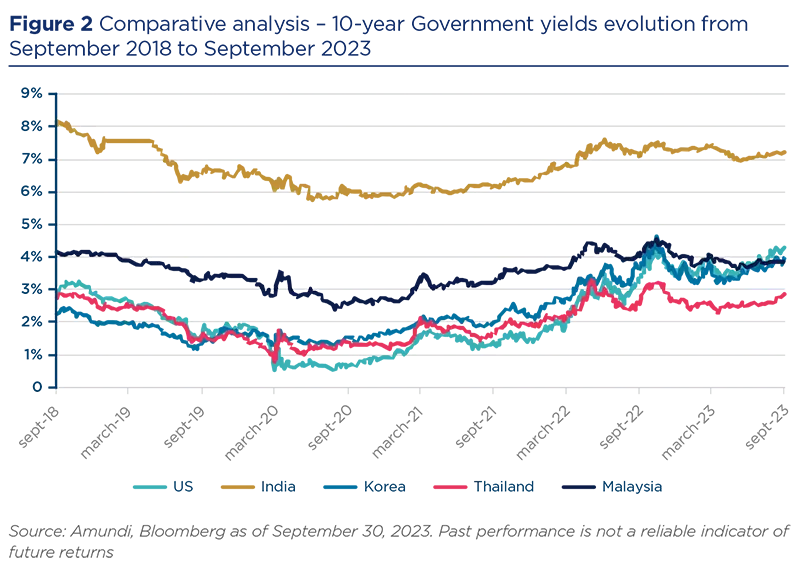

This rapid regime shift prompted insurers to significantly reassess their fixed income allocation to realign portfolio yield in a context of rising rates while maintaining or enhancing regulatory capital efficiency. Indeed, as illustrated in the Figure 2 below, the great repricing in interest rates impacted insurers worldwide, irrespective of their geographical location – American, European, or Asian insurers all faced similar challenges and adjustments.

Capital efficient portfolio repositioning in a rising rate environment

Using Matching Adjustment (MA): a quick “why & how”

Using Matching Adjustment enables a reduction in the capital charge for the interest module and the credit module of the PCR.

Why: The Matching Adjustment (MA) regulatory provision allows insurers to save on regulatory capital in the case where anticipated cash flows of fixed income assets would be aligned with the predicted liabilities cash flows.

How: On the one hand, the matched liabilities are valued at a favorable discounting rate, hence reducing their present value. On the other hand, the credit spread applied to the matched credit portfolio also induces a reduction in capital requirement. Using Matching Adjustment enables a reduction in the capital charge for the interest module and the credit module of the PCR (Prescribed Capital Requirement).

Using Matching Adjustment enables a reduction in the capital charge for the interest module and the credit module of the PCR (Prescribed Capital Requirement).

Yield improvement in a capital efficient manner: a two step-approach

In an interest rate rising cycle, MA can contribute in realigning portfolio yield, while maintaining or enhancing regulatory capital efficiency.

Our approach consists of 2 steps:

- Step 1: Using Matching Adjustment for a portion of the portfolio to free regulatory capital

he first step involves aligning a portion of the fixed income assets portfolio with corresponding liabilities cash flows to release prudential capital. This phase allows to reduce capital requirements related to liability valuations, credit exposures, and to diminish the duration gaps between assets and liabilities. - Step 2: Enhancing portfolio yield by redeploying freed capital into better yielding assets

The second step refers to the utilization of the remaining fixed income assets and freed-up prudential capital which could be invested in better yielding fixed income instruments.

Case study: simulation of Matching Adjustment implementation for a Singaporean Insurer under RBC 2 regulatory framework

Solvency 2 and RBC 2 follow the same principals, including the Matching Adjustment provision, yet RBC 2 has bespoke calibration in each country of the region.

Scenario overview

We explore the fictive case of an insurance company based in Singapore, seeking to rescale the yield of its fixed income portfolio in a context of rising rates while in parallel facing the challenges related to the transitioning towards an evolving prudential regulation framework, namely Singapore Risk-Based Capital 2 (RBC2).

About RBC 2: similar to Solvency 2 in Europe, Singapore Risk-Based Capital 2 RBC 2, is an updated version of the RBC framework, designed to ensure that Asian insurers, including Singaporeans ones, maintain adequate capital buffers in relation to the risks they undertake, incorporating refinements and adjustments to better align with evolving industry practices. Solvency 2 and RBC 2 follow the same principals, including the Matching Adjustment provision, yet RBC 2 has bespoke calibration in each country of the region.

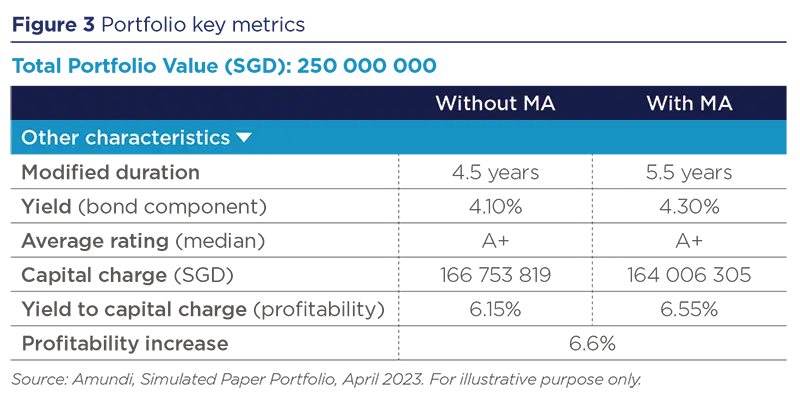

In this case study, we examine a fixed income portfolio with a total value of SGD 250 million. The assets have a total duration of 4.5 years, a 4.10% yield and an average rating of A+. The liabilities’ duration exceeds 30 years. All data and calculations were done as of April 2023.

Approach and strategy

We applied the 2-step approach exposed above:

- We implemented the Singapore RBC 2 MA for 50% of the fixed income portfolio to release a portion of the regulatory capital. This has an impact on the overall return and exposure to foreign exchange due to eligibility rules of the Matching Adjustment.

- After releasing prudential capital in the previous step, we reposition the remaining 50% of the fixed income asset portfolio into domestic credit instruments. Thereby, this enhances the overall portfolio yield. This selection, focused on both government and corporate domestic bonds, also results in reduced regulatory capital requirements for foreign exchange exposures but indeed increases the prudential capital related to credit exposures.

- The combination of steps 1 and 2 is done while ensuring the preservation of the overall A+ credit rating of the fixed income securities.

Outcome

As presented in Figure 3, for a total portfolio value of SGD 250 million, the value chain translates into:

- Better asset-liability alignment: the duration extended by one year, from 4.5 years to 5.5 years. This implies a reduction of the duration gap between assets and liabilities by one year

- A reduction of SGD 2.75 million in regulatory capital requirements

- Enhanced portfolio yield: we observed a 20 basis-point increase in the portfolio yield, rising from 4.10% to 4.30%

- Boosted prudential profitability: the return on prudential capital ratio witnessed a 6.6% rise increasing from 6.15% to 6.55% and showcasing strengthened profitability within regulatory bounds

- The average rating of the portfolio has been maintained at A+

Analysis and insights

Impact of step 1: Release of regulatory capital

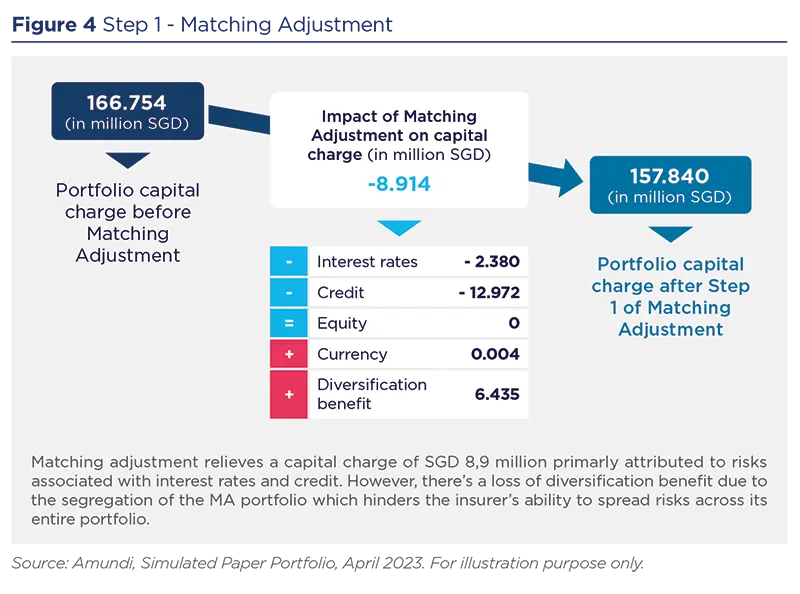

As shown in Figure 4, introducing the MA facility (on 50% of the fixed income portfolio) has permitted the release of SGD 8.91 million of regulatory capital out of a total of SGD 166.75 million:

- The first leg of the matching adjustment - the interest rate leg that enables a reduction of the present value of liabilities - allows to save SGD 2.38 million.

- The second leg of the matching adjustment, which involves the reduction of the credit spread capital charge, allows to save SGD 12.97 million in regulatory capital.

Note: One of the eligibility conditions of the MA facility is that the MA portfolio needs to be segregated. Therefore, for this part of the fixed income assets, it is not possible to apply the diversification rule with other pockets of the portfolio. In this case, the loss of diversification benefits amounts to SGD 6.43 million.

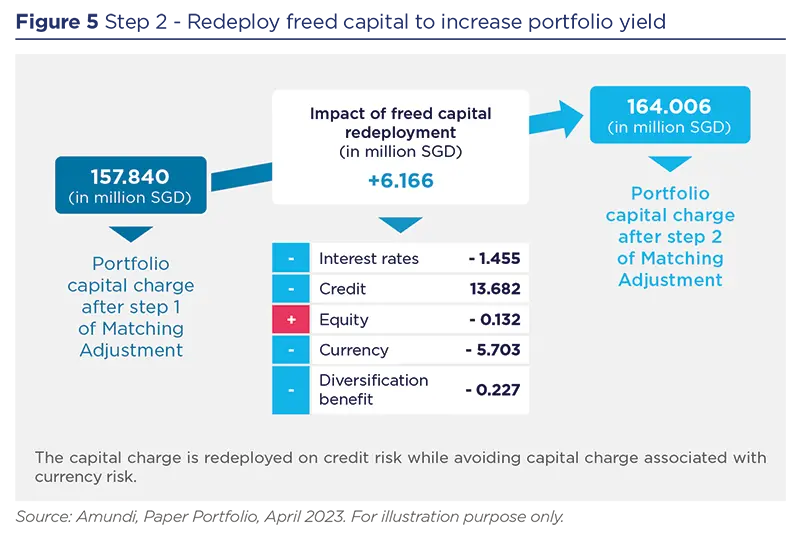

Impact of step 2: Redeploy the freed capital to generate better yields

As a reminder, the initial 50% of the total fixed income assets were used for Matching Adjustment, resulting in the release of SGD 8.91 million of regulatory capital charge.

This section details the actions taken with the remaining half of the fixed income assets, in order to redirect the released capital towards better yielding securities. Figure 5 illustrates that a total of SGD 6.17 million capital has been redeployed. Since less capital has been redeployed than what was freed up, this implies a net capital gain of SGD 2.75 million.

During this step, the portfolio is repositioned towards more domestic credit assets in order to improve the overall yield of the portfolio (at a capital cost of SGD 13.7 million), with a reduction of the foreign currency exposure (resulting in a capital benefit of SGD 5.70 million), an interest rate capital benefit of SGD 1.45 million and marginal equity and diversification capital benefits.

This case study highlights that the introduction of the matching adjustment coupled with a repositioning of the portfolio can enable to simultaneously:

- Reduce capital requirement

- Improve the yield of the portfolio

- Boost overall profitability

Conclusion

For insurers, constant reassessment of portfolio allocation remains crucial.

Fixed income reallocation strategies leveraging on regulatory provision like matching adjustment can provide valuable flexibility, enabling the release of regulatory capital and enhancing portfolio yield.

The illustrative “Singapore case study” offers relevant insights, emphasizing the importance of a proactive and suitable approach aiming to maximize financial performance in an evolving financial landscape and within a constrained regulatory environment.

Sources

- European Insurance and Occupational Pensions Authority (EIOPA)

- MAS Notice 133 (Monetary Authority of Singapore)